In summary: What is the real reason for the collapse of the FTX empire?

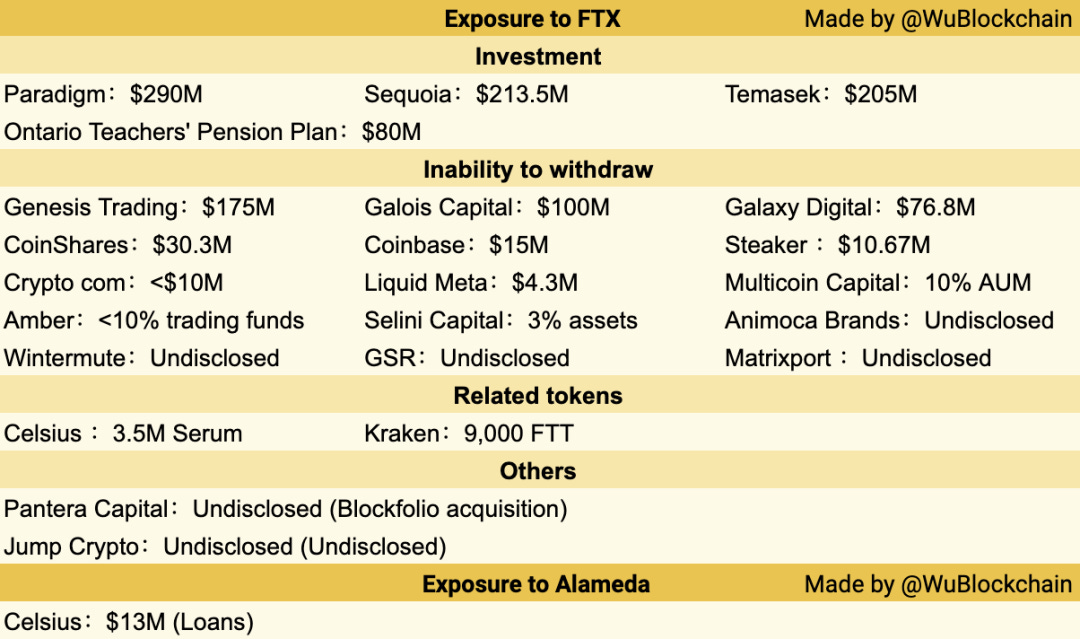

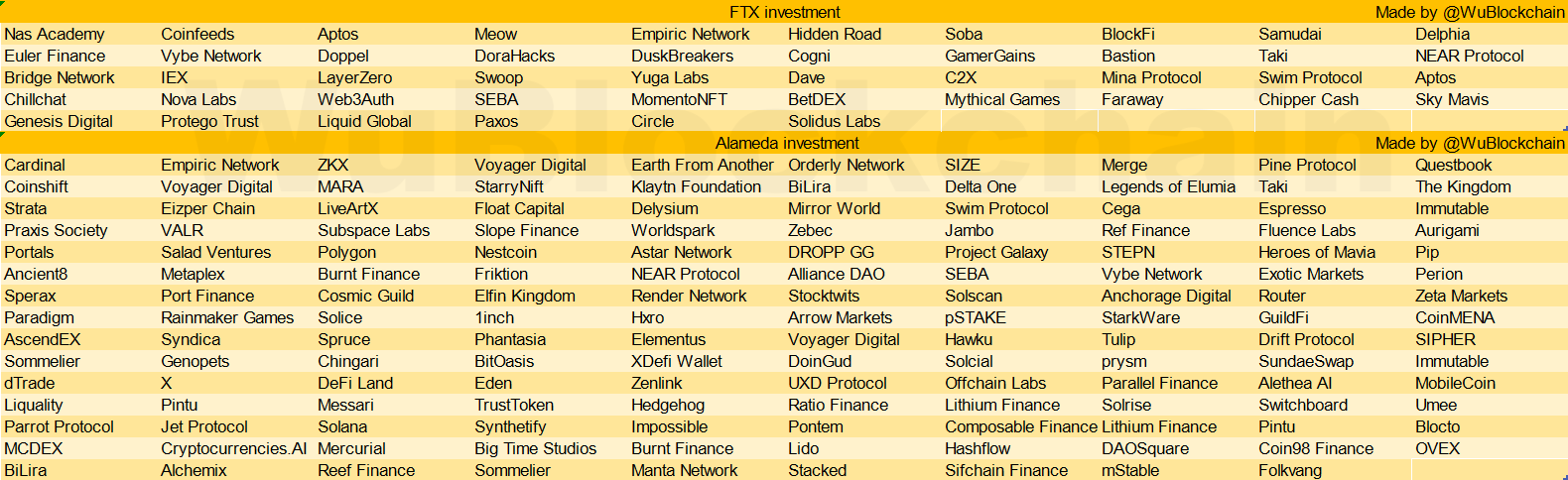

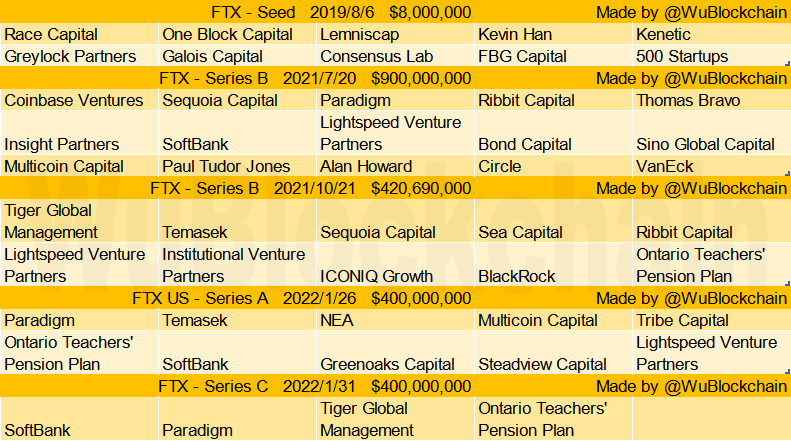

Written By: Colin Wu Before the FTX empire collapsed, 99.9 per cent of us thought: maybe he had a lot of connected parties, maybe he was expanding too fast, but a collapse was "not so likely"? After all, it has such a polished image as a leader in regulatory communication in the crypto world, the first choice of many institutional users, and the leading investor in a number of high-profile projects. In the days leading up to the crash, SBF paid out a generous $6m in compensation to several retail investors who lost money because of the API KEY leak, although third-party software, rather than FTX, may have been to blame. When CZ and SBF announced Binance's acquisition of FTX to each other, the reaction was: Oh my God, something really happened to him. When CZ then walked away, saying FTX's finances were too bad, it finally became clear that FTX was done. What exactly caused the collapse of the FTX empire? As more information comes to light, it turns out that the answer is as simple as c: borrowed too much money, collapsed during Luna, couldn't pay it back, and appropriated user funds. (Alameda may not have lost money outright on Luna, but because Terra collapsed and lenders were chasing large amounts of loans.) Alameda faced a barrage of demands from lenders after 3AC, a crypto hedge fund, collapsed in June, according to the Wall Street Journal. In a video conference with Alameda employees late Wednesday Hong Kong time, Alameda chief Executive Caroline Ellison said, She, Mr Bankman-Fried and two other FTX executives, Nishad Singh and Gary Wang, were aware of the decision to send customer funds to Alameda. Singh is FTX's director of engineering and a former Facebook employee. Mr Wang, who previously worked at Google, is FTX's chief technology officer and co-founded the exchange with Mr Bankman-Fried. FTX used client funds to help Alameda repay its debt, says Caroline Ellison. Lenders started calling in those loans around the time the cryptocurrency market crashed this spring. But the money Alameda spent was no longer readily available, so it paid with FTX client funds. SBF explained to the New York Times that Alameda had accumulated a large "margin position" on FTX, which in effect meant it had borrowed money from the exchange. "It's a lot bigger than I thought it would be," he said. "In fact, the