Research: How USDT is used in online casinos and how it causes your exchange account to be frozen

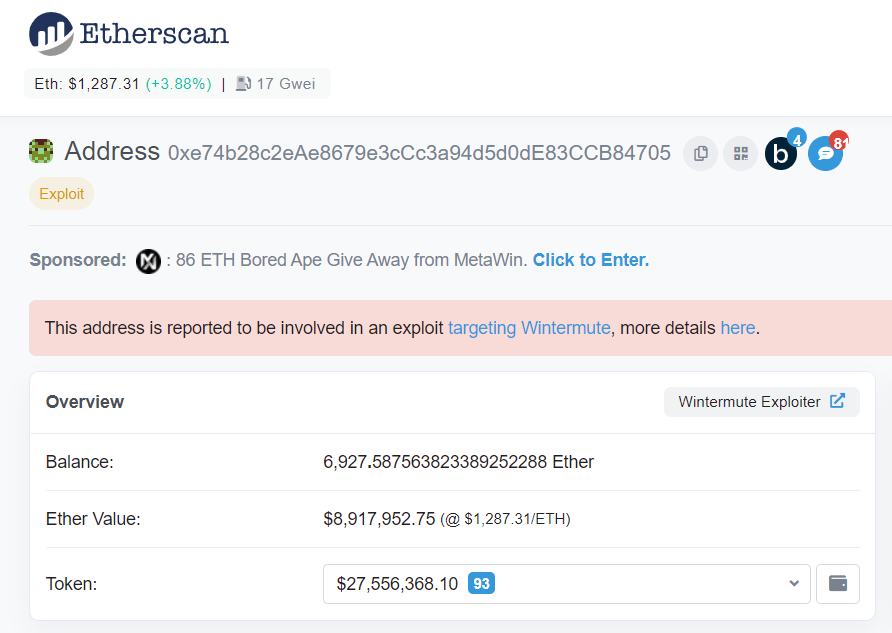

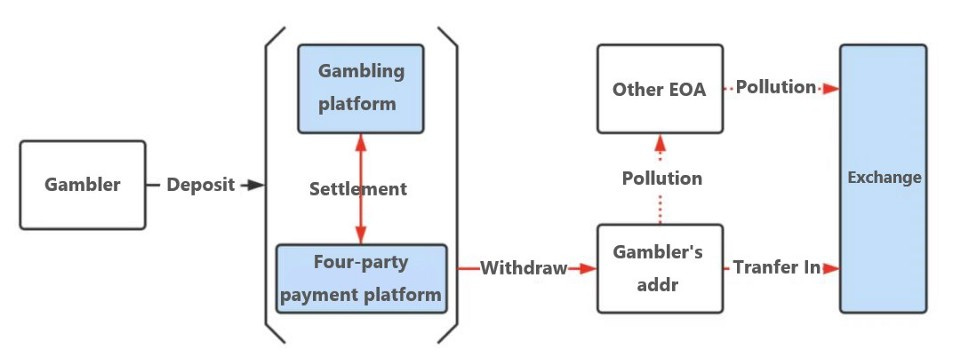

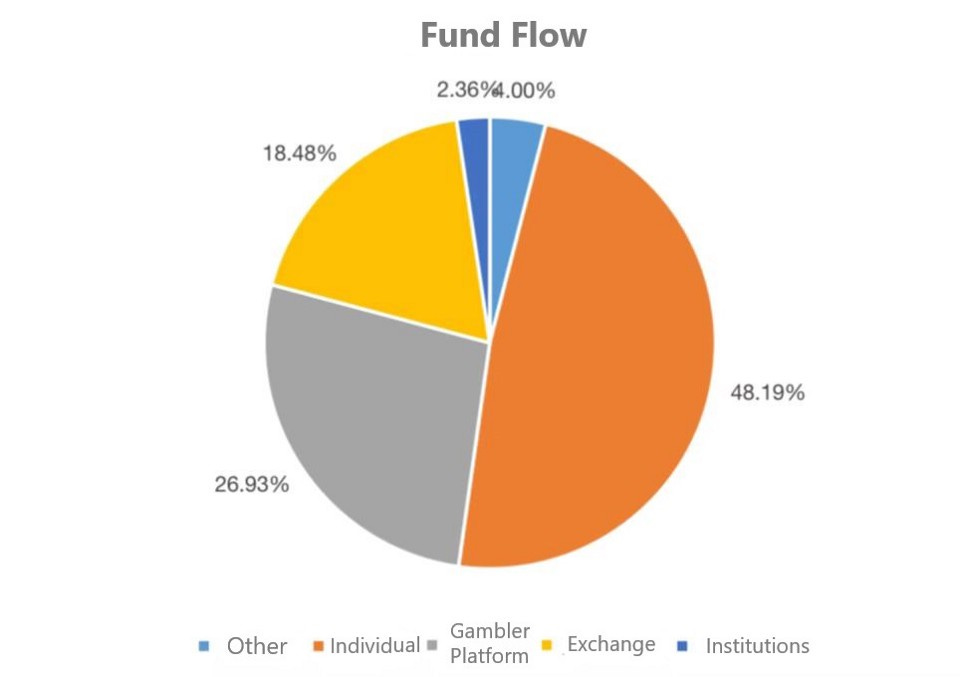

Author: Bitrace WuBlockchain authorized translation and reprint source: https://mp.weixin.qq.com/s/kTWd68GCccOfAu67ERUxGw The Anti-Telecommunication Network Fraud Law of the People’s Republic of China has been adopted by the Standing Committee of the National People’s Congress and will come into effect on December 1, 2022. Article 25 of the Law clearly states that “no unit or individual shall help others launder money through virtual currency transactions and other means.” Combined with the recent public disclosure of a number of precedents in cryptocurrency-related cases, the criminal risk for practitioners in the crypto has risen precipitously. The trend of dirty money Since the launch of China’s “Clearning Card Action” in October 2020, it has become a common knowledge in the industry that black money laundering has been used by cryptocurrency transactions in large quantities, and investors are mostly aware of the fact that receiving black funds may lead to frozen cards or even suspected of helping credit.Therefore, the implementation of this new law is only interpreted as a routine beating against the industry and has not attracted enough attention from the industry. However, in fact, as the adoption of cryptocurrencies in various scenarios has increased, there have been few cases of criminal laws being imposed due to receive black money in the course of transactions. Take the First Instance Criminal Judgment of XX Assisting Information Network Criminal Activities [1], issued on August 25, 2022, case No. (2022) Shaanxi 0104 Xingchu №219, as an example. According to the verdict, the two defendants, who were over-the-counter acceptors on a cryptocurrency exchange, earned profits by buying USDT at a low price and selling them at a high price. During the period, they were arrested because the ¥50,000 received came from a fraudulent source. The People’s Court of Lianhu District, Xi’an City, held that the defendants, knowing that others might commit information network criminal activities, provided them with assistance in payment and settlement, and that their behavior had violated the provisions of Article 287bis Paragraph 1 of the Criminal Law of the People’s Republic of China, constituting the crime of assisting information network criminal activities. In this case, the two defendants were sentenced to one year and eight months in prison and fined ¥5,000 and ¥3,000 respectively, and the proceeds from the sale of the USDT were returned to the victim for understanding. Not only losed money, but also imprisoned. The first appearance of Dirty USDT USDT generated based on blockchain technology has been adopted in the money laundering segment of many upstream crimes, including online gambling, extortion, drug trafficking, theft, fraud, and riot, due to its high liquidity and concealment characteristics. These USDTs associated with illegal activities are defined by the industry as “Black U”. And based on the degree of exposure of Black U, we further divide the source addresses into two main categories: One type of address is associated with an on-chain security incident that is primarily a hacking attack. Such addresses are often flagged by major data platforms or AML platforms immediately after an incident because of the widespread industry attention. Take the 