WuBlockchain editorial team's predictions for 2023 Part 1

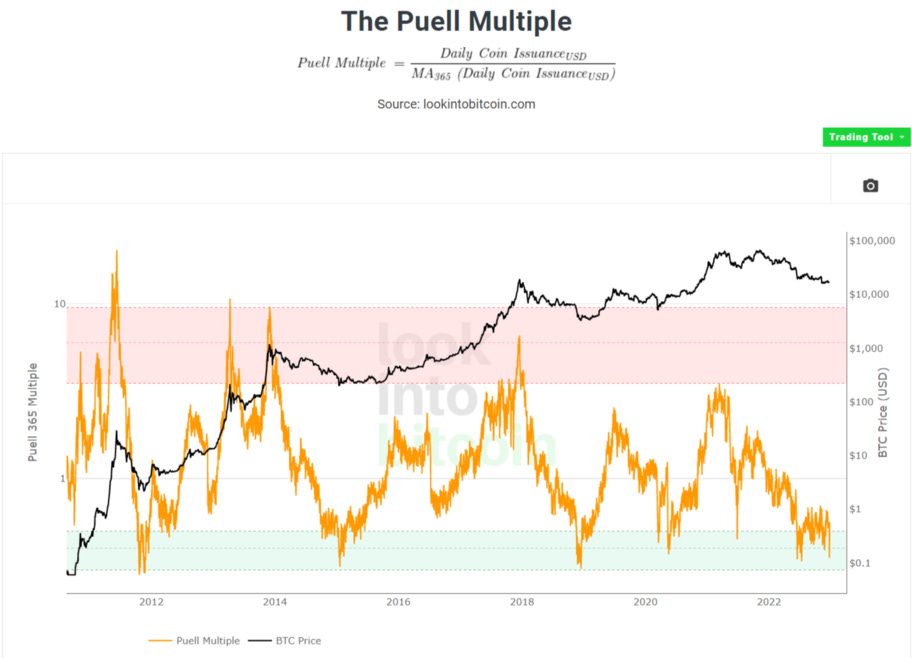

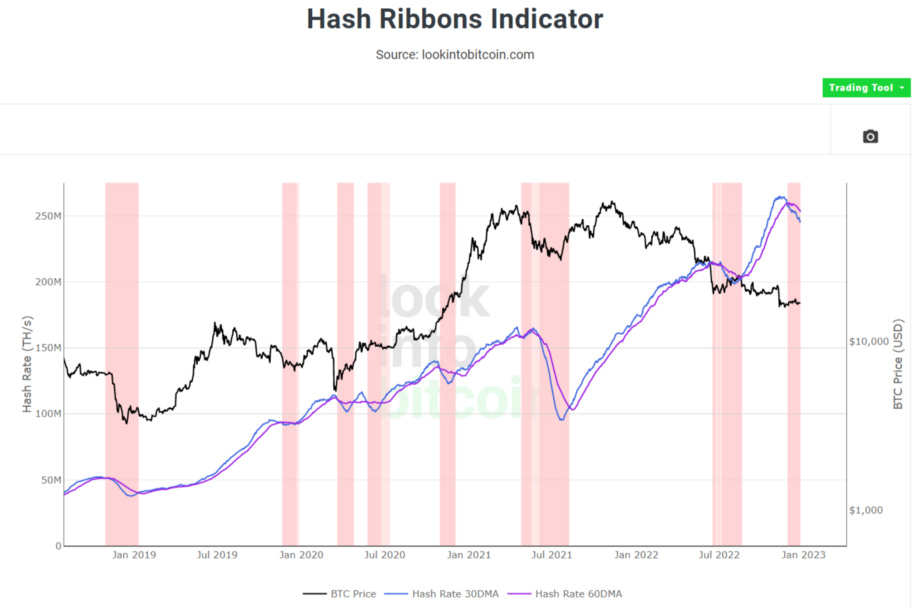

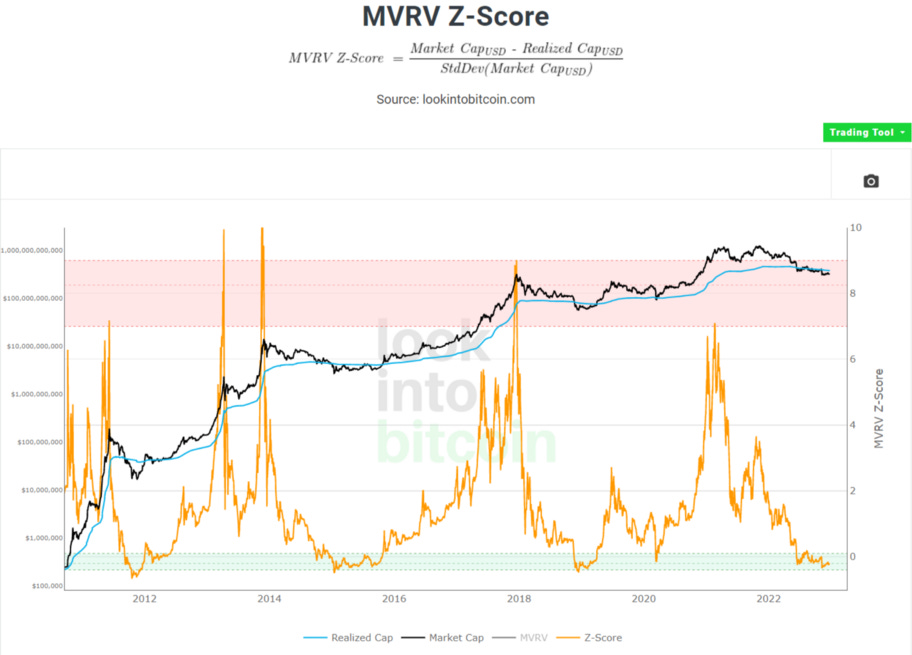

Author: Joey Wu This article is only a personal opinion, does not constitute investment advice, does not represent WuBlockchain’s opinion. 1. Bottom of the big cycle: 2023 is likely to be A year of recovery (not just for the crypto market, but also for the A-share market) for the following reasons. 1) Price below Cost In times of extreme greed or extreme panic, people tend to ignore the underlying pricing logic of assets and focus too much on the news side. BTC is essentially a mineral resource, and its underlying pricing logic is that production costs determine the market price. When there is too much hot money in the market, BTC will gradually leave the commodity property and become a speculative product, and the price is much higher than the cost at this time; Otherwise, it will gradually return to commodity attributes. So the standard for determining whether BTC is speculative or digital gold is whether the price is below cost. When the price is below cost, even the most loyal producer have left the market, how much is left for speculators? This is why BTC would follow the US stock market in the bull market, but now BTC does not follow the US stock market up or down. Using U.S. stocks to predict crypto markets may not work in the year ahead. There are two main elements to measure BTC cost: average cost of miners and on-chain transfer cost. I think there are three indicators that can effectively measure the two: Puell Multiple, Hash Ribbon, and MVRV Z-Score. The first two measure miner costs and the latter measure on-chain transfer costs. Interference items must be discarded during the analysis of on-chain data. Many people blindly believed in some new indicators during the whole decline of BTC and took bottom fishing in advance. Now, when the real core indicators showed a buy signal, they said that the on-chain indicators had become invalid or useless. On-chain indicators are always valid, but they must be metrics that truly reflect the underlying logic of the asset. Moreover, indicators guide long-term prices, so it is not unusual for prices to continue to consolidate for months after a buy signal. 2) The pace of interest rate hikes slowed At present, the interest rate has been 4.25%-4.50%. In the first half of next year, the interest rate will continue to rise, but the space will not be too large. It is expected that the subsequent increase will be 50 or even 25 basis points, until it stops around 6, so the interest rate hike has gradually come to an end. However, with the global economy set to fall into recession next year, many investors are betting that BTC prices will continue to fall. However, in fact, at the end of the Federal Reserve’s interest rate hike and the early stage of the recession, the demand for goods did not decline significantly. At this time, the financial attributes of goods often dominated the price of goods, and the financial conditions improved significantly with the slowdown of interest rate hike, so the improvement of financial conditions was often stronger than the deterioration of demand. In