|

I’m Isaac Saul, and this is Tangle: an independent, ad-free, subscriber-supported politics newsletter that summarizes the best arguments from across the political spectrum on the news of the day — then “my take.” First time reading? Sign up here. Would you rather listen? You can find our podcast here.

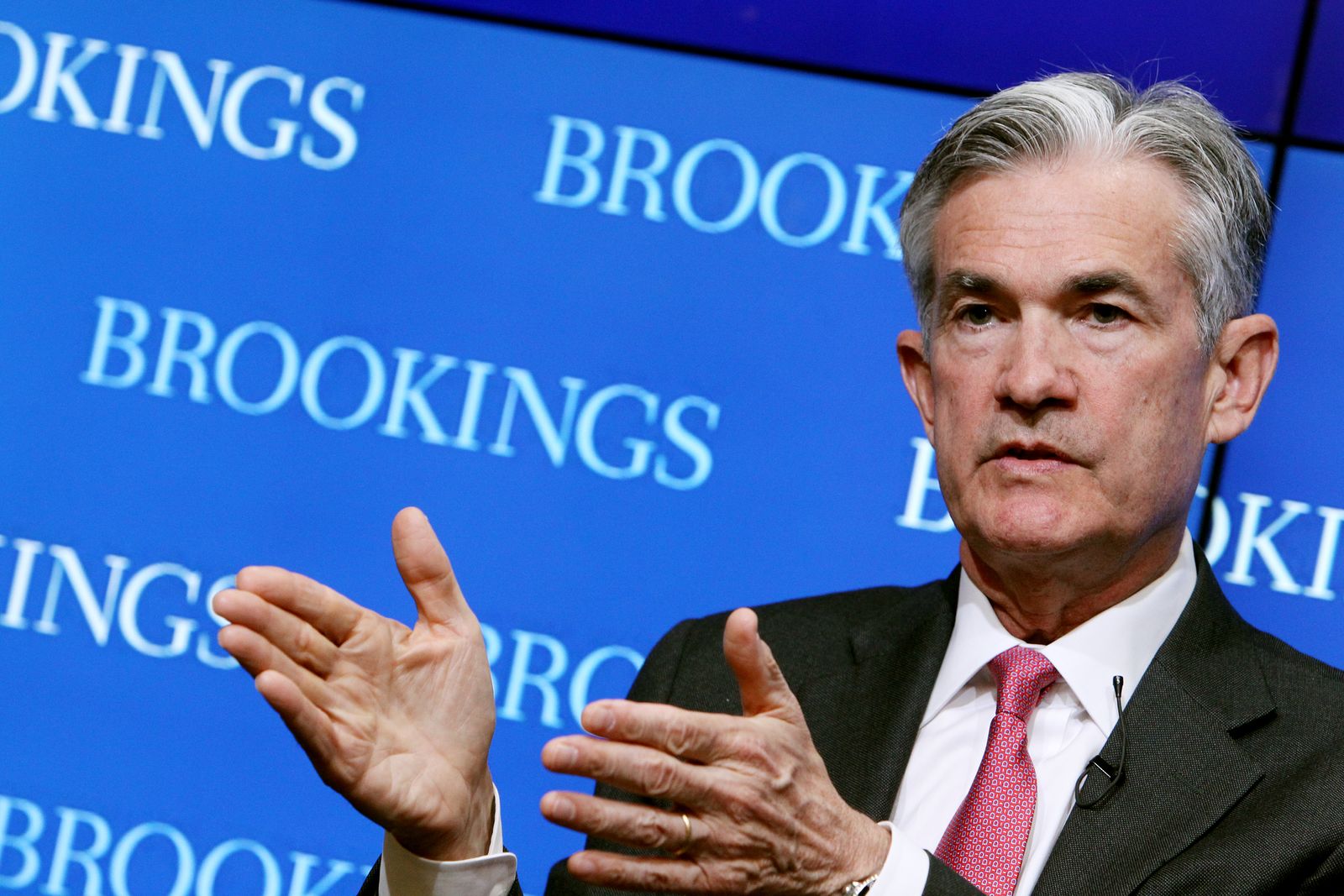

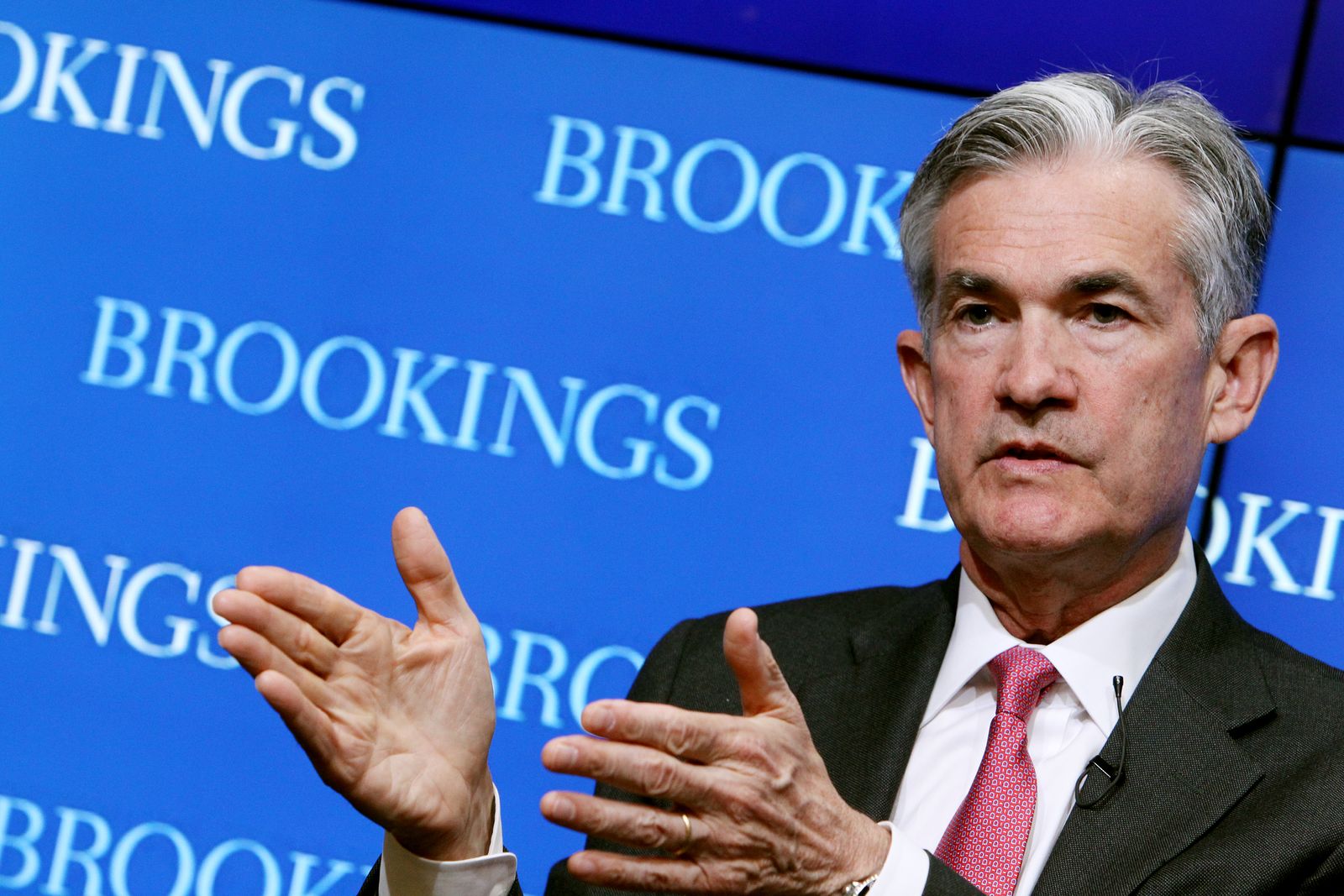

Today's read: 11 minutes. We're covering the latest inflation news. Plus, some reader feedback, a preview of tomorrow's subscribers-only edition, and a question about immigration judges.  Current Fed chairmen Jerome Powell, who is tasked with finding a way to end inflation. Image: Sharon Farmer / Brookings Institution

Tomorrow...In tomorrow's subscribers only edition, I'm going to be writing a personal piece about some of what I'm seeing in American culture and the political world right now. Namely, what I'm noticing about the assumptions we make about the people around us. It's a piece that has been percolating in my head for a few months now and, tomorrow, I'm finally going to let it out. Reminder: You are on our free mailing list right now. That means you get the newsletter on Monday, Tuesday, Wednesday and Thursday. If you subscribe, you also get Friday editions, and access to all of our premium content in our archive. Nearly 8,000 people are on our premium list. You can subscribe here.

