Earnings+More - Sep 30: Weekend Edition #66

Sep 30: Weekend Edition #66Scandi analyst initiation, XL Media H1, Aristocrat/Roxor, XPoint fundraise, Macau analyst update, Nevada data +More

Thought bubble Bored with selling Gamesys for the umpteenth time, ex-founder Noel Hayden appears to have embarked upon a tidying up process with his other interests in the betting and gaming space. In early September, his LiveScore business saw a major investment from the Switzerland-based media group Ringier while this week he sold Roxor Gaming to Aristocrat. At the risk of over-interpreting, it appears that one of the European industry’s most significant founders is cashing in at least some of his chips. That feels significant. Scandi analyst update

Cheap at the price: Looking at the prospects for the biggest names in the Scandinavian listed arena, the team at Jefferies suggests the two B2B providers Evolution and Kambi are underpriced versus the potential for the live casino and OSB opportunities.

EvolutionLive forever: Jefferies points to live casino as being the fastest-growing segment in gambling right now and suggests Evolution’s leadership position in providing a “differentiated, complex product delivered at scale” means it is in the “sweet spot” of the gambling sector.

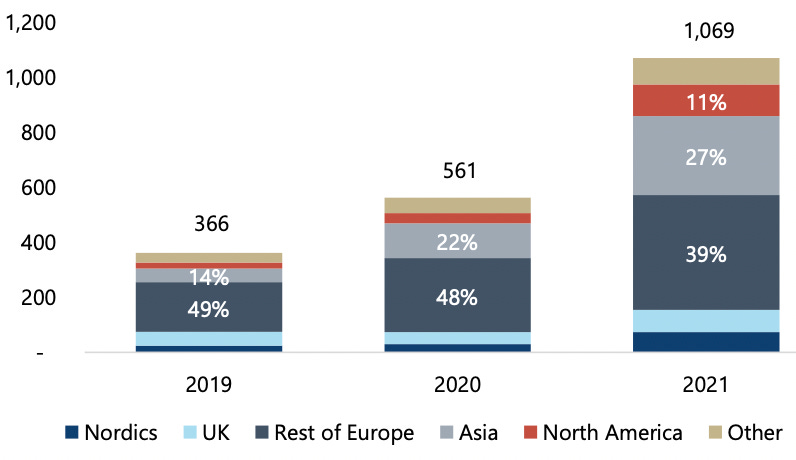

💶Evolution’s revenues by geography 2019-2021 Sou Source: Jefferies KambiScarcity value: Jefferies says Kambi’s prospects should be helped by positive regulatory changes in the US, where it currently holds a 20% share. It adds that following the loss of the DraftKings contract, “material” new contracts have endorsed the proof of concept while earnings are progressing from existing licensees. Crucial to Kambi’s prospects, of course, is new jurisdictional licensing and Jefferies argues it is well-placed to benefit from an easier rollout of OSB compared to iCasino.

KindredDubbele problemen: Jefferies points out that Kindred’s Netherlands troubles occurred at a particularly inopportune time given it was already facing tough comparatives from trading in the pandemic period.

