The Signal - EV financiers get a helmet

EV financiers get a helmetAlso in today’s edition: Mutual funds give Adani shares the snub; How Wipro spotted moonlighters; China economy heads south; Netflix’s Finland play

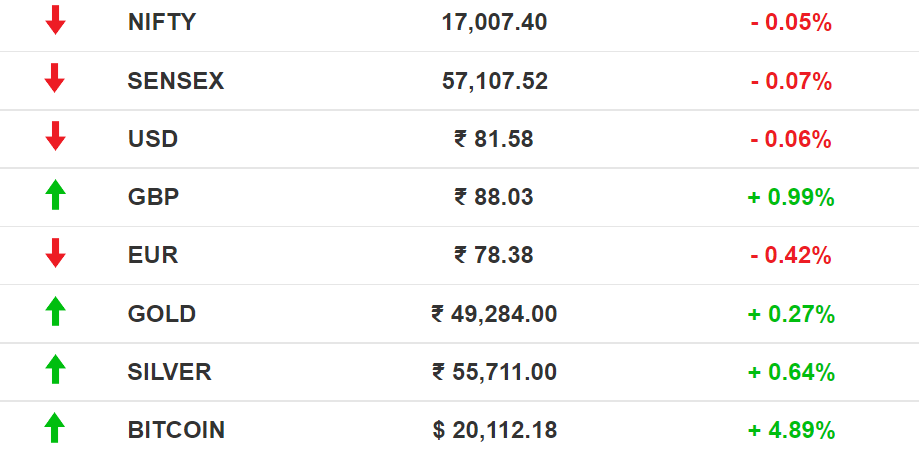

Good morning! One of the world’s newest and longest flights is facing headwinds. No, literally. Air New Zealand’s inaugural 17.5-hour non-stop Auckland-New York service is slowing down because strong winds buffet it in North America, reports Bloomberg. The airline has to dump luggage and offload passengers to carry more fuel. What was meant to be a flight of revival for New Zealand tourism is now a drain on the state-owned carrier. 🎧 Will NavIC share space with GPS in newly launched handsets? The International Telecommunications Union will pick a new head this week. This high-stakes election may just decide the future of the internet. The Signal Daily is available on Spotify, Apple Podcasts, Amazon Music, and Google Podcasts, or wherever you listen to your podcasts. If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram. The Market Signal*Stocks: A dozen out of 41 big-ticket IPOs have made investors poorer after they crashed 50%-65% from their all-time highs. Indian billionaire Gautam Adani is no longer the world's second richest person, after losing approximately $7 billion in the market rout. Early Asia: The SGX Nifty sunk -0.89% from its previous close at 7.30 am India time. The Hang Seng Index (-1.82%) and Nikkei 225 (-1.26%) were also down. INVESTINGMutual Funds Cool To Red-Hot Adani SharesMultibaggers are a fund manager’s dream but most of them are missing out on the Adani Group’s Midas touch. Diversified mutual funds’ exposure to the group was a meagre 0.76% of the group market cap, a Mint analysis showed. Minting money: Founder Gautam Adani’s wealth grew 1,440% in five years on the back of his companies’ market capitalisation. Even the shares of Ambuja Cements and ACC he purchased from Holcim for $6.5 billion in May were worth $13.5 billion by the time he pledged them last week. Scared stiff: Yet, fund managers have largely stayed away from Adani companies that would have earned them 18-46 times returns. More money will likely flow into these stocks now that they are included in indices, but the likely reason for fund managers’ disinterest could be the high levels of debt and sky-high valuations. WORKHow Wipro Stumbled Upon MoonlightingWhen Wipro chairman Rishad Premji fired 300 staff for moonlighting for rivals, it sparked off a controversy that is still raging. Accidental discovery: How did Wipro find out its employees were secretly working for rivals? Here is an interesting tidbit hidden in an article by Founding Fuel. When Wipro bought IT consultancy Appirio in 2016 for $500 million, TopCoder, a marketplace with nearly 1.5 million freelance engineers, data scientists and designers, came with it. Founding Fuel quotes insiders as saying that the company discovered a few hundred of its own employees listed on TopCoder with Wipro email IDs. Yet, it kept quiet all these years. Although platforms such as TopCoder are said to aggregate gig workers and freelancers, can that be foolproof? Wipro might have managed to throw out its own staff but there could be others employed elsewhere who are moonlighting on TopCoder. AUTOEV Financing Gets A CushionFinancing two- and three-wheeler electric vehicles (EVs) is set to become less risky and, hopefully, cheaper. The Indian government, along with the World Bank and Small Industries Development Bank of India (SIDBI), is planning to roll out a $1 billion fund to hedge bank loans given out for EV purchases. What’s more: A $300 million corpus will be set up initially to shield financial institutions in case of loan defaults. This is also expected to knock down the cost of financing EVs by 10%-12%. Erstwhile: NITI Aayog, the Indian government’s public policy think tank that’s facilitating the project, was in talks with the World Bank to introduce a similar hedging mechanism in 2021. But the slated programme lead, State Bank of India, shied away from it.