each of the past six rate hikes, commodities bottomed out for about half a year. In gold, for example, half are in a state of bottoming out: in 1984, gold bottomed out and then oscillated; In 1989, gold continued to fall; In 2000, gold fluctuated downward; In 1995, 2006 and 2018, gold fluctuated upward. All in all, the overall policy direction next year is dominated by slow interest rate hikes, and the market is unlikely to enter a bull market, but there is a high probability that the unilateral decline will turn into a volatile upward or wide shock (refer to 2019). In September, I wrote this paragraph: “The crypto market, like the stock market, reflects people’s expectations about the future economy. The crypto market started its downtrend while people were still under the illusion that a higher dollar rate would not hit the market. Now, the market is divided on whether the U.S. economy is about to enter a recession. Once the U.S. economy starts to officially enter a recession or geopolitical conflict flares up in full force, the bottom will be there.” Now, with the FTX explosion, the collapse of mining companies and the layoffs of leading American companies, most people are aware that the global economy will be in recession next year. Moreover, the two big variables mentioned then: the mid-term elections in America, appointments in China and pandemic policies have now all been settled (much earlier than expected). 3) Technical analysis The current five-wave decline at the weekly level is complete from the perspective of wave theory. In the short term, if the price can make new lows, it can be at the daily and weekly level at the same time the bottom divergence, so perfect. The perfect price, around $12,000, is the price that everyone is looking for, but will the market make everyone happy? It is more likely that either the bottom is well below $10,000 or that this is the bottom. If the market chooses the former, then all of the above analytical methods will fail and the downtrend pattern will be completely destroyed, and the various analytical methods will be replaced by FUDs. In investing, the right method of analysis is more important than the right result. 4) Emotions Everyone’s perception of market sentiment is different, and this conclusion is one-sided. I only describe my feelings on the emotions of people around me. At present, I am surrounded by various FUDs, including those predicting BTC regression to 2015, and those predicting all crypto assets except BTC return to zero, most of whom expected 100,000 a year ago. Once $30,000 was the bottom of their minds, now they can’t even think about it. In terms of investor sentiment, I don’t think it can get any worse. 2. Allocation of assets Since next year is a year to repair confidence, everything should be focused on core assets, BTC and ETH. For the rest of the assets, I only focus on the highly deterministic fields, namely public blockchains, DeFi, and mining halving. 