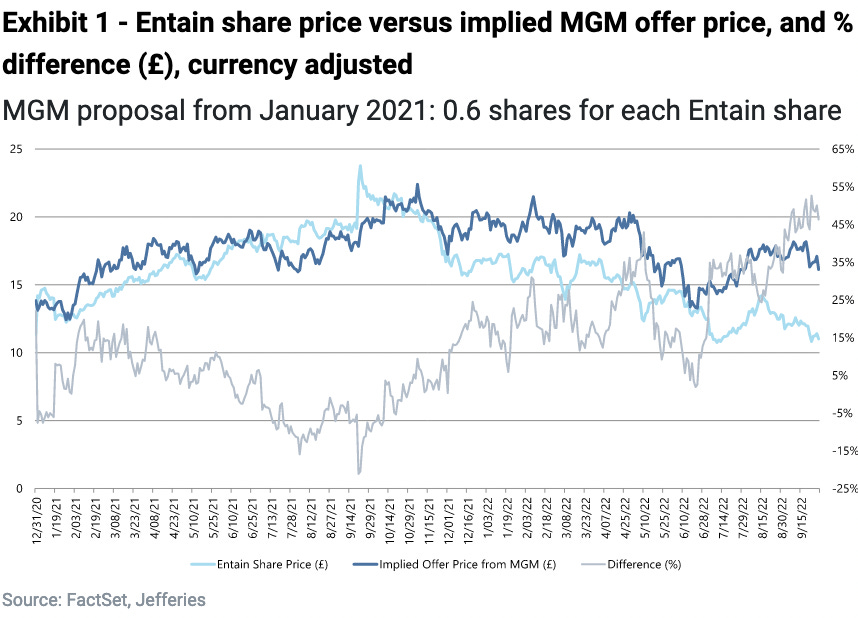

EntainOn the cheap: In a separate note, the Jefferies team have also revisited their Entain thesis and suggests the company has never been cheaper for potential acquirer MGM. The team notes that MGM’s original offer, adjusting for recent currency moves, is now worth ~£16.34.

🎯Entain’s share price vs. the implied MGM offer price (ADD DIVIDER) ** SPONSOR’S MESSAGE** GiG is a leading gaming platform and sportsbook provider for online and land-based operators with digital aspirations. We deliver a full end-to-end solution through our award-winning iGaming and sportsbook solutions. Built for regulated markets and a top-class customer experience, GiG is pioneering the multi-platform era. If you are looking to expand your operations into new, profitable markets, our strategy is the solution. Find out more at sales@gig.com. Aristocrat/Roxor Gaming

Get your rox off: The deal for Roxor marks Aristocrat’s latest attempt to establish a foothold in the iCasino space after the much bigger aborted $2.8bn takeover of Playtech in February. Roxor was formed in 2019, originally as an in-house developer for Gamesys where Hayden was the majority shareholder.

By the numbers: Companies House filings show Roxor Gaming’s turnover nearly doubled to £8.2m in 2021 while operating losses were trimmed by 18% to £17.8m. Roxor games are currently live in New Jersey as well as in the UK. Streaming M&A

Here come the Belgians: The deal to buy Eleven augments DAZN’s soccer proposition with the rights to the top leagues in Portugal and Belgium, as well as a presence in the markets of Taiwan and southeast Asia, and adds 40,00 games a year to DAZN’s existing soccer portfolio.

XPoint fundraise

On point: The new investors join Courtside Ventures, the Raine Group and Suro Capital Sports as the company seeks cash to help drive its expansion in North America. XPoint Verify, its real-money gambling product, is now live in New Jersey and Ontario while its XPoint Lite offering, aimed at DFS operators, is live across the US.

Macau analyst update

Let the good times roll: Prospects for a reopened Macau have been rekindled this week following the eVisa and group visitor news and it has led to the team at Wells Fargo dusting down their Macau recovery scenarios.

Note: The tourism office says it is expecting the number of visitors during Golden Week to reach up to 25,000 visitors per day. Earnings in briefXL Media: Revenues were up 38.2% to $44.5m, while adj. EBITDA rose 60.6% to $10.6m. Over the past year XL Media has shifted away from volume-led casino affiliation in non-regulated European markets to brand-led growth in regulated EU and US jurisdictions, with a focus on sports-betting. CEO David King said he expects the sites to return to growth in 2023, with the focus on “marquee sites” bearing fruit. STS: Half-year NGR was flat at PLN296m, with 81.6% coming from online and 18.4% from retail, while EBITDA fell 7.1% to PLN117m. In current trading, July and August NGR rose 32% to PLN103m with the return of European soccer. FL Entertainment: Group revenues for Betclic’s parent company increased 19% YoY to €1.8bn and +15.6% at constant currency rate, while adj. EBITDA was up 16% to €301m. Online sports-betting and gaming revenues were down 3% to €396.6m, while adj. EBITDA was down 4.6% to €103.2m due largely to Bet-at-home being down 16%. Revenues ex-Bet-at-home were up 4%. Event reviewsiGaming NEXT: Predictions for the future was a big theme in Valletta this week as during the opening panel Todd Haushalter, chief product officer at Evolution, put the questions about where the industry was heading to Tim Heath, founder at Yolo Group, and Robin Reed, ex-founder at GiG.

