The Diff - The Other "MoviePass Economy"

Welcome to the weekly free edition of The Diff. Last week, we looked at why the German real estate industry is piling up so much leverage (as it turns out, rent control converts an apartment building into a weird annuity), the "Index Orphan" stocks that have been ejected from the S&P, and how stop losses are a form of intellectual honesty—investing is the rare field where most of your problems have an off switch. Coming soon: understanding growth stocks by working backwards, a turnaround in the TV business, and how a PE executive copied Cornelius Vanderbilt. The Other "MoviePass Economy"Plus! Economists; Regulatory Outsourcing; Come for the Network, Stay for the Tool; Oil; Covid and Social Mobility; Diff Jobs

Welcome to the free weekly edition of The Diff! This newsletter goes out to 41,277 readers, up 495 since last week. In this issue:

This week's Diff Jobs posts focus on especially early-stage companies, and cases where the role is for an internal entrepreneur who can build something new. Scroll to the end to see some of our current opportunities. The Other "MoviePass Economy"Back in 2018, Kevin Roose wrote a wonderful short piece: "The Entire Economy Is MoviePass Now. Enjoy It While You Can." The main thrust was that the US economy—especially the economy as it's experienced by young people with pretty good jobs in big cities—was increasingly full of unsustainably cheap consumer products financed by VC largesse. MoviePass was the poster child for this model, since their default plan was a $9.95/month subscription that allowed customers to watch a movie a day, at a cost to MoviePass of about $9 per viewing. So at 3% utilization, MoviePass was a 10% gross margin product, the sort of thing that only works out if costs are tightly controlled and user acquisition is dirt cheap. At 6% utilization, it's a money pit. A year and a half later, MoviePass was bankrupt. (Ironically, if they'd held out just a little longer, Covid would have addressed that negative margin problem.) But, four years after that article, MoviePass is back, with a new system that has higher prices, more restrictions on viewing during peak times, and partnerships with 25% of theaters to access discounted tickets. And that partnership number would be higher if the biggest chains didn't all have membership programs of their own. Between AMC Stubs, Regal Unlimited, and Cinemark, around 40% of US movie theaters have some kind of paid subscription model available. And that's in a fairly fragmented industry. MoviePass was poorly-implemented, but the general concept turns out to be popular. Memberships are everywhere:

