Accelerated - 🚀 Twitter sparks doxxing debate

trending 📈⚖️ SBF goes to jail. Former FTX CEO Sam Bankman-Fried was arrested in the Bahamas, after an eight-count federal indictment was issued by the U.S. Attorney’s Office for the Southern District of New York. The charges include wire fraud, money laundering, and conspiracy to commit commodities and securities fraud - and carry a maximum sentence of 115 years if convicted. Bankman-Fried was denied bail due to flight risk concerns, and will remain in jail until his February 8 extradition hearing. 🛑 Twitter cracks down on doxxing. Twitter erupted on Thursday night after a number of users were suspended for violating the platform’s anti-doxxing rule, which prevents real-time sharing of another person’s location. Among the suspended users were journalists from CNN, The New York Times, and The Washington Post - as well as the account of Mastodon (a Twitter competitor). The suspended accounts had tweeted about and linked to @elonjet, an account tracking Musk’s private plane, which was banned after a stalker followed a car carrying Musk’s son. The suspensions were intended to last seven days, but Musk lifted them early after polling Twitter users - 59% voted to reinstate immediately. 🎯 Tech giants refocus. In an era of cost cutting, some big tech companies are shuttering ancillary products or features. Updates from this week:

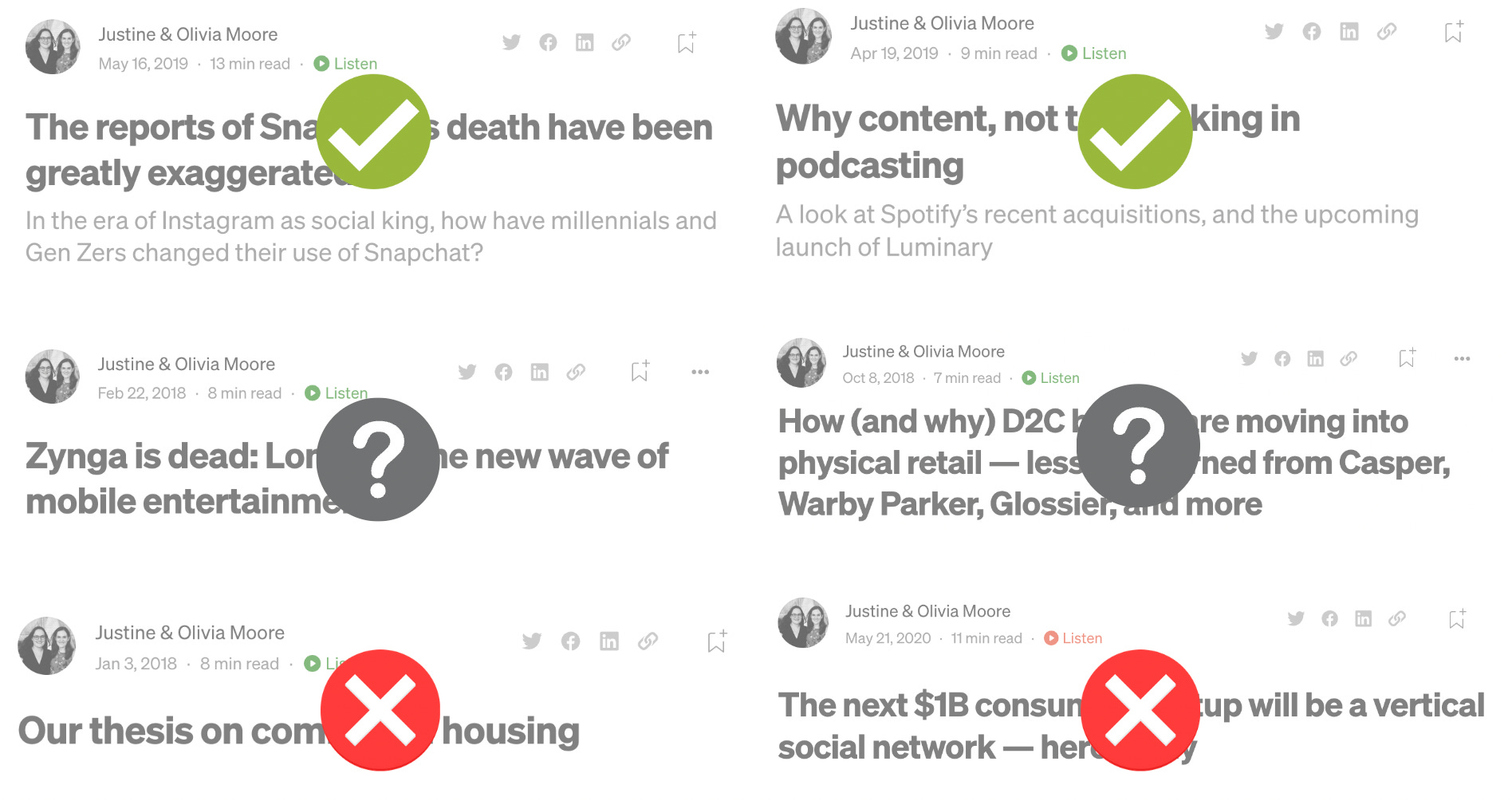

In an interesting turn of events, Instagram is bucking the trend! The app launched a few new features this week - including group profiles / collections, more “candid” Stories, and Notes (60 character posts with text and emojis). what we’re following 👀A look at the investors buying rights to the back catalogs of Youtubers. Netflix is giving ad $ back after their new tier underperformed expectations. How work from home patterns are shifting. A recap of all the generative AI content from a16z. ‘Tis the season for predictions! The a16z team had some great ones - ranging from the rise of “third places” to AI for credit counseling to the nuclear renaissance. This year, we thought it also might be fun (if not slightly painful) to revisit our personal predictions from prior years. We’ve been writing about tech trends for more than five years now, so there’s lots of material. What did we get right vs. wrong? And why? Let’s start with the misses: 🛑 “The next $1B consumer startup will be a vertical social network.” We wrote this piece in May 2020. Since then, two social products have reached the mainstream - Clubhouse and BeReal - both of which are not vertical social networks. Instead, vertical networks have popped up within TikTok: BookTok, FinTok, and WitchTok are just a few. TikTok’s FYP is so curated it feels like the app is designed for your interests, with dozens of thriving “subcultures.” No standalone app has been able to beat TikTok’s density of content and users - yet 👀. 🛑 “Our thesis on communal housing.” In 2018, we were bullish on co-living! We thought large real estate developers would build hotel-like apartment complexes with small units and shared amenities. This thesis was based on a few trends - migration into cities, student debt burdens, and young people getting married later. We haven’t seen this type of co-living play out at scale (COVID may have been a factor!), but a different form of co-living emerged….millennials are moving back in with their parents at unprecedented levels, with an estimated 25% living at home now. And now, a few predictions we got somewhat right: 🫳 “Zynga is dead - long live the new wave of mobile entertainment.” In the wake of HQ Trivia (those were the days), we expected to see a wave of startups delivering live, interactive experiences to your phone. We mentioned live commerce in China as inspiration, but thought U.S. apps would focus on entertainment or gaming, not necessarily shopping. While the broader live and interactive thesis played out, the biggest breakout so far has been Whatnot - a live shopping app. Whatnot was the fastest-growing private marketplace company for the last two years! 