Why is Core Scientific, the largest bitcoin miner in North America, on the brink of bankruptcy?

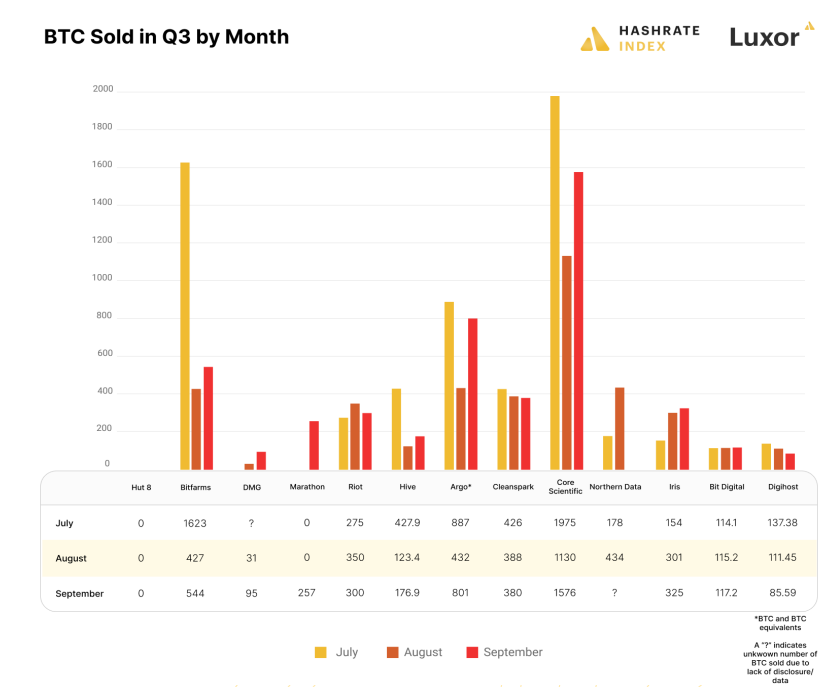

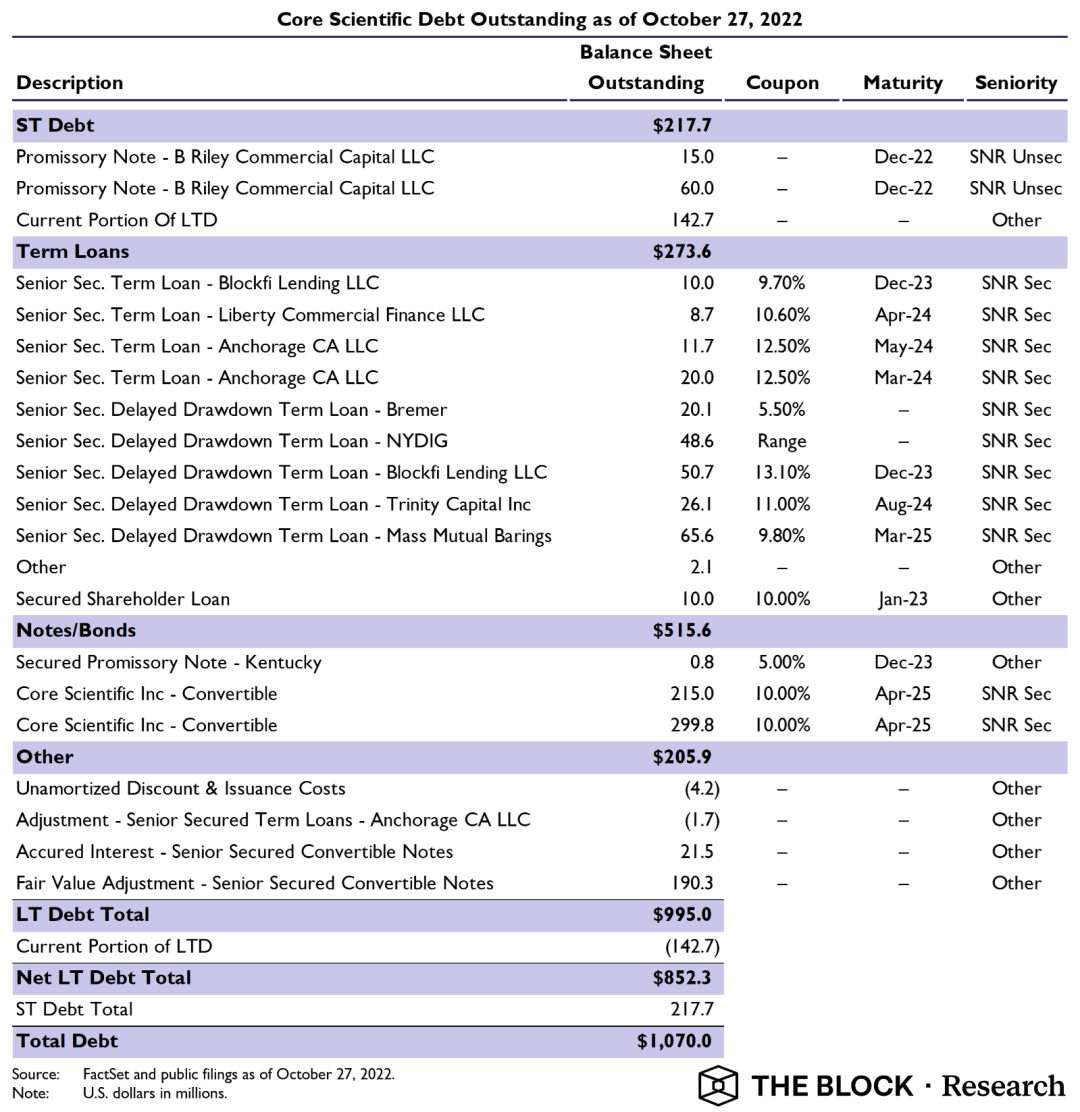

Editor: Kate Li, TSE Core Scientific, one of the largest publicly traded crypto mining companies in the U.S. with a purported 457 MW of operations, filed a statement with the U.S. Securities and Exchange Commission last week citing the possibility of bankruptcy in the future, the company also revealed , it won't pay its debt due in late October and early November, and its stock price plummeted 77%, further widening the endgame for Core. Why is North America's largest miner Core Scientific (hereinafter referred to as "Core") now on the brink of bankruptcy? Let's start with history and explore why. News Source: Shares of CoinDesk Troubled Bitcoin Miner Core Scientific Continue to Plunge on Bankruptcy Risk History Core has been operating mining farms in North America since 2017, both self-mining and hosting services. Core has mines in Georgia, Kentucky, North Carolina, North Dakota and Texas, and expects to begin operations in Oklahoma in the coming quarters. Core is very secretive and rarely discloses trading details to the market. Early in 2018, a filing revealed the startup was raising a $40 million investment round, and three months later it was revealed that founder Aber Whitcomb was raising a massive $100 million investment that could grow to $2.5 million. billion, but he declined to provide details on how the investment would be used. In July 2021, Core announced a merger with Power & Digital Infrastructure Acquisition Corporation (XPDI) to list on the Nasdaq at an enterprise valuation of approximately $4.3 billion. Previously, Core purchased 76,595 and 112,800 Bitmain mining machines in 2020 and 2021 respectively, all of which are new-generation mining machines such as S19, S19 Pro, S19J and S19J Pro. Supported by the bull market, holding these mining machine assets continues to push up Core's market valuation. Source: Core Scientific, Marble Factory, in North Carolina After that, Core and an affiliate of private independent energy company Tenaska Energy, Inc. reached an agreement to build a 300 MW data center in Denton, Texas, for which Core committed to invest $200 million, expected by the end of 2022 Facility construction will be completed. Besides, Blockcap, founded in 2020 by former Core executives, has so far purchased 42,000 miners from Bitmain and Canaan, 12,000 of which are already operational. The company plans to have an additional 18,000 miners on the shelf by the fourth quarter of 2022, and then 12,000 more by 2022, all hosted on Core’s own mining farms. According to a press statement on Core's official website, the company expects to run about 325,000 mining machines (combined with self-mining and hosting) in its data center by the end of the year, and has a purchase plan for about 90,000 mining machines. The pressure to pay principal and interest is increasing, and there is still a question mark as to whether more than 320,000 mining machines can be deployed as scheduled. Before June 2022, Core implemented a HODL strategy (holding Bitcoin for a long time). After June, mining machine orders, mining farm capital expenditures and debts were like three mountains, forcing Core to start a large number of Sell bitcoins. As a result, it sold 7,202 bitcoins in June, raising about $167 million; in