0xe74b that stole thousands of ETH from the institution wintermute in September this year as an example [2], which has been marked as an attacker by etherscan, and users across the network are able to self-censor based on account association and know whether they will be subject to AML investigation as a result. Another category is the on-chain fund addresses of various types of black products. The illegal activities of this type of black industry are often hidden and niche, and their on-chain fund flows are rarely mined by mainstream data analysis platforms, but they still have an impact on the address security of normal users. Take the adoption of USDT in online gambling platforms as an example. It is illegal to provide any form of online gambling business for citizens in China. Some of the online gambling institutions set up outside of China allow gamblers to use USDT as an access tool in order to recruit Chinese users while circumventing the money tracking of law enforcement agencies. When normal USDT enters the online gambling site’s pool, it is “contaminated” and spreads through user withdrawals, causing harm to normal users’ addresses and exchange accounts. For example, in September this year, there were online gambling users who transferred their chain of online gambling funds to an exchange, which triggered the risk control rules of the account of the institute, resulting in a large number of associated accounts being subjected to financial risk control, and some users’ funds were frozen for up to six months, which also caused negative damage to the normal development of the business of some of these institutions. Online gambling dirty money pollution evidence According to the Bitrace risk situational awareness platform data, 1,031 new online gambling platforms using USDT will be included in 2022. According to the monitoring data of 20 active online gambling websites, there are more than 5 million online gambling USDT deposit order addresses and related addresses in 2022, and 161 new USDT payment platforms are associated. These gambling sites generally support the deposit and withdrawal of USDT by gamblers and the settlement of funds by the online gambling platforms themselves through access to cryptocurrency quadrilateral payment platforms. The black USDT is transferred to the addresses of ordinary on-chain users and exchange users through the withdrawal of funds by gamblers and the transfer of profits by the platform. Taking the above 20 online gambling platform crypto funds flow status as a sample, Bitrace makes accurate distinctions according to the destination of the USDT funds involved in gambling and the type of contaminated addresses. Data show that between 2021 and 2022, the group of online gambling platform-associated addresses outflows a total of 4.2 billion USDT to the outside world, of which more than 60,000 exchange deposit addresses directly receive gambling-related funds, with a total deposit volume of 780 million USDT, accounting for 18.57% of all online gambling outflows. Among the other 310,000 individual addresses that directly received gambling-related USDT, the funds further spread through the blockchain network, including address transfers, on-chain lending, anonymous transactions, cross-chain transfers and other interactions, and quickly contaminated more crypto addresses. According to Bitrace address portrait analysis, more than 53% of the contaminated addresses are Chinese users. Currently, the related gambling involved USDT funds as well as