The Diff - How Does Upwork Work?

Welcome to the weekly free edition of The Diff. Last week's subscribers-only posts included a profile of the TV station company whose performance almost matched Netflix's over the last decade, how to think backwards about growth, and why Adobe's purchase of Figma is best understood as covering a short position. Coming soon, we'll talk about lessons from a late-blooming airline billionaire, the business of earning float, and a controversial short thesis. How Does Upwork Work?Plus! Captions; Robotics; Fixing Airports; Capex; YouTube Shorts; Diff Jobs

Welcome to the free weekly edition of The Diff! This newsletter goes out to 41,897 readers, up 620 since last week. In this issue:

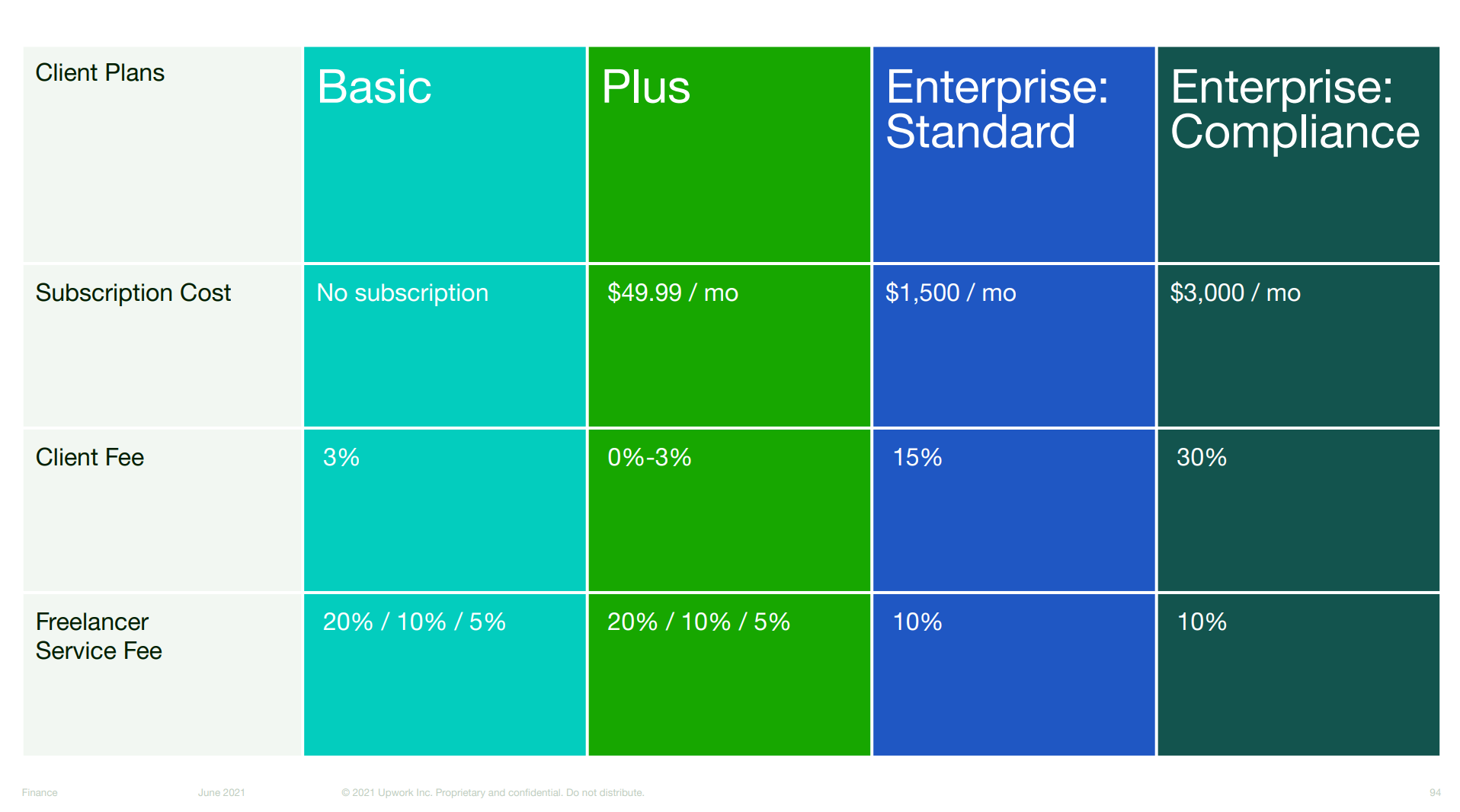

How Does Upwork Work?Upwork is one of those companies that accidentally built the sort of business you'd create if you were worried about a global pandemic disrupting the normal economy. They've been a hub for remote work for over a decade, matching individual freelancers to employers who range from individuals working on side projects to Fortune 50 companies. Like anyone who has been involved in short-term remote work, they learned early on that monitoring was important—not just to maximize productivity but to maximize customers' perception of productivity. A manager at an office can gaze over cubicles and see a bunch of employees who are at least pantomiming productivity, but someone who outsources to a far-off freelancer needs to wait for results. Like many Covid plays, Upwork's shares are down from the peak of work-from-home-forever fever, and currently trade at $16, down from $60 a year ago. But unlike some Covid beneficiaries, Upwork did not overshoot: shares are still up 52% from January 2020. Freelancing's sensitivity to broad economic conditions is tricky to parse. BLS data on employment among temporary workers shows that it's a leading indicator of the start of a recession but a coincident indicator of the end of one—which could be another way of saying that when the economy is running hot, temporary workers shift into full-time jobs. When companies are recovering from a downturn, they're more cautious about hiring, and one way to handle growth without increasing fixed costs is to hire in less than 2,000-hour-a-year increments. Upwork's goal is to make this easier, for both sides: they provide search and rating functions for freelancers, and have recently branched out into a "Product Catalog," basically a way for freelancers to productize offerings. The company describes this as fittig "small, fast, transactional projects," and it's one of many ways they try to convert one-off relationships into recurring activity from both sides. One of the joys of a two-sided network is finding out which risks loom large for one side but not the other, and mediating between the two. Getting paid reliably, for example, is a big part of Upwork's marketing to freelancers. The company, like so many intermediaries, is partly a bank. Or, if you want to put it more cynically, there are some companies that essentially use freelancers as banks, treating them as a source of zero-cost financing by delaying payments or renegotiating after the fact.