Bankless DAO - Tokenization | Decentralized Law

Dear Crypto-Legal Observers, She opened her eyes, and there was the world. While many people new to crypto may take the existence of tokens for granted, others who have been around a little longer know it’s a bit more complex than that. In a very broad sense, tokenization refers to the process of digitizing an asset that can then be used on chain. As a practical matter, tokenization refers to the ways in which a project can raise money; fund operations; and pay investors, the team, and contributors; and, of course, distribute the token according to the project’s goals. As lawpanda writes in this month’s issue of Decentralized Law, tokens “are a tool for successfully distributing a project's core value. While token distribution can incentivize participation, create (non-equity) value, and aid in the development of credible decentralization, the mechanisms that facilitate investment in the protocol, the function of token issuance, and distribution of those tokens, are often complex and compartmentalized or operating in regulatory gray areas.” Because of this regulatory gray area, questions of how, when, and where to tokenize are often among the chief concerns for any new project. In fact, any project since Bitcoin must deeply consider the mechanics of tokenization:  The most common types of tokens include security tokens, utility tokens, and currency tokens, and much of the regulatory noise in Western jurisdictions involves trying to figure out just how our new blockchain-based world fits in with regulations created for fiat enterprises. Post Bitcoin, methods for tokenizing proliferated. Even those with no interest in crypto probably recall the Initial Coin Offering craze in 2017. While ICOs are one model — largely disfavored because the SEC views these offerings as securities — other token distribution models involve Token Warrants and SAFTs, rather TradFi-looking instruments. Other crypto-native models for tokenization exist, like the Lockdrop + Liquidity Bootstrap Auction, but the bottom line is that tokenization is hard. You need a lawyer. You need Andrew Hinkes. Andrew Hinkes is an OG crypto lawyer, having joined the space before the launch of Ethereum. Now a partner at international powerhouse K&L Gates and an adjunct professor at NYU, Hinkes brings his unusually deep crypto experience to bear on some of the industry's most compelling problems. In this issue of Decentralized Law, Andrew discusses a range of issues, including the importance of regulating behavior not technology, the groundwork necessary for on-chain securitization, and why he’s optimistic about the regulatory horizon. Also in this issue, we analyze different tokenization methods, dive into the problems with so-called crypto banks, get a refresher on the Howie Test, assess MiCA’s treatment of stablecoins, and summarize news and articles from throughout the cryptoverse. Although this newsletter may help to familiarize readers with the legal implications arising out of blockchain technology, the contents of Decentralized Law are not legal advice. This newsletter is intended only as general information. Writers’ opinions are their own; therefore, nothing in this newsletter constitutes or should be considered legal advice. Contact a legal expert in your jurisdiction for legal advice. Welcome to Decentralized Law. Contributors: eaglelex, hirokennelly.eth, COYSrUS, Trewkat, Cheetah, pub-gmn.eth, lawpanda, tiello, MDLawyer, G0xse, Jay the Legal Wizard, Oluwasijibomi, Lanksss This is the official legal newsletter of BanklessDAO. To unsubscribe, edit your settings. 🙏 Please Support Our Friends: 🗞 The Rug NewsletterThe Rug is Web3’s mostly credible news source. We take money, seriously. The Rug places a satirical lens on crypto culture. Think "The Onion" for Web3. Our publication includes recaps of the best jokes, funniest articles, behind the scenes podcasts, and throwback newspaper-style NFTs, all of which we produce on a regular basis. Subscribe to our newsletter and read all about it! 🎙 InterviewAndrew’s Dog Is Named Satoshi, of Course

I’ve always been fascinated by technology and found bitcoin through a friend who initially made money trading it in 2012. He smartly observed that my tech background and legal training, along with general interest in nerdy, niche things, might make bitcoin really click with me. I bought my first bitcoin in 2013 and wish I still had it. I also wish I wasn’t so immediately skeptical of ETH (thanks Chris & Junseth). In the course of learning about how bitcoin works, I realized that there were innumerable open questions about how law would approach digital assets, and how law would adapt to more self- sovereign types of technologies that would open up amazing opportunities for businesses, all of which would need lawyers. At that point I decided to risk my career on the bet that crypto would spawn an industry that would need advice from lawyers who understand the law, the tech and the culture.

America. America is built on the idea that we can do things differently. Shortly after the passage of the Constitution we added the Bill of Rights, including the 4th amendment, which remains a wonder. Here’s the government giving people power against the Government. That’s not how it usually works. We take for granted today how radical this was at the time and still is. Under the 4th amendment, we have a right to create carve outs where the government cannot invade our privacy without due process. Of course, over time those carve outs have been eroded by the BSA and the third party doctrine, so the privacy we have and the right to keep the government out of our affairs is narrowed and weakened. I did a talk on this at the Block[Legal]Tech event in 2019. Crypto immediately caught my attention as a new way to secure one’s privacy in their affairs, a way that’s protected by math. This remains appealing to me.

Regulate people and their behavior, not technology. Don’t get hung up on the right terminology to define the tech; tech changes every day and your definition will stink in the short if not medium term because of it. There are still statutes that require things to be recorded on one-time writable CD-ROMs. This isn’t the way. Regulate conduct by people.

Don’t regulate nodes. That will only cause network forks that exclude the US.

Nothing is impossible to regulate as long as regulable people are involved.

I was chosen! It’s a long story but (in one of the most fortuitous and wonderful events of my life), Professors Yermack and Miller at NYU offered me the opportunity to teach the law side of the JD/MBA class “Digital Assets, Blockchains and the Future of Financial Services.” It’s been one of the most important, most fun, most impactful things I've ever done and will ever do. Since I started teaching the class in 2018, I’ve seen the level of student awareness and engagement soar, and seen students go from curious to blazing trails in the industry. It’s been an absolute blast and remains an incredible privilege.

Besides naming my dog Satoshi? I’ve been around a while and had an opportunity to take part in some interesting matters — but a lot of the juicy stuff is privileged.

I’m optimistic. For the first time we’re seeing bipartisan proposals, like the Lummus Gillebrand bill, that are mature proposals that incorporate input from stakeholders in the industry and that have a real prospect, in some form, of being passed.

