The Product Person - The Rise and Fall of FTX - Part 1

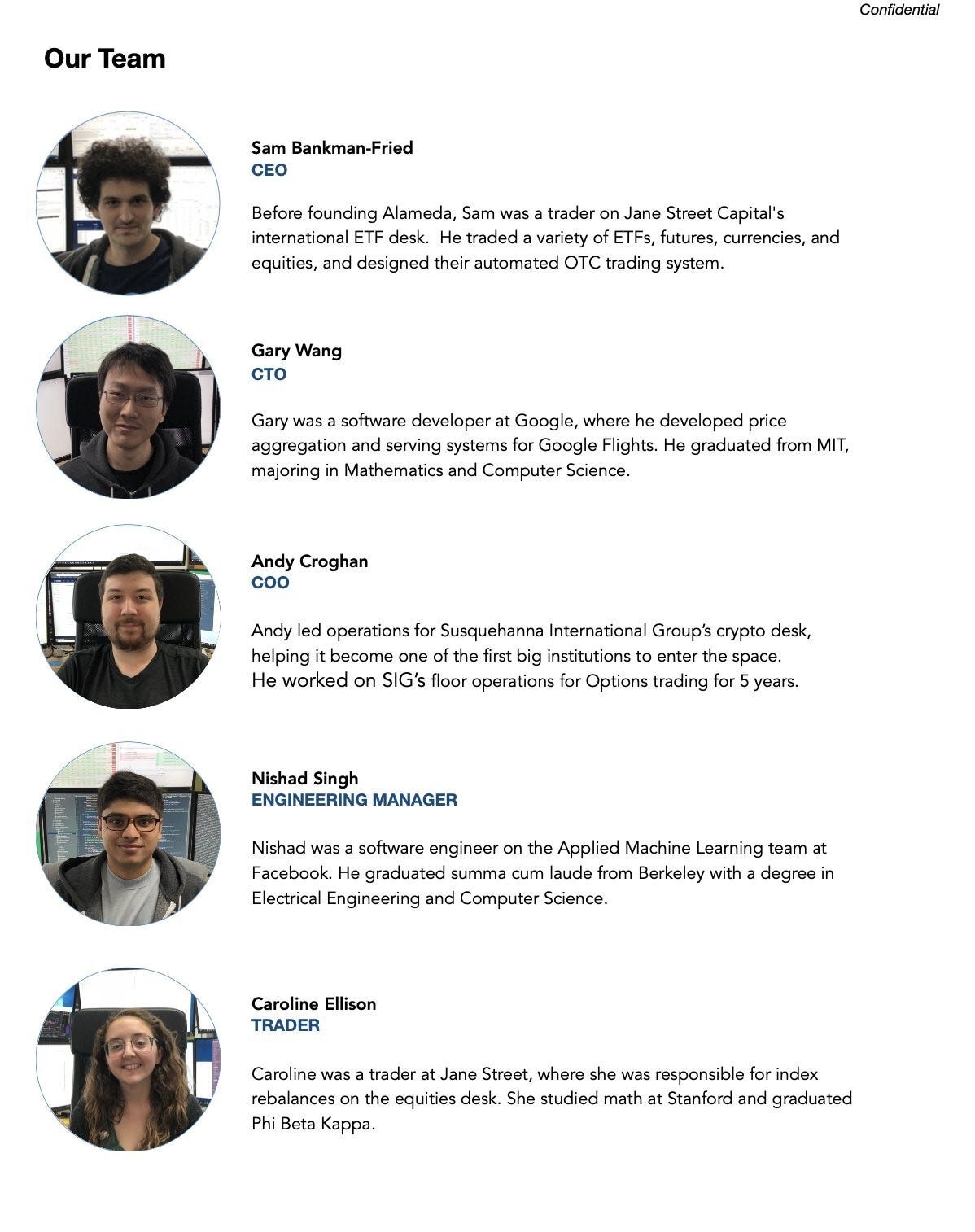

Hey everyone! Richard here. It’s been a while since we last published to Product Person. In that time, I started a new content agency - we drive organic growth for startups through premium content. Recently, I’ve been following the FTX saga and honestly, most reporting around FTX is incredibly biased and piecemeal. So, I buckled down and wrote out a history of FTX, from inception to disgrace. ----- It was the middle of 2017 and Sam Bankman-Fried (known as SBF) had just quit his job at Jane Street. Unsure of what to pursue next, he made a list of things he wanted to do. It included becoming a journalist, venturing into politics, fundraising for a non-profit, building a startup, or just generally bumming around the Bay Area. [0] After a short stint of bumming, he started tackling this list. First, Sam joined the Centre of Effective Altruism as a Director of Development. Shortly thereafter, he founded Alameda Research. In both of these efforts, he was joined by Tara Mac Aulay. Tara was a pharmacist by training who previously went to school in Australia. She served as the COO for the Centre of Effective Altruism from March 2015 to September 2017 and became CEO until January 2018. [1] SBF’s tenure at the Centre would be much shorter. He resigned after just one month to instead focus on Alameda. East Asian ArbitrageOfficially, Alameda Research was founded in September 2017 by SBF and Tara Mac Aulay. [2] Neither of the two had previous experience with crypto and only Sam had a trading background. After a few uneventful months, the pair found a big break in January 2018. At the time, the crypto world was abuzz with something called the “Kimchi Premium”. Bitcoin prices in South Korea were roughly 30-50% higher than in the US. Someone could buy a bitcoin in the US for $10,000, transfer it to Korea, sell the bitcoin in Korea for $15,000, and pocket a tidy $5,000 profit. [3] This was the stuff of arbitrage dreams. But most traders could only look at the Kimchi Premium with envy. South Korean crypto exchanges required both a South Korean-based phone number and bank account. Both of these were close to impossible to obtain quickly, especially for a foreigner. Even for South Korean citizens, the legal annual limit for transferring funds abroad was $50,000. On top of that, sending that money back overseas meant at least 17 different transfers among 3 different banking institutions. Because the South Korean crypto market wasn’t connected to the rest of the world, the Bitcoin price was on average 4.73% higher in Korean than in the US from January 2016 to February 2018 [4]. Alameda couldn’t crack the Kimchi Premium either. But SBF quickly turned his sights on other