The AMM Edition (Part I) | DeFi Download

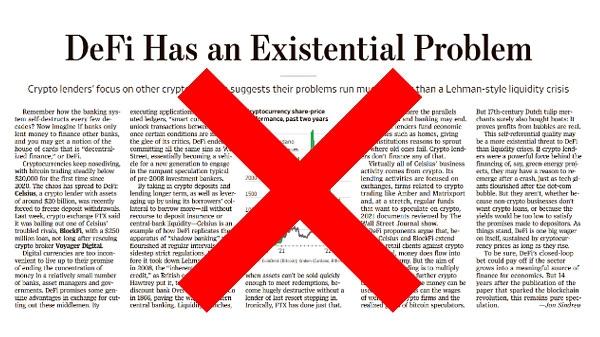

The AMM Edition (Part I) | DeFi DownloadYour Trusted Source for 101s, Project Announcements, and Tokenomics Tutorials.Dear Bankless Nation 🏴, Stablecoins and lending markets are essential to so much of what we do in decentralized finance, but DeFi as we know it would not be possible without Automated Market Makers. AMMs power decentralized exchanges, which allow users to swap cryptocurrencies with each other. Such swapping is a key DeFi innovation and has helped to usher in a new era of financial self-sovereignty. Prior to AMMs, the only way to acquire cryptocurrency was to mine it or buy it through a centralized exchange, what in traditional finance is known as the order book model. With the order book model, a buyer had a price and a quantity in mind and a seller had the same — when these prices and quantities matched up, an asset exchange occurred. With the advent of AMMs, out went the order book and in came the smart contract. At their most basic level, AMMs are smart contracts that create asset pools enabling users to exchange cryptocurrencies without an order book or a trusted counterparty. The liquidity pools upon which AMMs are built typically consist of two or more assets, and the algorithm governing the pool sets the price for the tokens. When a user wants to swap tokens, they connect to the DEX, select the tokens to swap, confirm the transaction, and the liquidity pool smart contract does the rest. While it seems almost too easy, the liquidity pool is the key to a functioning AMM. Part I of this AMM Edition of the DeFi Download will cover all of this and more, equipping you to competently and confidently interact with DEXs and provide liquidity to pools. Although AMMs as we know them are only a few years old, as you’ll understand after reading this issue, they are the future of finance. Contributors: BanklessDAO Writers Guild (Bl0ckb0y.eth, Chameleon, Elemental, teeLEROO, siddhearta, SpiritedF, hirokennelly.eth, Jake and Stake)

This is the official newsletter of BanklessDAO. To unsubscribe, edit your settings. 🙏 Thanks to our Sponsor

The DeFi Download Guide to AMMs

First we begin with the purpose of AMMs and the role of the constant product function. Afterwards, we move onto the basic terms and concepts before breaking down the basics of AMMs. Part I of the DeFi Download Guide to AMMs will get you up to speed on this fundamental DeFi money lego. Why AMMs?Cryptocurrencies w users to trade and send value through the internet, but at first, users could not get these tokens without first running a block producer. But not everyone was interested in running mining software, and instead opted to purchase these tokens as investments in the future. Due to the limited expressibility of early cryptocurrencies, this meant that users had to purchase these tokens through centralized exchanges. These exchanges would route orders to other users or to market makers in typical order book fashion, providing liquidity for each side of the market by providing quotes for buy and sell orders. They profit from the difference in the spread and through arbitrage. Often, these exchanges hold custody over these assets making them juicy targets for hackers. Today, there are fewer hacks because of advances in security best practices and technological improvements, but users of centralized exchanges are still subject to asset seizure. From Coinbase’s Q2 2022 10-Q:

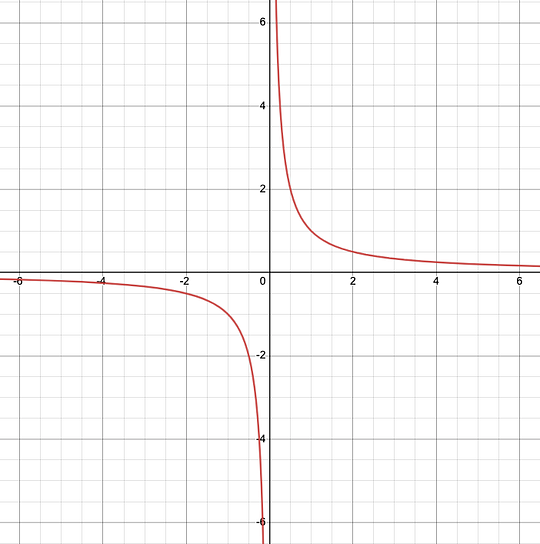

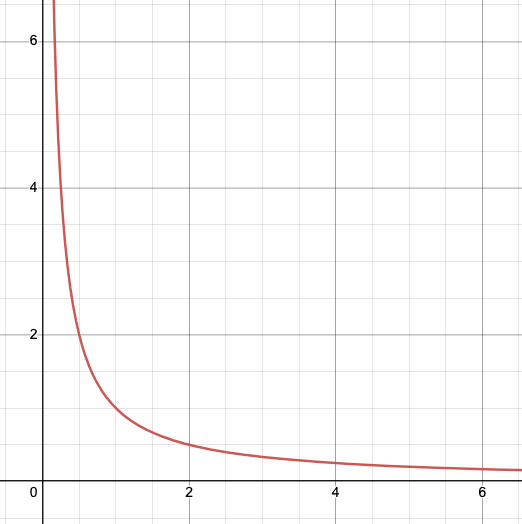

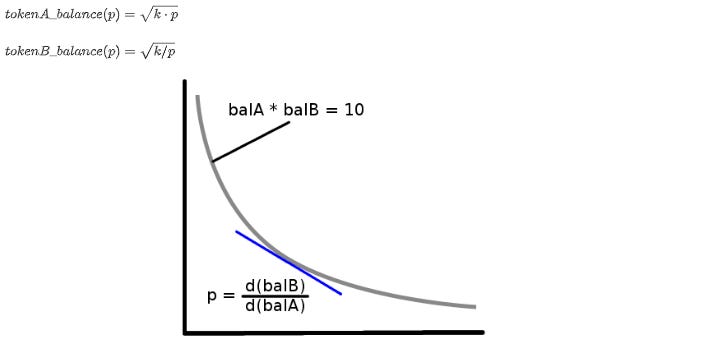

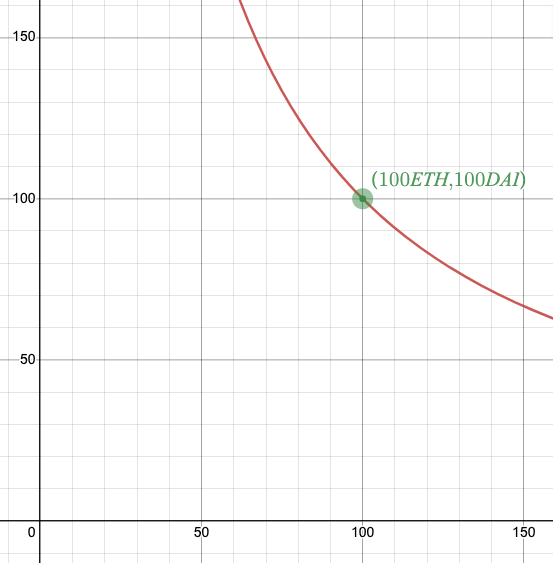

Users need a way to exchange value (without losses through slippage), maintain custody of their assets, and reduce counterparty risk. In 2014, entities like NXT and Counterparty were developing early peer-to-peer exchanges, but Decentralized Exchanges (DEXs) based on AMMs were not developed until much later. Early decentralized exchanges were similar to TradFi order book exchanges except using smart contracts to facilitate transactions. Users would post limit orders to the contract and get matched with other users to be on the other end of the trade, but there were complications like high competition for cheap prices, increased gas costs, and subsequent transaction failure. Projects like EtherDelta use an order book exchange, but the spreads were unreasonably high (sometimes 10%) because market making was expensive. Automated Market Makers (AMMs) using constant product functions were conceived of by Vitalik in 2016 and formalized in his post “On Path Independence” in 2017. AMMs are a set of smart contracts that create pools of assets that serve as liquidity for traders—without an order book. These pools serve as the “market maker” for traders, but because the price is set algorithmically by smart contracts, counterparty risk is significantly lower. Constant Product AMMs (Semi-Technical)Constant product functions are how AMMs price asset pairs. The constant product function creates a hyperbola where the x = k/y for some constant k. Given x and y are greater than zero, we can omit the bottom left quadrant in the graph, giving something like this: This is the curve that defines an asset’s price in relation to another asset. With a little algebra, we can see a familiar function x * y = k, where x and y denote the reserves of each asset. This has the benefit of always having liquidity as prices reach infinity. The pool’s assets would float along the curve with the price determined by the derivative: From Vitalik:

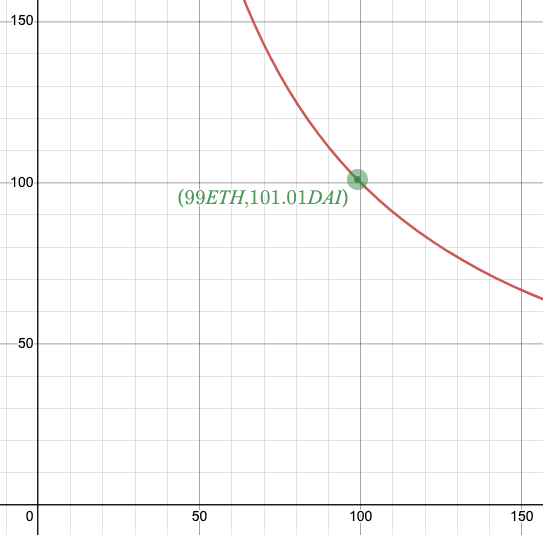

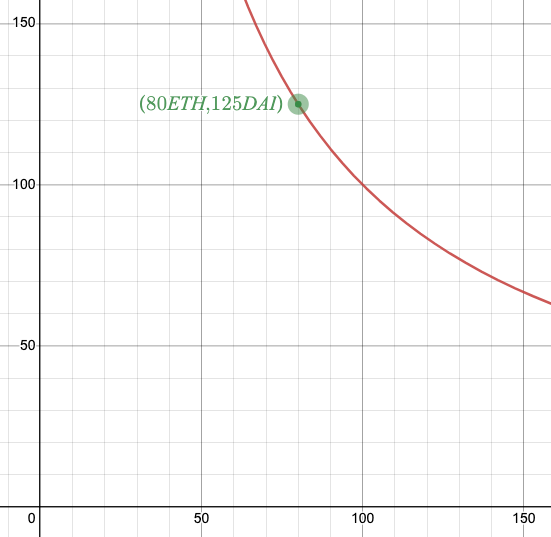

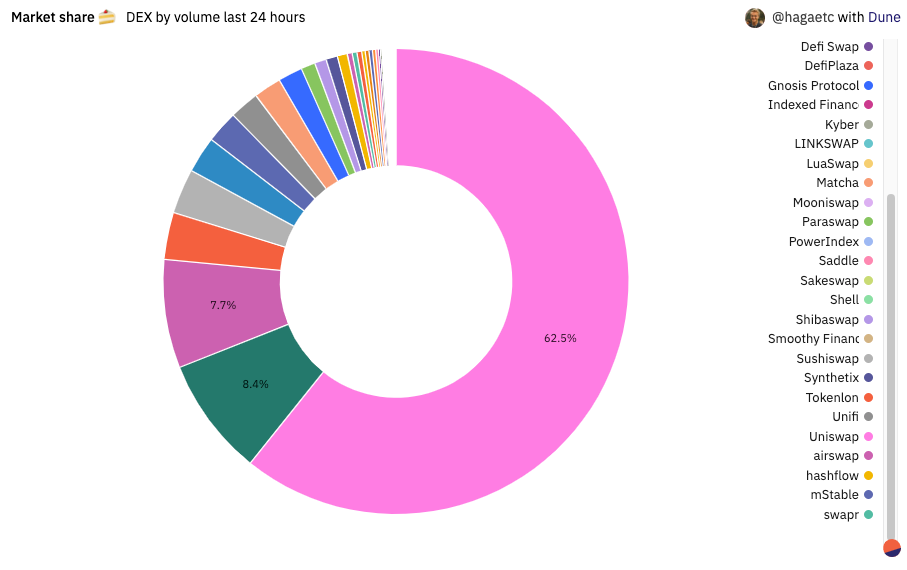

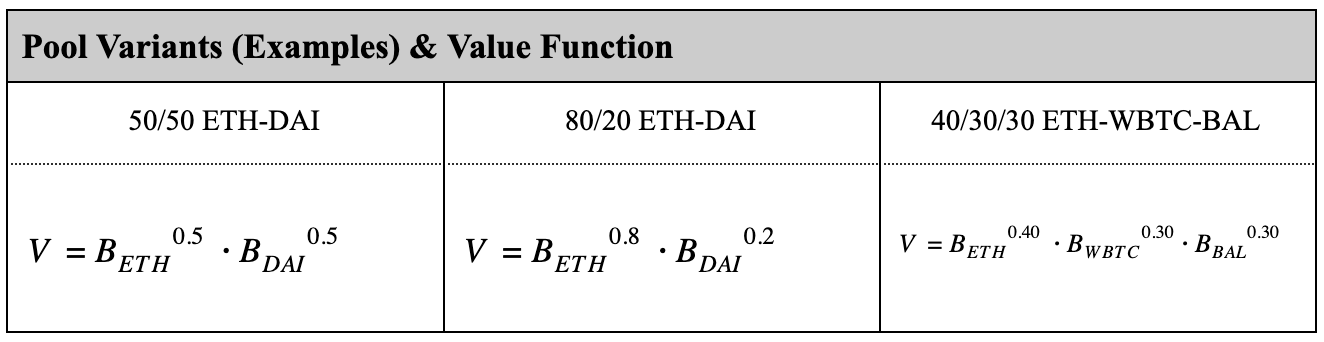

Let’s walk through an example. Suppose you have a pool composed of 100 ETH (A) and 100 DAI (B). The exchange rate on the primary market is 1:1, and A * B = 10,000. Thus the pool must maintain A and B such that A * B = 10,000. Suppose you want to buy 1 ETH. How much DAI must you provide to complete your transaction? Well, if you buy 1 ETH the pool will be left with 99 ETH, so to maintain our constant of 10,000, the pool must have 10,000/99 DAI (about 101.01 DAI). So to pay for your transaction you must provide ~1.01 DAI. This price is very close to the primary market’s price of 1:1, but this is a relatively small order. Larger orders will have a larger impact on the price you must pay. Suppose you wanted to buy 20 ETH. 80 ETH will be left in the pool, so the pool must maintain 10,000/80 DAI in the pool after your order is complete (125 DAI). So, you must pay 25 DAI for your 20 ETH resulting in a price of 1.25 DAI/ETH. If the price movement is far from the true price of 1:1, some arbitrageur can step in, buy that DAI, and sell it to make some risk-free profits, resulting in an exchange rate closer to the market price. In a nutshell, this is a description of the mechanics behind how the constant product function works and how it enables AMMs to facilitate permissionless peer-to-peer trading. AMM BasicsBy Elemental Liquidity Liquidity is the lifeblood of any market. It describes the ease at which an asset can be exchanged for another without affecting its price. Cash is highly liquid as it’s generally easy to exchange. Tangible assets such as real estate are less liquid because many factors — such as the supply and demand for houses — can affect the speed and price at which they sell. A rare or exotic asset can be highly illiquid as a ready buyer might be difficult to find. At the most fundamental level, market liquidity for a cryptocurrency varies based on the supply and demand for the token. It’s a function of how many tokens holders are willing to sell, at what price, at a certain point in time. With a traditional order book exchange, you can see the quantity and “ask” price that sellers are willing to sell at and the quantity and “bid” price buyers are willing to pay. With highly liquid markets, there are usually a lot of ready buyers and sellers at the current market price. With less liquid markets, there is a spread between the highest bid price and the lowest ask price (the bid/ask spread), meaning someone will need to adjust their price or wait for a new order to be placed at their price for the exchange to happen. Liquidity Pool A liquidity pool is made up of quantities of two or more different tokens deposited into a smart contract. They are the key innovation to making DEXs, AMMs, and many other DeFi protocols work, and most attempt to maintain a proportional balance between tokens in the pool. For example, an ETH/DAI liquidity pool might be set in the smart contract to maintain 50% worth of ETH and 50% worth of DAI. Instead of needing to wait for a human counterparty to agree to exchange crypto tokens with you, you figuratively pour your tokens into the pool, and the smart contract automatically scoops out the appropriate amount of the other token to send to you. Slippage Slippage is the difference between the expected price and what the final price is when the exchange is executed. While slippage occurs in many marketplaces, including stock markets and crypto order book markets, it can be significant in AMMs and DEXs — particularly with large trades and small liquidity pools. Large pools with deep liquidity are better at handling swaps with less slippage. For example, let’s say you wanted to place a market order to exchange 10 ETH for BANK (bullish!). Such a large swap will likely remove a significant volume of BANK tokens from the liquidity pool. An AMM automatically adjusts the exchange rate between currencies while the swap is happening. In this case, it would raise the price of BANK, causing you to pay more per token and end up receiving fewer BANK tokens than you calculated from the original market price — that’s slippage. Most AMMs and DEXs display estimated slippage and allow you to set a limit to how much slippage you will accept. However, setting a low slippage tolerance limit could make your order take a long time to fill. Liquidity provider Decentralized exchanges and AMMs don’t use their own funds to fill liquidity pools, which would require a tremendous amount of capital. (Uniswap alone has over $7 billion worth of assets deposited in its pools!) Instead, they rent assets from liquidity providers, investors who earn interest, fees, and/or rewards for depositing cryptocurrency tokens into the pools. When a liquidity provider deposits tokens to the pool, they receive synthetic LP tokens to represent their deposit. They can redeem the LP tokens later to withdraw deposited tokens. Impermanent loss While liquidity providers are earning fees and rewards from their deposited tokens, they also face a risk that could ultimately cause them to lose money: impermanent loss. Impermanent loss occurs when the market price of the deposited assets changes compared to when they were deposited. AMM liquidity pools use algorithms to maintain a steady ratio between the value of the tokens in the pool. A 50/50 ETH/DAI pool, for example, is designed to keep the value of the ETH tokens equal to the value of the DAI tokens in the pool. If the price of ETH rises on the open market, arbitrage traders (or bots) will purchase the below-market-price ETH in the liquidity pool by depositing DAI until the ratio of values of the two tokens returns to 50/50. As a result, when a liquidity provider redeems their LP tokens, they could find that the tokens they receive are worth less than if they had simply held them in their wallet. The loss is called impermanent because the loss isn’t certain until the LP tokens are redeemed. If the price of the tokens returns to where they were when they were