StockTips - STATUS UPDATE

IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. Past performance does not guarantee future results. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.It will take a week to refund my annual subscribers. Hold tight. The only reason it will take so long is I need to load money from the Stocktips bank account to Stripe, & then From Stripe to my Subscribers. The Markets: I love being right about potential rallies. Last week I claimed that the market may pump for no other reason than the pivotal news is behind us. Sure enough, last weeks news is behind us, the market blasted upward, & the futures for Tuesday indicate (but do not guarantee) continuation. Alas this is but temporary (Remember that!). What I Expect: People are getting slaughtered by inflation. High interest rates aren’t just hurting the housing market, but the auto market as well. Need a new appliance? Need some house work done? Have a business that operates on frequent debt? Need a loan for anything? YOU’RE GOING TO PAY! SO STAY AWAY FROM STOCKS THAT RELY ON MASSIVE AMOUNTS OF DEBT TO CONDUCT OPERATIONS!!! They will NOT serve you well amid high interest rates. REMEMBER: Markets are forward looking! Do I expect lower lows? Yes I do! Do I expect a recession? Who doesn’t? But does a recession necessarily mean the markets will not price in equities through the following year? If history has shown us anything, its that recessions do not necessarily mean a poor performance for stocks amid the recession. This is because firms will invest with the expectations that the recession will eventually end … & its better to be too early than to be too late. Has this time come? Absolutely not! Remember that inflation may be painful today, but equities will eventually inflate as well. Eventually we will have headlines on record company revenue … but in reality … in real value … inflation will be the driver of the record revenue despite profit margins being within historical norms. A Note on Dividends: If you didn’t read my write up on dividends yesterday, please do so. I think its important. A Hard Landing?: Likely! The holidays are upon us and you can bet that folks are going to spend some money. Demand may increase a little driving inflation higher & incentivizing the reactive thinking Fed to stay the course. Businesses will compete for seasonal employees raising the demand for labor. At least that’s what markets will assume. After the holidays we cannot rule out that folks will have incurred a massive amount of debt … & at higher interest than traditionally expected. The tax returns thereafter will therefore likely service that debt, not stimulate the economy. Most people are horrible with money! Most people live paycheck to paycheck. They will spend during the holidays with the expectations that they will get a hefty tax return in February-March. The tax loss harvesting prior to the new year may be brutal! And the Fed is selling (QT) in an effort to rollback QE. So after the holidays I fully expect some nasty nasty markets! With this said, please plan accordingly. Put some money away for you an your family. Attempt to save as much as you possibly can. Try to have a savings that will sustain you for at minimum 3-6 months. Keep it liquid in some sort of bond tracking ETF where you wont make much, but you wont lose much either (Its a good hedge if nothing else). I’m expecting some serious job insecurity next year. Firms will be hesitant to engage in layoffs during the holidays, but after the holidays (which is an even worse time to partake in layoffs) all bets are off. TAKE CARE OF YOURSELF & YOUR FAMILY!!! IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. Past performance does not guarantee future results. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.If you liked this post from StockTips Newsletter, why not share it? |

