Net Interest - Harnessing the Power of Insurance

Harnessing the Power of InsurancePlus: Inflation, Market Stress, Payment for Order Flow

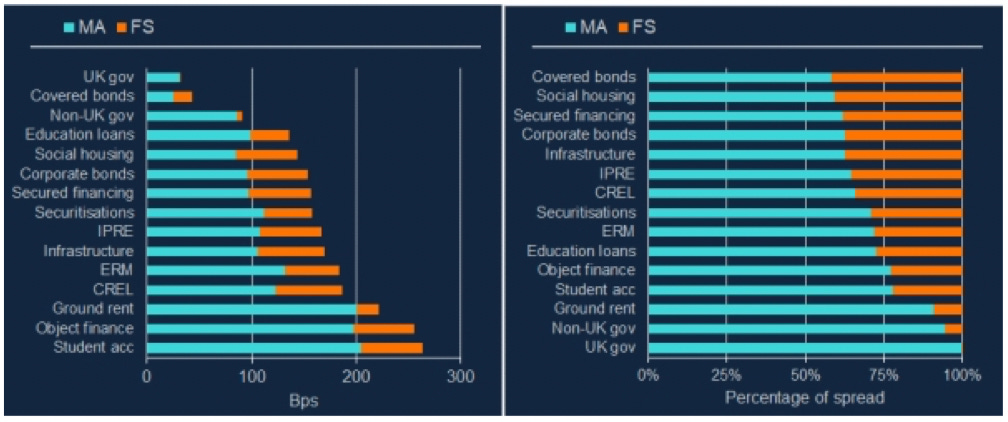

It’s not often you see a national leader take an active interest in obscure elements of financial services regulation. But Liz Truss, newly appointed prime minister of the UK, has done just that. On her campaign trail over the summer, she toured the country promising members of her party that she would reform “Solvency II”, a framework insurers use to model capital requirements. Her rival in the leadership contest, Rishi Sunak, seemed bemused. During one televised debate between the pair, he turned to the audience and asked, “Can anyone put their hands up… Does anyone know what Solvency II means?” Before any financial geeks in the crowd had a chance to respond, Truss shot back: “Rishi, it’s about enabling investment into towns like Stoke-on-Trent, that’s what it is about.” Today, Liz Truss’s government unveiled a new growth plan. Among many other initiatives, it promises that “the government will bring forward an ambitious deregulatory package to unleash the potential of the UK financial services sector. This will include the government plan for repealing EU law for financial services and replacing it with rules tailor made for the UK, and scrapping EU rules from Solvency II to free up billions of pounds for investment.” So what is Solvency II and how does scrapping it free up billions of pounds for investment in towns like Stoke-on-Trent? To understand, we need to start with why financial companies hold capital and how they calibrate it. Stay with me… The Role of CapitalAll companies need capital to support their business, whether to invest in plant and equipment or to finance short-term cash flows. How much they rely on debt and how much on equity is usually up to them, as is how they allocate the overall amount. Financial companies are different. Their key source of finance – deposits in the case of banks, policyholder funds in the case of insurance companies – are a core part of their business and can’t be seen simply as external funding the way debt is for non-financial companies. To convince customers to entrust them with funds, financial companies need to hold a certain amount of equity capital as a shield against uncertainty. Bank customers want to be assured that unexpected losses don’t eat into their savings and insurance customers want to be assured that any claim they may make in the future will be met. In the days before deposit protection schemes, financial companies would advertise the health of their capital buffers in an effort to woo customers. During the financial market panic of 1907, banks published abbreviated balance sheets in local newspapers highlighting the size of their equity capital base. In later years, credit ratings served as a proxy. More comprehensible than a balance sheet, a top rating signalled a strong capital base. Before alternative sources of funding opened to them via capital markets in the mid-1990s, banks like Deutsche Bank and Credit Suisse cherished their AAA credit ratings. For insurance companies, credit ratings became a very important benchmark, with many designing their capital structure to target specific credit ratings. Following the introduction of deposit and policyholder insurance schemes, financial companies no longer had to appeal directly to customers but, in order to protect the integrity of those schemes, they became subject to regulatory capital requirements. Initially, requirements were calibrated simply. The Basel Capital Accord of 1988 required banks around the world to hold capital equivalent to 8% of their assets. Recognising that not all assets are equally risky, assets were “risk weighted” but the range of risk categories was narrow: corporate loans were assigned a 100% risk weighting, government securities a 0% risk weighting and residential mortgages a 50% risk weighting. Over time, regulatory capital requirements grew more complex as they sought to solve more accurately for the risks inherent on financial company balance sheets. In banking, the original Basel Accord gave way to Basel II and then Basel III. A few years ago, a comprehensive overhaul was agreed, paving the way for Basel IV. As a junior banks analyst in the era of the original Basel Accord, I could reverse