downside risks are very significant." He said the position was in the billions of dollars but declined to provide further details. So the question is, why did they not shrink and close the loopholes, but continue to carry out large-scale investment and even rescue the so-called bankrupt enterprises? For this point, there is no detailed explanation from the media. When SBF embarked on an acquisition spree this year, investing in struggling cryptocurrency companies, he did not share information with key employees, the New York Times reported. When he was told he was overextended and encouraged to hire more staff, he rejected the suggestions. One possible judgment is that SBF wants to continue building the facade of expansion and complete the financing to get more money. As you can see, FTX US also raised $400 million in early 2022 at a whopping $32 billion valuation. Oddly, FTX continued to tell the media that it was raising money. It was also difficult for the outside world to understand. After all, exchanges are a very profitable business on a regular basis, so why do you need to keep raising money? Another possible explanation is that SBF is not so concerned about Alameda's multibillion-dollar breach that it may not be worried about a run on the exchange. For all intents and purposes, he did not think much of this risk until CZ began his attack. It was only then that people realised how vulnerable the FTX was. Internal management problems at FTX are also widely believed to have contributed to the collapse. As we often criticize: FTX emphasized that they only had 200-300 people and even in the days before the crash, were bragging that they had produced the highest per capita revenue/profit. But in terms of its ecology, which was once as big as Binance's, Binance has 7,000 employees. Obviously 200-300 people cannot properly manage such a huge company. The opacity of FTX's decision-making and the SBF's clique culture were also seen as potentially problematic. Insider says, "I personally doubt that anyone other than Sam, Nishad, Gary and Caroline really knows the full picture of what's going on." When it comes to information cocoon, SBF can easily make wrong or even crazy decisions. In conclusion, credit was used to carry out disorderly and wild expansion, internal management was out of order, and it could not be repaid when the market was down. The misappropriation of user funds was exposed as a "whistle". The FTX Empire crash, in fact, is that simple. SBF had nearly $9 billion in