Earnings+More - Reality bites: US market exits

Reality bites: US market exitsSigns of distress in US sports betting, Allwyn Camelot bid, the week ahead, Apple policy move, startup focus – Atlas World Sports +MoreGood morning. On the agenda for today:

Reality bites in US sports bettingKindred’s Iowa exit and the withdrawal of all applicants for supplementary licenses in Illinois show how the tide has turned on enthusiasm for US sports betting. Taking the temperature: Kindred’s somewhat quiet exit from the Iowa market, compounded with the news from the Illinois Gaming Board that all four of the applicants for the next round of sports-betting licenses had withdrawn, suggests a market where the froth is fast disappearing.

IL behavior: At the same time, the Illinois Gaming Board said late last week it was reopening the application period for more sports-betting licenses after three of the four that had previously lodged an interest withdrew.

Under the cosh: In the recent Deal Talk edition of the newsletter, sources suggested that brands spending time and money fighting for single-digit percentages of the market was “not sustainable”.

Live or let vie: Meanwhile, the Sharpr newsletter reported last week that Esports Entertainment has closed down its esports-focused sportsbook Vie.gg, including in New Jersey where it only launched earlier this year. As Sharpr noted, in New Jersey in July Vie.gg took in a total of $570 in gross wagers. One out, one in: As also reported in last Friday’s Weekend Edition, Las Vegas-based retail sportsbook Superbook has gone live in Iowa. **Sponsor's message: Spotlight Sports Group is a leading technology, content and media business specialising in sports betting. Working with the largest media companies in the world, including AS.com and Advance Local, Spotlight Sports Group offers fully managed solutions that allow publishers to maximize revenue across their highly valuable sports betting audiences. For more information visit: spotlightsportsgroup.com MGM Macau Covid blowMGM Cotai is subject to a lockdown after a positive Covid case was identified on site. Less than Zero: China’s zero-Covid policy has struck once again, as Inside Asia Gaming reported yesterday that MGM Cotai is now in lockdown after a dealer at the resort tested positive. According to the report, no one is allowed to either enter or exit the building. Allwyn’s Camelot talksAllwyn has confirmed a report that it is in “advanced discussions” with the owners of Camelot about buying its UK operations. In a statement released over the weekend, the Czech-based lottery and gaming operator confirmed it was in talks with the Ontario Teachers’ Pension Plan (OTPP) about a potential acquisition of Camelot UK.

Tidying up: The Sky News report suggested that, if a deal were to be agreed, it would give Allwyn access to Camelot's UK earnings roughly a year before it surrenders control of the franchise. It also suggested it would bring a halt to Camelot’s outstanding legal challenge against the regulator.

The week aheadAnother important set of earnings looks with Caesars on Tuesday and MGM Resorts on Wednesday, while Penn reports on Thursday and DraftKings on Friday. Primed: With Thursday’s Nevada data proving that the Strip appears to be defying gravity, all eyes will be on what the casino giants say this week about prospects for Q4 and beyond.

Analyst data pointWith 70% of the market having reported the team at Truist suggested market-wide September GGR was up 48% on handle that rose 36%, helped by strong hold margins of ~12%. This is on top of data from August showing same-store GGR up 59% on handle up 11%. Apple pauses gambling adsThe move follows complaints from developers about the appearance of gambling app advertisements in unrelated categories. New inventory: According to MacRumors, the complaints were caused by Apple's announcement that it had made new inventory available on the App Store that would provide more advertising opportunities for developers, including advertising their apps in categories different to their own.

REIT reviewAnalysts remain optimistic about the prospects for the largest gaming REITs despite the obvious pressure around interest rates. Jefferies said GLP’s “better than expected results” showed its model was able to generate “high-quality stable cash flows”, while Deutsche Bank said VICI currently “offers investors stability in an otherwise uncertain environment”. DB added that M&A discussions including REIT parties “remain somewhat active within the regional gaming environment”.

The shares weekThe Hong Kong listings of the leading US operators in Macau suffered a punishing week as the sector from the wider Xi third-term market sell-off. There Xi Goes: The major Hong Kong-listed offshoots of US gaming’s leading players suffered along with the rest of the Chinese-facing markets as investors reacted badly to President Xi’s consolidation of power at the recent Communist Party conference.