We are currently in a simultaneous state of over and under regulation. We arguably have to consider 3-4 different legal regimes when evaluating a digital asset, because the law that applies to digital assets is not settled and contradicts other laws. A digital asset might be a commodity, a security, property, money, or value that substitutes for currency, depending on who in the government you ask. Just like anything else, trial and error. My suggestion would be to undercorrect, rather than overcorrect.

Yes, they will be common once the base layer of legal infrastructure is built; once that's in place, it won’t look terribly different than existing models for other asset types. I’m still a believer that tokenization of IRL assets is inevitable. We need clarity as to the “connective tissue” that fastens the IRL asset to its digital twin. That connective tissue will come in the form of legal agreements or perhaps statutory legal defaults.

They should be cautious but they should move incrementally.

The US will win. We’re still the biggest and best place there is to do business. But like in other markets, niches will be there and others will win as well. These are global, borderless systems. More than almost anything else, it’s not a zero sum game.

A lot of calls, zooms, emails and writing; blogs, articles, and memos. I wish I had time to read more.

I’m always working on 4-5 writing projects, some of which will actually see the light of day. Crypto is amazing in that it’s constantly evolving and there are always new questions. I wish I had time to think about all of them.

I’ll offer 2 things that are surprising. 1. It’s incredibly fun to work with innovators. 2. The Crypto Bar (i.e. the group of lawyers who work extensively in crypto) is amazingly collaborative and collegial. We’re an eccentric but fantastic tribe that's ever growing.

More institutionalized and more clearly regulated. Nominated as one of Coindesk’s Most Influential People in Blockchain in 2017, Andrew "Drew" Hinkes is a partner with K&L Gates, working as part of its National Blockchain and Digital Currency practice. Drew was appointed as an Adjunct Professor by the NYU Stern Business School and the NYU School of Law, where he co-teaches "Digital Currency, Blockchains, and the Future of the Financial Services Industry." Since 2019, Drew has been involved in law reform, serving as an observer for Uniform Law Commission/American Law Institute, Uniform Commercial Code and Emerging Technologies Digital Assets Working Group, and the UNIDROIT Working Group on Digital Assets and Private Law working group focusing on secured transactions. Mr. Hinkes is frequently quoted and cited in articles related to digital assets and blockchain technology, and regularly speaks at legal, industry, and academic conferences and symposia. ⚖ DevelopmentsImmaculate CoinceptionAuthor: lawpanda