deposited, the projected loss will disappear. Arbitrage Arbitrage is when a trader takes advantage of the spread between prices or within markets to make a profit. A simple example is when a trader spots a difference between the price of an asset on two different DEXs. If they move quickly, they can buy a bunch of the lower-priced token on one exchange and sell them at the higher price on the other, pocketing the difference. Other arbitrage opportunities exist when there’s a significant bid/ask spread on an order book exchange or, as mentioned above, when impermanent loss is occurring in a liquidity pool. Unfortunately for human traders, it can be hard to beat the speed of bots that are programmed to find and quickly front-run arbitrage opportunities. AMM ProjectsUniswapBy Siddhearta Uniswap is one of the leading DEXs and one of the most powerful DeFi protocols. Since its inception as the first AMM, the Uniswap protocol has been creating efficient markets and allowing users to put their assets to work for them by creating liquidity pools, providing liquidity, and swapping assets. Uniswap has consistently held the The Uniswap protocol is an open-source, non-upgradeable, and censorship resistant protocol that is designed to facilitate the exchange of ERC20 tokens without trusted intermediaries. Traditionally, centralized exchanges used the order book model to provide liquidity for market making and required a trusted intermediary. Decentralized exchanges (DEX) replace the order book model by using automated market makers (AMMs) which operate using smart contracts. Rather than executing trades by finding a trading pair using an order book, AMMs use liquidity pools for each asset in their smart contracts in order to execute trades. With Uniswap V1, users could create a liquidity pool for any token with an ETH base pair using a constant product formula. While this created —or market depth—for each asset, it was inefficient and costly to switch between token pairs as everything had to be converted to ETH before trading. If a user wanted to trade the UNI for AAVE, they would need to swap UNI to ETH, then ETH to AAVE. Uniswap V2 introduced several new features and allowed multiple ERC20 token pairs, allowing liquidity providers to choose the token pairs that they wanted to allocate assets to. This innovation set the stage for exponential growth in AMM adoption as Uniswap allowed many small cap assets to trade via their protocol, serving a long-tail of assets. Today, Uniswap is one of the most highly forked DeFi protocols. In Uniswap V2, liquidity is provided along a price curve with an even distribution across all price ranges. Although this provides market depth across all prices, it is not capital efficient. Since liquidity was spread thin across all prices from zero to infinity, market depth was often too thin and often resulted in high degrees of slippage as well as LPs only earning fees on a small fraction of the portion of their assets where funds are being traded. Uniswap V3 created capital efficient markets by introducing concentrated liquidity. Concentrated liquidity allows LPs to set the price range in which they would provide liquidity, so rather than their capital being spread thin it can be directed to a narrower range of prices where there is more market activity. Concentrated liquidity makes capital more efficient by providing higher fees to LPs as well as increasing market depth. The introduction of concentrated liquidity allowed Uniswap to become the most flexible and efficient AMM ever and it also solved some of the major challenges for creating capital efficient decentralized markets. The Uniswap protocol is owned and governed by UNI token holders. A description of their governance process and documentation can be found on their Governance page. SushiSwapby SpiritedF SushiSwap was founded in 2020 by an anonymous entity that goes by the name Chef Nomi, in addition to him, Sushiswap had two unknown co-founders known as 'Sushiswap' and '0xMaki'. This trio of co-founders was responsible for the code, product development, and business operations of Sushiswap. Sushiswap is a fork of Uniswap, which means that the developers of Sushiswap copied Uniswap's open source code since and makes new changes (alternations) to it. The objective behind Sushiswap was to diversify the AMMs market, they would add additional features that can't be found on the Uniswap platform, notably creating a token to govern the protocol: $SUSHI. The protocol began incentivizing liquidity through rewards denominated in this token. Since inception, there have been a variety of concerns regarding the project: the Chef Nomi exit, the Phantom Troupe, and ownership of the protocol by FTX. Sushiswap’s main feature is an automated market maker(AMM) that leverages smart contracts to provide liquidity pools for users to trade cryptoassets with no intermediary. Users can also become liquidity pool providers by supplying an equal value pair of two cryptocurrencies, to earn rewards, when other users make use of the liquidity pool. It is a decentralized finance (or Defi) protocol. Investors/users stake $SUSHI to earn a portion of the platform's profits. These earnings are shared in xSUSHI tokens(they are sushi tokens purchased on the open market with the profit from the exchange). The open market operation brings in passive income for investors that stake their SUSHI tokens. 0.05% fees of all the trades that happen on the Sushiswap platform go to the xSUSHI stakes. This means you continue to earn passive income as an xSUSHI staker. Sushi as a platform has a variety of products aside from its DEX to help projects create DeFi utility for their tokens (Bento, Miso). Balancerby Siddhearta Balancer protocol is an open-source AMM allowing users to trade tokens, create liquidity pools, and create LP positions to earn yield. Unlike other AMMs that use a 50/50 asset split to create liquidity pools, Balancer allows users to create pools with up to eight different tokens. These pools are automatically balanced according to smart contracts, which significantly reduces the risk of impermanent loss.

