The Daily StockTips Newsletter 08.16.2022

IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. Past performance does not guarantee future results. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.I am still waiting for substack to reach out to me on the billing fix. It seems since I temporarily paused billing they’re having trouble restarting it. They tell me their engineers are working on it. Once things are fixed I can get back to business as usual and see about lowering the price of the overall newsletter. As a result of this setback I have revised the newsletter as you all remember it. Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. BUILDING PERMITS & HOUSING STARTS YESTERDAY: Consensus Housing Starts were 1.54m while consensus building permits were 1.65m. Actual numbers came in 1.446 & 1.674, respectively. RETAIL SALES THIS TODAY: Retail Sales MoM for July will be reported today with FOMC minutes. Consensus retail sales are expected to come in at an increase of 0.1% MoM. That’s not a great number, & its a sure fire indicator that people have adjusted their spending habits to cope with inflation. Now, if this number comes in negative it will rock the markets! However they may come higher than consensus given the most recent retail earnings. FOMC MINUTES: I don’t suspect any surprises here unless the big money in the market wants to use it as a negative catalyst. We know the Fed wants to increase rates until they see a noticeable & reliable shift on inflation. We also know that the recent decrease in month to month YoY inflation is not enough to give the Fed a warm & fuzzy. I expect the Fed to signal that tackling inflation is their priority over all else, beyond that of employment & the market. THE UK HIT DOUBLE DIGIT INFLAITON!: The UK consumer price index rose 10.1% annually, according to estimates published by the Office for National Statistics on Wednesday, above a consensus forecast of 9.8% and up from 9.4% in June. Rising food prices made the largest upward contribution to annual inflation rates between June and July. The Bank of England expects inflation to top off at 13.3%. I suspect there will be some spillover effects from Europe as their prices continue to increase. Remember its a world wide market & Europeans, due to ridiculously low interest rates, are getting priced out quicker than folks here in the US. Major US based global corporations sales will likely be affected as Europeans economize on their needs & cut back on their wants. Indeed its easy to view the world through the market you know. However many of the major companies you think of in the market you know are affected by headwinds across the world from the supply chain to the retailers. BE CAREFUL IN THESE MARKETS: Do you think that the forward effects of Fed Rate Hikes & Inflation are appropriately priced in or do you think the market is getting ahead of itself? Ask this question to yourself prior to investing. JULY EXISTING HOME SALES TOMORROW: Existing homes sales are expected to come in at 4.89m. Existing home sales haven’t been that low, aside from the pandemic drop, since 2016. WORLD MARKETS:

RECOMMENDED:

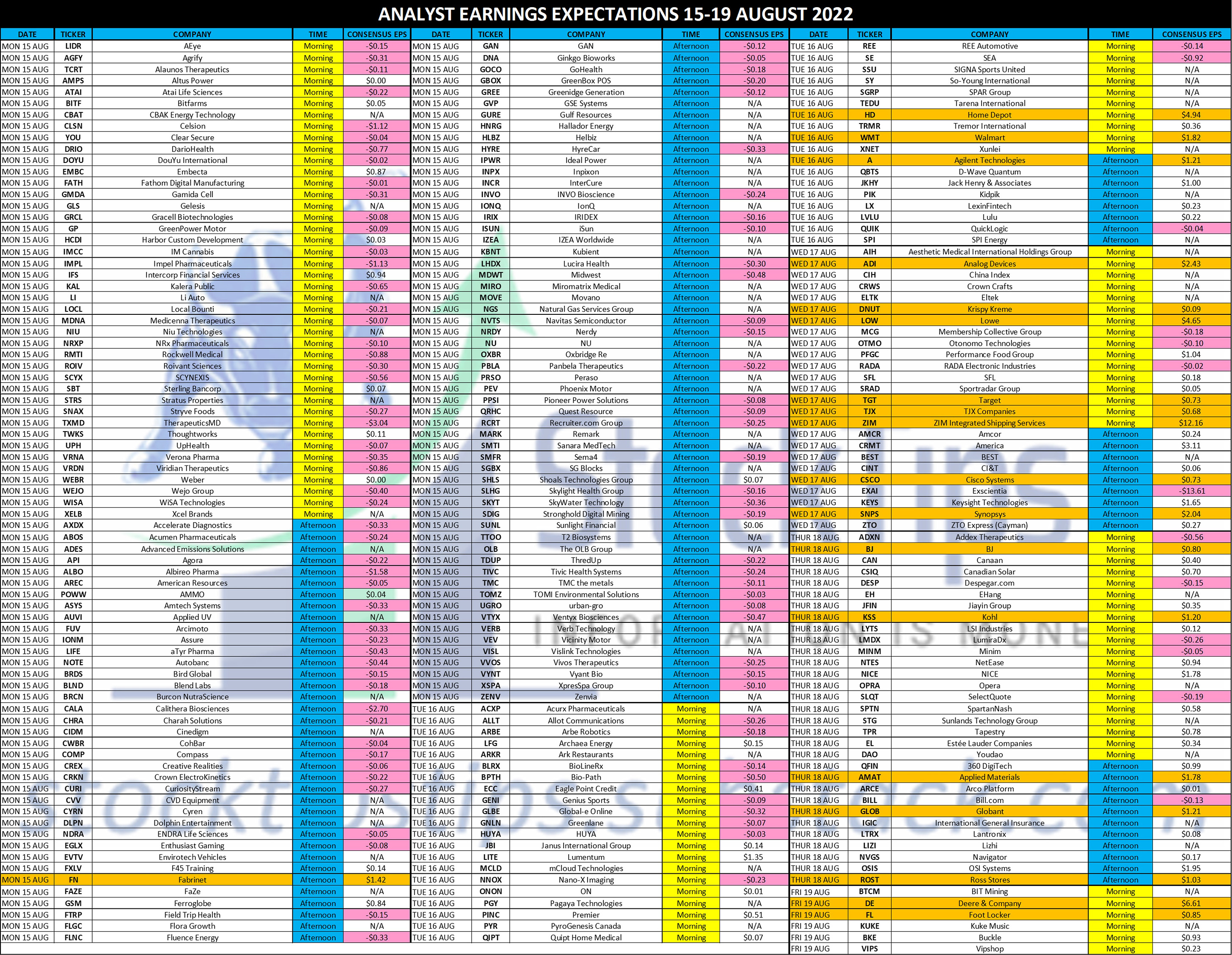

TODAY’S EPS EXPECTATIONS: Keep reading with a 7-day free trialSubscribe to StockTips Newsletter to keep reading this post and get 7 days of free access to the full post archives. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 08.16.2022

Tuesday, August 16, 2022

(Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 08.15.2022

Monday, August 15, 2022

(Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 08.10.2022

Friday, August 12, 2022

(Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 08.10.2022

Friday, August 12, 2022

(Published 7:30 AM ET MON-FRI)IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever

Working on Some Fixes

Friday, August 12, 2022

All, It seems that the newsletter is having issues setting up new paid subscribers after I paused billing for a bit. I am working on this fix. StockTips

You Might Also Like

🇺🇸 The president's crypto fund

Monday, March 3, 2025

Crypto's back in favor and European defense stocks got an, uh, arm up | Finimize Hi Reader, here's what you need to know for March 4th in 3:15 minutes. The US president announced plans for a

CDs supercharge your savings

Monday, March 3, 2025

You could earn up to 4.10% for a 1 year term ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, March 1, 2025

Hackers, Safety, EBITDA, More Hackers, Feudalism, Randomness, CEOs Longreads + Open Thread By Byrne Hobart • 1 Mar 2025 View in browser View in browser Longreads A classic: Clifford Stoll on how he and

🚨 This could be a super bubble

Friday, February 28, 2025

An expert said we're in the third-biggest bubble ever, the US poked China one more time, and OpenAI's biggest model | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Boring, but important

Friday, February 28, 2025

For those life moments you might need . . . ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Last Trader Standing

Friday, February 28, 2025

The Evolution of FX Markets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

My secret 15-minute video sharing my triple digit options strategy

Friday, February 28, 2025

Free training + book ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👋 Bye bye, bitcoin

Thursday, February 27, 2025

Bitcoin's biggest one-day blow, Trump's latest tariff threat, and robots playing soccer | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 28th in 3:12 minutes.