Earnings+More - Welcome to Las Vegas

Welcome to Las VegasG2E preview, Kindred’s Norwegian defense, AGA CEO survey, Startup Focus – OrbitalBet +More

Good morning. On today’s agenda:

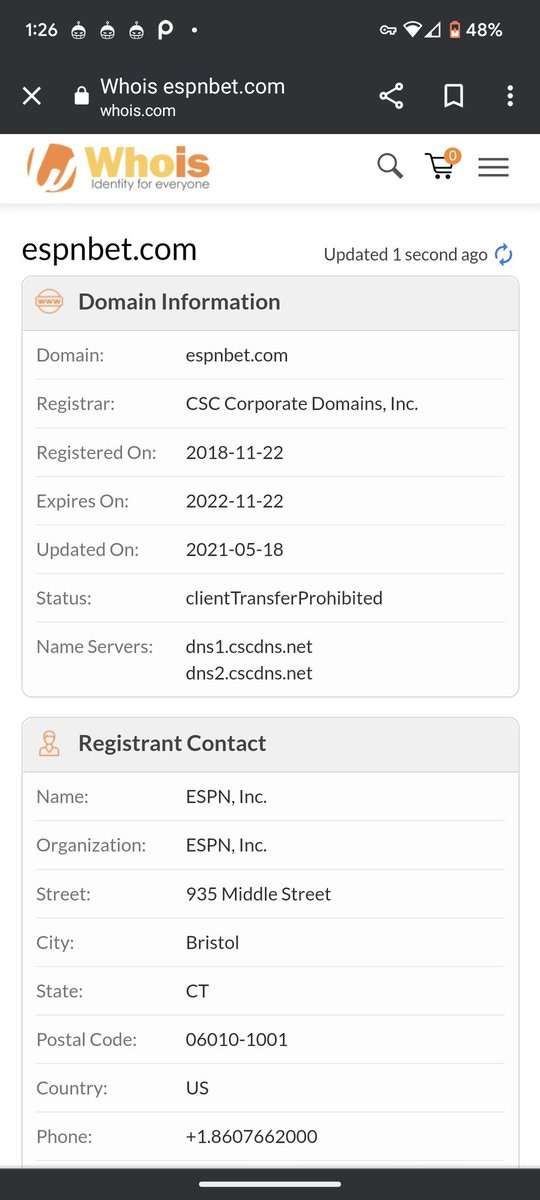

So you think you can tell heaven from hell. G2E previewA keynote triple header involving Amy Howe and Jason Robins discussing digital are among the highlights this coming week. Top of the bill: The keynotes on Tuesday feature a series of three double-headers taking place in the Venetian Ballroom, starting from 8.55am. Of particular note, Jason Robins from DraftKings will no doubt be avoiding questions about the rumors of a partnership with ESPN when he takes to the stage in the company of Amy Howe, CEO at rival FanDuel.

The best of the panels:

Analyst view: Jefferies said it is expecting a strong turnout this year, with discussion set to revolve around the buoyancy of the Strip and digital strategies at the likes of Wynn and Caesars.

E+M sponsors at G2E:

**Sponsor’s message** Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. The Gaming Fund, regulated by the Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy. Yolo Investments has just opened its fund to new investors as it looks to scale new cutting-edge concepts, including its exclusive high-roller land and live casino brand, Bombay Club, global banking network & OTC desk Aims Group. DKNG x ESPN on social 2/ I think this deal will also kick off a round of skin-tight integrations (BetMGM and Yahoo already working on this) between sportsbooks and adjacent properties. DraftKings will want as few clicks as possible between a betting opportunity on ESPN and the actual placing of a bet

Kindred’s Norwegian defenseOperator will “passively accept” Norwegian players while it appeals an Oslo district court ruling that it operates illegally in Norway. Passive aggressive: Kindred has said it will continue to “passively accept customers residing in Norway” and maintained that it can legally operate in the market through its Malta-licensed subsidiary Trannel offering gambling services in the EU/EEA area.

Daily appeal: Kindred’s Unibet, Maria Casino, Storspiller and Bingo.com brands all operate in Norway. The group has appealed against the daily fines and the court ruling, and said it “disagrees with the NGA’s statement”. The NGA said it had suspended the fines until Kindred’s appeal had been processed. For the suspension to be maintained Kindred must abide by the following conditions:

Best solution: In its statement, Kindred said a Norwegian licensing system “compliant with EU/EEA law” was the best solution and pointed to its actions in the Netherlands, where it “proactively decided to make changes to its international offer”.

American CEO surveyAGA study points to cautious optimism despite macroeconomic pressures. Caution ahead: Corporate leaders in the US gambling industry remain cautiously optimistic about the future of the sector although macroeconomic factors continue to dampen expectations, a survey carried out by the AGA and Fitch Ratings has found. Key findings from the survey revealed that:

Juice Reel dataSeptember data from Juice Reel illustrates the rise of parlays and underdog impact on margins. Bet count rise: The latest data from the bet tracking and analytics app Juice Reel revealed that although parlays have modestly decreased as a percentage of handle (18% in Sep21 vs. 16% in Sep22), they have “notably increased” as a percentage of bet count, going from 26% in Sep21 to 31% this year.