Older messages

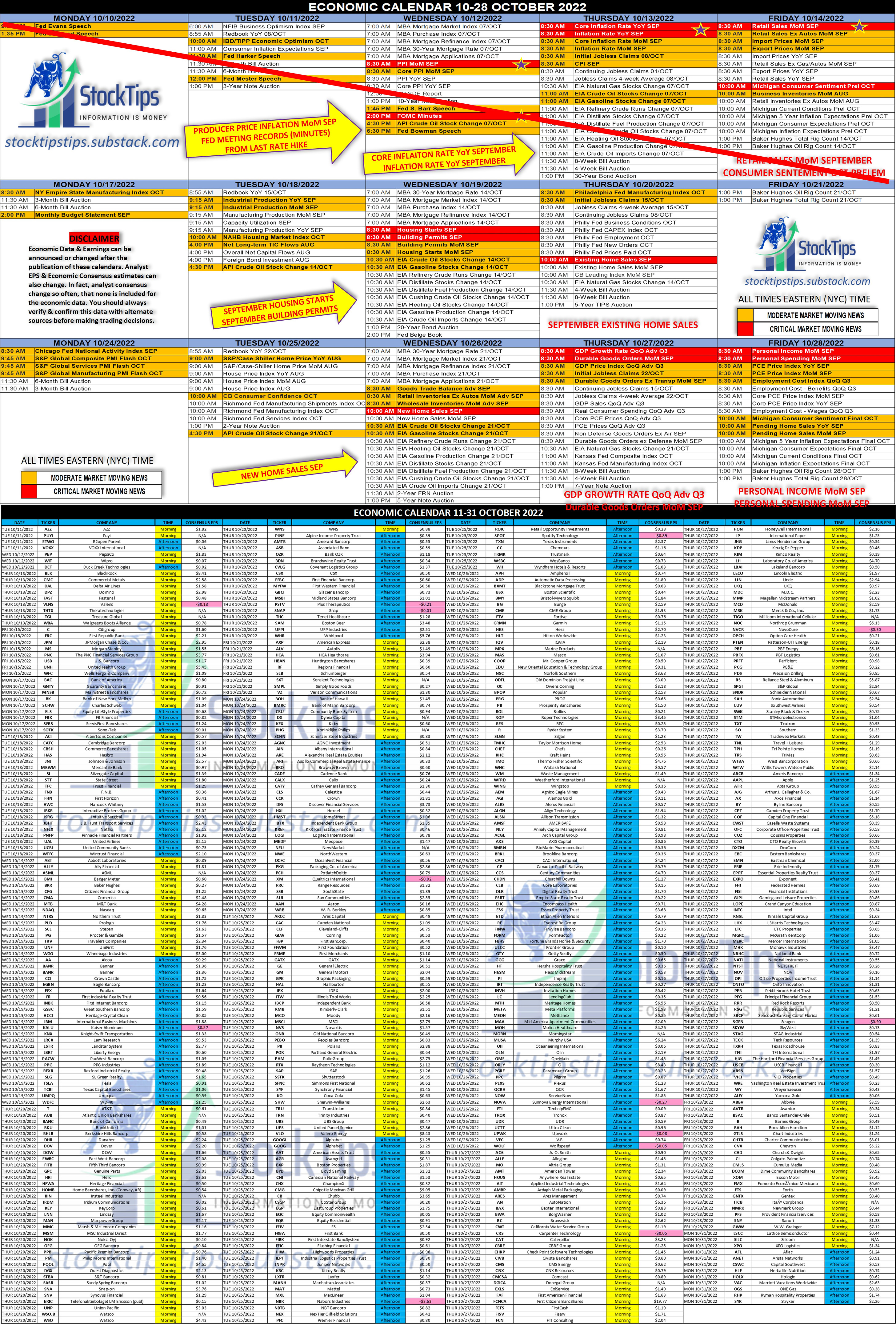

The Daily StockTips Newsletter 10.14.2022

Friday, October 14, 2022

(Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 10.13.2022

Thursday, October 13, 2022

(Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 10.12.2022

Wednesday, October 12, 2022

(Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 10.11.2022

Tuesday, October 11, 2022

(Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 10.10.2022

Monday, October 10, 2022

(Published 7:30 AM ET MON-FRI)

You Might Also Like

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, March 1, 2025

Hackers, Safety, EBITDA, More Hackers, Feudalism, Randomness, CEOs Longreads + Open Thread By Byrne Hobart • 1 Mar 2025 View in browser View in browser Longreads A classic: Clifford Stoll on how he and

🚨 This could be a super bubble

Friday, February 28, 2025

An expert said we're in the third-biggest bubble ever, the US poked China one more time, and OpenAI's biggest model | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Boring, but important

Friday, February 28, 2025

For those life moments you might need . . . ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Last Trader Standing

Friday, February 28, 2025

The Evolution of FX Markets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

My secret 15-minute video sharing my triple digit options strategy

Friday, February 28, 2025

Free training + book ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👋 Bye bye, bitcoin

Thursday, February 27, 2025

Bitcoin's biggest one-day blow, Trump's latest tariff threat, and robots playing soccer | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 28th in 3:12 minutes.

Don't Overlook this Sector Billionaires are Quietly Investing In

Thursday, February 27, 2025

The Billionaires' Energy Secret (You Can Get In) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Giveaway: Set Sail on Your Next Adventure 🚢

Thursday, February 27, 2025

Enter to win a chance to win a free trip from Virgin Voyages. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