the associated addresses are still growing rapidly. A bigger crisis In addition to the impact of centralized institutions against the risk control of user account funds, anti-money laundering investigations from government departments will also become a problem that ordinary users have to consider. If individuals and institutions in the industry are unable to accurately identify and therefore receive black digital currency during transactions or business development, they will likely fall into a loop of the black money laundering path or even be involved in cases and face legal risks, just like receiving traditional black money. Take, for example, the XX Criminal Judgment of First Instance on Criminal Concealment and Concealment of Proceeds of Crime, etc., issued on October 1, 2022 [3]. The verdict shows that the defendant, knowing that others used an exchange trading account to launder over accounts for online gambling crimes, still provided his account registered in an exchange to others for use in order to obtain remuneration. on February 7, 2021, two fraudulent funds totaling ¥55,200 from the deceived people in Yue Tang District of Xiangtan City were successively converted into USDT after converging in the upstream bank and WeChat accounts involved in the case flowed into his trading account. The Yue Tang District People’s Court in Xiangtan City, Hunan Province, held that the defendant’s actions violated the provisions of Article 312(1) of the Criminal Law of the People’s Republic of China and held him criminally liable for the crime of concealing and concealing the proceeds of a crime, and sentenced him to eleven months’ imprisonment and a fine of RMB 10,000. This is a wake-up call for individual and institutional users who are still trading cryptocurrencies within centralized trading platforms. It can be said that after the freezing of bank cards due to receive of black money, the freezing of platform accounts due to the receive of black crypto funds will also soon become a consensus in the crypto circle and will have a huge impact on the industry. How to avoid Black U Based on the Bitrace team’s long experience working with regulatory and law enforcement authorities, we offer the following principles: ● Do not be greedy for small bargains. Stay away from cryptocurrencies that deviate too much from the market price. If USDT is sold at a price much lower than the market price, it may be a dump by the black and grey industry. ● Avoid trading on anonymous platforms. KYC mechanism has a high binding effect on OTC participants, which can reduce the possibility of users being exposed to black USDT to a certain extent. ● Emphasize the risk audit of cryptocurrency sources. Individual or institutional users with frequent transactions should do a good job of analyzing the composition of their daily sources of funds, and regularly conduct retrospective analysis and audits for business addresses. ● Emphasize on the background review of counterparties and their related counterparties. Avoid trading with unfamiliar counterparties, and in the transfer transaction scenario out of the platform situation, need to do a good job of relationship risk review of counterparty addresses and their associated addresses. ● Avoid lending your own chain address or platform account. Unhealthy address usage by others, especially the act of receiving USDT of unknown origin, may bring legal risks to oneself. Follow us |

Older messages

Analysis: Why is on-chain data analysis prone to misunderstanding?