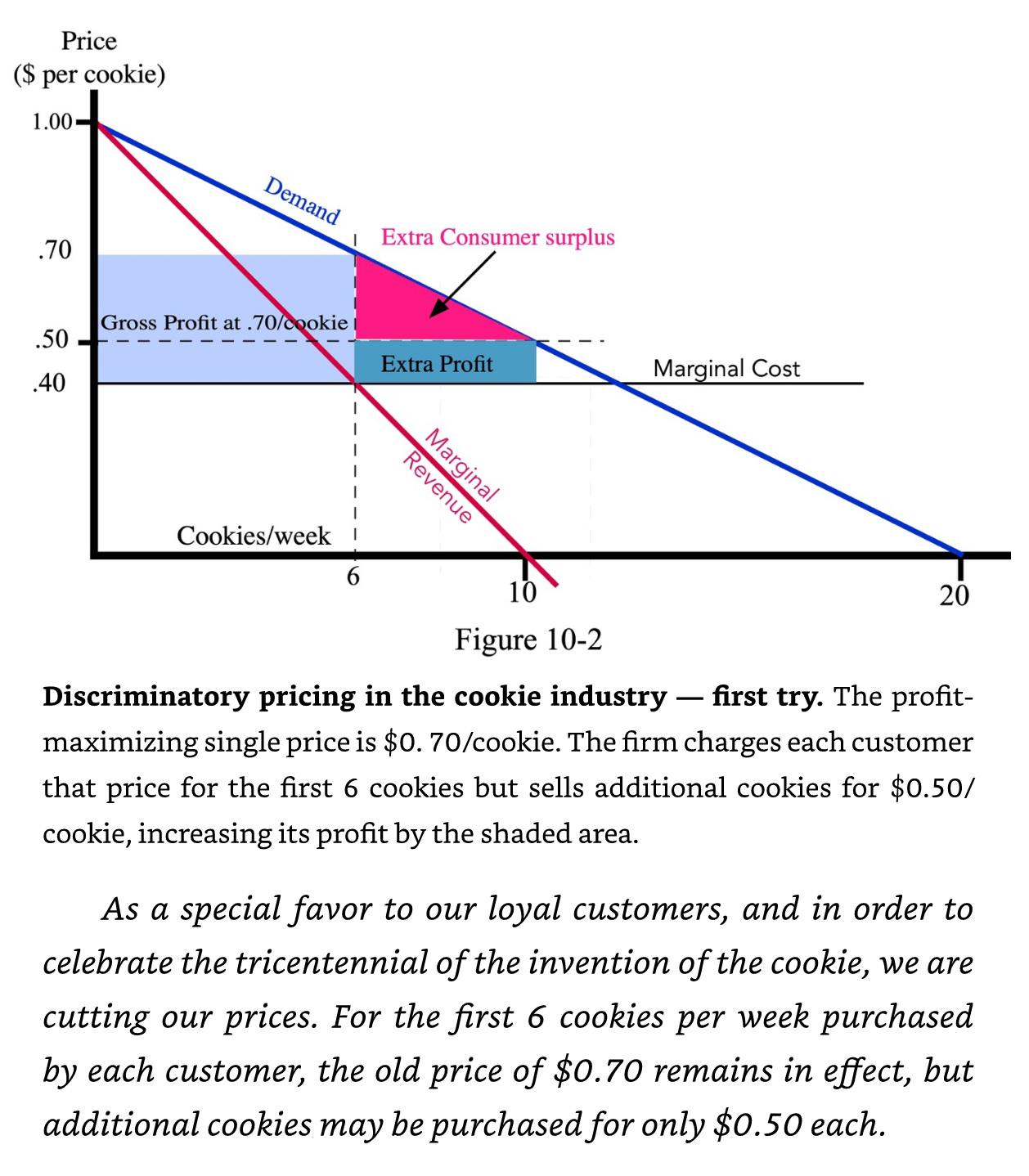

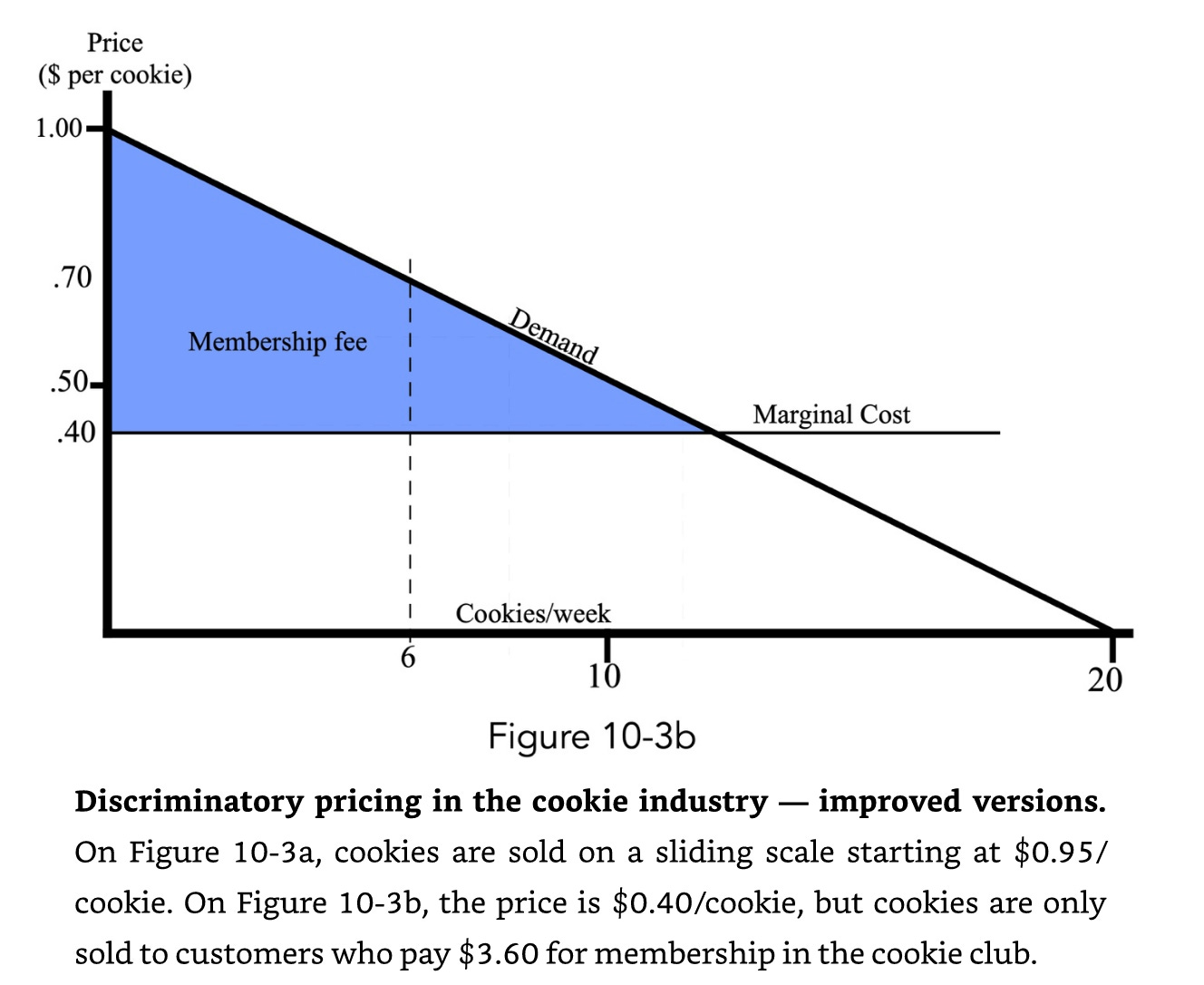

Why is it that every company that makes money on transactions seems to be crunching the numbers and concluding that it's time to launch ThatCompany+, ThatCompany Prime, or ThatCompany One, often at $9.99 per month? Is the future of consumer spending going to be dozens of 5% discounts every month, and a thousand dollars a year of subscription fees to pay for access to them? The increasing prevalence of subscriptions represents three trends, both of which are tied to the increasing maturity of the tech sector and of tech-enabled retail.² First, as markets get more competitive, the challenge moves from altering customer behavior to winning share among customers who engage in a particular behavior. There was a time when "hail a cab with your phone" was a weird idea, and when "buy it online even if you need it tomorrow" was a ludicrous proposition. Some of these behavioral changes were gradual—the first time I ordered Seamless while working late, instead of just leaving the office to grab some fast food, it felt like the height of decadence. Then it got routine. Once there are fewer customers to be gained by radically changing habits, there are more customers to be lost from slight shifts in habit, like using a different app to perform the same function. Covid was a massive push towards adopting new consumption habits, especially habits that involved delivery. This has partly receded, but it's meant that there's no longer a meaningful population that isn't at least considering alternatives to brick-and-mortar stores. Economically, part of what you're doing when you sign up for an app subscription is that you're buying your consumer surplus upfront. David Friedman's Hidden Order has a chapter on exactly this: he imagines a demand curve for cookies such that a price discrimination strategy—buy your first six cookies for $0.70 each and any further cookies for $0.50 apiece—leads to more gross profit per customer. He then extends this to a more fine-grained price discrimination, with a sliding scale price for each cookie. And then, the magic trick: sell the customer a subscription, price each cookie for subscribers at marginal cost, and the producer captures the entire economic surplus; the supply/demand graph looks like perfect price discrimination applied down to the crumb. Price discrimination won't be perfect. Even cookies' costs have some variability (a customer who asks for elaborate customization—or who holds up the line because they're distracted by their phone while waiting for their