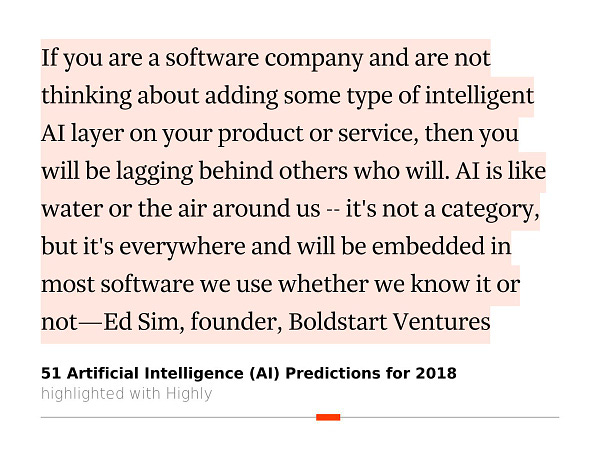

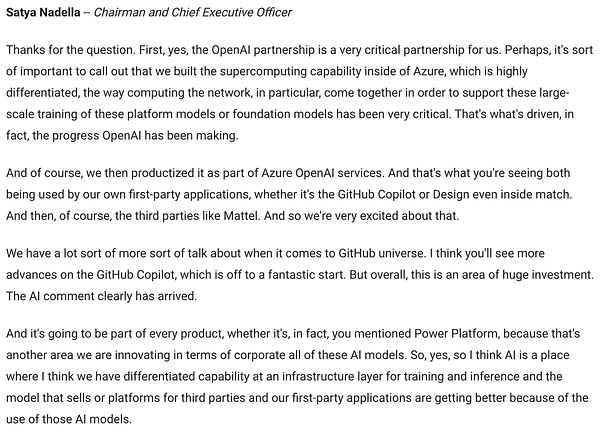

| As I sat down reflecting on this past year and what’s ahead for 2023, it’s quite clear to me that I’m not very good at predictions. Making predictions for me is more of a forcing function to step back and aggregate themes or trends from the past year and try to extrapolate those heading into the next year. It’s a great way for me to pause and zoom out. With that backdrop, I decided to look back at some of my way too early predictions from the past 7 years, and my theme this year is “what’s old is new again.” Technology rhymes for sure, and this year with the market correction, I see many themes from years past repeating and rhyming. We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run. Roy Amara So here they are…much overestimated in years past and continuing its upward arc into 2023. OpenAI giveth and taketh away: It’s probably one of the best things to happen to the startup ecosystem since the cloud became real but don’t rush into starting an OpenAI or ChatGPT company as any one can use the same foundational model. Founders and investors have to still focus on the problem that is being solved and remember that AI may help users be way more productive, but its not a business. I don’t see a full market here, but more the fact that this will be embedded into every single application. Notion AI has already done so, and Satya from Microsoft says it will embed OpenAI in all apps. The tech is amazing, but to start a standalone business with the same models everyone else can use and compete with existing SaaS cos with massive distribution is not for the faint of heart. From Dec 2016 (boldstart in 2016, enterprise tech in 2017) AI is table stakes for any enterprise app, not a separate market but weaved into every app from SaaS to infrastructure like CRM, BI, BPM, monitoring and security. (boldstart recap 2016) And from November 2017

Here’s what Satya had to say about OpenAI in October Too many developer tools = need better developer experience as DevEx = increased developer productivity, building and shipping product faster. With the rise of the developer, we now have way too many tools which have shifted ⬅️ and now need to integrate them all to work seamlessly with self service for developers and centralized governance from corporate. If you’re a developer first company and don’t have a plan to hit these budgets with real ROI, you’re in deep trouble. Many enterprises are spinning up their own teams to build these integrations and workflows - this is also known as platform engineering which Daniel Bryant has discussed here. Hashicorp (see What’s 🔥 319) has made a living selling to the new platform engineering teams. My partner Shomik Ghosh is also quoted in TechCrunch discussing some of our boldstart portfolio cos like Env0, cloudquery, Spectro Cloud, Roadie, and Jeli. Same theme from forecast for 2021 except it now has a name with a budget. From Dec 2020 (boldstart 2020 recap and what’s 🔥 in enterprise 2021) 4/From developer first to embedded workflow: And there you have it again, the word “workflow”. Product led growth only works when a product is designed to make a user of one a superhero. Same goes for developer first companies and the trick is to know how to embed easy invites and interactions so a user can easily share with their team. From there, the journey from user of one to small dev team and organization begins. Given the number of developer first and open source companies that are all funded with a fair amount of capital, this means that not every company will succeed in making this journey from individual to team workflow. For enterprises, finding that balance between speed, developer empowerment and self service capabilities versus centralized policies and governance will be an ongoing battle in 2021, especially as we live in a hybrid working world. One project to keep an eye on is Backstage (from Spotify) which is an open source platform for building developer portals and Clutch (from Lyft) which is similar in vein. Other areas that will be 🔥 include infrastructure as code automation with companies like Env0 (a portfolio co) and git-like version control from companies like Optic which is Git for APIs.

