Earnings+More - Sep 26: Allwyn calls SPAC halt

Sep 26: Allwyn calls SPAC haltAllwyn opts out of Cohn Robbins deal, the week in shares, iGaming NEXT preview, startup focus – Sparket +More

Good morning. On today’s agenda:

Allwyn pulls plug on SPAC deal

SPAC to the drawing board: Global lottery and gaming operator Allwyn pulled its planned merger with the Cohn Robbins SPAC citing “prolonged and increasing market volatility”. Despite what Allwyn said was “strong indications of support” and up to $700m of committed investment, the company said now was not the right time to go public.

Business case: Allwyn CEO Robert Chvatal said the feedback during the marketing period had demonstrated the “attractiveness of the business to the investment community”. In its recent Q2 earnings call, Allwyn trumpeted its success in boosting online and lottery revenues in its key markets of the Czech Republic, Austria and Greece. The week in stocks

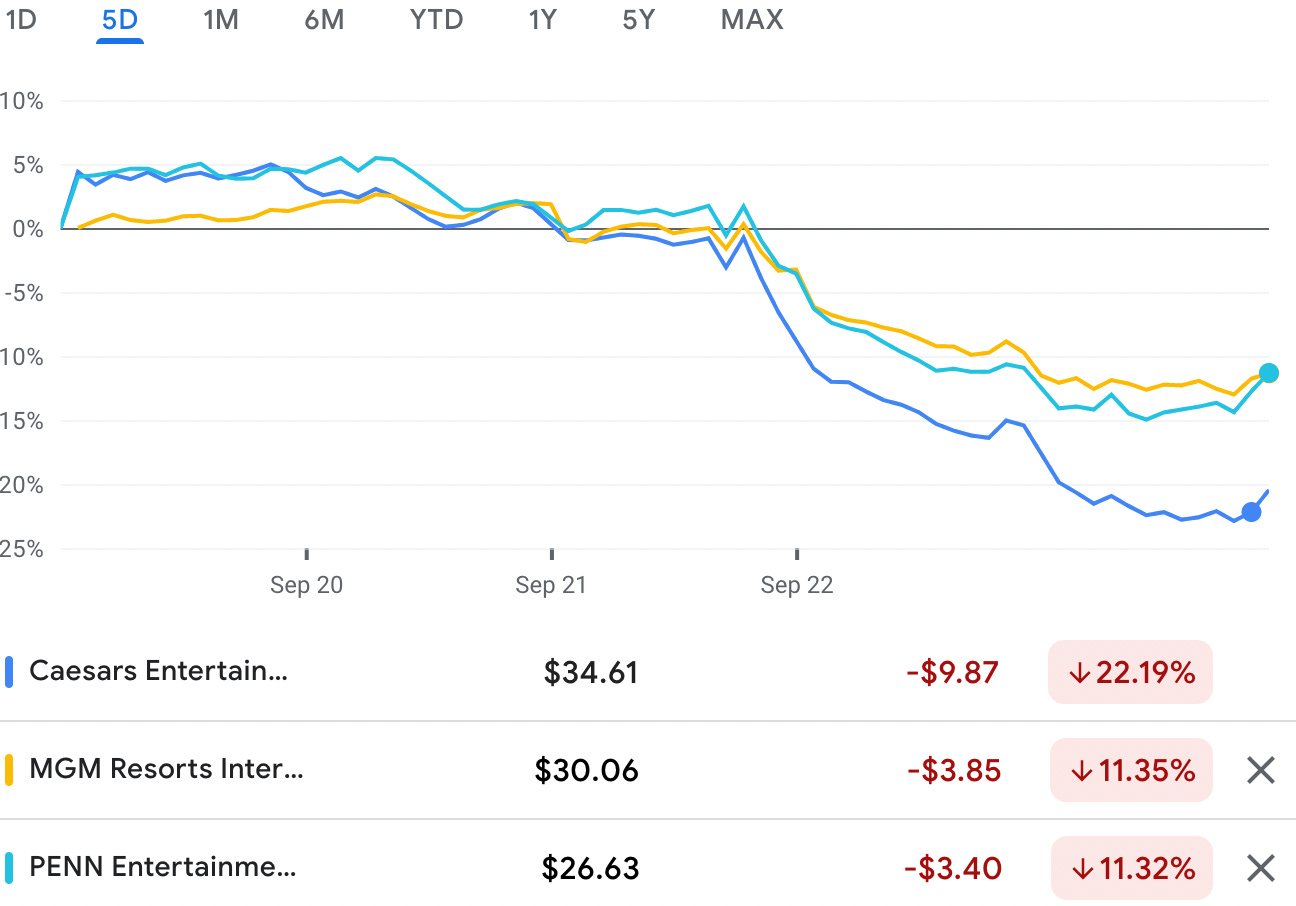

Chicken-licken: Investors “threw in the towel” last week as the sentiment judged that a hard landing for the US economy was more likely following gloomy messaging from the Fed after it raised rates by 0.75%. Leading the way was Caesars Entertainment with a 22% fall on the week, while rivals MGM Resorts and Penn Entertainment were each down over 11%.