Reader feedback. Dimitry, a Soviet Jewish immigrant born in the USSR and now living in New York City, wrote in about "my take" on Ukraine, saying, "Isaac, strong disagree on your take. Ukraine gets to decide this conflict's end game, not the U.S., and if any Russian troops are left on Ukrainian soil, including Crimea, it will only serve as a staging ground for yet another conflict once Russia regroups and rearms. The only solution, and fastest path to peace, is military support for Ukraine and a complete Russian rout. Anything short of that will further embolden Putin. The pundits in America have been wrong about Ukraine's capacity to withstand Russian aggression from day one, and anyone supporting a 'peace treaty' or 'negotiations' now is unfortunately supporting a freezing of the conflict and extending an unnecessary lifeline to an otherwise floundering Putin regime on the brink of collapse. Instead, we need to be preparing for a political near future in which Ukraine is the undisputed victor in this conflict, and Russia likely undergoes a regime change. See this Atlantic article: It's Time to Prepare for a Ukrainian Victory." Reminder: You can reply to any newsletter to write in with your thoughts. I love reading your feedback and publishing dissenting opinions in Tangle.

Quick hits. - The White House announced that a deal between freight-rail unions and their rail firms was reached, averting a potentially crippling strike. (The deal)

- The U.S. said it will release $3.5 billion in frozen Afghan central bank reserves to the "Afghan Fund," hoping the money will reach the Afghan people without being passed through the Taliban. (The move)

- Florida Gov. Ron DeSantis helped fund 50 migrants who were flown to Martha's Vineyard in Massachusetts, mimicking an effort led by Texas Gov. Greg Abbott. (The migrants)

- A judge unsealed new documents related to the search of Mar-a-Lago, which shows the Justice Department sought "any and all surveillance records, videos, images, photographs... from internal cameras." (The documents)

- Armenia and Azerbaijan agreed to a ceasefire to end fighting that killed close to 100 combatants in the worst violence in the past two years of the decades-long conflict. (The ceasefire)

Our 'Quick Hits' section is created in partnership with Ground News, a website and app that rates the bias of news coverage and news outlets.

Today's topic.Inflation. On Tuesday, the latest numbers on inflation were released by the Bureau of Labor Statistics. Reminder: Inflation is measured by the Consumer Price Index (CPI), which is designed by the Bureau of Labor Statistics to measure price fluctuations for urban buyers, who represent the vast majority of Americans. The CPI tracks 80,000 items in a fixed basket of goods and services, representing everything from gasoline to apples to the cost of a doctor's visit. The CPI rose 8.3% year over year in August, and was up 0.1% compared to July. Last month, inflation rose 8.5% year over year and was flat month to month. Analysts predicted inflation would fall slightly on the month-to-month level in August, and the 0.1% rise caused a major market sell-off and speculation that the Federal Reserve would continue to aggressively raise interest rates to cool the economy. The inflation growth was driven mainly by shelter, food and medical care costs, which have all continued to rise sharply. The food index is now up 11.4% year over year, the highest increase since 1979. However, gas prices and energy both plummeted, keeping the total year-over-year inflation number steady and the month-over-month inflation number nearly flat. Core CPI, which is a measure of inflation without more volatile food and energy prices, rose 0.6% month over month and was up 6.3% year over year. Core CPI is a critical metric for the Fed, which looks to it while determining whether to continue to raise interest rates. The Fed's goal in raising interest rates (the cost of borrowing money) is to slow spending across the economy, thus bringing down demand and prices (a reminder on what the Fed does here). As we've mentioned before, inflation is one of the most important issues to voters — one that impacts real wages and everyday living in a very tangible way. Given that, and polls reflecting that it is still a top concern for voters, we have taken the unusual step of covering it repeatedly, nearly once a month since it became a national story. You can find our previous coverage here. Today, we're going to take a look at some reactions to the latest report from the right and left, then my take.

What the right is saying.- The right is discouraged by the numbers, saying inflation is persistent and Biden's policies aren't helping.

- Some pointed out the immediate shock to the stock markets, a worrisome sign that investors were expecting better numbers.

- Others called out the Biden administration for continuing to pass spending bills in the midst of historic inflation.