Steak 🥩 dinners are back - there are 3 trends related to this - rise of OpenAI will mean way more spam and the noise for targeted buyers will be higher than ever. Some backlash starts over product led growth everything as you still need to sell (read more on my thoughts on PLG as a continuum). Tighter budgets means getting more done IRL, in person, so dinners are back as IMO every startup eventually sells to the enterprise with direct reps, it’s just a matter of sequencing and timing. Focus on efficient growth continues but best companies who got ahead of burn management will have the opportunity to acquire new logos with a land and expand model as others pull back. From December 2018 (boldstart 2018 recap/what’s 🔥 enterprise 2019) Balanced growth vs. growth at all costs: No conversation about 2019 will be complete without considering the uncertain economic, financial and geopolitical environment in which we are currently living. The 10 year bull market where every company’s revenue chart is up and to the right is over. Many startups were funded on growth alone and this is the year that efficient growth plays a huge part in determining who the next winners will be. Startups should also make sure they are well funded for 24 months and have contingency plans to put on the brakes in case another nuclear winter occurs. Look at 2001 and 2008’s Lehman collapse and Sequoia RIP Good Times deck for lessons learned.

Year of Day 2 Cloud Ops: Phase 1 was all about migrating workloads to the cloud, but Phase 2 is about Day 2 Operations; securing, operating, managing and 👆🏼 making the cloud more efficient. As the economy heads towards a recession and cloud growth has been 🤯, its time for companies to finally prioritize FinOps and other efficiency categories in 2023. This covers not only the cost of cloud instances but also consumption spending on data and SaaS applications. My prediction for 2020 was a bit early 😃 but this is the year. From December 2019 - pre-COVID (boldstart 2019 recap and what’s 🔥 in enterprise 2020) Rise of FinOps: As cloud and SaaS continue to dominate, the sheer costs of cloud hosting are becoming a bigger and bigger line item under cost of goods sold. While version 1.0 was all about analyzing cloud spend reactively, the next generation will need to be proactive and help companies set policies upfront and understand, control, and manage these costs dynamically. FinOps helps companies address this problem as it’s incredibly complicated for someone in finance to know why costs spiked because a new product release was made or because data science used more GPUs to train their model. Coordinating all of these processes and allowing companies to set policies while providing self service will be the basis of many new companies in 2020. With infrastructure as code rising, we believe that the opportunity to proactively manage and codify this is already happening and that’s why excited about companies like Env0 (a portfolio co).

1 Large Acquisition in Cloud Security: One of largest spend categories for Day 2 Cloud Ops will be cloud security which is a team sport as security professionals, developers, and cloud/platform engineering teams all need to work together. There are so many entry points to sell into this market from shift ⬅️ developers, to top down CISOs or cloud/platform engineering teams and this, IMO, will be the #1 battleground for old school incumbents looking to aggregate each entry point into an organization. The 💰 up for grabs is mind blowing, and there will be a large acquisition in this space as Palo Alto Networks, Datadog, Google Cloud, AWS, and Microsoft continue to expand their footprint into developer and cloud security. They will look to catch up to pure plays in the cloud security market like Wiz and Orca and startups in the shift ⬅️ developer security market like Snyk. A close second in the cloud security space will be the DSPM (Data Security Posture Management) market as Palo Alto, Wiz, and others look to expand - keep an eye out for BigID (a port co) who is an early leader in this market. From Dec 2020 (boldstart 2020 recap and what’s 🔥 in enterprise 2021) Security continues to go developer first: For the last 20 years, security has…

Blockchain/crypto - yes I still believe - it’s the best time to invest in crypto infra now due to the double whammy of interest rates and negative sentiment on crypto. DeFi works but still need to solve for security issues if crypto goes mainstream and onboarding for non-degens. From last year, Dec 21 (boldstart 2021 recap & what’s 🔥 in enterprise 2022) The next big thing in 2022 is blockchain is the new “dev tool” as many long time enterprise founders rush to explore and build newcos in crypto infra and enterprise investors fund any company with “enterprise + crypto.” Despite the number of companies that don’t make it, there will be a handful of foundational companies started in 2022 that will create returns that far exceed the money lost.