engineer risk-weighted assets on a few lines of a spreadsheet. That’s no longer the case. Now, banks employ teams of people to crunch the numbers internally and even then they make mistakes – in recent years, both Metro Bank and Coventry Building Society admitted to errors in calculation. Along the way, minimum capital requirements have risen, leading to complaints from bankers. Just this week in Congress, Jamie Dimon, Chairman and CEO of JPMorgan, bemoaned “the continued upward trajectory of regulatory capital requirements on America’s already fortified largest banks.” For financial companies, more capital, if it cannot be deployed productively, becomes a drag on profitability. So What is Solvency II?For many years, rules in the insurance industry lagged those in banking. A Europe-wide regime was rolled out in the 1970s, but like the earliest iterations of bank capital regulation, it was not particularly risk-sensitive. Property & casualty insurers had to hold capital equivalent to a fixed percentage of premiums and life companies a fixed percentage of liabilities – neither of which reflected the risk of the underlying business. Although not ideal, there was little urgency for reform, particularly compared with the banking sector which posed a greater systemic risk to the broader financial system. But in the early 2000s, a number of insurance company failures prompted a rethink. In Japan, life insurers had promised policyholders high guaranteed returns predicated on high government bond yields and buoyant equity markets that had prevailed in prior years. Facing lower interest rates and negative returns on equity and real estate, insurers struggled to meet those returns. As concerns grew, customers began surrendering policies, exacerbating the problem as insurers were forced to sell illiquid assets at distressed prices. Between 1997 and 2001, seven of the 18 traditional private domestic life insurers in Japan went bankrupt or entered rehabilitation. European insurers were not immune to a similar fate. Mannheimer Life in Germany failed and in the UK, Equitable Life, the country’s fourth largest life insurer, came close to collapse. The UK government was called on to pay out more than £200 million in compensation to policyholders. While Equitable Life’s problems didn’t stem solely from weak capital, solvency issues certainly contributed and the government embarked on an overhaul of the rules. In 2004, UK authorities introduced a new regime for insurers called Individual Capital Adequacy Standards (ICAS). Insurance companies were expected to assess capital requirements appropriate to their business mix using stress tests and other models, which regulators would validate. Companies were required to hold sufficient capital to absorb anything up to a one-in-two-hundred year event. At the same time, regulators in Europe began working on something similar. Drawing on many of the principles behind ICAS, they had the additional objective of harmonising standards across the region to create a level playing field for insurers. After 15 years of development, a new regime was finally introduced at the beginning of 2016 – Solvency II. As in later iterations of banking regulation, Solvency II was a lot more complex than anything that preceded it. The rules ran over 3,200 pages. Like at the banks, it also led to an uplift in capital. While UK regulators have noted that the difference in capital versus the old ICAS regime was only £1 billion out of £126 billion, individual insurers have pointed to higher inflation. Legal & General claimed that under Solvency II, a £100 lump-sum of premium handed to it by a customer to purchase an annuity attracts a £27 capital charge, compared with an £8 charge under ICAS and a £4 charge under the original “Solvency I” regime. Unlike for banks, authorities do seem to be listening. Embedded within the EU Directive that formalised Solvency II is a requirement for the European Commission to carry out a periodic review of the rules. The latest review promises to release €90 billion of capital across the industry in the short-term. However, now that the UK is no longer bound by European rules, it can go it alone. “Following Brexit we have a once-in-a-generation opportunity to reshape insurance regulation to work better for the UK,” said Sam Woods, Deputy Governor for Prudential Regulation at the Bank of