August, it sold 1,125 bitcoins, raising about $25.9 million; in September, it sold 1,576 bitcoins, raising about $32.2 million in total Dollar. As of Oct. 26, the company held just 24 bitcoins and about $26.6 million in cash. Source: Hashrate Index As can be seen intuitively from the graph, Core sold more Bitcoin than all other listed miners. What the hell happened this year to make Core start selling bitcoin so much that it might even go bankrupt due to cash flow issues? Situation Analysis Private and publicly listed crypto miners owe as much as $4 billion as of July 2022 to fund the construction of sprawling facilities across North America, according to data compiled by industry players and CoinDesk. Core is also part of a wild expansion. As mentioned earlier, it expects to deploy over 320,000 mining machines by the end of 2022. It means that excluding the hosting machines, the total value is roughly estimated to be nearly $1 billion (according to the spot market price, if the purchase time node is earlier, the purchase cost of the mining machine may be higher). This is only the amount of mining machines, and it does not take into account mining farm construction expenses, electricity costs for large-scale deployment of mining machines, and loan interest. If the price of the currency remains high and the miners can pay the electricity bill, then the Core can maintain the cash flow and realize its great cause step by step. However, an Oct. 19 court filing revealed that Celsius in the crypto lending space had unpaid electricity bills totaling about $2.1 million to Core in August and September of this year, and that Core was still losing about $53,000 a day in electricity bills , a month is 1.59 million US dollars. News: Celsius Network refuses to pay Core Scientific, leading to financial turmoil Celsius was once one of the largest companies in the crypto lending space, offering annual returns of nearly 19%, but it filed for bankruptcy this spring. Core had an agreement with it to provide its infrastructure. According to the agreement, both miners and mining revenue belong to Celsius, while Core only charges electricity and custody fees. In the filing, Core asked the court to force Celsius to pay overdue bills or allow it to fulfill contracts. “Celsius either needs to abide by the contract, or Core and Celsius must terminate their relationship before Celsius brings another business partner (Core) into bankruptcy.” The game has yet to settle down. U.S. Judge Martin Glenn will preside over their hearing next month, and the outcome remains to be seen. Caused by a series of factors, such as the amount Celsius owed, it is a high debt that is difficult to repay. According to statistics, Core’s total debt principal is about $1 billion, including investment bank B. Riley, MassMutual Barings and crypto lender BlockFi, as of October 27, Core owed them $75 million, $65.6 million, and $60.7 million, respectively . And a total of $48.6 million in deferred senior secured instalments owed to crypto financial services firm NYDIG and $31.7 million in senior secured instalments from Anchor Labs, the parent company of digital asset bank Anchorage Digital., and most debt will expire in three years. Source: THE BLOCK Research Reason analysis Bitcoin’s price has fallen from an all-time high of over $69,000 in November 2021 to around $20,500, a loss of nearly 70% in value, combined with fierce competition