Asian markets. As it turned out, Japan also had a 5-30% premium on Bitcoin relative to the US market. Japan was not as restrictive as Korea, which granted Sam enough leeway to execute his arbitrage strategy. He could buy Bitcoin in the US on an exchange like Coinbase. From there, he could send the money to a Japanese exchange through a Japanese partner verified with the exchange. That same Japanese partner could sell the Bitcoin and deposit the earnings from the sale into their Japanese bank account. From there, they could transfer the funds back to Alameda. Rinse and repeat. While simple in theory, there were still hoops to jump through. First, Alameda needed to set up a Japanese entity that would skirt the suspicion of Japanese banks and regulators. They would partner with Takashi Hidaka, an organizer at Effective Altruism Tokyo with over 20 years of banking experience. Officially, the Japanese entity of Alameda would be called ‘Alameda Research K.K.’ The research part of Alameda’s name would help fool rural Japanese banks. [5] Second, while transferring Bitcoin to Japan was easy, sending fiat back to the US was anything but. To help them, Sam and Takashi found a Japanese grad student with Effective Altruism ties. Each morning, he would line up at the bank branch and execute the wire transfers to the US. [6] As you can imagine, all of this sounds quite shady. In the words of Sam: “And finally sent the wire, and they're like, wait, you sent this yesterday. This is a mistake. Like, no, no, no. We're sending again. Like, no, no, no. You sent this exact one yesterday. Like, yeah, that's right. We're sending it again. And now they're like, wait, you're telling me that two days in a row, you're sending an international wire transfer across currency, across continent, in the same direction for the same size with no transfer coming the other way. That's sketchy as s***, right? Where is your money coming from? And we're like, well, it's fake internet money. And they're like, oh, that makes us feel better.” [7] Somehow it all worked. Alameda started raking in a daily 10% return on their starting capital of $50,000. Hungrier for greater returns, SBF’s previous trading experience kicked in. At Jane Street, he traded currencies, futures and exchange-traded funds. He knew exactly what needed to happen to scale this up from $5,000 to $5,000,000. He needed more powder. After raising funds, Alameda would quickly have $50 million in assets under management (AUM) [5]. Or at least, that’s what SBF claimed. He would also later throw around the figure of $25 million [8] and $100 million [9] in AUM. In retrospect, it’s much more likely that Alameda’s AUM was much closer to $5 million. With a 10% daily return and $50 million, just 30 days of trading would mean a gain of $822.47 million. The arbitrage opportunity would close after just four weeks of trading in January 2018. Other crypto traders had figured out the trick, and the sudden inflow of Bitcoin from Alameda and other traders into the Japanese market depressed the price of Bitcoin. No more Japanese premium. In total, Alameda made out with $20 million in profit. [10] The Early GunslingersTo execute the Japanese arbitrage, SBF had help from two previous acquaintances. The most important of them was Gary Wang. He fit the classic programmer stereotype to a tee – high intelligence with no desire for the spotlight. SBF first met Gary at summer math camp in high school and were roommates at the Epsilon Theta house in MIT. His peers at MIT considered him to be the smartest of the bunch (even above SBF). [11] Gary wrote a bitcoin arbitrage trading bot in 2014, making a “couple thousand dollars” one semester. He would later turn off the bot before a summer internship at Google. After graduating in 2015, Gary would return to Google and work on software for aggregating prices across millions of airline flights, while decreasing latency and memory usage by over 50%. [12] When starting Alameda, SBF reached out to his connections at MIT to recruit them for the team. Most turned him down. Gary was one of the few that accepted Sam’s offer. This time, he would reverse course, leaving Google to join the fledgling Alameda. When starting Alameda, SBF reached out to his connections at MIT to recruit them for the team. While most turned him down, Gary was one of the few to accept Sam’s offer. This time, he would leave Google to delve back into crypto trading. At Alameda, he would work in a three-bedroom apartment with SBF and write the entire software stack for Alameda – algorithms, frontend UIs, trading systems, API connections. Later, Gary would become the CTO of FTX. The other key hire was Nishad Singh. Nishad was a fellow middle and high school classmate from Crystal Springs Uplands School, and was close friends with SBF’s younger brother, Gabe. While in high school, he became the second person in the U.S. to complete a 100-mile race at the age of 15 and hold the world record for the fastest 100-mile endurance run for under-17’s (23 hours 33 minutes). [13] Nishad graduated from UC Berkeley in 2017 and had been working at Facebook as part of their infrastructure team for five months before joining Alameda. He joined Alameda in December 2017 and shared responsibility with Gary over the technical infrastructure at Alameda. [14] — Not everyone was a fit for the fast-moving Alameda. Known internally as “the April Fiasco”, Alameda Research lost roughly $10 million throughout the course of several bad trades in April 2018. According to a former employee, these trades included:

It became clear that not everyone was comfortable with an SBF-led Alameda. Tara Mac Aulay, Sam’s original cofounder, left the firm in April 2018. In addition, close to half the firm, many of which were part of the effective altruism community, also resigned. The separatists went on to form two new crypto trading firms called Lantern Ventures and Pharos Fund. Both Lantern and Pharos would post middling returns. [15] With Tara and most of the senior Alameda leadership gone, SBF now owned 90% of the firm, with Gary Wang accounting for the remaining 10% stake. — After the April Fiasco exodus, SBF moved quickly to refill his cabinet. Among one of the new hires was Caroline Ellison, a former colleague of SBF’s from Jane Street. Sam and Caroline shared some striking similarities. SBF’s parents were Stanford professors. Caroline’s father was an MIT professor. SBF moved from the Bay Area to Boston to attend MIT. Caroline would do the opposite, moving from Boston to Palo Alto to attend Stanford. Both started at Jane Street shortly after graduation. While Sam worked at the international ETF desk, Caroline was responsible for index rebalances at the equities desk. When he reached out to her about Alameda, she readily made the leap. She joined Alameda in March 2018 as a trader. [16] Sam also recruited Andy Croghan, previously part of Susquehanna International Group's crypto desk. Andy would join Alameda as COO in August 2018. As one of the few adults in the room, Andy attempted to bring order to Alameda and later, FTX. “I was like, ‘Sam, you’ve got to cut your hair, dude — it looks ridiculous.’ And he said, ‘I honestly think it’s negative EV for me to cut my hair. I think it’s important for people to think I look crazy.’” Crazy worked. Andy would arrange for high-profile visitors to arrive while SBF openly power napped on a beanbag. Later, SBF would simply wake up and walk into the meeting. Their goal was to create an air mystique around SBF. It worked – investors would pledge billions betting on SBF. “Sam and I would intentionally not wear pants to meetings. Sam literally said to me, ‘The only people I think I’d wear long pants for are Congress,’” said Andy. [17] Hunting for CashBeyond the April Fiasco, as crypto prices fell throughout the year of 2018, Alameda’s performance remained stable. By the end of 2018, SBF had assembled an all-star team of traders from Jane Street, Optiver, Susquehanna, Facebook, and Google, all while boasting a claimed $55 million AUM. Some of Alameda’s earliest backers would come from the Effective Altruist community, including Jaan Tallinn, the cofounder of Skype. SBF would claim that Jaan contributed up to $50 million in Alameda in his interview by Sequoia. Hungrier still, Alameda looked to raise even more capital. They started by pitching traditional crypto investors. One prospect was Alexander Pack, who had just co-founded the crypto venture capital firm, Dragonfly Capital. Although the two liked each other at first, Pack’s due diligence process unearthed some rather grisly findings - Alameda had lost a lot of money in April, and they were spending Alameda resources to build a new crypto exchange called FTX, without distributing any FTX equity. [18] Pack’s diligence lasted months, much to SBF’s impatience. Alameda started looking for different avenues of funding. They started pitching various crypto funds to lend them capital at a 15% return. Their goal was to raise another $200 million to add to their war chest. To convince investors, Alameda prepared a six-page pitch deck on their firm. This pitch deck, full of grammatical mistakes and incredible claims, has since leaked. Notably, the top of their deck claims, “We are the best crypto trading firm in the United States and among the most serious firms across the globe.” While a bit of an exaggeration, there was an element of truth to the claim. There weren’t many crypto trading firms, and fewer still with solid trading talent. Most were cowboys that had been in crypto early or small operations looking for small plays among the volatility. As the deck continues, another phrase which stands out is, “we haven't had a losing week in six months.” Interestingly, Alameda claims they made an 8.7% return in April despite multiple outside sources citing high losses… Annualized, they showed that they were on track to make a 110.6% return. For reference, the greatest investor of our time, Warren Buffett, only saw 60% annual returns at his peak. Later, the deck quips “high returns with no risk” (red flag much?) and that, “these loans have no downside – we guarantee full payment of the principal and interest, enforceable under US law and established by all parties' legal counsel. We are extremely confident we will be pay this amount.” Many investors didn’t buy what Alameda was selling. Perhaps the most famous among them is Zhu Su from Three Arrows Capital (another crypto trading firm that went bankrupt earlier in 2022) who tweeted a screenshot of the Investment offerings part of the deck with a thinking emoji 🤔. [19] With little traction, Alameda would pause on fundraising. At least for the moment… Footnotes[0] Mentioned directly by SBF on an Acquired podcast. [1] Tara’s LinkedIn [2] From Tara’s Twitter. She’s received an incredible amount of hate after things blew up. Almost none of it is justified. She left nearly half a decade before FTX’s liquidity crisis. [3] The Kimchi Premium from Investopedia [4] The Kimchi Premium was so famous that a research paper was written on it. I wonder if the authors traded based crypto at the time. [5] One of many nuggets from the Sequoia article about SBF. We’ll use this post again in the future, it’s too good not to. [6] Takashi’s LinkedIn. Interestingly, he resigned from FTX Japan but not Alameda Japan. [7] NPR’s podcast on the whole FTX saga is one of the most digestible. [8] Mario at The Generalist wrote a three part saga about FTX. This is actually where I first learned about FTX. [9] Nearly every source, NY Mag included, has a different number on how much money FTX moved. [10] The official quote is roughly $10 to $30 million. However, other sources peg it around $25 million. Based on $5m in capital and the arbitrage existing from 3.5 weeks and not including weekends, we get to a net outcome of $25.27 million. Take out the $5 million in initial capital and we get $20 million. [11] Adam Yedidia is probably pretty happy now for not joining Alameda. [12] Information on the internet about Gary Wang is surprisingly sparse for someone so embroiled in controversy. [13] Nishad Singh, on the other hand, is quite well documented. [14] Nishad’s LinkedIn [15] Middling returns aside, Lantern and Pharos are testaments that it doesn’t take a professional trader to build a trading firm. [16] Most news outlets have used incredibly soft language towards the FTX / Alameda ringleaders including Caroline Ellison. Almost none of the news outlets have interviewed victims of FTX and Alameda. [17] The title, A Crypto Emperor’s Vision: No Pants, His Rules, is so close to saying that the emperor has no clothes. [18] Alexander Pack has since then moved on to found Hack VC. [19] While funny, Zhu Su is simply SBF on a smaller scale. Enjoyed this? Please share it with a friend or two. |