England, in a speech earlier in the summer. It’s a message that comes straight from the top, one that Liz Truss clearly supports. The UK regulator has already proposed a 60-70% cut to the “risk margin” carried by long-term life insurers – the buffer Solvency II requires them to hold to cover non-hedgeable risks. Life insurers currently carry a risk margin of over £32 billion so such a cut would release around £20 billion in capital. A smaller 30% cut for non-life insurers would release a further £2 billion. Such cuts would clearly be beneficial to insurance companies and their shareholders (and make Jamie Dimon envious) but how would they help investment in towns like Stoke-on-Trent? Well, there’s more… Mark to MarketA recurring debate within the financial services industry is how best to reflect the value of assets and liabilities on a balance sheet. In the 1980s, the convention was to use historic cost accounting. Loans would simply be marked at their original cost, whatever happened to market rates in the interim, even though a loan paying a fixed 5% is worth a lot less when rates shoot up to 10%. Following the savings and loan crisis, this model came under scrutiny. Rising rates in the late 1970s and early 1980s reduced the value of fixed-rate mortgage assets on savings and loan institutions’ balance sheets, rendering many economically insolvent. But because there was no requirement to mark these loans to market, underlying losses were obscured, showing up only gradually through negative net interest income. Many savings and loans companies ultimately failed, but had problems been detected earlier via mark-to-market accounting, the situation may have been able to have been addressed at a lower fiscal cost. At the same time, deregulation of interest rates caused a change in the strategies of financial institutions and they traded securities positions more actively. Many financial institutions developed dynamic risk management strategies that enabled them to sell investments before maturity. To reflect this changing backdrop, accounting bodies introduced standards allowing financial companies to mark-to-market their assets. Some companies went too far. A big proponent of mark-to-market accounting was Enron. It’s a “lay-my-body-across-the tracks issue,” said Jeff Skilling when he joined the company. In May 1991, he convinced Enron’s audit committee to approve the use of mark-to-market accounting in his new Finance division and when the Securities and Exchange Commission rubber-stamped the change a few months later, he cracked open a bottle of champagne. Skilling famously went on to abuse the accounting method, using it to value assets that didn’t have a real market value and to book profits up front, overstating the growth of his business. Mark-to-market also came under the spotlight during the financial crisis. While it enabled some firms (e.g. Goldman Sachs) to get ahead of the curve, it put pressure on others who were forced to take mark-to-market losses through their capital base regardless of their intention to hold the assets to maturity. Forced selling led to further losses which exacerbated the issue. AIG is a case in point. Back in 2008, company executives argued that they were prepared to hold some of their most toxic mortgage assets through to the end, and that collapsing market prices were discounting too high an expectation of default. The market and then the authorities didn’t give them time to find out. The Federal Reserve Bank of New York lifted $100 billion of the worst securities from AIG’s balance sheet at a 51% discount to face value and injected them into two special vehicles, Maiden Lane II and Maiden Lane III. AIG executives weren’t quite right – these assets were far from money good – but they didn’t turn out as bad as the market was discounting at the time. Both Maiden Lane vehicles were ultimately liquidated for a total gain of $9.5 billion. Six years later, actual write-downs amounted to 5.1% in the Maiden Lane II portfolio and 12.0% in the Maiden Lane III portfolio. Despite its drawbacks, the premise of mark-to-market accounting is now firmly established. Solvency II embeds “market consistency” in the pricing of assets and liabilities as a key feature. But to get round the issue of long holding periods, there is a workaround. It’s one UK insurance companies lobbied heavily for. Recognising