Startup focus – OrbitalBetWho, what, where and when: UK-based OrbitalBet was founded in 2021 by CEO Matt Howard who has spent the last decade helping numerous companies develop their B2B and B2C platforms. The company’s aim is to enable operators to utilize scalable, high-functioning tech via selling codebase IP. Funding backgrounder: OrbitalBet is self-financed with a two-year development plan and, according to Howard, it “intends to remain this way for as long as this is realistic”. The pitch: The company’s aim is to enable operators to utilize scalable, high-functioning tech via selling codebase IP to each operator, in turn allowing them to “truly own their development roadmap and to build a platform which supports and promotes their brand to their customers”.

What will success look like? Howard says the aim is to “genuinely be able to help the industry move forwards and to serve the customers better”.

Dabble fundraiseDabble: A recent startup focus subject Dabble has announced a A$33m (US$21m) investment from Tabcorp, which values the company at $165m. As part of the deal, Tabcorp will also appoint a director to the board of the Twitter-meets-Sportsbet business.

Further fundraisingsBetsala: The Chilean-facing betting operator has raised an undisclosed amount from Happyhour.io to accelerate growth. Betsala has been in operation since 2020 and is fronted by Chilean soccer star Marcelo Salas. Verse Gaming: The P2P fantasy sports provider has completed a $585k pre-seed funding round led by RallyCry Ventures. The Brooklyn-based Verse was founded in July 2020 by Syracuse University alums David Rosen and Dan Zimmermann. Lottery.com desertionSixes and sevens: The lottery.com implosion continues unabated. Despite the appointment of two new independent directors, the company saw its auditor Armanino throw in the towel late last week. This came after the auditor warned about the unreliability of Lottery.com’s account in late July.

Analysts in briefNew York: Delving into recent data from New York, the analysts at Roth Capital suggested the lower handle seen in the first three weeks of the NFL season is an indicator of less bonusing. They noted that daily average handle has been between 15-20% lower at the start of the NFL compared with handle levels in the first three months of 2022. Caesars: Jefferies suggested last week’s $3bn debt deal removes one overhang for Caesars, with the uncertainty over the impact of rate rises removed. It leaves just the potential sale of a Strip property as the remaining concern for investors. While they believed there are multiple interested parties, the valuation could be impacted by the less-supportive debt market. ** SPONSOR’S MESSAGE** GiG is a leading gaming platform and sportsbook provider for online and land-based operators with digital aspirations. We deliver a full end-to-end solution through our award-winning iGaming and sportsbook solutions. Built for regulated markets and a top-class customer experience, GiG is pioneering the multi-platform era. If you are looking to expand your operations into new, profitable markets, our strategy is the solution. Find out more at sales@gig.com. The week aheadTeam of rivals: On Wednesday, esports-focused bookmaker Rivalry will host an investor day. Then on Thursday, Q3 season kicks off with Entain publishing its quarterly trading update. DatalinesMacau: GGR in the third quarter was down 92% vs. 2019 and -70% YoY at MOP5.5bn due to casino closures in July. Sep22 was down 87% vs. 2019 and -50% YoY at MOP3bn. The Macquarie team said “demand remains hampered by strict travel restrictions”, but there was “light at the end of the tunnel” with the recent announcement that from next month China will reinstate package tours and eVisas under the Individual Visit Scheme (IVS).

Clarity: The 2023 outlook could get clearer following the Chinese Communist Party Congress on Oct 16, Macquarie added, with the medium term helped by Macau being a “coiled spring” with significant pent-up demand.

Iowa: Casino GGR in September was up 5% YoY at $146.7m. Sports-betting GGR was up 76.3% MoM and +128.3% YoY at $25.4m. Handle was up 63.4% MoM but down 7.4% YoY to $200.2m, the first time handle has declined YoY in Iowa, Deutsche Bank noted. Ohio: Casino GGR for the month rose 1.8% YoY to $188.6m. GGR at market leader Penn Entertainment’s properties was up 2.8% YoY to $64.4m. Illinois: GGR came in at $113.8m for the month of September, up 7.1% YoY overall and up 2.7% on a same-store basis. Compared to 2019, Illinois September GGR was up 2.0%. NewslinesBetting content provider and affiliate Tallysight has extended its partnership with Gannett Publishing and will offer its services across Gannett’s network of more than 200 local media outlets. Previous Startup Focus subject the Gaming Society has signed FanDuel as its first official sportsbook partner, sponsoring an NFL-focused newsletter. What we’re listening toHuddle Up: Why 14 Americans could break the Premier League. On socialEars burning.  The Mets Couldn't Score Off Joe Musgrove So They Had The Umpires Stop The Game And Rub His Ears To Make Sure He Wasn't Cheating barstoolsports.com/blog/3437827/t… Calendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

DKNG x ESPN? Weekend Edition #67

Friday, October 7, 2022

DraftKings/ESPN 'close in' on partnership, Catena Media update, 888Africa launches, California vote trouble +More

Pod #18

Thursday, October 6, 2022

Watch now (31 min) | You spin me right right, baby, right round.

The Startup Month

Tuesday, October 4, 2022

Quarterly fundraising review, default dead or alive, Startup (re)Focus – Sporttrade, latest transactions +More

Oct 3: Endeavor boosts its entourage

Monday, October 3, 2022

Endeavor completes OpenBet acquisition, GeoComply sues XPoint, gaming debt analysis, Startup focus – TopProp Fantasy +More

Sep 30: Weekend Edition #66

Friday, September 30, 2022

Scandi analyst initiation, XL Media H1, Aristocrat/Roxor, XPoint fundraise, Macau analyst update, Nevada data +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