😱Gaming sector giants cut down to size Capitulation: Notably, Caesars has fared badly against the S&P 500, which is down 23% in the YTD; whereas Caesars is off by over 62% with most of the underperformance in the past three months. 🚨Caesars vs. the S&P 500 - no contest Also in the firing line were DraftKings and Rush Street Interactive, which were down over 18% and nearly 20% respectively last week, as investors once again soured on online.

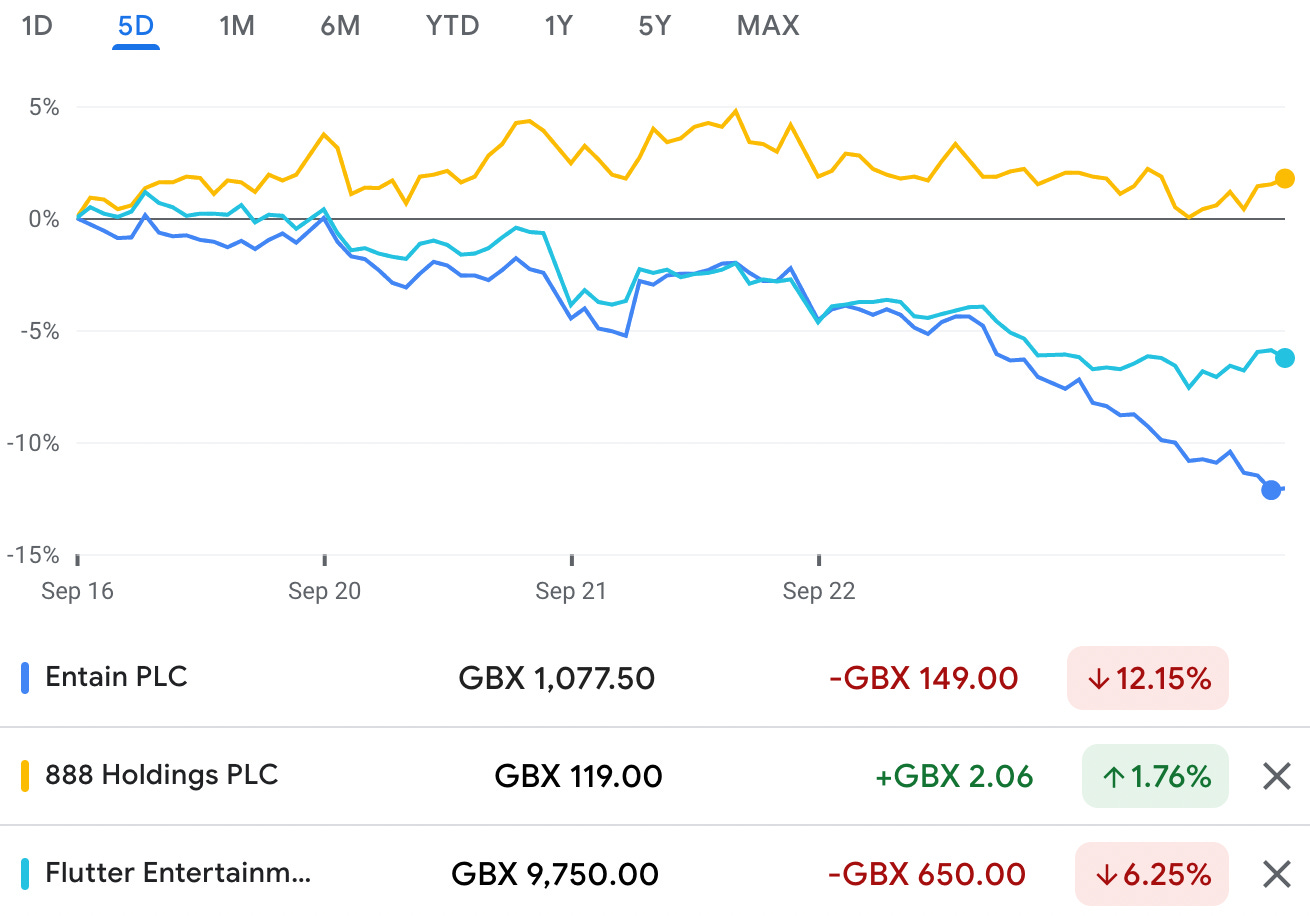

🛟 DraftKings and Rush Street investors seeking lifeline KamiKwasiBritannia unhinged: The UK’s leading listing gaming operators suffered along with the rest of the market as the new Tory Chancellor Kwasi Kwarteng unveiled his mini-budget and promptly sent the markets into a tailspin.

