Main Street Insiders - The Greatest Wealth Transfer Ever

In the late 1800s, a small group of industrialist titans emerged in America’s economy. They used “ruthless and unethical business tactics to dominate vital industries”, earning them the nickname “robber barons”. This time period is referred to as the Gilded Age. These men were captains of industry and some of the richest people in history. As noted by Britanica, they:

They had names you might recognize, such as:

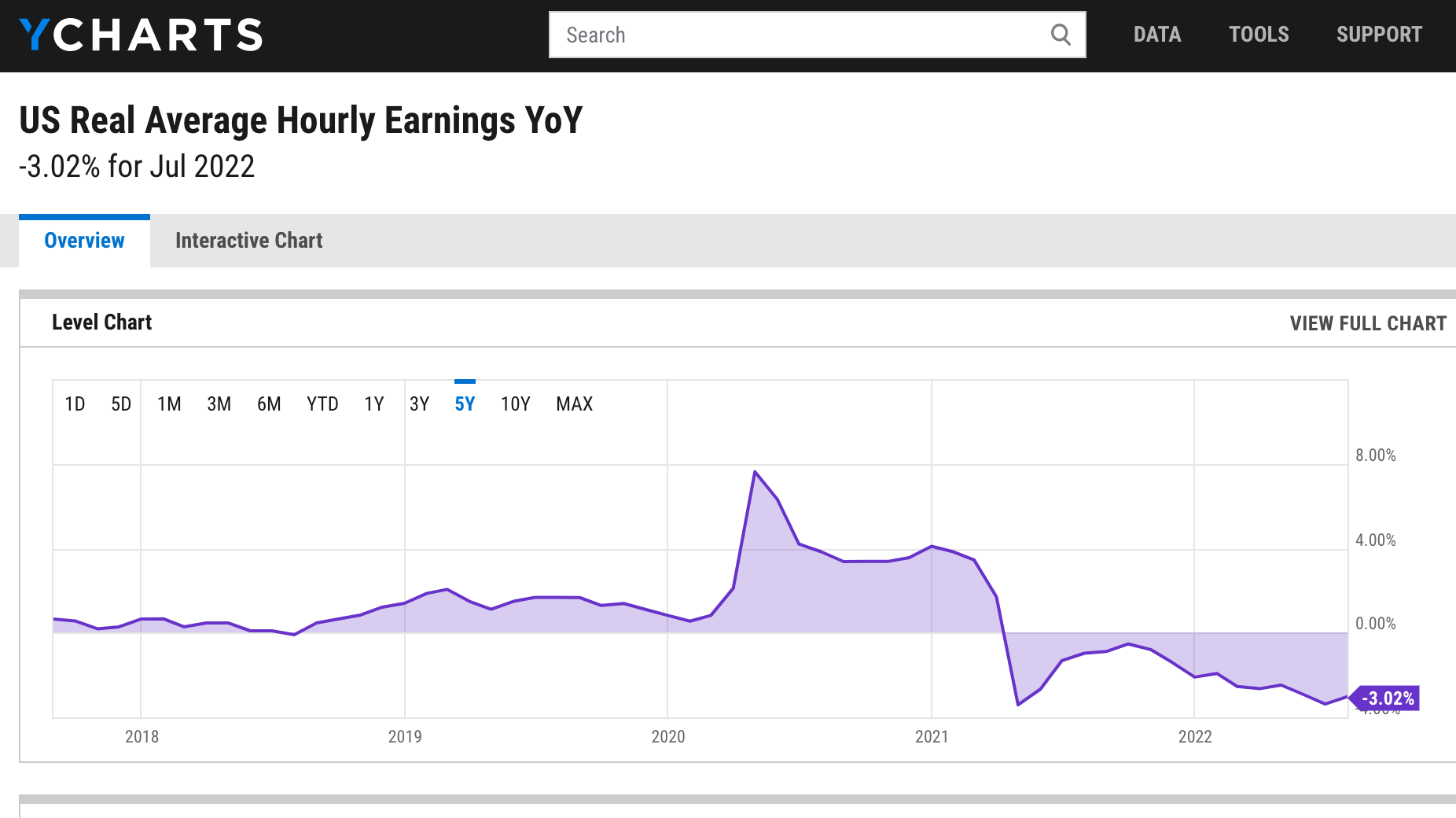

By some measures, Carnegie and Rockefeller’s wealth reached almost $400 billion - each. While many recognize these names for their philanthropy, they accumulated their wealth by taking, not giving. The New Gilded AgeFor all the faults of the robber barons of 150 years ago, those were the good old days. We are currently in a new Gilded Age. And today’s robber barons are much more powerful and destructive than the barons of yesteryear. They are driving the largest transfer of wealth in history. A transfer that drains power from regular folks and accumulates it in the hands of a powerful few. While you might recognize the names of some of today’s robber barons, much of this is being orchestrated by global elites who often fly under the radar.     While this transfer of wealth is about much more than money, that’s an obvious place to start. Transferring Wealth From “The Forgotten Man” to Davos ManThink about this for a second. The wealth of the world’s 10 richest men doubled during the COVID pandemic. Doubled. While “non-essential” businesses were shut down, Amazon and Walmart kept humming. While unemployment skyrocketed, Alphabet (Google) and Meta (Facebook) did just fine. As a result, the likes of Jeff Bezos, Warren Buffett, and Mark Zuckerberg cleaned up. And Elon Musk? His wealth increased by 10x. Meanwhile, the number of employed Americans has only recently reached pre-pandemic levels. After 2 ½ years and $6 trillion in stimulus spending. After adding one million people to our population (not counting illegal immigration). After all that, Main Streeters are back to square one. Worse news is that 40% of small businesses don’t have enough money to pay rent. Those are Main Streeters serving their communities and trying to build a future for themselves. About ½ of those businesses are minority owned. It’s tragic. If these businesses can’t pay rent now, it means they soon won’t be able to pay employees. Many of those businesses won’t survive.   But have no fear . . . Walmart had unexpectedly good earnings last quarter. As one analyst put it, Walmart will “remain a leader and market share gainer”. Small businesses lose. Walmart gains. It’s the perfect microcosm of the wealth transfer from the common man to the elite. Then there’s the ravages of runaway inflation and a worsening recession. These erode our income and eat away our savings. For example, look at real hourly earnings (i.e. earnings when taking inflation into account). After four years of being positive, real hourly earnings went heavily negative in early 2021 and have remained negative since. (Hmm, seems like something else shifted in early 2021 as well. Never mind, nothing to see here.) These types of economic conditions further consolidate power into the hands of the elites. Remember that big business elites have the financial strength to weather economic storms and outlast smaller competitors. If they fail at all that, they can probably expect a bailout. That’s why they can flippantly declare inflation and recession as “transitory.” It is, for them. The biggest US corporations are sitting on a huge pile of cash. While down slightly from 2021, cash balances are well above the record highs set before the pandemic. Big business will come out on the other side of our current recession ready to buy up the wreckage and cash in on the rebound. Meanwhile, on Main Street there are real people fighting for real dreams. A chance at their version of the American dream, where they can live a free and full life - and make a better life for