You’re an enterprising founder with a unique project in the Web3 space. You have received angel investment and set up your startup company using Stripe Atlas, Doola, or the like. Somehow, you found enough devs to build the project, and you’ve come up with a killer marketing campaign. You know the right people, and your cap table is ready to go for those first funding rounds. As you begin meeting with investors, they start asking about SAFTs and SAFEs, token warrants, ICOs, and what kind of SPV you will utilize to launch your token and in what jurisdiction. You then realize that you have no idea how the rest of this stuff works. Should you talk to an attorney? Where do tokens even come from? This article is meant to provide a very general — non-legal advisory — overview of some of the steps and mechanisms involved in the funding and issuance of a token. There will, of course, always be distinctions and exceptions based on considerations such as whether a project is anon or doxxed, whether it exists as a fully on-chain entity or has one or more associated development companies (‘devco’) or other operational entities, whether the project is raising VC funding, and whether the project intends to establish a DAO or remain operating in a more centralized manner. Notwithstanding this multitude of considerations, however, obtaining funding and effectuating token issuance in the manner discussed below is a common journey for many projects. Bitcoin’s Immaculate ConceptionAccording to Nic Carter, “Bitcoin benefited from an extremely rare set of circumstances. Because it launched in a world where digital cash had no established value, it circulated freely. That can’t be recaptured today since everyone expects coins to have value. Not only was it fair, but it was historically unique in its fairness. The immaculate conception”. Unlike Bitcoin, most projects require investment and funding, with all of the attendant regulatory concerns and considerations for investor/founder exit. Digital tokens are expected to return value for investors. While Satoshi never had to worry about securities laws, almost every subsequent project does. In 2017, spurred largely by the ICO boom, the then U.S. Securities and Exchange Commission (SEC) Chair, Jay Clayton, stated that cryptocurrencies are ‘intended to provide many of the same functions as long-established currencies such as the U.S. dollar, euro, or Japanese yen but do not have the backing of a government or other body’. However, he also noted that whether a given digital asset that is labeled as a cryptocurrency is a security ‘will depend on the characteristics and use of that particular asset’. While that sounds like an appropriately nuanced position, the current SEC Chair Gary Gensler stated in a 2021 interview that investors ‘buying these tokens are anticipating profits’, which is one of the conditions that any asset must meet to be deemed a security, and this causes them to fall under the SEC’s jurisdiction. The ability to serve as a replacement for a sovereign currency can be difficult to achieve. As Scott Kupor, managing partner at Andreessen Horowitz, has previously written, “in the pre-network stage, tokens will generally be characterized as securities in light of the “reliance on the efforts of others” prong of the Howey test. However, post-network launch — provided that the network is sufficiently decentralized — the nature of the token can change from security to non-security, owing to the fact that the holder of the token is no longer relying on the efforts of others”. In that context, the token is seemingly transformed into an alternative currency or commodity. It is not clear, though, whether the SEC would agree that a token can cease to be a security. In the United States, Section 5 of the Securities Act requires that market participants register ‘securities’ with the SEC prior to offering them for sale unless an exemption applies. Section 2(a)(1) defines the term ‘security’ by enumerating a list of financial arrangements that Congress expressly intended to capture within the purview of the statute. A digital asset may be deemed a ‘security’ and be subject to federal securities laws if the asset is one of the enumerated examples of securities. Unsurprisingly, blockchain-based coin and token offerings are not expressly listed among the enumerated examples of securities in Section 2(a)(1). However, alongside the enumerated examples of asset classes commonly referred to as securities, Congress curiously included but did not define a catch-all term—‘investment contract’. According to the Howey Test, an investment contract exists if there is an “investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others”. Because of this draconian default characterization as a security in the U.S. and other jurisdictions, most entities issuing tokens are, in function, attempting to recreate the aspects of Bitcoin’s issuance that allow it to be characterized as a currency or commodity and not as a security. Ultimately, the mechanisms to fund a project and launch a token in a manner that does not violate securities laws often require a behind-the-scenes legal shell game that results in what appears to be the immaculate conception of a token that is then bestowed upon an awaiting community for governance, investor exit, and whatever other purposes. If you’re not doxxed or are somehow out of the reach of the more ‘oppressive’ regulators, you could certainly always drop a contract and issue a token, then conduct a sale on-chain. Unfortunately, most projects don’t have that option, if for no other reason than founders are concerned about liability or that the potential funding won’t be sufficient to achieve the project's goals.  Initial Coin OfferingsInitial Coin Offerings (ICO) are probably the most well-known funding mechanism for projects in the crypto space. An initial coin offering, like an IPO, sells something to fund the creation or operation of a new cryptocurrency. An arguable and important distinction between an IPO and an ICO is that contributors to an IPO are investors who are acquiring shares of the company, i.e. equity. In contrast, ICO backers are acquiring what might more appropriately be characterized as a product in the form of the token, which does not generally represent equity in the token’s issuing company or network. However, despite what seems like a fairly clear distinction, in the U.S. the SEC requires projects to follow private placement and public offering rules when conducting an ICO. However, for the same reason that Special Purpose Acquisition Companies (SPAC) were incredibly popular in the 1990s and again in 2020 and 2021, most projects don’t want to deal with the hurdles and regulatory burden of registering a public or private offering. Ultimately, an ICO or SPAC merger is generally considered easier. ICOs first became popular in 2017 because they allowed entities in the crypto space to raise capital and fund development without having to go through the regulation-intensive processes mentioned above. Numerous projects sold tokens in the period between 2017 and 2018. According to a Harvard Business review article, the average amount of capital raised by a via ICO in 2017 was thirteen million, with the number increasing to twenty-five million through the third quarter of 2018. According to Coindesk, most of these sales netted less than $100 million, though projects remained eager to utilize the mechanism despite the looming regulatory risk. The success of these ICOs consequently attracted significant regulatory scrutiny, most notably from the SEC . As a result, ICOs have largely fallen out of favor as a funding mechanism due to the associated regulatory obligations and potential exposure to regulators. They are also just flat-out banned in certain jurisdictions like China. SAFTsFor institutional investors, equity term sheets are a standard mechanism for investment in early-stage companies. Instruments such as a convertible or a ‘simple agreement for future equity’ (SAFE), which was initially popularized by Y-Combinator, are generally used to convey future equity to investors. However, when an investor receives a startup’s native token instead of equity, a simple agreement for future tokens (SAFT) is utilized. The SAFT was initially hailed as a novel way to carry out ICOs in a manner that complied with federal securities rules. As with the distinction between an IPO and an ICO, where a SAFE offers equity in exchange for an investor's early-stage investment, a SAFT provides for the delivery of fully functioning future tokens once issued. In the 2017-2018 ICO boom, SAFTs were often utilized by institutional investors in conjunction with an ICO. As with ICOs in general, the two-step ICO + SAFT strategy quickly ran afoul of the SEC, which brought several high-visibility enforcement actions against offerings from the messaging app Telegram and rival messaging app Kik. In both instances, the SEC found that distributing tokens to investors in the form of a SAFT with a view toward onward distribution in the U.S. by those investors is not, in fact, a private placement but a preparatory step for a public offering via cryptocurrency exchanges, with the SAFT holders being regulated not as investors, but as statutory underwriters for onward distribution to the public. Due to the SEC’s creative assertions, this entire line of litigation is confusing, even to experts in the space. Currently, at least in the U.S., the SAFT — instead of the yet-to-be created token offering — is characterized as a security that can be offered to accredited investors in a private placement. Outside the U.S., the necessity of restricting SAFTs or tokens to accredited investors will be determined by local legislation. In function, SAFTs are generally utilized when the project has already decided on the type of token it plans to issue, has already detailed tokenomics, and has created a token distribution plan (including prices and stages of distribution). This is because a SAFT cannot be signed without detailing the material terms of issuing and transferring tokens to investors. SAFT terms usually include:

Therefore, a detailed paper with a description of token use cases, tokenomics, and token distribution plans is generally considered necessary to prepare a full-fledged SAFT. In exchange for this promise of future tokens, Web3 startups can use funds from the sale of SAFT to develop their projects, mint their tokens, and issue their tokens to investors, who usually have an expectation that there will be a secondary market to sell these tokens. Token WarrantsMore recently, token warrants have gained favor as an investment mechanism among Web3 venture funds. In a recent tweet, Su Zhu of the embattled Three Arrows Capital (3AC) accused 3AC's liquidators of failing to exercise StarkWare token warrants, causing 3AC to allegedly lose out on significant future returns from the putative StarkWare token. In doing so, he inadvertently dropped a whole lot of alpha regarding StarkWare’s plans for token issuance. A token warrant is a broad instrument that secures investors' rights to tokens that will (or may) be issued in the future. Issuing warrants doesn’t mean a token will be issued — though it seems very unlikely that StarkWare is not issuing a token. While SAFE and SAFT documents are well known and widely utilized by investors, not all founders, retail, and non-institutional investors are familiar with the warrant mechanism. Token warrants can be distributed to equity holders in an associated devco or parent entity. They can also be issued from an entity specifically created to issue the warrants and tokens. Token warrants do not usually specify the amount of the issue, the allocation for the investor, the price, or any other significant conditions, but only establish the investor's right to receive these tokens proportional to the equity ownership percent times the token allocation percentage for investors (for example, in a situation where 25% of tokens are allocated to investors, a seed investor holding 10% of the company’s equity would acquire a right to 2.5% of the project’s tokens, or 10% x 25%). To further incentivize investors, protocols often include a significant discount from the market rate on the token purchase price when the warrant is exercised. Entities like SporosDAO are now utilizing token warrants in their startup solutions to provide compliant sweat equity distribution mechanisms to contributors. The mechanisms utilized by Sporos track contributions in a manner that is meant to limit a startup's legal considerations by allowing tokens or future tokens to remain non-transferable, or illiquid, until the occurrence of a liquidity event. This arguably shields distribution of tokens or equity from securities registration for the timeframe leading up to the liquidity or token generation event. Entity StructuringOne of the main motivations — and struggles — for DAOs to associate with or ‘wrap’ in a legal entity is due to the creation of fictional legal personhood, which provides liability protection and the ability to contract and act as a counterparty to a warrant, SAFT, or other agreements. For anonymous teams, this similarly creates a variety of issues. To the extent a project has a devco or other entity in place while it is seeking funding, that entity can contract on behalf of the startup or putative DAO. However, even if there is an entity in place, most projects ultimately utilize multiple distinct entities in a ‘stack’ to facilitate conducting a raise or token sale, issuing a token, and managing the project after the token generation event. This arguably provides optimal risk mitigation because it silos function and liability. This structure may also seem familiar as it is generally analogous to structuring in legacy financial offerings and investment funds. In addition to the startup entity/devco or unregistered DAO, an ‘optimized’ legal stack that provides the most potential insulation often includes: 1) a special purpose vehicle (SPV) that issues or countersigns funding instruments (the SAFT/warrant/options/conducts the ICO, etc.); 2) an entity that stewards the project or community after the token generation event (often a foundation as the sole beneficiary of the SPV or other nonprofit structure); and 3) an entity that performs necessary development or service work on behalf of the project or DAO (this is often the devco). In some instances, separate SPVs are utilized to manage fundraising and token issuance. In addition to acting as a counterparty, the SPV’s primary purpose is to establish a limited liability shield between token creation and distribution events and the potential personal liability of the project founders and investors. Once the token distribution event is completed, the SPV transfers its assets, generally consisting of the balance of the tokens initially issued and proceeds of any token sale, to a foundation beneficiary or other entity. After assets have been transferred to a foundation or other appropriate entity, the SPV is dissolved to avoid non-fraudulent regulatory issues or legal risks associated with token sales and issuance that might carry over to the entity that is now managing the token treasury. A common combination is a British Virgin Islands (BVI) Company as an SPV and a Cayman Islands Foundation Company, which can also be made ‘faceless’ if formed without founders and members. It is worth noting that while these solutions are often considered optimal, they are generally cost prohibitive for many projects. Arguably, this is because organizations and protocols utilizing these structures have historically been in the financial sector, where cost is not a significant barrier to entry. Broken down for clarity, the sequence of funding and token issuance is generally as follows:

Wrap It Up

Tokens are a tool for successfully distributing a project's core value. While token distribution can incentivize participation, create (non-equity) value, and aid in the development of credible decentralization, the mechanisms that facilitate investment in the protocol, the function of token issuance, and distribution of those tokens, are often complex and compartmentalized or operating in regulatory gray areas. Due to regulatory uncertainty, most crypto ventures strive to achieve the holy grail of decentralization. From Ethereum to decentralized finance platforms like Compound, Synthetix, and Maker, these protocols emerged under the centralized leadership of core teams who gradually relinquished control to a larger community. However, these protocols and core teams required significant initial seed capital that could not be easily raised in a decentralized manner at the time, or likely even now. Behind every decentralized protocol, there was a startup entity, foundation, SPV, etc. that could contract with investors and secure appropriate funding to achieve the project’s goals. However, externally, it often appears that the project token was immaculately co[i]nceived from the ether, à la Bitcoin. lawpanda is a U.S. attorney with an active litigation and counseling practice. He is a member of BanklessDAO’s Legal Guild, LexDAO, the LexPunkArmy, and member/consultant/contributor to a variety of DAOs and protocols. When he’s not writing for Decentralized Law, he is working to reduce operational and governance friction between on-chain and legacy entities through corporate structuring and common-sense legal solutions. Connect on Twitter, LinkedIn, or at lawpanda.eth@gmail.com. Crypto Banks Are the Worst of Both WorldsAuthor: lawpanda

Centralized exchanges such as FTX, Binance, Voyager, Celsius, BlockFi, etc. — often called ‘crypto banks’ — seem to fall into a strange regulatory gray area that facilitates the type of obfuscation and lack of accountability that ultimately damages retail investors and the industry as a whole. While most retail investors reasonably believe that these entities (which are registered companies in various jurisdictions, some even publicly traded on exchanges) are subject to regulatory scrutiny and consumer protection requirements, that is often not the case. Logically, if a company can sponsor a Super Bowl ad or brand a sports arena, why would a retail investor not trust that the company has appropriate risk management or compliance processes in place? Unfortunately, as Three Arrows Capital's contagion spread to various crypto banks, it became apparent that, much like with investment banks in 2008, regulators were too busy complaining about DeFi to actually regulate registered crypto entities. Chief among these retail-focused ‘crypto banks’ is Celsius Network. From 2018, until its recent meltdown, Celsius had grown into one of the largest asset managers in crypto, with almost $12 billion under management as of May 2022. In June 2022, Celsius entered into bankruptcy protection after freezing client funds and withdrawals. Celsius isn’t publicly traded, but its token, CEL, is utilized in a manner that is comparable to equity, albeit in a fully unregulated manner that has arguably now impacted countless retail investors. Just to be Clear, ‘Crypto Bank’ Celsius Isn’t Actually a BankCelsius and similar companies are not regulated like traditional banks and brokerage firms, so investors’ losses are not insured by the Federal Deposit Insurance Corporation or protected by the Securities Investor Protection Corporation. “Due to the volatility of the cryptocurrency market and the lack of regulatory oversight, these platforms present a heightened risk of loss to investors”, then New Jersey Acting Attorney General Andrew Bruck said in a statement in September 2021. In form, Celsius is arguably not subject to oversight from regulators in either the investment or banking sectors. However, because Celsius utilizes its native CEL token as an equity offering — often in a manner that would be facially improper in a publicly or privately traded company — it should likely be subject to oversight from regulators in the finance industry. ‘Utility Token’ BuybacksCelsius’s risk disclaimer clarifies that maybe it is not a security, stating in full:

While CEL may or may not be considered a security by regulators, Celsius certainly seems to utilize it as one. As best stated by a Seeking Alpha article from 2021:

The SEC’s 2019 Framework for “Investment Contract” Analysis of Digital Assets publication, which notes that certain characteristics ‘while not necessarily determinative’, make it more likely that the relying on the ’efforts of others’ prong may be fulfilled:

Celsius’s ongoing buybacks and other mechanisms to limit supply and increase price seem to clearly fit this description. According to Arkham Intelligence, Celsius utilized CEL in a variety of ways that supported its market. For example, instead of redistributing CEL fees from lenders to users, Celsius was purchasing hundreds of millions of dollars of CEL (over $350 million) to pay out interest on deposited funds to users. Celsius’ purchase and distribution of its customers' CEL payments, rather than using CEL tokens received through fees or distributing from the treasury, expended capital that could have been retained as reserves or to cover withdrawal requests. Because Celsius didn’t need to purchase CEL to satisfy these obligations (they purport to own 335 million CEL which is about 48% of the total supply of the token), these purchases are very apparently more analogous to a stock buyback from a publicly traded company and functionally make the CEL token deflationary, increasing the price. Even in Bankruptcy, the Company Is Worth $1 Billion (Albeit in Tokens They Can’t Sell)Celsius claims to have more than 1.7 million users and up to $4.72 billion of its debt in locked client funds. Celsius currently holds only $1.75 billion in cryptoassets excluding its CEL token holdings, which it valued at $600 million at the time of its bankruptcy filing. Also, according to its bankruptcy filing, Celsius has 658 million CEL tokens in its treasury. Celsius owes 279 million of the tokens to clients, leaving the firm with a 379 million surplus. At the short-squeezed market price as of August 15, 2022, the net value of Celsius’s CEL position would be worth almost $1 billion, more than double what it was at the time of its bankruptcy filing. Despite this seeming windfall, most of this token’s supply is locked on the platform, and CEL pair liquidity on exchanges is likely too thin to support significant exchanges. This is particularly relevant because Celsius is projected to run out of funds by October 2022. However, if the firm attempts (or is even able) to sell portions of its treasury of CEL tokens to cover a part of its balance sheet shortfall, prices (which were artificially inflated due to buybacks in the first place) would likely tank. “The asset side of the CEL holding is probably worth zero”, said Thomas Braziel, founder of 507 Capital, an investment firm that provides financing around bankruptcies and reorganizations, adding further that the liabilities are still there because CEL token owners will likely pursue claims against Celsius in the bankruptcy court. In a liquidation or bankruptcy setting, where a bank would be put into receivership or managed by regulators, and a publicly traded company’s stock would be delisted from exchanges, Celsius’s CEL token has continued to trade, allowing major token-holders like Celsius CEO Alex Mashinsky exit liquidity. Insider Trading and Market Manipulation?Arkham Intelligence determined that blockchain addresses associated with Mashinsky appear to have sold $45 million of CEL throughout their lifetime, sometimes on the same exchanges where Celsius bought the token with corporate funds. During these time periods, Manshinsky was promoting CEL to users and denying that he was selling the token. Potentially, Celsius was also using corporate funds on the same order book that Mashinsky used to exit his position. On October 9, 2021, Mashinsky tweeted, “Lots to CELebrate here in #London busy week with a lot of large deals and events. It pays to #HODL”. Nine hours later, on the very same day, a suspected Mashinsky wallet sold 12K CEL on Airswap for $69k in USDC. Two months later, on December 9th, he tweeted:  Nuke Goldstein @NukeGold Not only I did not sell 1 CEL since May, I have accumulated some and will add. Can't wait for US accredited investors earn in CEL, now that it was cleared by legal. https://t.co/lV1DXMQ8NQJust five days earlier, on Dec 4, a suspected Mashinsky address sold 11K CEL for $43K in WBTC. Market manipulation refers to any attempt to interfere with the free and fair operations of the market. While legislation against market manipulation exists, there is none specific to cryptocurrency or entities like Celsius. Additionally, in publicly traded companies, rules on market manipulation generally prohibit market participants from trading based on price-sensitive information (this being information that has the potential to influence a particular company’s share price) or artificially pumping stock into a sale. Accordingly, as an investor, you cannot take advantage of other investors not having the price-sensitive information you have. Unfortunately, ‘crypto banks’ do not specifically have the same insider trading safeguards in place as a bank or publicly traded company. That, however, may be changing. Recently, the U.S. Department of Justice (DOJ) charged a former Coinbase product manager and two accomplices with wire fraud and insider trading. The DOJ alleged in a press release that the employee shared information about what cryptoassets Coinbase would list prior to the actual listing. The SEC also brought charges against the three individuals tied to the same insider trading allegations. The regulatory uncertainty regarding CEL’s characterization as a utility token vs. a security may ultimately expose Manshinsky, and other insiders, to this type of prosecution. How Do I Value a Crypto Bank?Unfortunately, you can’t. In legacy finance, the most common way to value a stock is to compute the company's price-to-earnings (P/E) ratio. The P/E ratio equals the company's stock price divided by its most recently reported earnings per share. A low P/E ratio implies that an investor buying the stock is receiving an attractive amount of value. With a company like Celsius, due to the lack of disclosure requirements: 1) retail investors don’t specifically know what is happening with their funds while Celsius has them due to a lack of disclosure requirements; 2) unlike a bank or investment firm, Celsius did not appear to be limited based on standard risk management and compliance practices in how it invested retail funds; and 3) Celsius used the CEL token like a de-facto security that allowed the perception that the entity was doing well as its price increased, this also significantly inflated Celsius’s overall valuation. While there are certainly arguments about what tokens are securities and how they should be regulated, centralized crypto banks operating in regulatory gray areas should not be issuing tokens masquerading as de facto equity due to the potential for the types of abuse discussed here. lawpanda is a U.S. attorney with an active litigation and counseling practice. He is a member of BanklessDAO’s Legal Guild, LexDAO, the LexPunkArmy, and member/consultant/contributor to a variety of DAOs and protocols. When he’s not writing for Decentralized Law, he is working to reduce operational and governance friction between on-chain and legacy entities through corporate structuring and common-sense legal solutions. Connect on Twitter, LinkedIn, or at lawpanda.eth@gmail.com. 🏛 RegulationsThe SEC’s InsecuritiesAuthor: tiello