Selling England by the pound: The cratering pound could make UK assets look very cheap indeed when compared with dollar values for excess cash and equity. 💷 UK-listed Entain, Flutter and 888 take divergent paths during last week’s sell-off Bucking the trend: Macau’s decision to reopen to tour groups from mainland China from November sent casino stocks surging last week, Bloomberg reports, with the region’s six casinos gaining more than 10%. Over the weekend, the authorities also said they would reinstate both package tours to Macau and eVisas under the Individual Visit Scheme (IVS). **Sponsor's message: Spotlight Sports Group is a leading technology, content and media business specialising in sports betting. Working with the largest media companies in the world, including AS.com and Advance Local, Spotlight Sports Group, offer fully managed solutions that allow publishers to maximize revenue across their highly valuable sports betting audiences. For more information visit: spotlightsportsgroup.com OSB analyst update

Seesaw: Looking at the promotional spend tracker data, the WF team said operators have been spending more on new customer acquisition during the first weeks of the NFL regular season. In the week ending this past Sunday, the average promo for new customers weighted by market share was up 43% .

Losing bet: They noted that DraftKings’ promotion of awarding a win to a money line bet on NFL teams that went up between 7 and 10 points during a game was a popular promotion. But the company reportedly took a large loss after numerous come-from-behind wins. iGaming NEXT preview

Ball gazing: Tim Heath is joined by Robin Eirik Read, CEO of Happyhour.io and formerly co-founder of GiG, and Thomas Haushalter, chief product officer at Evolution, as the keynote panel discusses where they think the industry is headed.

Off the agenda: More prosaic concerns will be top of mind when Lindwall takes to the stage for another fireside chat, though, going by past appearances at such events, don’t expect too much to be said about Betsson’s ongoing regulatory struggles in the Netherlands and Norway or indeed its exposure (albeit via a B2B deal) to Turkey. Panel highlights

When we’re speakingGood timing: Whoever determined the agenda for Valletta can be commended for prescience with the panel being chaired by E+M’s Scott Longley discussing whether, for affiliates, streamers have too much control.

MGM fireside chat

Choices: Speaking at the Deutsche Bank leveraged finance conference last week, CFO Johnathan Halkyard said MGM has “long held the ambition” to translate its Las Vegas casino brands into the digital space.

Group think: In Las Vegas, he noted that group and convention business was now coming back strongly and, with visibility into next year, gave the company great confidence despite what would appear to be worsening macro prospects.

Analysts in briefIGT: A phrase we are likely to hear a lot more of in the months to come is macro-resilience and this is something the analysts at Truist believe IGT has in abundance. With “healthy operating trends across the segments”, Truist said it was “comfortable” with IGT’s FY22 revenue guidance of $4.1bn-$4.2bn and $1.55bn-$1.65bn of adj. EBITDA.

UK analyst update: Regulus Partners noted monthly data from the UK Gambling Commission shows Entain, Flutter and 888-William Hill are down c15% YoY and OSB -26% having “taken a tough, proactive stance on affordability”. But with these measures now being lapped, OSB is entering a period of easy comps that should see an increase in betting GGY from current levels. Startup focus – SparketWho, what, where and when: Co-founders Aaron Basch and Evan Fisher came to the betting space with fintech backgrounds and with the idea of creating a B2B hub for providing additional F2P and real-money betting content. Funding backgrounder: Basch said the company has raised $825k to date from friends, family and a handful of angel investors. News on a funding round is imminent. The pitch: Basch said the ability to easily bring on new content will help the industry capture new and current underserved audiences. “Our self-setting odds platform allows any type of new wagering event particularly outside of traditional sports to be offered to users,” he said.

What will success look like? Near-term, Basch said Sparket will soon be integrating new bet types and enabling the acquisition of new users from outside of the traditional sports leagues. He noted that Sparket has been pre-revenue until now but will have brought in $100k by the end of the year.

DatalinesDC Aug22: Sports betting handle was up 15.9% to $13.1m and GGR was up 20% YoY to $1.8m. Caesars Sportsbook was once again market leader on $683.3K of GGR and handle of $5.7m. NewslinesPointsBet has received authorisation from the Louisiana Gaming Control Board and launched operations in the state, the company’s 12th in the US. The Swedish regulator said it will continue to work towards opening its application process for B2B supplier licenses in Mar23 despite the bill not having passed the legislature and a new government taking power. Malta-based Rootz has received a license to operate slots in Germany. What we’re readingPaul McCartney’s freakish memory On socialCalendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

Sep 23: Weekend Edition #65

Friday, September 23, 2022

Playtech H1 call, PlayUp SPAC merger, SBC Summit Day 2, analysts in brief, Twitch slots ban +More

Sep 22: Segev – betting only a piece of DAZN puzzle

Thursday, September 22, 2022

SBC Summit Day 1, Playtech H1, US gaming analyst update, California Prop. spend, Inspired analyst update +More

Sep 20: German regulator’s 100% channelization goal

Tuesday, September 20, 2022

Gaming in Germany Day 1, SBC Summit Barcelona preview, California tribal gaming analysis +More

Sep 19: Esports Entertainment hits rights issue button

Monday, September 19, 2022

The week in shares – Esports Entertainment, Wynn New York, Startup focus – StatsDrone, New Jersey – August +More

Sep 16: Weekend Edition #64

Friday, September 16, 2022

Kindred, US betting survey, US market entrants, Allwyn Q2 call, sector watch – crypto +More Thought bubble A history lesson: In its response to the news this week that Australian financial crime

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