Exclusive – Simplebet scouting NCAA games

Exclusive – Simplebet scouting NCAA gamesMicro-betting supplier goes in-stadia for data, November sees OSB declines across majority of states, startup focus – Outlier +MoreGood morning. On today’s agenda:

Simplebet’s NCAA scoutingThe micro-betting provider says it is gathering data about NCAA games with an eye on launching a College game-focused product. Somebody’s watching me: Simplebet is seeking to expand its suite of instant-gratification betting products to College sports and is scouting NCAA games in order to access the data, according to COO Mark Nerenberg. Talking to E+M, he said the company “really wanted a College football product”, while for basketball the company would be aiming at being up and running for March Madness.

Well connected: Nerenberg said the NCAA “knows” Simplebet is already scouting games. Without naming any specific Colleges, he said Simplebet had “spoken to various schools”. “We are very connected in the College space.”

Background: As it stands, the status of NCAA data for betting purposes remains murky. Genius Sports is the official data partner of the NCAA but this is limited to the NCAA LiveStats product for media and coaching purposes. The organization does not have a data partner for betting reasons and if it did that would be limited to NCAA championship data, not regular season or conference championship stats.

Micro footprint: Simplebet’s micro-betting product is currently live with DraftKings and Caesars and covers NFL, MLB and NBA. Nerenberg said the format was a “tech challenge” where the collection of data was central.

**Sponsor’s message** Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. The Gaming Fund, regulated by the Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy. Yolo Investments has just opened its fund to new investors as it looks to scale new cutting-edge concepts, including its exclusive high-roller land and live casino brand, Bombay Club, global banking network & OTC desk Aims Group. New York casino raceThe snappily named New York Gaming Facility Location Board has kickstarted the process for issuing three downstate casino licenses. Green field: Last week, the RFA process for what the analysts at CBRE suggested is the “most lucrative remaining greenfield casino opportunities in the US” was launched by the New York state gaming authorities. But the opportunity comes at a cost, the team pointed out.

In it to win it: CBRE suggested MGM Resorts is well-placed to win one of the licenses, expanding on its current Empire City slots-only property in Yonkers.

November analysisRecord iCasino GGR in November is offset by weak sports-betting GGR, says Truist. Highs: US iCasino GGR across the six regulated states increased 34% YoY to hit a new monthly record in November at $463m, according to the analysts at Truist. The team added that November was the fourth straight month during which operators recorded more than $400m in GGR.

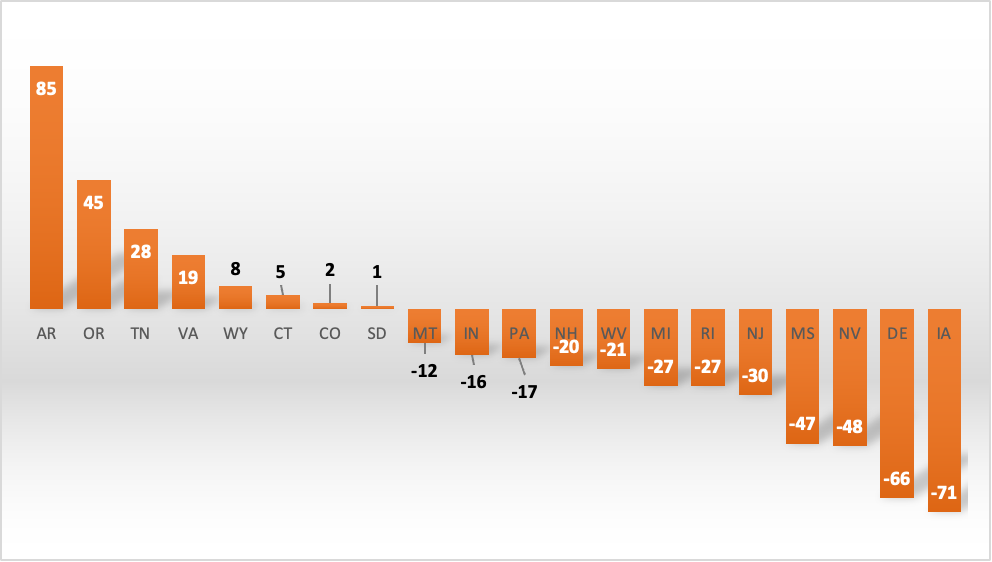

Lows: On the OSB front, with 85% of states having reported November figures, Truist said bookmakers experienced a 20% YoY drop in GGR, despite handle rising 26%. Truist added that early December data was mixed, with handle and GGR tracking at +46% and +64% YoY respectively.