V is considered the constant (like the constant product function), which changes with additions or subtractions of liquidity, but remains unchanged during token swaps. The result is a protocol for programmable liquidity that gives users security, flexibility, capital efficiency, and gas efficiency. Users can also perform single-asset liquidity provision—provide liquidity to only one asset in the pool. This gives them a proportional claim on the fees. Balancer is designed to be similar to traditional index funds, giving users broad exposure to the crypto market. When users deposit tokens into liquidity pools, they earn a percentage of fees in BAL tokens, which are the governance token used to vote on Balancer improvement proposals. The front end user interface of the Balancer protocol also operates as a DEX, allowing users to swap tokens without relying on centralized intermediaries. Balancer V2 also created a new Liquidity Mining Program allowing liquidity providers to stake assets in different pools to receive BAL tokens. There are three different tiers with each tier getting a fixed amount of BAL each week. CurveDecentralized exchanges and automated market makers allow you to trade cryptocurrencies and provide assets to liquidity pools in return for yield, but not all DEXs and AMMs are created equal. Curve Finance is a protocol that enables you to swap tokens and provide liquidity, and it primarily focuses on stablecoins and Ethereum-based versions of Bitcoin. By pooling like-assets together, such as its famous 3Pool made up of USDC/DAI/USDT, Curve minimizes impermanent loss because volatile assets, like ETH, are not paired with stable assets, like DAI. On top of that, it has relatively low trading fees, is also a DAO, allows users to deploy liquidity pools, exists on multiple chains, and deploys time-locking mechanisms for governance and increased yield. Suffice to say, Curve is a complex protocol, but we’re going to stick with the basics. What Is Curve?Curve is a non-custodial, non-upgradable exchange and AMM whose main goal is to enable its users to swap cryptocurrencies with low fees and slippage. Historically it focused on stablecoins, but it recently rolled out a v2 that allows for a broader type of cryptoasset in its pools. Like all AMMs, liquidity providers earn fees on their deposits. But unlike other AMMs, Curve employs a tokenization model that enables governance-minded users to increase their yield. The key to this model lies in the CRV token. What Is the CRV token?The CRV token is the native-governance token for Curve DAO and liquidity providers receive CRV in exchange for providing liquidity to Curve’s pools. According to Curve, Curve DAO exists to incentivize liquidity providers and participation in protocol governance. Curve DAO does this by using a tripartite approach of staking, voting, and ‘boosting’. Staking and VotingCurve users are encouraged to stake their CRV, which is really a form of locking up CRV for a set period of time. In exchange for locking their CRV, users receive veCRV, which stands for vote escrowed CRV. Fifty percent of all trading fees are allocated to veCRV holders in the form of the 3Pool’s LP token. The LP token can be exchanged for one of the stablecoins in the 3Pool or users can stake 3CRV LP token to earn additional CRV. Users can lock their CRV for up to four years, and the number of veCRV received in return varies depending on the length of time the CRV token is locked. Users receive one veCRV for every four years of lockup; therefore, if you lock one CRV for one year, you’ll receive 0.25 veCRV. BoostingCurve DAO members need veCRV to participate in governance, but for many this is not incentive enough to vote on Snapshot for proposals affecting Curve. To further incentivize governance participation, veCRV holders can earn up to a 2.5% bonus in their share of liquidity pool fees otherwise due to the liquidity provider. The amount of boost varies by pool. Among other things, the boost percentage is determined by the amount of liquidity provided to the pool. Curve PoolsThe Curve liquidity pools are like standard liquidity pools, but a few come with a twist. In regular liquidity pools, liquidity providers earn a share of the fees generated from trading. The more transactions and more fees, the higher the yield. While this is true for all Curve pools, some of these pools also earn additional yield by working with lending protocols like Aave and Compound and thus earning lending fees in addition to trading fees, which Curve calls yPools. Finally, some pools have rewards in addition to CRV, typically in the native token of another protocol. Ahead of the CurveCurve is a cutting-edge exchange that has low fees and slippage, reduced risk of impermanent loss, and like most AMMs, allows users to participate in liquidity pools at their leisure. In addition, its time-lock staking mechanism incentivizes governance while also increasing yield to those committed to the protocol. Curve isn’t simple, but this basic overview should provide you enough information to check out the protocol and stay ahead of the ever-accelerating DeFi curve. Actions steps📖 Read What explains the rise of AMMs? | Hassebq ⛏️ Dig into On Path Independence | Vitalik 🎧 Listen How do Liquidity Pools work? | Finematics 🙏 Sponsor: Oasis.app - Borrow Dai & Earn Project Releases 🎉