among miners and rising energy prices, compressing mining profit margins. The bulk of Core’s loans were used to buy mining machines and build mining farms, and most of them began in the second half of 2021, when Bitcoin prices were rising (peaking at nearly $70,000 in November) and miners were racing to grow their business. Bull markets always amplify desire and reduce risk control. It has to be said that under the big market in 2021, many people’s mentality is floating, expanding wildly and adding leverage: the overall investment cost of mine construction last year was high, and the average market price may be 250-500,000 US dollars / MW, mergers and acquisitions At the time of mining, the valuation can even reach 1 million US dollars/MW; the unit price of buying mining machines is between 55 - 105 USD/T (the price of S19J Pro falls to less than 20 U/T). Under the double attack, the huge investment in assets in the early stage and the sharp drop in income have made it difficult for many mining companies to continue. The specific purchase price of Core has not been disclosed, but we can know that it still needs to pay Bitmain cash on a monthly basis. When the cash flow can't keep up, then its default on Bitmain is real. Coupled with the increase in energy and electricity prices in the United States, and the increase in operating costs, even if the original bitcoin is continuously sold to replenish cash, the stock will eventually be exhausted, and there is almost no one in the capital market to replenish blood for mining companies cash out. Under multiple pressures, the Celsius incident was like the first domino that fell, triggering this series of crises. Will Core really go bankrupt? We have no way of knowing, but here is a passage from Compass Point for your interpretation: “With the price of mining rigs falling significantly in 2022, we think there is a good chance that the creditors holding this debt will decide to restructure rather than take the collateral. Nonetheless, without knowing the discussions with Core creditors, we believe it must be taken seriously Treat Core's application for Chapter 11 protection, especially if Bitcoin prices fall further from current levels." Reference: https://www.theblock.co/linked/95124/blockcap-us-10000-bitcoin-miners Top Speed Energy (www.tsedata.com) is committed to spearheading the definition of cryptocurrency mining services in North America. With years of experience in the local natural gas landscape (original website: www.topspeedenergy.com), on top of run-of-the-mill Grid-powered Bitcoin mining facilities, TSE also extends to set up 100% natural gas-powered facilities as well as 100% hydroelectric ones across a plethora of states and provinces in USA and Canada, including but not limited to Texas, Ohio, North Dakota, British Columbia, and Alberta. TSE features a double-shift operation and maintenance team, delivering one-hour response promise to ensure the streamline operations of clients’s miners all year around. Being a local player in North America, TSE poses itself as a trustworthy partner to international clientele — it can assist foreign clients with local incorporation registry, tax planning among with legal advice to help them enter the North American mining market safely and worry-free, in a compliant way. Contact us Telegram Colinwu1989/wuhongliang1@gmail.com If you liked this post from Wu Blockchain, why not share it? |