🫳 “How (and why) D2C brands are moving into physical retail.” We wrote this piece in 2018, the golden era of D2C brands (think Casper, Glossier, Warby Parker) from a VC $ perspective. We were initially surprised to see brands expand into brick-and-mortar retail, but after visiting a dozen stores, concluded that it might be the best of both worlds. While we were right that omnichannel was the future of D2C, we were wrong that this would involve many brands opening their own stores. Selling through existing mega retailers like Nordstrom and Target has been the preferred play. We’ll conclude on a positive note - predictions we nailed: ✅ “Why content, not tech, is king in podcasting.” We’re podcast superfans, and have been following the space for almost a decade. In 2019, we theorized that most of the value in podcasting would accrue not on the tech side (e.g. new listening apps, analytics platforms) - but on the content side (shows or studios). This seems to be true - at least so far! There hasn’t been a breakout tech company focused on podcasting, but platforms like Spotify and Apple have continued to invest billions of dollars in original shows, as well as make acquisitions of content startups. ✅ “The reports of Snapchat’s death have been greatly exaggerated…” 2019 was a dire time for Snap. The prior year saw DAU growth fall to an all-time low, and IG was crowned the clear winner in “Stories.” Many believed that Snap was headed for extinction. However, our surveys suggested that Gen Z was still attached to the platform - posting fewer Stories, but using it as their primary messaging app. Since then, the company’s DAUs have doubled, and 67% of Gen Zers report regularly using the app. (Side note: we were also right about Gen Z being over Facebook!) jobs 🎓Haymaker Ventures - Associate (Remote) Serena Ventures - Associate (SF, Remote) Reach Capital - Investment Associate (SF) Prelay - Business Operations (SF) Turn/River Capital - New Grad Investment Analyst (SF) Samsung Next - Investor (Mountain View) Summit Partners - Associate, Healthcare (Boston) Index Ventures - Investor (New York) J. Crew - Associate Product Manager (NYC) Generate Capital - Associate (London) internships 📝Whatnot - Summer Software Engineering Intern (Remote) Topsort - Marketing Intern (Remote) BrightHire - Spring MBA Special Projects Intern (Remote, NYC) Airbnb - MBA Strategic Finance & Analytics Intern (SF) Amplitude - Revenue Ops Intern (SF) Denali Therapeutics - MBA Corp Dev Intern (SF) Chewie Labs - Product Design Engineering Intern (San Bruno) FLYR Labs - Data Analyst Intern (LA) Peloton - Content Program Management Intern (NYC) Alpaca VC - Spring Intern, Proptech (NYC) puppies of the week 🐶As the holidays approach, we’re featuring a few puppies of the week - all of whom are guaranteed to put you in the festive spirit! From left to right: Eggnog (bulldog), Apollo + Ares (Australian Shepherds), and O’Dee (Vizsla). All views are our own. None of the above should be taken as investment advice. See this page for important information. |