Immutable Fiat Off-Ramp

Aztec Connect

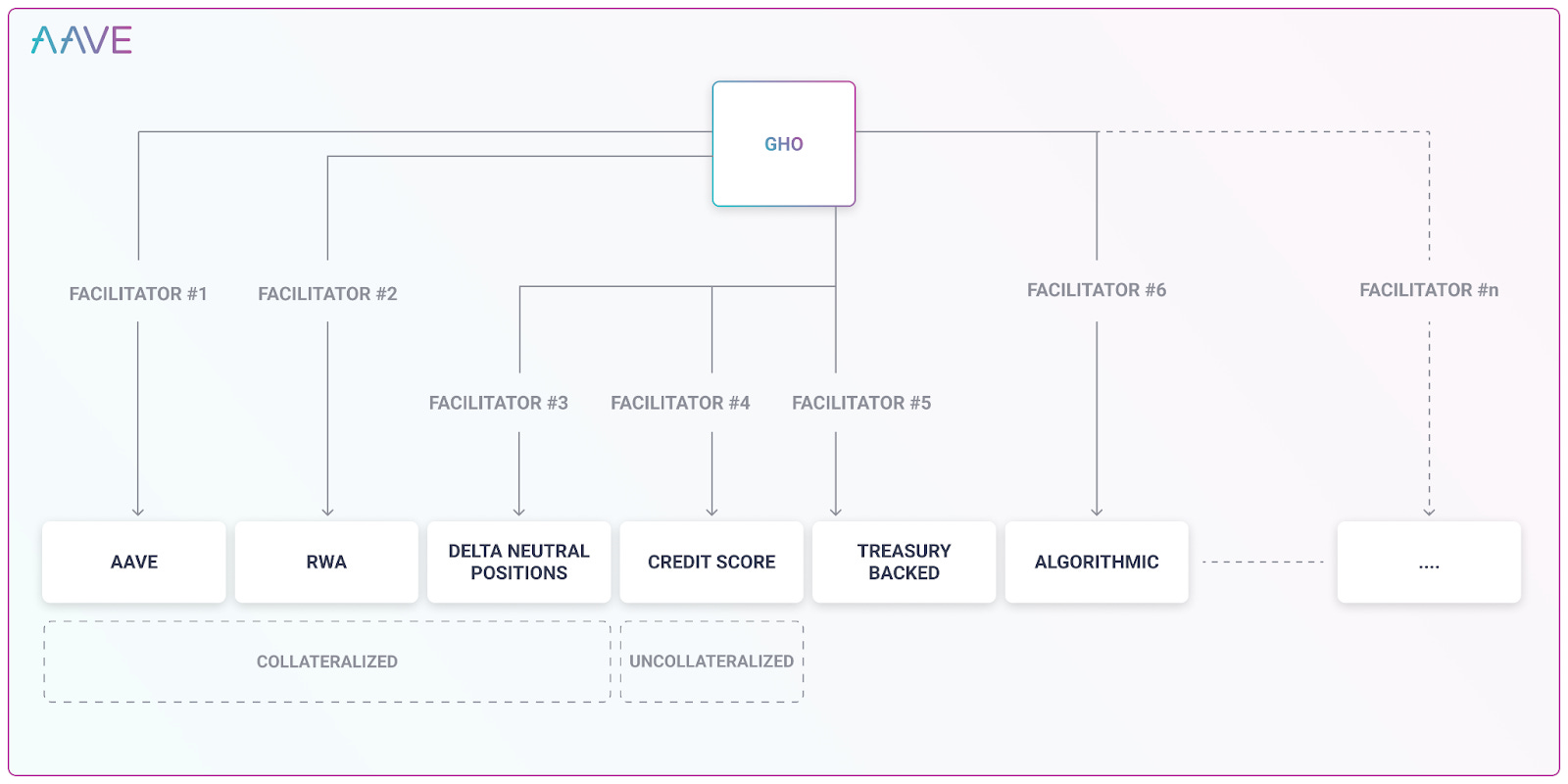

Aave Releases Stablecoin GHO

StarkWare Announces StarkNet Token Launch

Sudoswap Releases SudoAMM

Aave and Balancer Swap Tokens

Curve to Release Stablecoin crvUSDAcross Protocol Launches Token ACX

Chirping Birds

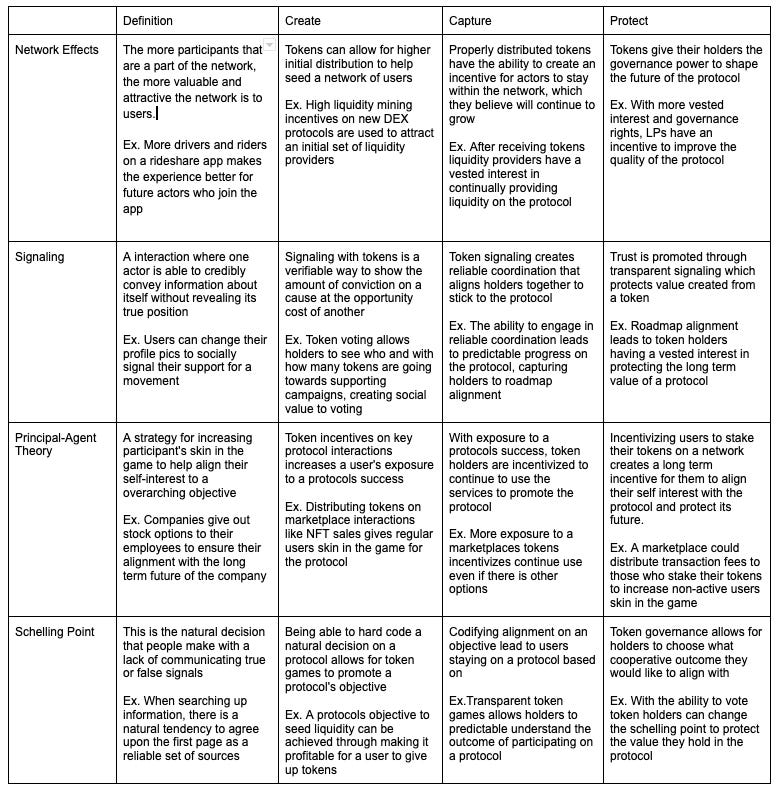

Blockworks @Blockworks_ NEW: Celsius has finished paying its loan to Maker DAO and got 21,962 WBTC (≈$440M) in collateral back          Tokenomics 101: Why build a token economy?I would like to thank Lisa Tan for inspiring this piece A token economy allows for a community to incentivize value creation, capture, and protection through the use of tokens on a decentralized and immutable layer of trust (smart contracts on a blockchain). Token economies allow for communities to transparently come to a consensus on a set of token incentives built on smart contracts that optimize their economy based on each community’s goals. A token economy’s success is driven through its communities ability to understand economic games and leverage them without the creation of large negative externalities. Value Creation, Capture, and ProtectionTokens allow for the community to design and use economic games that fit their goals. Goals can typically be split into those that are self-interest or collective. Self-interest is what a single actor would optimize for while a collective goal would typically be made through a group of actors and typically clash with self-interest. By using tokens on an immutable and transparent layer of trust, actors can agree upon incentive games that allow for strategic interactions that align both self and collective interest. This allows for a community to optimize their objective through designing incentives that accelerate value creation, ensure value capture, and promote value protection. While it might seem like using tokens to fuel economic incentive games is a simple way to align self and collective interests, there are also a lot of significant risk that come from using tokens in economies and it is important to understand them in order to mitigate them. Negative Externalities of Token EconomiesMoral Hazard This is the phenomenon when one actor, the agent, has more information on a contract than the actor who is issuing it, the principle. This means that the agent is able to leverage that information to make the principle pay the cost. The agent is able to increase their exposure to risk because they know that they would not have to pay the consequences for it. One example of this can be seen if someone who has car insurance doesn’t care how they drive the car because they know that their insurance will fix it. One way of mitigating this in a token economy could be through designing incentives or encoded barriers for reducing the value of the hidden information. A classic example of how this affects token economies is through a rug pull. A rug pull is where a project markets the release of a token without any true fundamental value behind it just to sell all of their tokens on the market to make a large profit. To mitigate this risk, more trusted projects will include long cliffs with vesting schedules where they are not able to dump the tokens until the market has enough time to determine the true value of the project. Adverse Selection Adverse selection is the phenomenon of poor price discovery due to one party having more information or different information compared to another. One example can be seen in the “lemon” problem where everyone assumes that the cars in a used market are bad so they naturally give low ball offers which encourages salesmen to sell bad cars. This can be mitigated in a token economy through using price oracles or decentralized methods for obtaining information. One example can be seen in a smart contract insurance protocol that aims to help provide coverage for smart contract hacks. In the system a smart contract auditor must lock funds in a pool to cover the risk of a hack, while they earn a proportional amount of fees from the members that want coverage from that pool. Auditors have the ability to profit from their expert knowledge while members have the ability to be protected by it. The transparency of this token model aligns the incentives of members and auditors to find a market price for the insurance that they are both comfortable with. This decentralized way of obtaining pricing information on an insurance protocol can lead to a market where both the seller and buyer have a financial stake to meet each other at a fair price. Pollution Pollution on a blockchain or smart contract rich environment refers to the amount of congestion on the network. Both in the literal amount of transactions being pushed through a protocol slowing it down and the noise to signal for what information is actually relevant to a protocol or token holder. Both of these can lead to slower interactions with the network and an overall market failure. This can be mitigated in a token economy through a term called Token Curated Registries (TCRs). These are a way to use tokens to create economic incentives to curate lists in a decentralized manner. Token holders have an incentive to maintain a high quality list so they put their tokens on the line to add, defend, or challenge entries. If lost they forfeit their tokens and have less curation power for the list. This is a strategy for protocols to organize the vast amount of tokens and smart contracts on the market to show what they believe to be the most relevant content for creating a successful interaction. While these are just a few externalities, there are many more that are relevant to any economic system and must be considered when designing token economies. As stated previously, the key value that a token economy brings is the ability to have a community that agrees on a transparent, codified set of incentive games that optimize for their collective goal. This is the novelty that tokens bring, and must be considered when thinking about our current economic structures around the world. 