Startup Focus – Atlas World SportsWho, what, where and when: Chicago-based Atlas World Sports was launched in January 2021 by founder and CEO Robert Kraft. Along with Kraft, the group’s co-founders are CFO Kevin Seiberlich, CSO Robert Bardunias and CTO Sasa Maljkovic. Funding backgrounder: The company is currently finalizing its seed round. To date it has raised $1m from angels with another $500k committed in December, and Kraft says a fund has committed $4m for a Series A in 2023. The pitch: Kraft says the concept “of course” came about in May 2018 after PASPA was repealed, with the idea being “very similar to Expedia or Priceline” with a central hub for sports bettors to make informed bets with a single, efficient, user-friendly experience.

What will success look like? An ideal exit “will probably make sense in three to five years”, Kraft says. “It will most likely be based upon a strategic buyer, whether it is a media company, a European affiliate or an American tech company seem to be the likeliest potential routes.” Earnings in briefBetMakers Q123 revenues rose 13% YoY to AU$23.8m thanks to the launches of six new partners during the period. The group is the tech partner of Matthew Tripp’s OSB startup Betr and also activated its agreement to distribute Penn Entertainment horse-racing content outside the US and Canada. DatalinesNew York: GGR was down 10% to $33.5m in the week ending Oct 23, despite handle rising 13% to $365.7m – its highest level since March Madness.

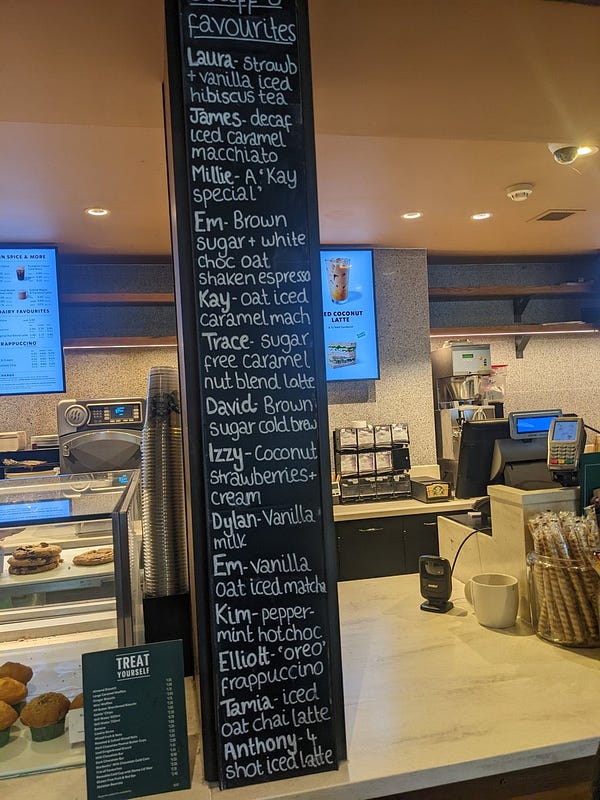

NewlinesAustralia-listed betting operator BlueBet has made a $500k strategic investment in free-to-play gamification specialist Low6. The agreement is for a five-year period and enables BlueBet to launch products on the Low6 platform. The Macau Government Tourism Office told GGRAsia that the SAR was preparing to welcome package tours from mainland China next month, although the measures will be implemented gradually. Spain’s Senate passed a bill that increases ad restrictions including not linking gaming to social success and the depictions of money. What we’re readingBetting on politics: US regulators ponder whether to allow election betting. On social 14 people work in this service station Starbucks and as far as I can tell, none of them like coffee. Calendar

Contact

If you liked this post from Earnings+More, why not share it? |

Older messages

Weekend Edition #70

Friday, October 28, 2022

Vegas Strip defies the odds, UK gambling ministers we have known, Red Rock 'staring growth in the face', sector watch – tokens +More

Kindred’s Dutch flier

Thursday, October 27, 2022

Kindred happy with Netherlands re-entry, Evolution not so much with RNG, Boyd analyst reaction +More

PointsBet chases super heroes

Wednesday, October 26, 2022

PointsBet identifies super users, Boyd beats but profits dip, Betsson buys B2B, Kambi falls +More

FanDuel’s media plays

Monday, October 24, 2022

FanDuel/Ringer deal, the shares week, the week ahead, analyst takes +More

Weekend Edition #69

Friday, October 21, 2022

Caesars' Times Square bid, Sightline's JP Morgan investment, Entain's new term loan, sector watch – affiliates +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