The stock market crash of 1929 left the majority of Americans in deep poverty and facing a Great Depression, not to mention the global consequences of such a financial disaster. In response, Congress enacted two statutes to restore order and provide some regulatory clarity: the Securities Act of 1933, which regulates the issuance of securities, and the Securities Exchange Act of 1934, which regulates the trading of securities. The legislation transformed the capital markets by creating a federal agency, the Securities and Exchange Commission (SEC), to regulate the issuance and trading of securities, establishing a disclosure-based regulatory system, and providing enforcement mechanisms for the failure to comply with applicable regulations and penalizing noncompliance. As Marcus Mendelson explains: “The … crash of 1929 was precipitated in no small part by the exponential growth in high volume, low-quality securities investments with very limited regulatory oversight…”. (Mendelson, 2019) Gosh, where have we seen that happen in the last 15 years? The main goal of the SEC is to vigorously enforce the federal securities law to prevent misconduct and market manipulation by regulating the public sale of securities. A security can be roughly defined as a 'fungible and tradable financial instrument used to raise capital', of which there are primarily three types: (i) equity (providing ownership rights to holders), (ii) debt (borrowed money that must be repaid), and (iii) hybrid (securities that combine elements of the first two categories). The question of whether a cryptoasset can be considered a security has a long and tortured history, leading to many legal brawls and much uncertainty. It goes without saying that if you decide to publicly sell an unregistered security in the United States, you’ll have the SEC knocking on your door. So how do we know exactly what a security is? To answer that question, two sources are needed: first, the Securities Act of 1933, which lays out the different types of securities but doesn't necessarily provide a definition; and second, the 1946 landmark U.S. Supreme Court decision Securities and Exchange Commission v. W. J. Howey Co. Howey Company sold tracts of citrus groves to buyers in Florida, who would then lease back the land to Howey. Company staff tended to the groves and sold the fruit on behalf of the owners. Both parties shared in the revenue. Most land buyers had no experience in agriculture and were not required to tend to the land themselves. Howey had failed to register the transactions as a security. The court determined the arrangements qualified as investment contracts and therefore, as securities subject to the SEC’s control. By doing so, the court also defined a set of criteria, called the Howey Test, which we still apply today: (i) an investment of money, (ii) in a common enterprise (iii) with the expectation of profits (iv) solely from the efforts of others. Howey and RippleThe Howey Test has been settled law in the United States since 1946. But when applied to cryptoassets, the standard creates uncertainty and controversy — for example, in the SEC v. Ripple case. What is Ripple and why is the SEC alleging it distributed unregistered securities? Eleven years ago, the blockchain-based payment system known as XRP and its founding fintech company, now known as Ripple, were started. Several years later, Ripple is now intertwined in a tedious legal battle, after being accused in late 2020 by the SEC alleging that the asset is an unregistered security and therefore in violation of federal law. According to the complaint, Ripple raised funds by selling XRP tokens in unregistered security offerings to investors in the United States and around the world. Additionally, Ripple offered billions of XRP in exchange for non-cash services like market-making and labor. Normally, the SEC settles most of its lawsuits. Crypto companies usually submit to the SEC’s demands and pay the penalties (like BlockFi, for example). Ripple, however, has refused to settle and instead has chosen to fight back. Ripple lawyers claimed that the SEC never warned nor gave any notice to Ripple that XRP was a security, which is not disputed by the SEC. Ripple believes the SEC was biased in applying the security concept to virtual currencies like XRP. If Ripple is able to substantiate their bias claims, the SEC's arguments about XRP could be weakened. The SEC and The Commodity Futures Trading Commission (CFTC) have not always agreed on what is a security and what is a commodity, and the SEC has not taken a consistent stance over the years. The Chairman of the SEC, Gary Gensler, has acknowledged that bitcoin is a commodity, not a security. However, he is not willing to say that any other cryptoasset is a commodity. In 2018, then SEC Director of Corporate Finance, Bill Hinman, stated that ether was not a security, due to its decentralized manner. The CFTC’s current chairman, Rostin Behnam, has stated that he is certain that bitcoin and ether are commodities. The push continues, with different agencies fighting over regulatory power. A Changing StrategyOn a different but somewhat related note, the SEC recently charged an ex-Coinbase employee and two associates with insider trading, stating they allegedly used privileged and private information to make certain trades, before public listing on the exchange’s roster. The complaint also stated that the SEC considered nine different tokens to be securities. The Cod3x blog by Gregory Schneider has an excellent summary of the SEC's civil insider trading case as well as the related criminal case brought by the U.S. Department of Justice. Schneider speculates that the SEC may be attempting to change its global litigation strategy through this insider trading case. First, the SEC may have intentionally chosen the forum for this case in a circuit other than the one hearing the Ripple case. If the SEC receives an adverse ruling, could that encourage the Supreme Court to take up the case to resolve the circuit split? Secondly, Schneider notes that the SEC did not pursue the issuers, nor the exchanges, but 'three random nobodies' who decided to insider trade these alleged securities. All InWe can see that the SEC is trying to go ‘all in’ on its argument that most cryptoassets, maybe all but bitcoin, are securities, even though their strategy can be critiqued. Possibly the future of market capital regulation depends on the results of these cases. The question remains as to whether the current regulatory environment can adapt quickly enough to deal with these new technologies without killing them off before they have had a chance to come to full fruition. tiello is a recently graduated lawyer from Argentina currently studying blockchain regulation. Will MiCA Create Hard Times for Stablecoins?Author: Eagle

