VC Monthly Report:Funding Overview in September

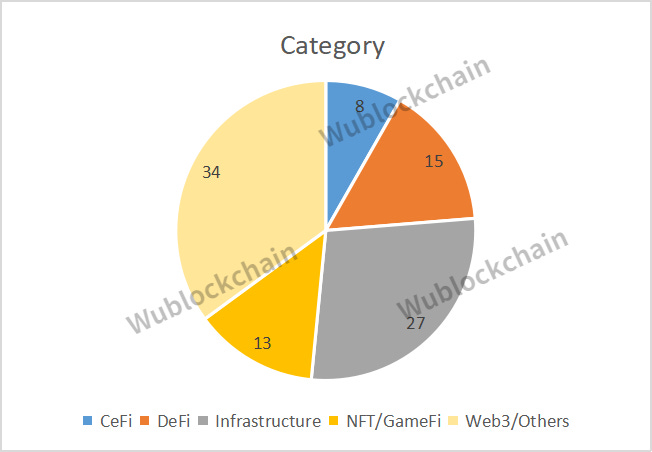

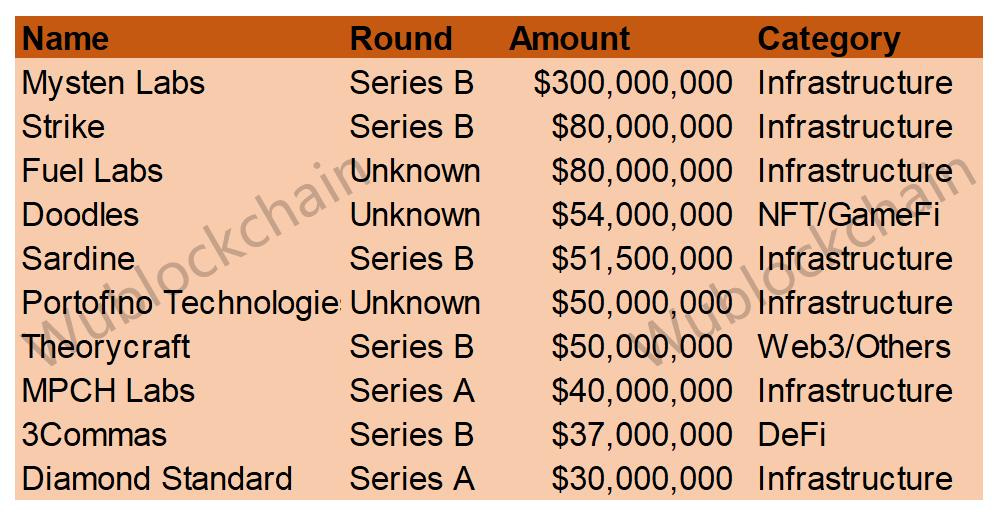

Author: Wublockchain Joey According to Messari, there were 97 public investments in crypto VCs this month, down 6.8% MoM (104 projects in August 2022) and down 23% YoY (126 projects in September 2021). The first category of the industry is as follows. The NFT/GameFi field saw a significant drop in funding amount this month, accounting for only 13.4%. The remaining, CeFi, DeFi and Infrastructure fields each accounted for approximately 8.2%, 15.4% and 27.8%. Total funding amount for the month was $1.57 billion, up 14.6% MoM ($1.37 billion in August 2022) and down 48.2% YoY ($3.03 billion in September 2021). The top 10 funding rounds (excluding CeFi) are as follows. Mysten Labs is the development team for Sui, currently valued at over $2 billion. The round was led by FTX, with other investors including a16z, Jump Crypto, Apollo, Binance Labs, Franklin Templeton, Coinbase Ventures, Circle Ventures, Lightspeed Venture Partners Sino Global, Dentsu Ventures, NGC Ventures, A&T Capital, Bixin Ventures, Greenoaks Capital, O'Leary Ventures, and others. Investors in this round will receive equity in Mysten, a portion of Sui's native token, which will begin trading at the time of Sui's public launch. Strike is a crypto wallet based on the Bitcoin Lightning Network. The funding round was led by Ten31, with other investors including Susquehanna, and will be used to build partnerships with major retailers such as Starbucks. Fuel Labs was the first Optimistic Rollup to be deployed on the ETH mainnet, primarily for payment-focused applications, and the current Fuel begins plans for a modular execution layer. This round was led by Blockchain Capital and Stratos Technologies, with participation from Alameda Research, CoinFund, Bain Capital Crypto, TRGC, Maven 11 Capital, Blockwall, Spartan, Dialectic and ZMT. Dialectic and ZMT, among others. Doodles has now launched Dynamic NFT, which allows users to change the appearance of the NFT to a full body frame or avatar at any time they want, and the NFT will be accompanied by animations and original music. The funding was raised with participation from Reddit co-founder Alexis Ohanian's 776, FTX Ventures and others. Doodles plans to use the proceeds from its capital inflow to increase its valuation to $704 million to expand in the music and gaming space. Sardine is a fraud detection platform that currently offers two products, an application programming interface (API) that companies can use to address fraud when opening an account or when money is flowing, and a payment platform that enables users to use bank transfers and bank cards to purchase cryptocurrencies and NFTs. The funding was raised with participation from Visa, ConsenSys, a16z and ING Venture, among others. Portofino Technologies, founded in April last year, is developing high-frequency trading technology for digital assets and claims to have traded billions of dollars on centralized and decentralized