Earnings+More - Due Diligence #1

Due Diligence #1Will DraftKings need to raise more cash from investors? Plus some recent analyst takesGood morning and welcome to our latest new monthly edition, Due Diligence, where the aim is to delve deeper into topics of importance to the sector. For our debut issue, we take a look into DraftKings and what the recent results say about its drive toward profitability and the problems it faces in attempting to achieve its goals. DraftKings and profitabilityRedemption song: The initial response of investors to DraftKings’ Q3 earnings will have been dispiriting for management, given the extent to which they have consistently said that profits will follow the high double-digit year-on-year revenue rises seen this year.

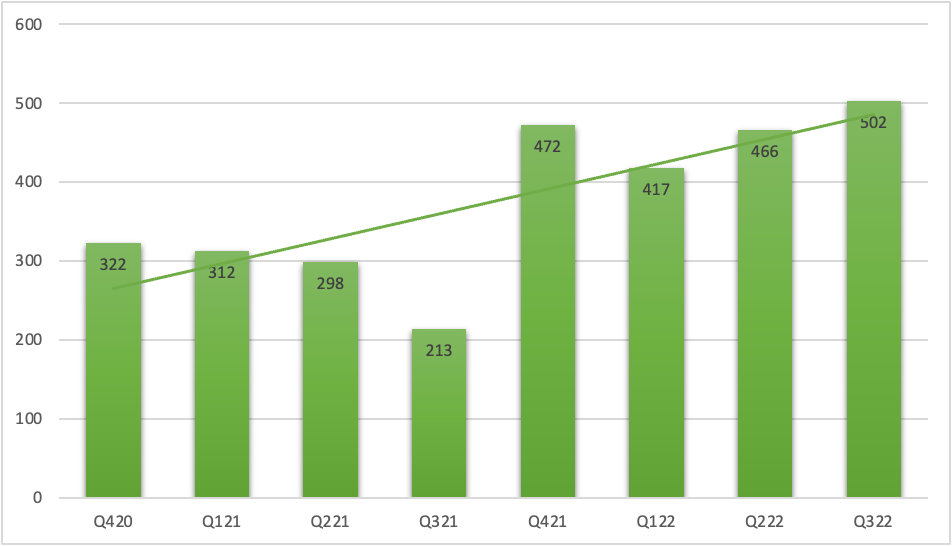

🪜DraftKings quarterly revenues Q420-Q322 ($m) Action/reaction: The new adj. EBITDA losses guidance for 2022 is now between $780m-$800m, while the new estimate for 2023 adj. EBITDA loss is predicted to be between $475m-$575m.

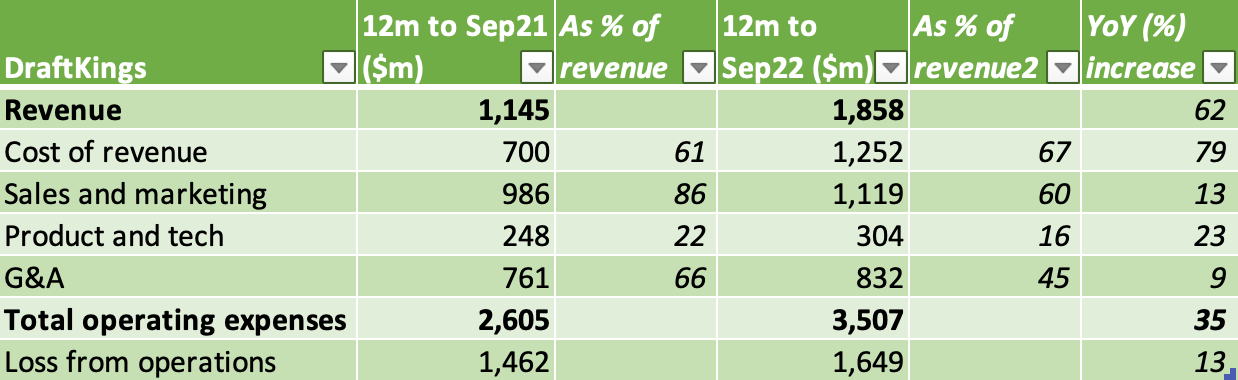

🎢DraftKings’ share price action in the last month ** SPONSOR’S MESSAGE** GiG is a leading gaming platform and sportsbook provider for online and land-based operators with digital aspirations. We deliver a full end-to-end solution through our award-winning iGaming and sportsbook solutions. Built for regulated markets and a top-class customer experience, GiG is pioneering the multi-platform era. If you are looking to expand your operations into new, profitable markets, our strategy is the solution. Find out more at sales@gig.com. Profit and lossA look at the last 12 months shows how revenues have risen 62% over the period to $1.86bn, while operating expenses have risen at a lesser pace, up 35% to $3.51bn, leaving the loss from operations up 13% at $1.65bn. On the face of it, it is heading in the right direction.

The heart of the problem: It is the cost of revenue line, however, which proves to be the standout metric from these figures and it is the one that is clearly the most troubling if you are a bull on US sports betting.

Why cost of revenues is rising and why it mattersDeath and taxes: Contained within the cost of revenues are various aspects of operations that are impervious to the benefits of scale. E+M spoke to Paul Leyland at Regulus Partners and he suggested that this bucket would include, among other costs, the following:

Lockstep: For each of these elements of the cost base, the percentages are somewhat fixed. Taxes, as the saying goes, are always with us, while the content, payments and market access fees will include large elements of revenue share. Hence, as revenues rise the cost of these revenues goes up in lockstep. The liquidity questionAnalysts have previously questioned whether DraftKings has enough cash at hand to get it to profitability. On the Q3 call, CFO Jason Park was keen to stress the company believed it was “well-capitalized to become free cash flow positive with existing resources”.

Making assumptions: There are, though, a number of assumptions here. First, as the analysts at JMP indicated, this assumes no more state launches than are already baked into this year’s and next year’s guidance, namely Ohio, Massachusetts and Maryland.

If the cost of revenues maintains at 60% of total revenues (i.e. less than the LTM figure) that equates to ~$1.7bn; with tech at 10% (or ~$290m) and G&A falling to 30% (or ~$870), it leaves yearly losses at ~$873m.

What the analysts thinkBird on a wire: The team at Roth noted management’s continued insistence that it will not need to raise additional capital before reaching free cash flow break-even but pointed out that “investors are increasingly skeptical”. CBRE added there was “nervousness”.

🚨More ominously, Roth said DraftKings “continued to ignore the market’s pleas for more capital discipline”. They suggested that achieving positive FCF “without requiring an equity raise” is still possible.

Recent analyst takes

Calendar

Contact

|

Older messages

Caesars & DraftKings lead sector bounce

Monday, November 14, 2022

The shares week, US sportsbooks hold analysis, startup focus – OSAI, the week ahead including FanDuel +More

Weekend Edition #72

Friday, November 11, 2022

Genius Sports' NFL in-play bounce, Endeavor open for business, NeoGames' iLottery hopes, sector watch – crypto exchanges +More

Flutter on a roll

Thursday, November 10, 2022

Flutter on a US high, California says 'no', GiG's aggressive approach, IGT's Powerball boost, Full House eyes Temp opening +More

Billings: ‘Tilmann got a bargain’

Thursday, November 10, 2022

Wynn Resorts's record Vegas profits, Light & Wonder transformed, Inspired's FX woes +More

Deal Talk #4

Tuesday, November 8, 2022

Flutter wins the (Fan)duel with FOX, MGM and Entain tensions ramp up, Kindred buyer left hanging +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