¹ The incentive to do this is understandable: many of the small businesses that rely on freelancers are perennially short of capital, and when they're deciding who gets paid, their priorities probably start with full-time payroll, ongoing suppliers, and rent, with one-off contractors further down the implicit preference stack. Since there's a fixed cost in time and money to collecting on a debt, smaller bills are the ones less likely to get paid on time. All of this is unfortunate, and it's not ubiquitous—plenty of companies pay on time. But for people who rely on freelancing to pay their own bills, when it happens it's memorable. Upwork reports "transaction losses" in the 1-2% of revenue range from when this credit provision doesn't work out in their favor, but like many kinds of vendor financing, it can be worth it overall even if the loans don't make money on their own. UpWork's pricing model has some complexity to it, but the basic version is:

The tiered pricing model encourages people who use multiple platforms to use Upwork more as its share of their income goes up. And Upwork can assume that people who keep getting business have a reasonable value proposition for the amount they're charging. So Upwork's pricing strategy is a way to organically raise contractor retention alongside quality. This necessarily implies a tradeoff where new contractors have a harder time getting started. But the company's bet is probably that the size of the global labor arbitrage is big enough that getting 80% rather than 95% of the first contract is still a big deal. One way to put their pricing in perspective is to look at other companies that market professionals for software, design, and copywriting projects. Ad agency Omnicom did $14.3bn in revenue in 2021, and paid $10.4bn in "Salary and service costs," meaning the company's effective take rate—what they got from customers and didn't pass on to billable workers—is 27.2%. Upwork's last year was 13.2%. So in the broad business of selling access to web designers, copywriters, and other knowledge workers, Upwork is the low-cost competitor. While their workforce is global, the company is not just exploiting country-by-country cost of living differentials. (Though there is some of that: 6% of their freelancers were in Ukraine and 4% were in Russia and Belarus, so they lost a big chunk of revenue when the war started.) 25% of their freelancers are in the US, as are 66% of their customers. In what context does it make sense for workers in a country with a GDP per capita of $69,000 to compete in a global, the-world-is-flat market where the GDP per capita is more like $12,000? There are a few possibilities:

On the customer side, there are also multiple motivations. Their typical customer is someone running a small business or a side hustle, who wants content written (or translated), needs a new feature on their site, wants to produce a presentation, etc. But last year, $35m of their $462m in marketplace revenue came from enterprise customers, and this revenue grew 73% compared to 37% for the overall business. Enterprise customers have very different economics from their typical user. Small businesses have a notoriously high churn rate for service providers of all kinds, both because they're budget-constrained and because the businesses themselves don't last very long. But Upwork's enterprise customers have a net dollar retention of 130%. Their corporate customers care about outsourcing knowledge work that's important, needs to be done on a timely basis, but isn't really core to their business. Updating an app to add new features is core; translating the documentation, and the copy on buttons, into fifty different languages is probably noncore. It's also something that needs to be done on a short schedule, and ideally in parallel. When those enterprise customers have a project like this, they don't want to waste time looking for the last handful of translators, so they'll go to the biggest platform. And that's incremental spend for Upwork. Ideally for Upwork, it also means that more corporate decisions bake in the possibility of scalably throwing lots of temporary labor at a problem. There are other areas where this works. One nice thing about the business is that they're definitely eating their own dogfood: at their investor day last year, they said that three quarters of their workers are freelancers. One case study they offered: their finance team, like many such teams, has long hours when they're closing the books on a reporting period. By using their own platform, they cut the team's overtime. Sometimes, adding freelance workers is the way a company retains its permanent staff. They also use their product for customer service; it's a cheap way to get global coverage, both in terms of time zones and languages. Upwork doesn't get a direct margin benefit from selling higher-quality workers. In fact, if anything, they take a margin hit since more of those workers will graduate to lower commission tiers. But they do get a take rate benefit for a higher-quality platform; when they're vetting workers and ensuring compliance, the spread between what freelancers get and what clients are willing to pay goes up. (And this reflects the client's economics, too; the cost of getting full-time workers to follow compliance policies is nonzero.) They've launched a few other products that help them improve their lock-in, both for large customers and for frequent freelancers. Upwork's "Direct Contracts" product is the tool without the platform: a way for their freelancers to manage all the contracts they're working on, with Upwork providing escrow. For companies, there's the similar bring your own talent tool for managing Upwork freelancers and external ones in the same place. It's a bit like OpenTable's strategy of offering software to manage the entire reservation process, and then monetizing an increasing share of those reservations through its own platform over time. (The marketing copy doesn't mention it, but both of these tools are also a nice way for Upwork to see if anyone is using the contract to get leads and then working with them off the platform later.) The business has a nice two-sided network effect, and these product launches help fill out the network. It's not without its risks, though. The services Upwork connects companies to are. exactly the stuff that's vulnerable to AI. If the output Upwork gives you is quick, cheap, and needs a second set of eyes before it can go live, then it's quite similar to the output you might get from GPT-3—except that Upwork is, by comparison, slow and expensive. On the other hand, perhaps that's an advantage. If I were running a startup that used AI to do quick freelance copywriting gigs, then knowing my sales and marketing spend was going to be 5% of revenue would give me a lot more certainty around my economics. And this fits, somewhat, with the spirit of Upwork: when a company is going to work with someone for a long time, integrate them into the company culture, train them to do their job better, etc., that company probably wants to hire a full-timer. If the company's plan instead is to complete a specific task that isn't part of their core competency and probably won't be repeated, then Upwork is where they go. And whether Upwork means hiring a part-time worker in a place with a low cost of living or paying a big markup on OpenAI is immaterial to the outcome. The other business risk is, well, the business. Including stock-based compensation, Upwork has only reported one year of positive EBITDA margins, back in 2017. In 2021, simply a wonderful time to be connecting companies to remote workers, their margins got worse. The company has a decent story to tell here: they're increasing their investment in sales in order to land more Fortune 500 companies (they'd gotten half as of 2021 and wanted to get them all) and to expand those deals. That's front-loaded. They also increased brand marketing to $21m last year. Upwork has made the process of finding a freelancer much easier and more transparent, but that expensive friction creates a lot of pricing power. The Accenture employee who closes a large contract with a Fortune 50 company is not the one doing most of the implementation, and part of Accenture's job is to profit from the gap between what companies will pay for results and what it costs in the global labor market to produce those results. Upwork is caught in the paradox that as knowledge work gets more commoditized, the business becomes less of a skills business and more of a sales business, and a less transparent platform is better optimized for targeting a baseline level of skills and maximizing its sales. Which can change, of course. And the company's current evolution is in that direction: a few years of 30% organic growth from existing enterprise customers and further growth from new ones will reset the company's growth rate to a higher level and probably raise the take rate they're earning on that growth. But it also means convergent evolution towards the model that big business process outsourcing companies have largely perfected. At that point, the bull case for Upwork will be a broader set of talent and better tools for matching people to projects. But it will be a very different company from the version that exists today. A Word From Our SponsorsThink of the last time you had to import a spreadsheet, did it work on the first try? Of course not. There’s a set of white collar tasks which are highly repetitive, time consuming, and still difficult to automate because there isn’t a standard format. Onboarding data via a CSV is one such task. Each customer has their own, slightly different processes for managing information about their business. So each time you onboard a new customer, you’ve got to adapt the data they bring in files to your system. Flatfile is the product that takes this complexity away. They have an embeddable drag and drop CSV importer, so you can jump seamlessly from closing a deal to a clean dataset. ElsewhereCaptionsThe WSJ highlights the trend of people under 40 watching video with closed captions on ($). (For the record, I'm 35 and I default to closed captions on.) There are two smartphone behaviors that probably spurred this:

All this is probably quite bad for video as an art form but decent for consumers. And that's the usual long-term pattern in advances in media technology. RoboticsTwo big elements of China's economic growth were cheap labor and an extraordinarily high savings rate (as of 2020: 44% compared to a global average of 27%). The cheap labor advantage is eroding, but high savings mean that labor can be substituted by automation: "China accounted for just under half of all installations of heavy-duty industrial robots last year" ($, WSJ). A common pattern in economic clusters is that they get more abstract over time: New York City used to have a cluster of leather tanneries a few blocks from City Hall, and as they got priced out, the tanneries moved away from the city but leather merchants stuck around. The other way this can happen is that companies can start out in a labor-intensive business and automate more of the most repetitive work as the cost of labor goes up. This is more visible in white collar professions so far—for simple tasks, it's easier to replace brains with code than hands with robots—but it can happen almost anywhere. Fixing AirportsThe WSJ has a wonderful story on improvements at LaGuardia's Terminal B ($), an airport Biden once described as "third-world." A big part of what worked was actually testing what the process was like:

An airport is a hard queuing problem, where there's natural variance in how many people want to get in, and how urgently they want to do so, and there are lots of problems that can propagate through the entire system. With enough passengers, this means that figuring out how the airport should operate means spending most of your time dwelling on multiple worst-case scenarios at once. But it also turns out to be a tractable problem. The Diff has an earlier look at why big cities generally tend to have worse government services ($). CapexLarge retailers are spending more on capex this year despite demand problems. Some of this may be strategic (the article cites a Gartner study indicating that companies that kept spending through a recession did better during the subsequent recovery). And some of it comes down to the cadence of spending decisions. In general, bigger checks, especially for fixed assets, have more inertia: doing a round of layoffs after overhiring is a bit less costly than halting construction on a new warehouse halfway through, since there's a large sunk cost already—and it takes a pretty severe recession to reach the point where a half-price warehouse doesn't get a good ROI, so on the margin the spending still makes sense. Cutting an automation program halfway through means higher training expenses (some employees need to learn the old system, some need the new one) and means more reliance on increasingly expensive labor. Some of this spending is also a reaction to the same phenomenon that's hurt retailers' financial results this year. They ended up overstocked on some goods after shortages earlier in the pandemic, and one way to both reduce swings in inventory and to reduce the cost of an inventory buildup in specific categories is to have a more efficient logistics system. YouTube ShortsAs a general rule, legacy companies have better distribution and monetization than challengers, and the smart ones lean on these advantages. This model shows up frequently with Meta's various clones of competing products, but also applies to what Alphabet is doing with YouTube Shorts: in addition to giving the product prominent placement in the YouTube app, the company is offering revenue shares to content creators. TikTok's model of grants meant that as long as usage grew faster than grant money, creators were continuously diluted—survivable to anyone growing, but agonizing to a performer whose audience had stabilized and whose earnings were constantly decreasing. A perk of having an existing advertiser base is that YouTube can earn high CPMs right away, which means they can give creators the kind of short video economics they'd expect from a mature platform instead of a nascent one more focused on user growth than monetization. Ironically, by making short-form video a viable job, TikTok made itself vulnerable to the fact that YouTube could offer high pay for the same work. Diff JobsDiff Jobs is our service matching readers to job opportunities in the Diff network. We work with a range of companies, mostly venture-funded, with an emphasis on software and fintech but with breadth beyond that. If you're interested in pursuing a role, please reach out—if there's a potential match, we start with an introductory call to see if we have a good fit, and then a more in-depth discussion of what you've worked on. (Depending on the role, this can focus on work or side projects.) Diff Jobs is free for job applicants. Some of our current open roles:

1 There's a lot of money in the general business of changing who acts as a bank. There's a sense in which American consumers over the last few decades have been recruited into the business of funding working capital needs: if you buy a big house and run a high credit card balance to fill it with stuff, you're storing inventory that would otherwise clog retailers' balance sheets. Companies like Uber and DoorDash highlight frequent payouts as a feature, and Square/Block's instant payouts feature is functionally equivalent to a 1,400% interest rate for a very, very short-term loan ($). But while this can be a good business move, it's not a good standalone business; it's a nice extra feature for an existing product. Given the high customer acquisition cost of financial services, a big part of the company-as-part-time-bank model is that its existing customers subsidize its financial services marketing. But starting with financial services and building a product around it usually leads to trouble. 2 Basic accounts get a quota of free connects each month, and the company lets them buy more. It also gives them away for taking various actions on the site. It's great fun to be able to mint your own currency, even for a limited use case, though as every money issuer discovers, it's hard to calibrate the money supply perfectly. 3 "Quiet Quitting" is probably a real phenomenon, but not necessarily a new one. Beware of any trendy alliterative term for a phenomenon that would be familiar to your great-grandparents. A constant throughout human history is that middle-aged people overestimate how diligent they were when they were younger, and imagine that the new generation represents a moral decline. Somehow, civilization persists. (On the other hand, maybe they're right about the direction and wrong about the timing—the fact that ancient Romans wrote about Kids These Days is heartening, until you remember what eventually happened to Rome.) You’re a free subscriber to The Diff. For the full experience, become a paying subscriber. |

Older messages

Longreads + Open Thread

Saturday, September 17, 2022

AI, Banks, Pakistan's Near-Unicorn, Market Share, Churn, PE, A&P

The Other "MoviePass Economy"

Monday, September 12, 2022

Plus! Economists; Regulatory Outsourcing; Come for the Network, Stay for the Tool; Oil; Covid and Social Mobility; Diff Jobs

Longreads + Open Thread

Saturday, September 10, 2022

Biology, AI, EA, YouTube, Xi, Cyclicals

A Taxonomy of Drawdowns

Tuesday, September 6, 2022

Plus! Watercooler Shows; Smart Thermostats; Substitutes and Complements; Monetization; Apple Ads; Diff Jobs

Longreads + Open Thread

Saturday, September 3, 2022

Fraud, Poop Music, Research, France, Athens/Jerusalem/Silicon Valley, Ireland

You Might Also Like

🇨🇳 The US is out, China is in

Tuesday, March 11, 2025

Citigroup's forecast for US and Chinese stocks, Lego stacked bricks, and Boeing's investigation | Finimize Hi Reader, here's what you need to know for March 12th in 3:10 minutes. Citigroup

The Under-the-Radar Threat to Your Retirement

Tuesday, March 11, 2025

Nearly half of older adults are burdened by bad debt ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

15 Years Since We Bought Our Toxic Asset

Tuesday, March 11, 2025

In a new Planet Money plus episode, former Planet Money hosts David Kestenbaum and Chana Joffe-Walt look back at a pioneering series that sought to explain a major source of the 2008 financial crisis.

👋 Investors ditched the S&P 500

Monday, March 10, 2025

The US president didn't rule out a recession, but TSMC eased some of investors' other worries | Finimize Hi Reader, here's what you need to know for March 11th in 3:07 minutes. TSMC's

💳 Find a new credit card

Monday, March 10, 2025

Let's get those rewards ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Text and Telos

Monday, March 10, 2025

Plus! Diff Jobs; Scaling; Retail Investors; Comparative Advantage; Transaction Costs and Corporate Structure; DeepSeek Governance Text and Telos By Byrne Hobart • 10 Mar 2025 View in browser View in

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