liabilities and $900 million in liquid assets, $5.5 billion in "less liquid" assets and $3.2 billion in liquid assets, according to a filing with investors the day before the bankruptcy filing, according to Bloomberg. The "less liquid" assets include Serum, Solana and FTT. SBF had previously said it paid off $6 billion in assets, with a shortfall of several billion dollars. Back in 2021, we ended our article describing SBF with this: Dig deep: How FTX's SBF made billions of dollars in 3 years "The magic of SBF lies in its extensive industrial layout and strong execution, which is beyond ordinary people. As a result, in only three years, SBF has accomplished what most people on the Forbes list have accomplished in decades. However, the SBF has also noted that most of his holdings are illiquid. I wonder if SBF can survive the bear market, or is it just a flash in the pan "legend" in this bull market cycle?" Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish |

Older messages

Global Crypto Mining News (Nov 7to Nov 13)

Monday, November 14, 2022

1. Bitcoin miner Iris Energy has received a notice of default on $103 million of outstanding debt, with the lender claiming it is behind on payments scheduled for October 25 and demanding that Iris

Weekly project updates:Chainlink introduced PoR, Aptos partnered with Google Cloud, NFT's weekly summary, etc

Saturday, November 12, 2022

1. Chainlink's weekly summary a. Chainlink Labs has introduced PoR, assisting CEX in prove its asset reserves. link On November 11, Chainlink Labs introduced proof-of-reserve (PoR), a new service

Clarify Merkle Tree:see how centralized exchanges "certify their innocence"

Friday, November 11, 2022

Based on Merkle Tree's proof model, exchanges can prove whether the assets held by each user are included in the exchange reserves, but this scheme still has flaws. Written by: Babywhale, Foresight

Justin Sun: China's Internet has no long-termism

Thursday, November 10, 2022

Author: Justin Sun Editor: WuBlockchain Foreword: This is a Chinese article published by TRON founder Justin Sun in 2021, describing why Chinese entrepreneurs and businessmen are more short-sighted,

CEX Data Report in Oct.: Spot Volume Steady, Futures Volume Down Sharply

Thursday, November 10, 2022

WuBlockchain's statistics showed that: Spot trading volume of all exchanges was down 6.1% in October, with major exchanges up 2.5%. The top three increases were LBank +34%, Gate +25% and Bitget +4%

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%