Older messages

🚀 Is this the end of homework?

Sunday, December 11, 2022

Plus, a new episode of the Twitter Files!

🚀 SBF goes on a (press) tour

Sunday, December 4, 2022

Plus, what comes after the AI avatar era?

🚀 Why is the NYC startup scene taking off?

Sunday, November 20, 2022

Plus, Swifties battle Ticketmaster!

🚀 Chaos reigns on the Internet

Sunday, November 13, 2022

Recapping the FTX bankruptcy, Twitter's verification debacle, and Meta layoffs

🚀 A tough week for tech

Sunday, November 6, 2022

Plus, a new anonymous social app hits #1!

You Might Also Like

🇺🇸 The president's crypto fund

Monday, March 3, 2025

Crypto's back in favor and European defense stocks got an, uh, arm up | Finimize Hi Reader, here's what you need to know for March 4th in 3:15 minutes. The US president announced plans for a

CDs supercharge your savings

Monday, March 3, 2025

You could earn up to 4.10% for a 1 year term ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, March 1, 2025

Hackers, Safety, EBITDA, More Hackers, Feudalism, Randomness, CEOs Longreads + Open Thread By Byrne Hobart • 1 Mar 2025 View in browser View in browser Longreads A classic: Clifford Stoll on how he and

🚨 This could be a super bubble

Friday, February 28, 2025

An expert said we're in the third-biggest bubble ever, the US poked China one more time, and OpenAI's biggest model | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Boring, but important

Friday, February 28, 2025

For those life moments you might need . . . ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Last Trader Standing

Friday, February 28, 2025

The Evolution of FX Markets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

My secret 15-minute video sharing my triple digit options strategy

Friday, February 28, 2025

Free training + book ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👋 Bye bye, bitcoin

Thursday, February 27, 2025

Bitcoin's biggest one-day blow, Trump's latest tariff threat, and robots playing soccer | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 28th in 3:12 minutes.