1) Core assets The most anticipated upgrade after the ETH merge is naturally sharding, but sharding is still at least two years away from maturity, so there isn’t much to look forward to next year. In addition, with the amount of VC financing decreasing month by month, investors are in a waitand see state, so the activities on the chain will not be very active next year, which will lead to a great discount in the use value of ETH network. Once the value of the network declines, the relative advantage of ETH over BTC diminishes, so the ETH/BTC exchange rate next year should not be higher than last year’s bull market. Currently ETH/BTC remains above 0.07, and personally, 0.06–0.07 is a reasonable range. 2) Public blockchain The development of public chains mainly revolves around three themes: L2, ZK and modularity. However, the latter two tracks have no mature projects online for the time being, and obviously there are no core assets. In terms of L2, OP is the only project that has launched tokens at present. Currently, OP is inferior to Arb in terms of fees and experience, and its own value capture ability is weak. However, from the price performance point of view, OP is relatively strong, currently in the stage of convergence and shock, once it breaks through the upper edge of the triangle, the imagination of the first half of next year is not small. Although there are many public blockchains in the market, they are not irreplaceable. If you are bullish on this field, it is enough to buy the leading asset ETH (the TPS of ETH in bear market is enough, there is no need to pursue higher performance). The competitor of future public blockchains is L2, and instead of investing in new public blockchains, it is better to focus on L2. In addition to the above three themes, the most anticipated development direction of the public chain track is the application chain. Leading projects such as Uniswap and Curve deserve to occupy a separate blockchain, which is why Cosmos has been my most optimistic public blockchain (except ETH) for a while. Compared to the complexity of ETH L2, Cosmos is much easier to build application chains, which makes it irreplaceable. However, with the 2.0 security model proposal rejected, Cosmos’s narrative for next year is more ambiguous, and whether it can catch the rebound depends on the community reaching a consensus. 3) DeFi DeFi’s past year has been nothing short of remarkable. I think the only thing to look forward to is the development of algorithmic stablecoins. After the Luna crash, there wasn’t a compelling algorithmic stablecoin on the market anymore. But I believe these kinds of products will come back, and the Defi world will never be fully decentralized without algorithmic stablecoins. Curve currently issues crvUSD, but the public white paper does not show what the collateral is, so we do not know which assets this will benefit. Empirically, the most likely assets to serve as collateral are again BTC and ETH. If CRV can also capture value from it, that would be absolutely positive for the price of the coin. 4) Mining Halve The rebound logic of the old tokens is little different from that of BTC. As long as the PoW model does not disappear, the asset price can always move up and down around the cost. Among the old tokens that will be halved next year, LTC and DASH are mainly worth looking forward to, which are also performing very well at present, both in a state of “rising rather than falling”. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish |

Older messages

Review the Top10 important events of 2022: FTX CRASH, ETH Merge, FED Rate Hikes, LUNA, BAYC, Tornado and more

Tuesday, December 27, 2022

Written By: Colin Wu 1. FTX crashed and contagion There is nothing more important for the industry in 2022 than the collapse of the FTX, where SBF suddenly degenerated from being a builder of a huge

Global Crypto Mining News (Dec 19 to Dec 25)

Monday, December 26, 2022

1. The National Weather Service has reported blizzard conditions from the Midwest to the Northeast, with a cold snap that will result in below-freezing temperatures in about 80% of the United States.

Asia's weekly TOP10 crypto news (Dec 19 to Dec 25)

Sunday, December 25, 2022

Author:Lily Editor:Colin Wu 1. Tokocrypto has been officially acquired by Binance link The Indonesian exchange Tokocrypto has been officially acquired by Binance, and about 58% of its employees have

Weekly project updates: Mojito Markets suspends development, Waves' new stable coin, Uniswap partners with MoonPay…

Saturday, December 24, 2022

1. Aptos' weekly summary a. Aptos eco DEX project Mojito Markets suspends project development due to FTX/Alameda crash link Mojito Markets, an Aptos ecological DEX project, announced that it was

WuBlockchain Weekly:DAO legislation in Marshall Islands、SBF court appearance、OKX down and Top10 News

Friday, December 23, 2022

Top10 News 1. DAOs recognized as limited liability companies by the Marshall Islands link In a world-first, the Republic of the Marshall Islands announced that the government has passed the

You Might Also Like

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: SEC Terminates Lawsuits Against Multiple Crypto Companies, Bitcoin Drops Below $80,000, OKX S…

Friday, February 28, 2025

On Friday, OKX market data revealed that BTC fell below $80000, reaching a low of $78258, with the current price at $80514, reflecting a 24-hour decline of 7.22%. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

FBI confirms North Korea-backed Lazarus hackers stole $1.5 billion from Bybit

Thursday, February 27, 2025

FBI tracks Ethereum laundering spree by North Korean hackers amid rising threat of cyber warfare in the crypto world. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with MicroStrategy Founder Michael Saylor: The Company Holding the Most Bitcoin in the World

Thursday, February 27, 2025

In this interview, Colin from WuBlockchain had an in-depth discussion with MicroStrategy founder Michael Saylor about the company's ongoing Bitcoin acquisition strategy, the growing adoption of

Abu Dhabi Invests $436.9M In Bitcoin ETF

Thursday, February 27, 2025

February 17th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Abu Dhabi Invests $436.9M In Bitcoin ETF Changpeng Zhao Sparks Meme Coin Rumours Coinbase Finally Lists POPCAT & PENGU

📈 BTC’s realised price (average acquisition price) reached an all-time high of $43,000; State of Wisconsin Invest…

Thursday, February 27, 2025

BTC's realised price reached an all-time high of $43000; Abu Dhabi's Mubadala Investment disclosed its BTC ETF holdings; South Korea to allow universities and charities to sell crypto donations

HashKey Exchange's Interpretation of the Hong Kong SFC Virtual Asset Roadmap

Thursday, February 27, 2025

We are pleased to see the Hong Kong government release the forward-looking and pragmatic “ASPI-Re” roadmap for advancing the virtual asset industry. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Argentina’s stock market plummets amid President Javier Milei’s LIBRA memecoin scandal

Thursday, February 27, 2025

Argentina's economic landscape shaken as Milei's LIBRA endorsement turns into multi-billion dollar fiasco. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Heated AMA Debate: 0G Team Responds to Allegations of CFX Soft Rug, Overvaluation, and Token Commitment Concerns

Thursday, February 27, 2025

This AMA primarily focused on the relationship between Conflux and 0G Labs, discussing 0G Labs' high valuation, fundraising structure, technical direction, and community concerns over transparency.

Pectra: Ethereum’s Next Major Upgrade

Thursday, February 27, 2025

Breaking down key changes included in Ethereum's Pectra hard-fork ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