The European institutions have reached a consensus on the contents of the Market in Crypto Assets (MiCA) Regulation, which will be enacted sometime between the end of 2022 and the beginning of 2023. MiCA will be a great innovation in the crypto-space, as the EU wants to set some global standards for the industry. MiCA rules seem particularly aimed at fostering some political inclinations of the European Union. One of the main fears from the European institutions, which has already been outlined in relation to the Facebook Libra project, is that private coins may grow too much and pose systemic risks. MiCA focuses therefore on stablecoins: cryptocurrencies whose value is pegged to a fiat currency like the U.S. dollar, other cryptocurrencies, or a commodity like oil or gold. During the last two years stablecoins have become not only an instrument to trade through DeFi applications, but also an apt medium of exchange that, thanks to the blockchain infrastructure, make international transfers of value fast and cheap. MiCA has adopted a strict approach that may turn out to be detrimental for the best-known stablecoins in the crypto scene, namely USDT, USDC and BUSD. Before addressing this issue, it is important to recall that MiCA’s rules on stablecoins are encompassed within two separate sets of provisions: a) “asset referenced tokens” (ARTs); b) “electronic money tokens” or “e-money tokens” (EMTs). ARTs purport to maintain a stable value by referring to the value of several fiat currencies that are legal tender, one or several commodities or one or several crypto-assets, or a combination of such assets; whereas EMTs purport to maintain a stable value by referring to the value of a fiat currency that is legal tender. EMTs should grant to the holders a claim against the respective issuer to redeem, at any moment and at par value, the monetary value of the e-money tokens, either in cash or by credit transfer. MiCA also entails strict rules concerning the internal organization of the issuer, prudential controls and the size and use of the reserve assets. Some of MiCA’s mandatory provisions may actually be welcomed in order to address the most problematic aspects that, from a legal standpoint, affect the relationships between the issuer and the holder of stablecoins. The authors of this recent article analyzed the standard provisions that bind holders to stablecoin issuers, and found a dramatic absence of legal protection for the holders, especially in cases of bankruptcy. It is important to protect users and to assure a wise management of reserve funds, but with respect to the most-used stablecoins, namely USDT, USDC and BUSD, MiCA seems to go too far in imposing unreasonable restrictions to the issuance and use of EMTs denominated in a currency that is not an official currency of an EU Member State. In this regard, Article 52(3) MiCA extends the scope of the quantitative limits for ARTs widely used as a means of exchange to EMTs. According to Article 19b MiCA of the latest MiCA draft (July 2022), restrictions apply when the transactions per day associated with uses as means of exchange, within a single currency area, are higher than:

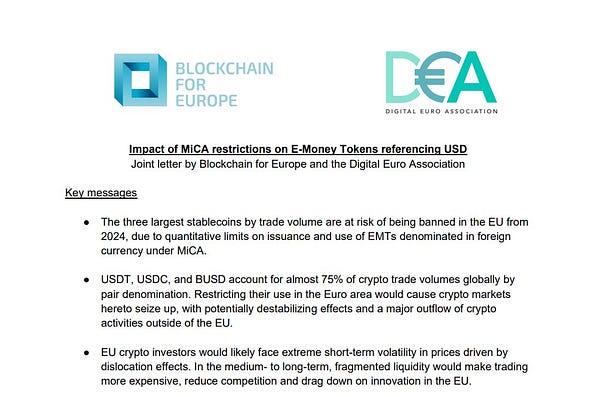

When in breach of the thresholds, issuers need to stop issuing and introduce a plan to reduce the use of its cryptoasset. Within a joint letter, Blockchain for Europe and the Digital Euro Association pointed out that the three largest stablecoins by trade volume (USDT, USDC and BUSD) are at risk of being banned in the EU from 2024, due to the aforementioned quantitative limits on issuance and use of EMTs denominated in foreign currency under MiCA.   USDT, USDC, and BUSD account for almost 75% of crypto trade volumes globally by pair denomination. The two aforementioned organizations declared that restricting their use in the Euro area would cause crypto markets here to seize up, with potentially destabilizing effects and a major outflow of crypto activities outside of the EU. Moreover, EU crypto investors would likely face extreme short-term volatility in prices driven by dislocation effects. In the medium-to-long term, fragmented liquidity would make trading more expensive, reduce competition, and drag down innovation in the EU. From another perspective, despite the momentum behind the EUR stablecoins, they account for a negligible fraction of trading volumes. It is therefore unrealistic to expect them to replace USD-referencing stablecoins in crypto trading, never mind doing so in a smooth manner by January 2024. Blockchain for Europe and the Digital Euro Association ask for a clarification of the concept of “uses as means of exchange” under MiCA to protect the role of USD-referencing stablecoins in enabling crypto trading and in providing liquidity to DeFi pools. One possible explanation to MiCA’s approach is the willingness to favor the so-called Digital Euro, which for some years has been on the books of the European Central Bank (ECB). Stablecoins are private initiatives which may affect the monetary policy of the ECB. Another political aim could be to induce private actors to invest more in Euro-denominated stablecoins (As known, Circle is in the process of launching a EUROC). But such an increase in Euro-pegged stablecoins does not appear to be something that could benefit the European monetary policies. Moreover, the first materials concerning the Digital Euro and the statements of Fabio Panetta, member of the ECB’s executive board demonstrate that so far institutions do not seem to believe in private actors when it comes to monetary policies. The truth is that this strict approach towards USDT, USDC and BUSD appears particularly aimed at harming foreign actors and protecting the EU monetary policies. Certain quantitative limitations will certainly need to be set in the future if stablecoins continue their exponential growth, but it seems unreasonable for the EU to put the bar at these low levels, in a way that will potentially harm its investors and consumers. The aim of MiCA should be exactly the opposite. Eagle is a Law Professor and Attorney. PhD in European Private law. Advisor of Polygon technology, member of Lex Punk DAO and of the Aragon Compliance subDAO 🌐 News and Selected Articles

Coinbase Shareholder Sues Company Over ‘Gross Mismanagement'Author: Jon Southurst 🔑 Insights:

Block by Block: Blockchain Technology Is Transforming the Real Estate MarketAuthor: Andrew Singer 🔑 Insights:

First Mover Asia: Bitcoin and Ether Fall; Angry That Hodlnaut Has Frozen Your Funds? Too Bad, It’s in the Terms and ConditionsAuthors: Sam Reynolds and James Rubin 🔑 Insights:

Is Ethereum's Merge Priced-In?Author: Daniel Kuhn 🔑 Insights:

GameFi Developers Could Be Facing Big Fines and Hard TimeAuthor: Rudy Takala 🔑 Insights:

What Determines the Price of a Cryptocurrency Coin?Author: CoinStats 🔑 Insights:

🧰 Legal ToolsWhat’s Up With the BanklessDAO Legal Guild Legal Entity Research Project?Author: lawpanda