that many insurance companies have capacity to buy and hold assets for a long period of time, Solvency II has a provision which parses the price of an asset into two components. There’s the “fundamental spread” which reflects the vagaries of the market – expectations around default, downgrade and so on. And there’s another piece, called the “matching adjustment” which reflects the rest, typically a premium which, for illiquid assets, can be quite large. Under Solvency II, insurers can take all the benefit of the matching adjustment up front into capital. The idea is to neutralise any short-term volatility in spreads. Comparison of Matching Adjustment (MA) and Fundamental Spread (FS) for different asset classes as at Dec 2020The mechanism worked well when markets sold off sharply at the outset of the pandemic in March 2020. Insurance balance sheets were largely unaffected by this period of market stress. But there are concerns that insurers are leaning on the matching adjustment too much, particularly given the discretionary element to its calculation. Total assets in portfolios subject to matching adjustments are currently around £380 billion in the UK, conferring a capital benefit of around £80 billion. Relative to total capital of around £112 billion in the UK life insurance industry, that’s a pretty large number. And it’s grown from around £60 billion when the Solvency II regime was introduced, as insurers have ratched up exposure to illiquid assets from 20% in 2018 to 40% in 2021. That’s perhaps unsurprising – financial companies are never slow to exploit cracks in regulatory rules. The situation has sparked a three-way stand-off between the government, the regulator and the industry. The regulator is concerned the rules are being abused and wants to tighten them up. It argues that the system as currently set up provides too strong an incentive for insurers to hunt out assets which happen to have a high return relative to their credit rating – often a recipe for disaster further down the line. The Bank of England proposes a lower matching adjustment benefit which will offset much of the capital released from the cut to the “risk margin”. Its Deputy Governor for Prudential Regulation, Sam Woods, reckons that on a net basis, capital released would be 10-15% of the current capital held by life insurers. The industry takes a different view. It doesn’t buy the 10-15% estimate and suggests life insurance firms would have to hold more capital than currently required under new matching adjustment allowances. The industry body, ABI, makes a direct appeal to the government, arguing that proposed changes would prevent insurers from being able to provide the funds that are needed for investment across the UK. “The attractiveness of America is going up a bit and the UK has gone down a bit,” said Nigel Wilson, CEO of Legal & General on a recent earnings call. “And we’re hoping one of the things that the new prime minister does is indeed reverse that to give us more opportunities to invest here in the UK.” Which brings us to the government. The current UK government is very keen to foster investment in infrastructure, but infrastructure is a tricky asset class to finance – it is long-term and illiquid in nature. The insurance industry brings a ready pool of long-term capital to the table. UK life insurance companies currently manage around £1.5 trillion of long-term savings, equivalent to around 70% of GDP. If this can be unlocked, the sunlit uplands beckon. The only thing standing in the government’s way is Solvency II. Provide the right incentives and the industry will go where the money is; the challenge is how to convince the regulator. You’re on the free list for Net Interest. For the full experience, become a paying subscriber. |

Older messages

The Case for UK Banks

Friday, September 16, 2022

Plus: Independent Equity Research, Banker Bonuses, Coronavirus Fraud

The Biggest Corporate Turnaround in History

Friday, September 9, 2022

Plus: Ambac, Fortress Investment Group, The Queen

Government Sponsorship and the Student Loan Crisis

Friday, September 2, 2022

Plus: Shaking It Up

Deglobalised Banking

Monday, August 22, 2022

Plus: Irish Banks, Big Tech Regulation, Stablecoins

Family Fortunes

Friday, August 12, 2022

The Origins and Growth of the Family Office

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