Heard on the floor: Simplebet has enjoyed a good month with the news on its deal for the global supply of micro-betting products to bet365 but, according to talk at the show, there is more news to come with another client in the US soon to be announced. We’re sworn to secrecy, but sources did say Simplebet isn’t resting on its laurels. East Coast Gaming Congress: Reporting back from the event, the analysts at Truist said there were “strikingly few” worries expressed over the macro picture, despite market turbulence and drops in lower-end customer spend levels

Analysts in brief888: “Catching up” with the newly merged 888/William Hill business, the team at Jefferies noted that high leverage (over 5x net debt/EBITDA) and rising interest rates remained a key concern. Reflecting the current environment, they have cut EBITDA estimates to £394m, noting this is below the £400m threshold that would trigger a £100m deferred payment to Caesars. GLP: In an initiation note, JMP said the gaming REIT had durable earnings backed by long-term leases and suggested that it could look to further M&A. GLP was recently involved in the sale of the Tropicana in Las Vegas to Bally’s Corporation, which completed this week. DatalinesNevada: With August Strip revenues up 5% YoY to $659.7m, the team at Macquarie suggested this supported the thesis of earnings beats for the third quarter. Total Nevada was up 3.5% to $1.21bn. Las Vegas visitation was up 6.4% to 3.2m.

On the download: Looking at the app data for week 3 of the NFL season, analysts at JMP showed that after a third consecutive week of growth the leaders keep piling on the downloads, with DraftKings leading the way, up 83% YoY on the season-to-date. Total downloads from operators representing 90% of the market were up 19% YoY to 287k.

Arizona Jul22: Sports-betting GGR was up 43% to $22m on a handle down 8.9% to $290.2m. FanDuel led by GGR with 41.3%, followed by BetMGM (25%) and DraftKings (14%) – this was despite DraftKings being just behind FanDuel by handle. Oregon Aug22: Sports-betting was up 127.4% at $2.3m, while VLT revenues were down 8.6% to $99.6m. NewslinesWarning shot: UK bookmaker Betfred has been fined £2.87m by the Gambling Commission for social responsibility and anti-money laundering failures. As a result of those failures it will receive an official warning from the regulator. Flutter’s Sisal has won the 10-year tender to supply its online sports-betting and gaming platform to Tunisia’s national operator Promosport. The UK group also opened a new FanDuel tech hub in Edinburgh. Rootz maneuver: The slots operator has received a license in Germany, the 15th license awarded. GAN’s B2B sports-betting technology and managed trading services GAN Sports debuted in the US, following the launch of GAN Sports with Island View Casino in Gulfport, Mississippi. What we’re writingSchrödinger's cat: The latest Pinchpoint went out earlier this week suggesting UK government policy on gambling has now reached the stage of quantum mechanics. What we’re readingNo country for old men: The Nevada Independent looks at the Fertitta past to understand the future of Red Rock. Where there’s a hit: BetMGM is sued in New Jersey over software glitches. On socialCalendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

Sep 26: Allwyn calls SPAC halt

Monday, September 26, 2022

Allwyn opts out of Cohn Robbins deal, the week in shares, iGaming NEXT preview, startup focus – Sparket +More

Sep 23: Weekend Edition #65

Friday, September 23, 2022

Playtech H1 call, PlayUp SPAC merger, SBC Summit Day 2, analysts in brief, Twitch slots ban +More

Sep 22: Segev – betting only a piece of DAZN puzzle

Thursday, September 22, 2022

SBC Summit Day 1, Playtech H1, US gaming analyst update, California Prop. spend, Inspired analyst update +More

Sep 20: German regulator’s 100% channelization goal

Tuesday, September 20, 2022

Gaming in Germany Day 1, SBC Summit Barcelona preview, California tribal gaming analysis +More

Sep 19: Esports Entertainment hits rights issue button

Monday, September 19, 2022

The week in shares – Esports Entertainment, Wynn New York, Startup focus – StatsDrone, New Jersey – August +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