Older messages

The Lean Startup

Thursday, August 25, 2022

Inside are 5 key insights from the New York Times Best-Selling Book, The Lean Startup.

7 Habits of Highly Effective Product Managers

Thursday, August 4, 2022

Hey, Nick here! In this newsletter, I curate insights and timeless principles on how to build great products. You'll improve your product skills with every issue. Here's an article for you

Ann Miura-Ko on Floodgates's Thunder Lizard Theory and Achieving Product Market Fit

Thursday, July 28, 2022

Hey, Nick here! In this newsletter, I curate insights and timeless principles on how to build great products. You'll improve your product skills with every issue. Here's a video for you today…

Prioritization Shouldn't Be Hard

Thursday, July 21, 2022

Inside we discuss how product leaders should think about prioritizing strategic initiatives

Product vs. Feature Teams

Thursday, July 14, 2022

Inside we detail the characteristics of the most effective product team structure...

You Might Also Like

Simplification Takes Courage & Perplexity introduces Comet

Monday, March 3, 2025

Elicit raises $22M Series A, Perplexity is working on an AI-powered browser, developing taste, and more in this week's issue of Creativerly. Creativerly Simplification Takes Courage &

Mapped | Which Countries Are Perceived as the Most Corrupt? 🌎

Monday, March 3, 2025

In this map, we visualize the Corruption Perceptions Index Score for countries around the world. View Online | Subscribe | Download Our App Presented by: Stay current on the latest money news that

The new tablet to beat

Monday, March 3, 2025

5 top MWC products; iPhone 16e hands-on📱; Solar-powered laptop -- ZDNET ZDNET Tech Today - US March 3, 2025 TCL Nxtpaper 11 tablet at CES The tablet that replaced my Kindle and iPad is finally getting

Import AI 402: Why NVIDIA beats AMD: vending machines vs superintelligence; harder BIG-Bench

Monday, March 3, 2025

What will machines name their first discoveries? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

GCP Newsletter #440

Monday, March 3, 2025

Welcome to issue #440 March 3rd, 2025 News LLM Official Blog Vertex AI Evaluate gen AI models with Vertex AI evaluation service and LLM comparator - Vertex AI evaluation service and LLM Comparator are

Apple Should Swap Out Siri with ChatGPT

Monday, March 3, 2025

Not forever, but for now. Until a new, better Siri is actually ready to roll — which may be *years* away... Apple Should Swap Out Siri with ChatGPT Not forever, but for now. Until a new, better Siri is

⚡ THN Weekly Recap: Alerts on Zero-Day Exploits, AI Breaches, and Crypto Heists

Monday, March 3, 2025

Get exclusive insights on cyber attacks—including expert analysis on zero-day exploits, AI breaches, and crypto hacks—in our free newsletter. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚙️ AI price war

Monday, March 3, 2025

Plus: The reality of LLM 'research'

Post from Syncfusion Blogs on 03/03/2025

Monday, March 3, 2025

New blogs from Syncfusion ® AI-Driven Natural Language Filtering in WPF DataGrid for Smarter Data Processing By Susmitha Sundar This blog explains how to add AI-driven natural language filtering in the

Vo1d Botnet's Peak Surpasses 1.59M Infected Android TVs, Spanning 226 Countries

Monday, March 3, 2025

THN Daily Updates Newsletter cover Starting with DevSecOps Cheatsheet A Quick Reference to the Essentials of DevSecOps Download Now Sponsored LATEST NEWS Mar 3, 2025 The New Ransomware Groups Shaking