🦄 Bloodbath in 2023 of not only orphaned companies but bankrupt 🦄 and down rounds galore! The late stage market in 2023 will finally start to open up in Q3 as many 🦄 run out of cash, and finally begin to accept down rounds with no structure. BTW, this resetting will be painful but also healthy for the industry. From last year, Dec 21 (boldstart 2021 recap & what’s 🔥 in enterprise 2022) Rise of orphaned companies — Speed bumps will surface for overcapitalized companies who raised too much 💰 too early and who tried to stay on the trajectory of super fast growth to be one of the top companies but fell short — lots of pain will surface in 2022 from these companies that overspent and don’t have much to show for it.

Lots of startups who raised capital in the height of the market will shut down as there are no more acquihires. There will still be some strategic acquisitions of startups but those will be few and far between until founders and investors adjust their price expectations. On the acquihiring front, the amount of talent available is only increasing which makes acquihires less appealing. In addition, most companies are cutting back burn and paying cash for a team to increase burn when talent is available makes little sense. Hence, it’s going to get ugly in 2023 on that front, especially as heads of Corp Dev that I’ve spoken with in the last 3 months tell me to take a ticket and get in line - there are more companies banging on their doors than they’ve ever seen. One bright spot could be some startups being rolled up into larger companies who have PE-backed sponsors. Either way, founders, find a way to control your own destiny. Chat is the new hot UI - because of ChatGPT, we’ll see a number of SaaS cos use the chat/messaging UI as standard form. WASM (first appeared in 2017) is the 🔥 new infra category as it moves from front end web browsers to server side to cloud and edge, providing super fast boot up times and crazy extensibility as developers can write in any language and compile to work on most platforms. Expect all the developer tooling to be built around supporting developers and operations to easily build, run, scale, and secure WASM infra. Take a look at Bytecode Alliance for some of the participants and Extism which just launched its universal plugin.

Finally here’s a 2022 recap for boldstart - I’m still amazed at all the founders were able accomplish in such a turbulent year. As always, 🙏🏼 for reading and please share with your friends and colleagues. Happy New Year to you and here’s to hoping the markets and economy recover faster than expected.

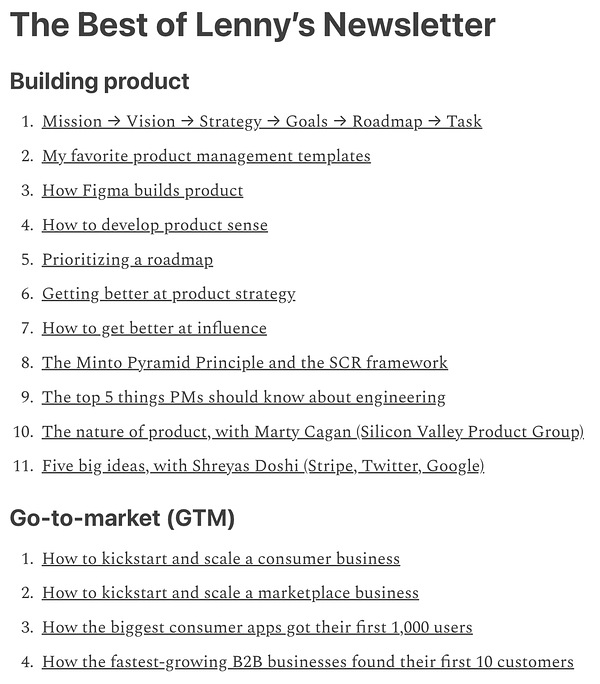

Small is fast, small is beautiful Lenny’s greatest hits

What’s ahead for cloud ☁️ in 2023 according to Snowflake

| |