In March 2022, Decentralized Law’s issue Legal Entity Solutions for DAOs addressed considerations related to decentralized autonomous organizations operating without a legal ‘wrapper’ or associated legal structure. Where previously, being fully on chain with nominal off-chain interaction was the default, DAOs and their contributors increasingly seem to be of the opinion that having a legal entity is beneficial — or necessary — to the DAO and its members. A legal entity provides a DAO with default statutory provisions, the ability to operate more easily in the off-chain world, and a jurisdiction in which it can pay taxes. A legal entity also protects DAO members from joint and several liability, which is common law in most U.S. jurisdictions where a DAO's default legal status is as a general partnership. That said, there are significant considerations as to why utilization of various agreements/documents to outline the parameters of participation in the DAO and avoiding association with off-chain entities may be preferable. As 2022 progressed, BanklessDAO’s Legal Guild revisited an ongoing background project considering various potential legal entity structures that might be beneficial to the DAO, future subDAOs, and even individual BanklessDAO projects. The Legal Guild charged lawpanda and Dr. Biyan Mienert (aka DAOLAW) with coordinating the project based on their incredibly uniquely named prior respective work comparing entity structures. See, e.g., How can a decentralized autonomous organization (DAO) be legally structured? and Legal Entity Wrapper Comparison & Assessment. The project also utilizes and takes into consideration work by Chris Brummer and Rodrigo Seira from Paradigm, Miles Jennings and David Kerr of a16z, along with a host of other projects and organizations. Entities like Poko and MIDAO have also volunteered time and information regarding their legislative efforts in the Marshall Islands and Kazakhstan. And members of Legal Guild have been assisting with research and documentation from their respective diverse practice jurisdictions. In late May 2022, the Legal Guild’s research proposal was approved by BanklessDAO’s Grants Committee and work began in earnest — though somewhat slowed by contributor summer vacations. Additionally, the scope of the project has increased during the course of research. The Legal Guild’s ultimate goal is to provide a functional public-good document that will provide BanklessDAO members — and the Web3 community as a whole — an overview of potential legal entity structures that may or may not benefit their DAO or project, a discussion why association or wrapping with a legal entity may or may not be ideal, and some more technical considerations for the various jurisdictions and entities. Because the final product will not be legal advice that should be relied upon for making determinations, the Legal Guild is gathering contact information for legal practitioners or companies that provide registration services in the respective jurisdictions. However, each DAO or project has the obligation to do its own research regarding potential entities, jurisdictions, and confirm the qualifications of any company or practitioner they ultimately retain. As stated above, the ultimate product is meant to provide an overview of options to allow BanklessDAO and other DAOs narrow the potential options before contacting appropriate counsel in the jurisdiction. The final product is intended to educate readers regarding considerations and what questions they should be asking whatever counsel they retain to set up their structure. An overview and tentative timeline for the project can be viewed here. The Legal Guild is looking to partner with entities or contributors that are interested in providing information, documentation, and insight related to the topics for entities and jurisdictions listed on the chart below. The Legal Guild is also looking to identify qualified practitioners in DAO-friendly jurisdictions who can be retained to respond to inquiries and potentially effectuate registration of the chosen entity. If you are a legal practitioner — or legal adjacent like MIDAO’s Adam Miller — interested in getting involved for the clout of your name being listed as a contributor, for advertising as a legal practitioner or registrar company, or for whatever other reason, please feel free to email lawpanda.eth@gmail.com or ping him on Twitter or Discord. For the purposes of lawyerly caveat, qualification, and carve-out, the BanklessDAO Legal Guild does not represent BanklessDAO or any member of the DAO unless specifically retained pursuant to the retained practitioner’s jurisdictional rules.This means there is no attorney-client relationship established and legal privilege does not attach when communicating with the Legal Guild and its members, unless a member is specifically retained. Additionally, BanklessDAO is not associated with the BanklessHQ media entity beyond utilizing the ‘Bankless’ brand. The Global Tax GuideAuthor: Metaversal Revenue Service

BanklessDAO’s Legal Guild has been hard at work building the future of crypto-tax information, and the Global Tax Guide produced by the Metaversal Revenue Service is the result of these efforts. The Global Tax Guide provides general introductory information regarding virtual currency-related income tax laws from major jurisdictions throughout the world. The mint is live! The mint fee is .08 ETH. Access has no expiration date, and the Tax Guide will be updated as laws change and jurisdictions are added. The Global Tax Guide will initially cover nine jurisdictions, with new jurisdictions regularly added. The initial jurisdictions include:

The Global Tax Guide plans to add Italy, India, UAE, Canada, Singapore, and Nigeria in its next update. Mint today to be at the edge of crypto-tax preparation! ✅ Action Items📚 Read The BANK Token - A Legal Assessment👩⚖️ Join the BanklessDAO Legal Guild 🏴⚔ Join LexDAO🐵 Join the LeXpunK Army🚨 Contact your Representatives or Senators🙏 Please Support Our Friends: 🗞 The Rug NewsletterThe Rug is Web3’s mostly credible news source. We take money, seriously. The Rug places a satirical lens on crypto culture. Think "The Onion" for Web3. Our publication includes recaps of the best jokes, funniest articles, behind the scenes podcasts, and throwback newspaper-style NFTs, all of which we produce on a regular basis. Subscribe to our newsletter and read all about it! If you liked this post from BanklessDAO, why not share it? |

Older messages

VaynerSports Steps Up Sports NFT Utility | Decentralized Arts

Tuesday, August 30, 2022

BanklessDAO Weekly NFT and Cryptoart Newsletter

Fight Club Punches Above Its Weight | BanklessDAO Weekly Rollup

Saturday, August 27, 2022

Catch Up With What Happened This Week in BanklessDAO

DAO Efficiency

Wednesday, August 24, 2022

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

Metaverse Art Week 2022 | Decentralized Arts #52

Tuesday, August 23, 2022

Dear Bankless Nation, Decentralized Arts (DA) celebrates with this issue its first anniversary. In this year we have brought you a myriad of stories around non-fungible tokens (NFTs) and the metaverse.

When Too Much Is Not Enough | BanklessDAO Weekly Rollup

Monday, August 22, 2022

Catch Up With What Happened This Week in BanklessDAO

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