their kids. The Price of “Progress”There’s something interesting about the Gilded Age of the late 1800s that we can’t deny. It was a time of rapidly increasing prosperity and quality of life. Advances in communications, transportation, and production created the industrial revolution that formed the basis of America’s economic boom in the early 1900s. Many Americans benefited from this boom. But at what cost? Do we have to accept monopolization of industries to see increases in quality of life? Do we have to tolerate predatory business and exploitation of the Producing Class to have economic growth? Previous generations didn’t think so. Senator Josh Hawley discusses this in his book The Tyranny of Big Tech. Hawley writes:

This was a time when a handful of men controlled a massive chunk of America’s GDP and owned much of the core infrastructure that drove our economy. These men had the ear – and the pocketbook – of many powerful politicians. And they could crush competitors at will, when they weren’t busy trying to crush each other and achieve ultimate dominance. However, earnest people came forward to promote core American ideals. Hawley continues:

As citizens and some brave leaders – including Teddy Roosevelt - pursued these ideals, the robber barons were tamed and their monopolies broken up. We are in a similar situation today. Big business, big tech, and big government work together to accumulate power for themselves and their elite friends. Facing that kind of power sometimes makes it hard to know where to start. Here’s a good place to start. Remember our ideals, including:

As mentioned by Martin Luther King Jr., you don’t have to see the whole staircase to take the first step. Remembering our ideals is the first step. This is the way. -Jeff and Luke |

Older messages

Make Wall Street Answer to Main Street

Thursday, August 25, 2022

Not the other way around

Strive Is Disrupting the Asset Management Industry

Thursday, August 18, 2022

Woke is out, excellence is in.

America First Is Not A Political Statement

Friday, August 12, 2022

Sorry, Not Sorry...We're The Best

To Weather The Recession, Think Like A Business

Friday, August 5, 2022

A Little Planning Goes A Long Way

Mid-Year Review

Friday, August 5, 2022

Highlights From Our First Six Months

You Might Also Like

From 0 to $5B (local non-US market)

Tuesday, March 4, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack From 0 to $5B (local non-US market) Nadiem Makarim is a guy who managed to create

Quiet quitting is out. Revenge quitting is in? 😜

Tuesday, March 4, 2025

Do it loud. Do it proud, I guess.

Building complete rank and rent sites in just minutes

Monday, March 3, 2025

This tool is incredible

🌁#90: Why AI’s Reasoning Tests Keep Failing Us

Monday, March 3, 2025

we discuss benchmark problems, such as benchmark saturation, and explore potential solutions. And as always, we offer a curated list of relevant news and important papers to keep you informed

I interviewed THE largest Amazon Seller [Roundup]

Monday, March 3, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

The state of data-driven decision-making for CPG brands

Monday, March 3, 2025

How marketers use purchase insights to maximize campaign performance

Facebook updates, TikTok ROI, Instagram format matches, and more

Monday, March 3, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo New week, fresh insights, Reader! Stay sharp with the latest updates on AI, social

Are you losing revenue to rivals?

Monday, March 3, 2025

This is a challenge that costs businesses millions every year: Their customers are switching to competitors for various reasons... even though most of them could easily be fixed. On Tuesday, March 4,

DeepSeek’s 545% Profit Claim

Monday, March 3, 2025

PLUS: Siri 2027?!

Insurtech VC resets, readies for growth

Monday, March 3, 2025

Europe's share of regional IPOs sinks; the agtech revolution is now; hope flares for natural gas deals Read online | Don't want to receive these emails? Manage your subscription. Log in The