🛠 BANK Utility (BanklessDAO token)With over 5,000 holders, BANK is one of the most widely held social tokens in crypto. So it bears asking, where are the best places to put our BANK to use? The five protocols below will allow you to deposit BANK in a liquidity pool and earn rewards. To get going, just click on the name, connect to the app, filter by BANK, and start earning passive income.   ⚖️ BalancerBalancer has two 80/20 liquidity pools, meaning that you are required to deposit 80% BANK and 20% ETH in the pool. There is one pool on Ethereum and another on Polygon. Once you’ve provided liquidity, you’ll receive LP tokens. Keep an eye out for opportunities to stake these LP tokens. There is nearly 500,000 USD in the two Balancer liquidity pools. 🍣 SushiSwapSushiSwap has a 50/50 BANK/ETH pool. As with Balancer, you will receive LP tokens, and while you can’t stake them on SushiSwap’s Onsen Farm yet, you may be able to in the future. Liquidity providers earn a .25% fee on all trades proportional to their pool share. The SushiSwap pool has a little over 100,000 USD in liquidity. ⏛ Rari Fuse PoolThe Rari Fuse Pool allows you to borrow against your BANK or earn huge APY by providing assets like DAI to the pool. At present, all borrowing is paused for this pool. There is over 450,000 USD deposited in the Pool. 🦄 UniswapThe Uniswap V3 liquidity pool is 50/50 BANK/ETH, and provides a price oracle for the Rari Fuse Pool. By depositing in the Uniswap pool, you can earn fees and help enable borrowing on Rari. This pool currently has over 500,000 USD in liquidity. 🪐 ArrakisYou can also provide liquidity to the Arrakis Uniswap V3 pool. The ratio is about 2/1 BANK/ETH. This pool is new, and only has a bit more than $6,000 in liquidity. In the future, you may be able to stake your BANK/ETH LP tokens within the protocol to earn additional rewards. AMM TacticsBeginner TacticsHow to use SushiSwapAuthor: William Peaster How to get the best prices using 1inchAuthor: Jessica Salomon of 1inch Exchange How to use Balancer V2Author: William Peaster 🏆 BanklessDAO Cryptocurrency Challenge: Winner Announcement!We’re not sure if the recent market upswing represents an escape from the bear’s clutch, but the world of BANK has been on the move with all portfolios increasing in value over the last half of the contest. Before announcing the champion, here’s a description of the winning strategy: leveraging BANK and enjoying an outsized return as BANK value leapt over 50%. The next best strategy was to hold BANK, followed by purchasing GMI. One person went all in. Congratulations for your 100% bet on the BANK accelerated portfolio Jengajojo! The 5000 BANK purse is yours! Rounding out the top three spots, we have Jarlaxle in second, and a tie for third featuring EthHunter and affifes. Thank you to all participants in the inaugural Challenge. Get Plugged InEvent HighlightsETHCC 5 —Paris, France— The Ethereum Community Conference (EthCC) is the largest annual European Ethereum event focused on technology and community. Three intense days of conferences, networking, and learning. Covering many different subjects at different levels education through conferences and workshops. The Maison de la Mutualité will be accessible from 9 AM to 7 PM July 19-21, 2022. DeFi Security Summit —Stanford, California— is the inaugural DeFi security event to address pressing DeFi vulnerabilities and mitigation strategies. The summit includes discussions and talks about DeFi vulnerabilities, cross-chain security, and audits. Confirmed speakers include Aave Head of Smart Contracts, Emilion Frangella, Nexus Mutual Founder Hugh Karp, and Optimism Security Engineer John Mardlin. August 27-28, 2022, Paul & Mildred Berg Hall, Stanford University, Stanford, California, USA. DevCon Bogota—Bogota, Columbia—hosted by the Ethereum Foundation that’s geared toward developers, researchers, and movers within the Ethereum ecosystem. Devcon aims to deliver a holistic learning experience through panels and workshops. This conference is for builders of all kinds: developers, designers, researchers, client implementers, test engineers, infrastructure operators, community organizers, social economists, artists, and more. Oct 11-14 📌 Agora Bogotá Convention Center ETH San Francisco—San Francisco California—Hailed as the West Coast’s premier Ethereum event of 2022, ETH San Francisco unites blockchain and crypto enthusiasts, as well as developers, industry experts, and tech companies. Discover more Ethereum events around the world here and check out the ETHGlobal site to get more updates about this and other upcoming events. November 3-5, 2022, San Francisco, USA. 🧳 Job OpportunitiesGet a job in crypto! Do you like solving hard problems, care about building more efficient markets for everybody, and want to work at the frontier of decentralized finance? KeeperDAO is looking for full time contributors, with salaries ranging from $169,000-$722,000. There are positions ranging from engineering, recruiting, product marketing, copywriting, and design. Sound interesting? Sign up for our referral program and go full-time DAO.