low marginal-cost cookie—messes up the whole model). Still, the theory is right: if you're confident that you know what demand looks like from individual customers, and you can persuade them to switch from buying incrementally profitable products to buying low- or no-margin ones in exchange for a one-time fee, you can turn the consumer surplus into profit instead. But companies can approach that asymptote because of the second powerful force in a maturing industry: it gets much more predictable. Food delivery used to be an economic Wild West. There was a wide range of plausible estimates for the lifetime value of a customer, and for what the long-term cost structure would look like. In general, market share accrued to companies that spent heavily on marketing, for both sides of their market. It's clear that some of these companies overspent; Uber has spent a total of $23.6bn on marketing since 2014, which doesn't include the de facto marketing of some of their pricing decisions. But one of the assets these companies have gotten is the ability to sketch out demand curves across many categories. When Uber offers you a five minute faster ride for $10 more, part of what they're doing is measuring the value of a minute of your time.³ Amazon has data on me going back seventeen years, and as their product pages have evolved and my purchases have expanded from entirely books to mostly books, they've started to get a sense of my price sensitivity and willingness to consider cheaper alternatives. Multiply that by 300 million and Amazon has an understanding of consumer demand and price sensitivity that would have made a Soviet economic planner salivate. Once one company starts doing this, its competitors have a strong incentive to follow along: someone who uses Uber and Lyft knows that whichever app they're a subscriber to is likely to have the lower marginal cost, so that app probably wins when they comparison shop and definitely wins when they don't. And once a company can model the long-term lifetime value of a subscriber, that changes its optimal pricing for non-subscribers: temptingly cheap introductory pricing can be paid back quickly through subscriptions, while users who stick around for a while but don't convert to a paid plan will probably end up seeing higher prices. It's notable that there's some convergence among these app offerings. Walmart didn't have a big streaming offering of its own, but launched one in 2016 and then sold it and bundled with Paramount's. Lyft doesn't have an Uber Eats-scale food operation, so they included Grubhub's in their offering. (And