In The Washington Post, Henry Olsen said Democrats cannot wish inflation away. "Don’t let the fact that overall prices rose from July to August by only 0.1 percent fool you," Olsen wrote. "That slow one-month rise, like July’s zero percent rise, was caused almost exclusively by declining prices at the gas pump. Food, shelter and most other items in the consumer price index continued to go up. Food consumed at home, for example, has now increased by 13.5 percent over the past year, which the Labor Department says is the highest yearly hike since March 1979. So the money Americans save when filling their tanks simply goes out the door to pay for the food on their tables. "That means Federal Reserve Chair Jerome H. Powell won’t take his foot off the monetary brake when the Fed’s Governing Board meets next week. Another 75-basis-point interest rate hike is likely, and another one is probably in store for when the Fed next meets right before Election Day," Olsen added. "That’s what needs to happen: Interest rate hikes always depress economic activity by making spending and borrowing more expensive. This, in turn, reduces inflationary pressures, slowing price increases to a manageable level. It’s not pretty or painless, but the Fed’s medicine always brings the inflation fever under control." The Wall Street Journal said investors got another jolt. "Tuesday’s report on the consumer-price index for August showed inflation has remained high and sticky, and markets promptly fell out of bed. And we mean from the top bunk," the board wrote. "The 3.94% tumble in the Dow Jones Industrial Average was the worst day since 2020, and the declines in the S&P 500 and Nasdaq were worse. Investors apparently had believed the hopeful chatter that inflation was headed downward, and that the Federal Reserve wouldn’t need to raise interest rates so high as to court a recession. Investing lesson of the week: Never trust a politician. "Consumer prices overall rose 0.1% in August, after being flat in July. But the decline was almost entirely the result of falling energy prices. Gasoline fell 10.6% and fuel oil 5.9% in the month. That was a happy respite from the spring when gasoline prices averaged more than $5 a gallon nationwide, but prices at the pump are still up 25.6% in the last 12 months and still average $3.71 a gallon," they said. "The larger problem is that the energy declines weren’t enough to offset price increases across nearly everything else. The 12-month inflation rate in August fell only to 8.3%, down from July’s 8.5%, but higher than the 8% to 8.1% that economists had expected." The Washington Times editorial board said if the damage Biden has brought to the U.S. economic doorstep wasn't obvious before, it is now. "Mr. Biden’s decision in 2021 to pour trillions of pandemic-recovery dollars into a resilient economy has pushed inflation to a 40-year high from where it has barely budged. Even as the Federal Reserve jacks up interest rates to tamp down the brunt of inflation, the president continues to multiply the economy-flattening force," the board said. "The August figures demonstrate the Fed’s four previous rate hikes this year have had little effect thus far. In callous disregard for the damning impact of his big-government spending, Mr. Biden and his fellow Democrats saluted one another on the White House lawn Tuesday. Their occasion for celebration: The passage of his so-called Inflation Reduction Act. "Authorizing $430 billion in new spending, the bill’s effect portends the opposite of its title. The embarrassing spectacle of their partying while the stock market tanked may explain why Democratic Speaker Nancy Pelosi was forced to beg the audience to applaud her ode [to] the president’s 'extraordinary leadership,'" they wrote. "It would not be senseless to tremble at the prospect of undergoing the sort of economic hardship that wracked the nation four decades ago when, for example, mortgage rates crested at 18.45% in 1981 — the highest ever recorded in the ‘land of the free.’ And, in fact, voters believe by a 36%-12% margin that the Inflation Reduction Act actually will worsen inflation, according to a recent Economist-YouGov poll."

What the left is saying.- The left is discouraged by the report, and divided on how to proceed.

- Some call on the Fed to shock the system with a major rate hike, while others advise against it.

- Some point to corporate profiteering as the cause of rising prices.