🚧 OSB GGR YoY in November – LA’s 545% fall excluded due to scaling

Hitting the brakes: The GGR for land-based casinos decelerated to ~1% YoY growth in November, which Macqaurie ascribed to a “slight” consumer reaction. “There’s nothing that’s meaningful to financials,” the team added.

Quarterly hold: In a separate note, Macquarie estimated Q4 marketwide hold will come in at 8%, suggesting this strong result will add ~1.5k bps of incremental GGR growth. But the team added that this 8% number is being dragged up by FanDuel and the proliferation of same-game parlays. For most operators, they predicted GGR hold will be between 50-100 bps lower.

DatalinesIowa: Casino GGR was down 3.5% YoY to $142.5m in December. Sports-betting GGR was up 55.2% YoY at $20.7m, with handle dropping 13.7% to $230m. Virginia: Sports-betting AGR was up 76.2% YoY to $52.8m in November, with handle rising 28% to $518.8m. Operators recorded margins of 11% during the month. Washington DC: Sports-betting GGR fell 40.% to $2.6m in November, but handle rose 4.3% to $22.3m. Wyoming: Sports-betting GGR rose 8.3% to $1.4m. Handle also rose, up 52.2% to $16.7m. Historical horse racing revenues increased 39.4% to $9.4m in November. Analyst takesSector outlook: Jefferies’ analysts suggested that, in the context of a recession, the gaming sector will remain out of favor with investors and they have “narrowed” their sector view in response. As a result, they have downgraded Penn Entertainment, Golden Entertainment and Sportradar.

VICI: JMP’s analysts saw the gaming REIT as remaining “aggressive on the deal front” this year, given ample liquidity, a low cost of capital and a robust pipeline. They also expected non-gaming investments to be a continuing theme. Startup focus – OutlierWho, what, where and when: Founded in 2019 by Evan Kirkham, Luis Lafer-Sousa and Peter Reggio, Colorcast – now Outlier – has launched a sports-betting platform allowing bettors to browse, analyze and execute picks from any major sportsbook in one place. Funding backgrounder: The latest Seed funding round closed last October raising $3.7m, with Next Coast Ventures taking the lead and follow-on investments from Alumni Ventures, Tribeca Early Stage Partners and Connetic Ventures, among others. The pitch: “The big innovation is the stitching of every piece of the bettor's user journey into one seamless flow,” says Kirkham, who adds that Outlier will be bringing all of the relevant information to the point of execution. “It’s one seamless flow on any of the major books, in two-clicks.”

What will success look like? “I'd prefer to keep this a little close to the chest if that's ok,” Kirkham says. The week aheadThe latest edition of Deal Talk will be sent tomorrow. It includes a look at the bid for PointsBet’s Australian-facing operation from Betr, analysis of sector M&A in 2022 and E+M’s estimates for the value of transactions in the last 12 months. NewslinesKambi relief: The sports-betting backend provider has signed a deal extension with major client Rush Street Interactive that will see Kambi support “continued growth in existing markets and expansion into further jurisdictions in the future”. Kentucky legislators have introduced a bill that would legalize online poker and online and retail sports-betting in the state. The tax rate for OSB would be 14.2% and 9.7% for retail betting. Go ahead: Waukegan City Council has unanimously approved permits for Full House’s The Temporary by American Place Casino. What we’re readingThe race: F1 takes a gamble on Vegas. A knight’s tale: The remarkable rise of chess.com. On social David Beckham's 2nd son arrived at training for Brentford, he asked the coach "What number shirt am I?"

The coach said "Wear four out there Romeo…” CalendarJan 10: Deal Talk #6 Jan 17: Due Diligence #3 Contact

|

Older messages

Weekend Edition #79

Friday, January 6, 2023

Bet365's year, Caesars vote of confidence, Fanatics' Candy talk, Genius/BetConstruct settlement, sector watch – Italian cash access +More

The Startup Month #6

Tuesday, January 3, 2023

The growth company funding environment for the year ahead, a look back to the funding achieved in 2022 +More

Ohio opens – without Fanatics

Monday, January 2, 2023

BetFanatics fails to launch in Ohio, other Betr makes PointsBet bid, Genesis Global goes belly up, startup focus – Players Lounge +More

Weekend Edition #78

Friday, December 23, 2022

UK regulation review, Massachusetts licensing, Churchill Downs' Exacta deal, iCasino pivot, the esports betting year +More

Due Diligence #2

Tuesday, December 20, 2022

The pivot to iCasino in the US, plus recent analyst takes

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