Grubhub doesn't have a ride-sharing service to bundle with its food delivery, so...). The likely end state is that each company will try to 1) determine which shopping decisions can start and end within their app, and bundle those into a subscription service, and 2) continuously expand the services in that category. The natural lifecycle of bundles is that they grow as they get optimized, then hit some external shock that leads to radical unbundling. Cable went through this cycle, where every incremental channel added to the price customers would tolerate for some bundles, until we reached the point that the average customer felt that they were mostly paying for things they didn't watch, and that Netflix was more likely to get them a satisfactory experience at a lower price. It's very hard for bundle-based services to respond by shrinking their own bundle, since their backwards-looking data will be so compelling. Given how cheap the current bundles are, we're probably in the early stages of this process. But while it continues, life will be very tough for the subscale bundling companies. In categories with infrequent purchases, we might see more loyalty programs show up, especially bundling across those categories—infrequently-purchased products have the daunting challenge that they need to re-acquire their consumers every time (which is why furniture companies try to sell small knick knacks, too; even if the transaction isn't incrementally profitable, it saves on marketing since it means not re-acquiring the customer when they need a new couch or dining room table. And it's why Zillow is fine with being the topic of jokes as long as the jokes reinforce their name recognition). The MoviePass Economy was partly about unsustainably cheap products. But part of what drove it was that with sufficiently loyal and predictable customers, the subscribe-for-discounts model can have sustainably cheap products instead. From the company's perspective, their customers are offering them a 100% gross margin product in exchange for giving them an unbeatable price advantage over competitors every time they sell. It's a deal worth taking. Disclosure: Long AMZN. A Word From Our SponsorsPower your investment decisions with quality expert insights on demand Need help making investment decisions based on vetted market insights? Look no further! Stream by AlphaSense helps investment research teams access unique, high-quality expert insights faster and more cost-effectively than most traditional expert networks. Sign up for a free 14-day trial here! With Stream, you’ll have instant access to:

Instead of using the same pool of experts for multiple interviews, we custom source and recruit experts for every request. Each expert has recent involvement in their industry and our rigorous vetting process helps create the highest quality interviews, so you can make truly informed decisions. ElsewhereEconomistsThe Economist has a good piece on how economics PhDs are increasingly working in the private sector, especially at big tech companies ($). ~99% of economics is explaining various ways that Econ 101 oversimplifies things, often due to the complexity of human behavior or the nonzero cost of information. But it turns out that many of the complexities of human behavior can be isolated and measured through A/B testing, and big tech companies certainly produce lots of information. So the skillset of finding either novel ways to apply economic theory, or good ways to refine models to account for new edge cases, can be applied by big tech better than just about anywhere else. Regulatory OutsourcingVisa is adding a new merchant code for transactions at gun stores, in response to lobbying. The direct effect of this is fairly minimal, but it makes it much easier to regulate gun sales at the level of the financial system rather than of gun ownership itself. Part of what Visa is doing is outsourcing regulation: by making it easier to implement regulations, they make those regulations more likely, meaning that they're less likely to face direct pressure to restrict gun sales when that can be done through legislation instead. Come for the Network, Stay for the ToolStreaming service Twitch has been reducing the amount it pays for exclusives, leading some popular Twitch streamers to stream on multiple services at once. This has not been without its complications:

Streaming has been a surprisingly hard business for anyone to retain high market share in. Top streamers have gotten poached, often at high prices, but if the economics tend to accrue to the entertainers rather than to the platform owners, those platforms will eventually be reluctant to try to control IP when they can do reasonably well without. For an earlier Diff look at eSports, see this profile of FaZe Clan. (Since that piece, FAZE shares have declined 5%, but at the current borrow cost a short seller would have had to pay 14% to be short over that period.) OilThe WSJ has a good profile of Occidental Petroleum CEO Vicki Hollub ($, WSJ). Occidental engaged in a clever feat of financial engineering: the company basically gave Warren Buffett a great deal on preferred stock in order to avoid having a shareholder vote over their merger with Anadarko, which is the sort of thing that gets activist investors excited. That deal looked awful originally, but has turned out fine since demand has done well and the industry has been fairly restrained. In a different macro climate, the deal would be an open-and-shut story about corporate empire-building and shareholder rights. In cyclical industries, it can be hard to tell whether CEOs are lucky or good—because part of being good means surviving during downturns in order to profit from booms, which is something that Occidental, as a highly-levered industry consolidator, did extremely well. Covid and Social MobilityIn the US, after-tax income for the bottom quintile of the income distribution is up 30% since 2019, compared to 6% for the top quintile. In China, trends are moving in the opposite direction ($, Economist): the lowest earners were more likely to lose their jobs because of shutdowns, and, because of China's household registration system, didn't have access to social services and often lost housing, too: "researchers have found that the wealth of China’s low-income households has fallen every quarter since the pandemic began in 2020, even as that of high-income households has risen." China's economic system has evolved around what was previously a much more closed and controlled one, and one result of this is that the poorest are much less legible to the state than the richest. Diff JobsDiff Jobs is our service matching readers to job opportunities in the Diff network. We work with a range of companies, mostly venture-funded, with an emphasis on software and fintech but with breadth beyond that. If you're interested in pursuing a role, please reach out—if there's a potential match, we start with an introductory call to see if we have a good fit, and then a more in-depth discussion of what you've worked on. (Depending on the role, this can focus on work or side projects.) Diff Jobs is free for job applicants. Some of our current open roles:

1 And that's just looking at recurring software revenue; in-app purchases and Apple's growing ad business ($) add some lumpier revenue to this. And we shouldn't forget Apple's Google deal, which, even if it's contracted as a fixed fee, is essentially a function of the number of active iOS users and their spending power. 2 A category that has included both Walmart and Costco since before Amazon existed. Running a low-price/high-turnover model is a data- and computation-intensive project; the faster inventory turns over, the harder it is to predictably keep the shelves stocked. Both Walmart and Costco have had to get very good at modeling seasonal sales trends, monitoring short-term trends, continuously adjusting their pricing and advertising to keep some inventory moving while holding other goods back, not to mention the daunting task of keeping track of every single product they sell from the time it comes off the assembly line to the moment it leaves the store. As a first approximation, any good supply chain management or marketing trick discovered by a DTC e-commerce company in SF or Brooklyn is old news in Bentonville. 3 Which is not a simple linear relationship by any means. Their model presumably takes into account the fact that some people will pay a big premium to arrive at someone's office at 2:56pm instead of 3:01, or that some trips to airports are high-urgency. Over time, though, they'll still get a sense of which users mostly care about price, which pay a premium for speed, and approximately what that premium is. You’re a free subscriber to The Diff. For the full experience, become a paying subscriber. |

Older messages

Longreads + Open Thread

Saturday, September 10, 2022

Biology, AI, EA, YouTube, Xi, Cyclicals

A Taxonomy of Drawdowns

Tuesday, September 6, 2022

Plus! Watercooler Shows; Smart Thermostats; Substitutes and Complements; Monetization; Apple Ads; Diff Jobs

Longreads + Open Thread

Saturday, September 3, 2022

Fraud, Poop Music, Research, France, Athens/Jerusalem/Silicon Valley, Ireland

Turning non-tradables into tradables

Monday, August 29, 2022

Plus! Grills, Ads, Pricing, Drops, Movies, Diff Jobs

Longreads + Open Thread

Saturday, August 27, 2022

NEPA, FOIA, Xi, Cold Chain, China, Anglo Irish

You Might Also Like

After inauguration, it's time to talk taxes

Wednesday, January 15, 2025

plus toad fashion + Post Malone ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 1-15-25 Stocks Look to Break Lower: Another Sign of a Top on December 16

Wednesday, January 15, 2025

Harry's Take January 15, 2025 Stocks Look to Break Lower: Another Sign of a Top on December 16 As we go into the new year, already with signs of a failed Santa Claus Rally and a failed first 5

🇺🇸 America's tariff future

Tuesday, January 14, 2025

A possible go-slow approach to tariffs, a spending worry for China, and the next obesity drugs | Finimize TOGETHER WITH Hi Reader, here's what you need to know for January 15th in 3:14 minutes. The

It’s a new year, get a new savings account

Tuesday, January 14, 2025

Earn more with high-yield options! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Private Equity Is Coming for Your 401(k)

Tuesday, January 14, 2025

The industry wants in on Americans' $13 trillion in savings ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

This Skateboarding Economist Suggests We Need More Skateparks And Less Capitalism

Tuesday, January 14, 2025

A skateboarder presented an unusual paper at this year's big meeting of American economists. View this email online Planet Money Skateonomics by Greg Rosalsky “The Skateboarding Ethic and the

Elon Musk Dreams, Mode Mobile Delivers

Tuesday, January 14, 2025

Join the EarnPhone revolution ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Shaping inflation expectations: the effects of monetary policy

Tuesday, January 14, 2025

Natalie Burr In economic theory, expectations of future inflation are an important determinant of inflation, making them a key variable of interest for monetary policy makers. But is there empirical

🌎 Another hottest year

Monday, January 13, 2025

Global temperatures crossed a threshold, oil prices bubbled up, and crypto's AI agents | Finimize Hi Reader, here's what you need to know for January 14th in 3:06 minutes. Oil prices climbed

Have you seen the Best Cars & Trucks of 2025?

Monday, January 13, 2025

Get a quote and protect your new wheels with Amica Insurance ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