The Economist said the Federal Reserve must "go big," and the odds of avoiding a recession look woefully long. "Now the dream has been dashed," they wrote. "Figures published on September 13th show that the pace of underlying inflation in August was fast and furious. Stock markets fell by the most since the early months of the pandemic; the price of junk bonds dropped; and short-term Treasury yields spiked. America still has an inflation problem. To fix it, the Federal Reserve must go big. The good news is that America has been spared the worst of the gas crisis that is wreaking havoc in Europe. As Vladimir Putin has turned off the taps, inflation in some places has crossed into the double digits. America does not rely on Russian energy. Its inflation rate peaked at 9.1% in June and fell to 8.3% in August as oil prices eased. "Strip out volatile food and energy prices, though, and underlying 'core' inflation is still roaring," they wrote. "It is tempting to sift through the components of the inflation basket in an endeavour to find signs of cooling... Yet when underlying inflation has been this high for this long the simplest explanation is the most obvious, no matter what happens to individual components: the economy is still overheating. The effects of generous fiscal stimulus, which stoked demand during the pandemic, linger today... Rather than continuing the cycle of tardiness and surprises the Fed should act in bigger increments, by bringing forward to this year the interest-rate rises it had planned for 2023." In Bloomberg, Robert Burgess said the Fed should avoid a 1% interest rate hike. "If the consumer price index report for August that showed inflation remains much hotter than forecast was not enough of a shocker, then talk that the Federal Reserve needs to raise interest rates in even bigger chunks starting with its meeting next week surely is," Burgess said. "The idea that the central bank must lift its target for the overnight rate between banks by 100 basis points — something it hasn’t done since the 1980s — after increasing it by 75 basis points in both June and July is not some fringe notion. Money market traders are pricing in a not insignificant 33% chance that it will happen. The thinking is that the Fed needs to get radical if it truly wants to get control of inflation, which rose 8.3% in August from a year earlier. "There are two primary reasons an increase of such magnitude would be a bad idea. The first and most obvious is that it would signal the Fed is in panic mode, which is not a good look for any central bank, let alone the most important one in the world. Risk premiums might blow out to compensate traders for the heightened risk of uncertainty around monetary policy. That would upend credit markets, the lifeblood of the financial system," he wrote. "The second reason the Fed might not want to get too aggressive is that it would perhaps make financing too expensive for real estate developers when a lack of supply is causing rents to soar. Shelter costs, which posted their biggest monthly gain since 1991, were a big factor in pushing up core CPI by 0.6% in August from July, double the forecast... Shelter costs are the largest component of CPI, accounting for about a third of the measure." In Newsweek, Robert Reich said the war on inflation is "about to get ugly." "Researchers at the International Monetary Fund are now saying that the unemployment rate may need to reach as high as 7.5 percent—double its current level—to end the country's outbreak of high inflation. This would entail job losses for about 6 million people. Who will bear this pain? Not corporate executives. Not Wall Street. Not big investors. Not the upper-middle class," Reich said. "The draftees into the war on inflation will be who they already are: lower-wage workers. As the economy cools due to interest rate hikes, they will be first to be fired as the economy plunges. They will also be the last to be hired. "The Fed is obsessing about a 'wage-price' spiral—wage gains pushing up prices. What it should be worried about is a profit-price spiral. Wages are going nowhere. But profits have been soaring," he wrote. "In the second quarter this year, U.S. companies raked in profits that were the highest on record, or close to levels not seen in over half a century. As a share of GDP, U.S. corporate profits in the second quarter rose to 12.25 percent, their highest levels since 1950. So there you have it: Profits are up, and wages are down. So what's pushing up prices? Profits. Wages are lagging behind inflation. Most workers' paychecks are shrinking in terms of purchasing power."

My take. Reminder: "My take" is a section where I give myself space to share my own personal opinion. It is meant to be one perspective amid many others. If you have feedback, criticism, or compliments, you can reply to this email and write in. If you're a paying subscriber, you can also leave a comment. - It's a disappointing report, and makes me nervous about the future.

- I don't think the root cause is "greed" as some on the left contend.

- Inflation may have peaked, but it looks like it will persist around these levels.

This one stung. In last month's write up on inflation, I struck some notes of hope and skepticism. The hope was that we finally got some relief on energy, and perhaps we'd see this translate into other sectors of the economy. The skepticism was that core inflation metrics still looked bad, and food and shelter prices were still rising. All of us, I said, should be rooting for those energy prices to keep falling and to finally see some relief on everything else. The biggest hope was that this was the beginning of a trend, where month-over-month inflation cooled. Instead, though, it looks like core CPI is continuing to rise, and food and shelter prices have shown no signs of falling. The good news for consumers is all tied to the energy sector, and we should be glad we're not reliant on Russia for oil and gas. The bad news is basically everything else. It isn't just that prices are still rising across most sectors, it's that they are rising after several interest rate hikes and despite so much focus on getting them down. Previously, I wrote about how convincing I found arguments like Robert Reich's on corporate greed. Then I wrote about why I changed my mind, namely by reading arguments like this and this that exposed the fallacy of the "greedflation" takes. The simplest retort to claims that corporate greed is causing inflation is that corporate greed is constant, and inflation is not. You can't rein in inflation by trying to convince corporations to want to profit less. Profits are rising, yes, because prices are rising. And because customers are flush with cash. These are all conditions we'd expect in any inflationary time period. Anyway, I don't know what the answer is. I'm hoping smarter people do. But it seems increasingly likely that the Fed is either going to have to shock the system with a large, unexpected rate hike, or it's going to have to slowly grind the economy to a halt with continued incremental rate hikes. It’s unlikely that more than a decade of near-zero interest rates and monetary stimulus will be undone with a few months of interest rate hikes. Yes, we may have seen peak inflation. But we also may keep experiencing that peak inflation for many months to come. Historically speaking, interest rates still aren't that high, and the Fed is probably hoping that falling energy costs are still going to bleed into other sectors. Either way, the "soft landing" outcome of no recession and cooling of inflation does, unfortunately, look less and less likely by the day.

