VC Monthly Report:Funding Overview in August

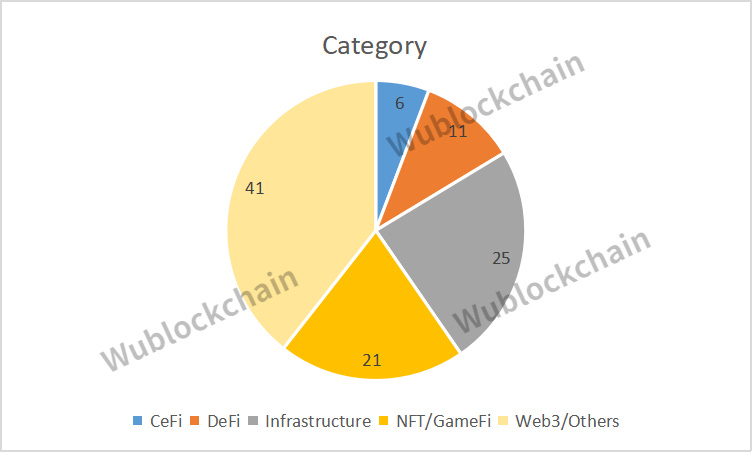

Author: Joey Wu WuBlockchain According to Messari, there were 104 public investments by crypto VCs this month, down 35% MoM (160 projects in July 2022) and up 22% YoY (85 rounds in August 2021). The industry-level breakdown is as follows. The Infrastructure track had the highest number of funding rounds this month, accounting for 24%. the CeFi, DeFi and NFT/GameFi segments each accounted for approximately 6%, 11% and 20%. Total funding for the month was $1.37 billion, down 29% MoM ($1.91 billion in July 2022) and down 32% YoY ($2 billion in August 2021). The top 10 funding rounds (excluding CeFi) are as follows. The highest amount of funding announced this month was for Limit Break, at $200 million. However, the actual funding closed last year, so it is not included in this month's statistics. Limit Break, the company that launched the NFT series DigiDaigaku, pioneered the "Free to Own" model. The funding round was led by Paradigm, Josh Buckley and Standard Crypto, with participation from FTX, Coinbase, Positive Sum, Shervinator and Anthos Capital. DigiDaigaku's floor price rose to around 18 ETH at one point after the funding announcement. OrangeDAO, a decentralized VC organization, closed $80 million in funding from Algorand and NEAR, with the rest coming from DAO members who are limited partners in the fund and a number of institutional investors. OrangeDAO was founded in September 2021 and is built on NEAR with a portfolio that includes Liquifi, Goldfinch and Spritz. Ready Player Me, a company focused on bringing avatars to VR and others, led this round of funding with a16z. The company's core revenue strategy is to include fashion brands, including Adidas, New Balance, Dior, Pull&Bear and others, as well as Dune movie costumes from Warner Bros. Inworld AI is a metaverse development company focused on creating AI-powered avatars in metaverse and video games, with this funding led by Section 32 and Intel Capital. Since closing its seed round in March 2022, Inworld has released its beta product, hired Academy Award winner Gaeta as Chief Creative Officer, and been selected as one of six companies to join the 2022 Disney Accelerator. PROOF is the parent company of the NFT series Moonbirds and the funding was led by a16z. PROOF announced that it is creating Moonbirds DAO as well as a third NFT series, Moonbirds Mythics. PROOF also revealed early plans to launch PROOF tokens, with more details expected in 2023. Gunzilla Games is a 3A game studio and this round was led by Republic Capital with participation from Griffin Gaming Partners, Animoca Brands, Jump Crypto and others. The funding will be used to build its game platform GunZ, a new AAA Battle Royale 2.0 third-person shooter. Injective Protocol is a decentralized trading protocol that allows users to create and trade any derivatives market by simply providing a feed system. The funding round was led by Jump Crypto with participation from BH Digital, the digital assets division of hedge fund firm Brevan Howard. The Terra eco-application Aperture is currently being migrated to Injective. Xterio is a game development company currently valued at $300 million. This round was led by FunPlus, Makers Fund, FTX Ventures, XPLA, with participation from Animoca Brands, HashKey and others. Thirdweb is a startup infrastructure development company focused on developing toolkits to make it easier for developers to build and launch Web3 products. This round was led by Haun Ventures, with strategic participation from Coinbase Ventures and Shopify. Spectral Finance is a decentralized credit scoring platform that proposes a paradigm shift to the DeFi lending ecosystem by introducing a credit risk infrastructure based on users' on-chain activity and behavior, and has now built a multi-asset credit risk scoring system, MACRO. The financing was led by General Catalyst and Social Capital, with participation from Samsung, Gradient, Section 32, Franklin Templeton, Circle Ventures, and Jump Capital. Fractional, an NFT fragmentation platform, rebranded this month as Tessera, led by Paradigm, with participation from Uniswap Labs, E Girl Capital and Focus Labs. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish If you liked this post from Wu Blockchain, why not share it? |

Older messages

Opinion: Aptos came at the wrong time

Thursday, September 1, 2022

Author: Joey Wu WuBlockchain Aptos makes an impressive entrance, and like Solana, it uses a new consensus protocol and pursuits high TPS. In fact, in terms of programming language alone, Move does have

TSE Sponsored:Global Crypto Mining News (Aug 22 to Aug 28)

Monday, August 29, 2022

1. As reported by rferl.org, Iranian authorities have announced the seizure of 9404 illegal cryptocurrency mining devices in Tehran since the end of March.Kambiz Nazerian, head of Tehran Electricity

Weekly Project Update:BendDAO's liquidity crisis, Synthetix、MakerDao、Ethereum's new proposals, and Top 11 Projects…

Saturday, August 27, 2022

Author:Mingyao Editor:Colin Wu 1、BendDAO faced a liquidity crisis and proposed BIP#10 to amend the Liquidation Threshold implementation schedule. Link Summary:Due to the depressed NFT market, BendDAO

WuBlockchain Weekly:Account Freeze、BendDAO、OFAC's Sanction Related、Mainnet Merge and Top10 News

Friday, August 26, 2022

Top10 News 1、FTX advises users not to use mixing service FTX recently froze the account of a user who sent money to Aztec's zkmoney. The official customer service replied that Aztec Connect-Aztec

Binance Helps Law Enforcement Agencies Ban Chinese Accounts Brings Controversy

Thursday, August 25, 2022

Author:Colin Wu Recently, some Binance users in the Chinese community found that their accounts were temporarily suspended due to requests from some law enforcement agencies. The screenshots spread

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%