🙏Thanks to our SponsorOasis.appOasis.app was born as the frontend to access Maker Protocol and create DAI. It allows you to borrow DAI, exchange your tokens internally and multiply the exposure to your collateral (among the 30 available cryptoassets). Oasis.app is now the most trusted entry point to the Maker Protocol. The long term mission is to allow users to simply and easily deploy their capital into DeFi and manage it in one trusted place. 👉 Get started with the Oasis.app 👉 Follow them on Twitter 👉 Join their Discord If you liked this post from BanklessDAO, why not share it? |

Older messages

NFTs Come to Football | Decentralized Arts

Tuesday, August 2, 2022

Dear Bankless Nation, What was Android #44 V864.962 thinking when it screwed into a shrub for a week? Was he exploring and imitating the archetypes—of which the Dusty Eye group speaks—or did he want to

Season of the Bear | BanklessDAO Weekly Rollup

Saturday, July 30, 2022

Catch Up With What Happened This Week in BanklessDAO

Decentralized Autonomous Organizations | Decentralized Law

Friday, July 29, 2022

A Monthly Legal Journal Covering the Crypto-Legal Space

Pooly Owners Are Fighting for DeFi

Wednesday, July 27, 2022

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

Dive Into the Otherside | Decentralized Arts

Tuesday, July 26, 2022

Dear Bankless Nation, One of the protagonists and undisputed leaders in the world of NFTs is definitely Yuga Labs, whose broad-spectrum strategy and progress continue undaunted. The involvement of Yuga

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