cryptocurrency exchanges as well as over-the-counter. The funding was raised with participation from Valar Ventures, Global Founders Capital and Coatue at an undisclosed valuation. Theorycraft is a game studio. The round was led by Makers Fund, with participation from NEA and a16z. Theorycraft Games says it will use the funding to accelerate development of its first game, Loki, and it is not yet clear whether Loki will introduce crypto mechanics. MPCH Labs is a multi-party computing technology studio that uses the MPC6 engine to create a toolkit for organizations to manage their crypto assets, wallets and workflows on a version-by-version basis. The funding was led by Liberty City Ventures, with participation from Animoca and others, and will be used for MPCH's first product called Fraction, which is expected to launch later this year. 3Commas, an automated crypto trading bot platform, was led by Alameda Research, Jump Capital, and others to fund a subsidiary called DeCommas that will focus on automatically access to the DeFi protocol. Diamond Standard is a startup focused on tokenizing diamonds and opening up the $1.2 trillion diamond market to investors. The $30 million investment, co-led by Left Lane Capital and Horizon Kinetics, will be used to expand capacity and accelerate distribution. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish If you liked this post from Wu Blockchain, why not share it? |

Older messages

Weekly Project Update:Cosmos launch native USDC, StarkWare Token launch delayed due to technical optimization and …

Saturday, October 1, 2022

Author:Mingyao Editor:Colin Wu 1. Cosmos will launch native USDC via Interchain-Atomic link On October 1st, according to Cosmos official Twitter, native USDC will be launched on Interchain using

WuBlockchain Weekly:Cosmos & Chainlink 2.0、Voyager Auction、VC Rank and Top10 News

Friday, September 30, 2022

Top10 News 1、Voyager Completes Successful Auction and Announces Agreement for FTX to Acquire Its Assets link Voyager ultimately selected FTX US as the highest and best bid for its assets, with a

Lawyer's point of view: Is POS's Ethereum a security?

Thursday, September 29, 2022

Author: Inal Tomaev From the moment of its creation, disputes regarding the nature of the ether could not be reduced to a single approach. These disputes will only increase given the recent transition

Why a Former Chinese Ethereum Community Leader Thinks POS Is a Lie and Joins Bitcoin Education Work

Wednesday, September 28, 2022

As almost everyone cheered the successful Ethereum merge, a 26000-word article was widely shared in the Chinese community. As one of the most famous leader of the Chinese Ethereum community, he bid

Opinion: Forecast Market Bottom Appear Time According to the Macro

Tuesday, September 27, 2022

Author: Wublockchain Joey Wu The crypto market, like the stock market, reflects people's expectations of the future economy. The crypto market had already started a downtrend when people are still

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%