Friday, December 16, 2022

Author: @tmel0211 Editor: WuBlockchain Original link: Is the Dragonfly shipment really cutting leeks? What is the reason for the frequent transfer of funds by Amber executives? Someone has made FUD

Global Crypto Mining News (Dec 5 to Dec 11)

Monday, December 12, 2022

1. Riot produces record 521 BTC and achieves new all-time high hashrate capacity in November 2022. Riot had a deployed fleet of 72428 miners, with a hashrate capacity of 7.7 EH/s. Riot held

TreasureDAO Ecosystem Inventory: The Nintendo of the Crypto Metaverse?

Monday, December 12, 2022

Author: @0xMavWisdom Recently, The Beacon, a chain game on Arbitrum, has suddenly become popular on social media. This simple pixel-style chain game, with its special "dungeon" and other

Asia's weekly TOP 10 crypto news (Dec 5 to Dec 11)

Sunday, December 11, 2022

Author:Lily Editor:Colin Wu 1. Binance in talks to acquire Indonesian crypto exchange link Crypto major Binance is in negotiations to acquire the Indonesian crypto exchange Tokocrypto. Binance had

Weekly project updates: 1INCH large unlock, ApeStake, Chainlink Staking v0.1 early access, etc

Saturday, December 10, 2022

1. ETH's weekly summary a. Vitalik discusses what in the Ethereum application ecosystem excites him link Vitalik posted an article analyzing what in the Ethereum application ecosystem excites him,

You Might Also Like

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: SEC Terminates Lawsuits Against Multiple Crypto Companies, Bitcoin Drops Below $80,000, OKX S…

Friday, February 28, 2025

On Friday, OKX market data revealed that BTC fell below $80000, reaching a low of $78258, with the current price at $80514, reflecting a 24-hour decline of 7.22%. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

FBI confirms North Korea-backed Lazarus hackers stole $1.5 billion from Bybit

Thursday, February 27, 2025

FBI tracks Ethereum laundering spree by North Korean hackers amid rising threat of cyber warfare in the crypto world. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with MicroStrategy Founder Michael Saylor: The Company Holding the Most Bitcoin in the World

Thursday, February 27, 2025

In this interview, Colin from WuBlockchain had an in-depth discussion with MicroStrategy founder Michael Saylor about the company's ongoing Bitcoin acquisition strategy, the growing adoption of

Abu Dhabi Invests $436.9M In Bitcoin ETF

Thursday, February 27, 2025

February 17th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Abu Dhabi Invests $436.9M In Bitcoin ETF Changpeng Zhao Sparks Meme Coin Rumours Coinbase Finally Lists POPCAT & PENGU

📈 BTC’s realised price (average acquisition price) reached an all-time high of $43,000; State of Wisconsin Invest…

Thursday, February 27, 2025

BTC's realised price reached an all-time high of $43000; Abu Dhabi's Mubadala Investment disclosed its BTC ETF holdings; South Korea to allow universities and charities to sell crypto donations

HashKey Exchange's Interpretation of the Hong Kong SFC Virtual Asset Roadmap

Thursday, February 27, 2025

We are pleased to see the Hong Kong government release the forward-looking and pragmatic “ASPI-Re” roadmap for advancing the virtual asset industry. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Argentina’s stock market plummets amid President Javier Milei’s LIBRA memecoin scandal

Thursday, February 27, 2025

Argentina's economic landscape shaken as Milei's LIBRA endorsement turns into multi-billion dollar fiasco. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Heated AMA Debate: 0G Team Responds to Allegations of CFX Soft Rug, Overvaluation, and Token Commitment Concerns

Thursday, February 27, 2025

This AMA primarily focused on the relationship between Conflux and 0G Labs, discussing 0G Labs' high valuation, fundraising structure, technical direction, and community concerns over transparency.

Pectra: Ethereum’s Next Major Upgrade

Thursday, February 27, 2025

Breaking down key changes included in Ethereum's Pectra hard-fork ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