Mutually Assured Destruction - The Daily Gwei #526

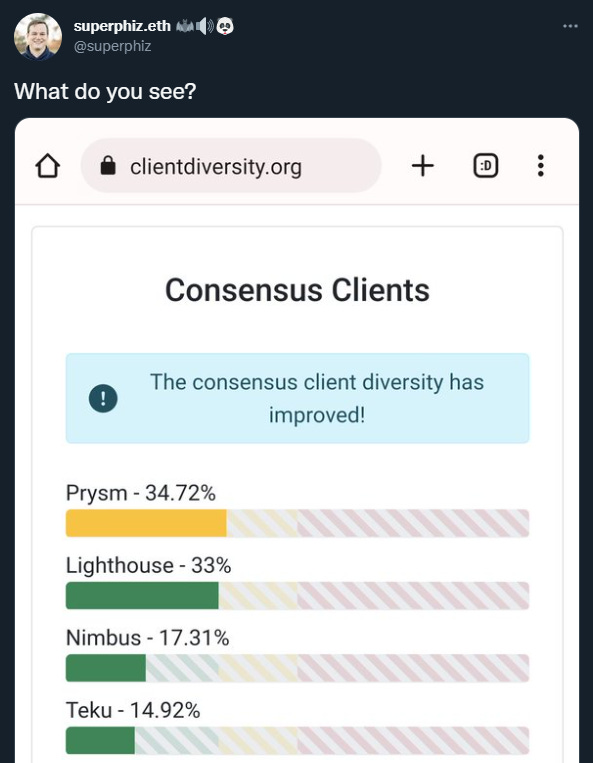

Mutually Assured Destruction - The Daily Gwei #526If you try to censor us, we will nuke you from orbit.Hey readers - I just wanted to apologize for the lack of newsletters over the last few weeks. Both my real life and crypto have been much busier than usual so it has been difficult for me to keep up the daily cadence of these newsletters. I haven’t even had a chance to write about the Tornado Cash sanctions (though I did talk about them at length on my 2 recent YouTube videos here and here). Anyway, I can’t promise that I’ll be able to maintain a daily cadence of these newsletters for the foreseeable future but I will endeavor to keep publishing them as frequently as possible - thanks for sticking with me :) Ethereum’s “social layer” has been quite topical lately due to the discussions being had around the Tornado Cash sanctions and the possibility of censorship on Ethereum. If you’re newer to the ecosystem you may not understand the importance of a crypto-networks social layer but make no mistake - it is the most important thing for a network and ultimately our last line of defense against any adversaries. I think Superphiz’s tweet above is the perfect example of Ethereum’s social layer in action. To give the context - a little while ago the Ethereum Beacon Chain’s validator client diversity was quite uneven with Prysm accounting for 60%+ of the network (and at one point over 66% which is the critical level we don’t want any one client to reach). Given this situation, there was a huge community push (led by Superphiz and others) to get people to switch to a minority client. Well, you can see the results of this push above - Prysm went from being around 67% of the network to just under 35% and client diversity has never been healthier that it is today! On this topic of the social layer, there’s been a lot of talk lately about potentially “socially slashing” any validators that decide to censor transactions on the Beacon Chain. I do want to be clear that this a “nuclear option” that would only be used as a last resort (and ideally it would never actually be used). This is because socially slashing large validating entities like centralized exchanges would lead to a lot of collateral damage for the entire ecosystem and a very messy time for Ethereum. Though the point of even talking about social slashing is to send a strong signal to these entities that censorship is an attack on Ethereum and will be met with an aggressive response in the worst case. Another way to think about the above is that there’s a “cold war” going on at the moment where a type of ‘mutually assured destruction’ is at play. If a centralized staking service provider decides to censor transactions at the base-layer, then the Ethereum community would react with its ‘nuclear option’ of socially slashing the offending validators. Because of the nature of slashing (literally burning a validators stake), entities have every incentive not to engage in any behavior that could get them slashed (socially or technically). So instead of censoring transactions because a government told them to, the staking service provider could simply exit their validators from the active staking pool (because the threat of social slashing is ever looming if they instead choose to censor). Personally I believe that if the Ethereum base-layer was to ever engage in permanent censorship, that would be the end of Ethereum. Our currently strong social layer would begin to break down, smart people would leave the ecosystem, developers would flee to other chains and users would abandon the chain in droves. Fortunately, I don’t see a future where the Ethereum base-layer becomes permanently censored - but only because I believe that Ethereum’s social layer is strong enough to resist this. Have a great day everyone, Enjoyed today’s piece? I send out a fresh one every week day - be sure to subscribe to receive it in your inbox! Join the Daily Gwei EcosystemAll information presented above is for educational purposes only and should not be taken as investment advice. If you liked this post from The Daily Gwei, why not share it? |

Older messages

Gas Guzzlers - The Daily Gwei #525

Friday, August 12, 2022

The evolving nature of Ethereum's blockspace.

A Red Letter Day - The Daily Gwei #524

Tuesday, August 9, 2022

Things just got (very) serious.

The ETH Milkshake Theory - The Daily Gwei #523

Wednesday, August 3, 2022

Banana, chocolate, or ETH flavored?

Poor Critics - The Daily Gwei #522

Monday, August 1, 2022

Ethereum critics leave a lot to be desired.

What's Your ENS? - The Daily Gwei #521

Friday, July 29, 2022

The future of finance is human-readable Ethereum.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