CHINAChina Lags BehindFor the first time in over 30 years, China’s economic growth is slower than the rest of Asia. China’s zero-Covid policies and the fall of the housing market has led the World Bank to forecast a GDP growth of just 2.8% in 2022, compared with 5.3% for the rest of the region. Tell me more: Europe is feeling it too. Germany’s economy is deeply entrenched in the Asian country. Biggie carmakers such as Volkswagen, BMW, and Mercedes, along with other industrial giants, have invested heavily. Germany’s sustained economic growth for nearly a decade and half relied on Russian energy and Chinese manufacturing. Fixing initiative: China is also taking the Belt and Road Initiative back to the drawing board after spending about $1 trillion in loans and being accused of “debt-trap diplomacy”. TECHNetflix Is Praying To SantaThe streaming giant is doubling down on video games. It's building a gaming studio from scratch in Helsinki, Finland, to be led by former Zynga and Electronic Arts exec Marko Lastikka. But why? Netflix made its ambitions clear when it bought Night School Studio, Boss Fight Entertainment, and Next Games since November 2021. It also joined forces with Ubisoft to create three exclusive mobile games, including Assassin’s Creed. Yet, only 1% of Netflix’s subscribers are playing its games. For a company under shareholders’ glare for poor growth this year, it is prudent to build quietly rather than splurge on acquisitions. But why Finland? Because Santa lives there and Netflix is hoping for manna from heaven. Just kidding. Finland is to mobile gaming what Silicon Valley is to tech—-home to legends such as Angry Birds maker Rovio and Clash of Clans developer Supercell, as well as the OG of mobile games, Snake creator Nokia. FYIKickstart: Swedish defence products company Saab will set up its first manufacturing facility in India to produce the Carl Gustaf M4 weapons system. In the queue: Jet Airways 2.0 won't make an appearance on the tarmac any time soon. Investors are having second thoughts about taking on fresh liabilities. New venture: Reliance has opened the first store of its new fashion and lifestyle chain, Reliance Centro, in New Delhi’s Vasant Kunj. It will replace Future Group’s Central. In the bag: Payment services provider Razorpay has snapped up loyalty and rewards management platform PoshVine, making it its fourth acquisition this year. Shut down: Meta removed a network of China-operated fake accounts that were being used to influence the US elections. Game plan: Gautam Adani, through his Adani Group, has plans to invest more than $100 billion in the next 10 years, and 70% of it will go towards energy transition. Pay up: Oracle has been slapped a fine worth $23 million to settle foreign bribery charges. According to the US SEC, the organisation created slush funds to bribe officials in India, Turkey, and the UAE between 2014 to 2019. FWIWCultural isolation: Russia is boycotting the Oscars for the first time since the fall of the Soviet Union. The decision by Russia’s film academy was swiftly followed by the resignation of Pavel Chukhray, the chairman of the country’s Oscar nomination commission. He said that the boycott was an “illegal” decision taken “behind his back”. Russia has won the award for best international feature film only once — in 1994 for Burnt by the Sun. Off the menu: Darjeeling’s iconic eatery Glenary’s, which is over 100 years old, has stopped selling…wait for it…Darjeeling tea. Why? Because it’s protesting against Darjeeling tea-planters' unwillingness to pay annual bonuses to workers all at once. The West Bengal state government had earlier asked Darjeeling tea producers to split the 20% bonus into two payments. Comfortable warmth: China's electric blankets have proved to be a ray of hope for Europeans looking to save costs. These cost less than a third of some models of heaters. Outcome: shares of Chengdu Rainbow Appliance are surging. Enjoy The Signal? Consider forwarding it to a friend, colleague, classmate or whoever you think might be interested. They can sign up here. We recently got funded. For a full list of our investors, click here. Want to advertise with us? We’d love to hear from you. Write to us here for feedback on The Signal. If you liked this post from The Signal, why not share it? |

Older messages

Flushing out Gameskraft

Tuesday, September 27, 2022

Also in today's edition: Toyota bends to investor wishes; Bloodbath in global markets; Consumers light up ecommerce; Apple's fintech is glitching

Tata recasting steel

Monday, September 26, 2022

Also in today's edition: LinkedIn: Acquaintances better than friends; Not productive if manager can't see staff; Temple treasure; Xi's October

How do you fix India's electric dreams, anyway?

Saturday, September 24, 2022

Adoption of EVs is constrained by the lack of an after-sales service network

Double-Job trouble

Friday, September 23, 2022

Also in today's edition: Biscuit brand power; Crypto, PEs take the rap; US banks to follow government order on China; Reliance Retail presses on

Google’s choice

Thursday, September 22, 2022

Also in today's edition: Spotify's Audible ambitions; Facebook tries democracy; Luxury beats inflation; It's YouTube vs TikTok

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