Your questions, answered.Q: I have long thought the answer (or at least the first and most obvious step) to address the border issue is to have more judges and courts for the hearings. I know this is your point of view, so I ask...why do you think this (seemingly simple and obvious) step has not been taken by any of the administrations over years? — Mark in Niles, Illinois Tangle: It's a great question. In January of 2021, I interviewed Alex Nowrasteh from the Cato Institute about immigration. Alex has very "pro-immigration" views from an economic perspective, in that he emphasizes the benefits of making legal immigration more accessible. In that interview, I told Alex about a piece of Biden administration legislation that would increase the number of judges, expressed my support for that policy, and asked what he thought. The first thing he said was, "So I'm torn on that. It depends entirely upon the policies that the judges are actually enforcing." I think that is basically the whole thing in a nutshell. Having a ton of immigration judges is a great idea if you think your policies are going to be enforced. If you want migrants coming here to work to be granted legal status, and asylum seekers to be processed and granted asylum safely and quickly, then yes, having thousands of judges to handle that work under a sympathetic administration like Biden's is great. But what happens if Trump or DeSantis wins in 2024? Then all of a sudden there is an army of judges enforcing new federal policies to expedite deportations and rejections (if you assume those candidates would restrict immigration, and I think it's obvious they would). So I guess it's a catch-22. Nowrasteh argued to me, explicitly, that the "administrative inefficiency" under Trump was a "blessing in disguise" because the backlog helped, "in the sense that people who were going to get their claims denied and then were going to be removed from the United States or deported from the United States" weren't. And Republicans in Congress probably don’t want thousands of judges right now who would help grant legal entry to migrants under Biden’s policies. Aside from that logic, I honestly don't have a great answer for you. It is incredibly disappointing, and I think gives credence to the cynical notion that the border crisis benefits both parties, so neither has much incentive to solve it. Want to ask a question? You can reply to this email and write in (it goes straight to my inbox) or fill out this form.

Under the radar.A sweeping New York Times investigation has found that 97 lawmakers or their family members were trading financial assets in industries that could be affected by the lawmakers' committee work. From 2019 to 2021, 183 current senators and representatives reported a trade of a stock or financial asset by themselves or a family member. Over half of them sat on congressional committees that could give them insight into the companies whose shares they reportedly bought or sold. The Times has the story.

Numbers.- $3.69. The average price of a gallon of gasoline in the U.S. today.

- $3.95. The average price of a gallon of gasoline in the U.S. a month ago.

- $3.18. The average price of a gallon of gasoline in the U.S. a year ago.

- 0.8%. The rise in medical care prices in the last month.

- 5.6%. The rise in medical care prices in the last year.

- 0.7%. The rise in shelter costs in the last month.

- 6.2%. The rise in shelter costs in the last year.

- ~1/3. The rough fraction of CPI that shelter costs account for.

Have a nice day. Brayden Nadeau is just 12 years old, but he's already helping feed his small town. The Minot, Maine, resident has fallen in love with the family tradition of farming, and now he's helping run his grandfather's 25-acre farm. Brayden first helped his grandfather steer a John Deere tractor when he was 2. By the time he was 3 he was helping feed the hogs and chickens, and at 5 he told his kindergarten teacher he wanted to be a farmer. On his own initiative, Brayden began planting, tending to, and harvesting produce from the farm two years ago, and now runs Brayden's Vegetable Stand, selling produce to his community. The Washington Post has the story.

❤️ Enjoy this newsletter? 💵 Drop some love in our tip jar. 📫 Forward this to a friend and let them know where they can subscribe (hint: it's here). 📣 Share Tangle on Twitter here, Facebook here, or LinkedIn here. 🎧 Rather listen? Check out our podcast here. 🛍 Love clothes, stickers and mugs? Go to our merch store!

|