Older messages

The direction of Web3 reform after Elon Musk's acquisition of Twitter

Thursday, November 3, 2022

On Oct. 28, the world's richest man, Elon Musk, completed the acquisition of social media giant Twitter for $44 billion after several twists and turns. After the acquisition, Musk fired

VC Monthly Report:Financing Amount in Oct. was the Lowest in Past Two Years

Thursday, November 3, 2022

Author: WuBlockchain Joey According to Messari, there were 71 publicized investments in crypto VCs in October, down 26% MoM (97 projects in September 2022) and down 46% YoY (131 projects in October

DID: How to return to use value from price speculation

Wednesday, November 2, 2022

Author: defioasis Editor: Colin Wu DID, full name Decentralized Identity, ie decentralized identity, is widely believed that DID has three characteristics: security, controllability and convenience.

The interpretation of the new crypto policy in Hong Kong, is it bullish?

Tuesday, November 1, 2022

Xiao Feng, Wanxiang Blockchain CEO Before March 1 next year, it is legal to set up a so-called virtual asset exchange in Hong Kong, if only trading BTC, ETH, etc., no one can stop it. In fact,

Global Crypto Mining News (Oct 24 to Oct 30)

Monday, October 31, 2022

1. Canaan today launched its new generation of high-performance bitcoin mining machine, the Avalon Made A13 (“A13”) series. Model A1346 features a hash rate of 110 TH/s and a power efficiency of 30J/TH

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%