Earnings+More - Deal Talk #6

Deal Talk #6PointsBet’s Oz sale, sector-related M&A deals in 2022 worth $10bn, IGAC SPAC downs PlayUp merger, gaming affiliate M&A is back (sort of) +MoreGood morning and welcome to edition #6 of Deal Talk. This month we are discussing:

My love and I, we work well together but often we're apart. All Points southThe news that PointsBet is in talks about the sale of its Australian sports-betting business has implications for its US ambitions. He’s been: Just after Christmas, PointsBet confirmed to the Australian stock exchange the pre-festivities story in The Australian that it had received a A$250m approach for its Australian-facing business from NTD, which operates the Betr brand. A subsequent ASX communication said talks were initiated in mid-November.

Who’s NTD? Not to be confused with the recently launched US-facing micro-betting operator betr, the company behind betr.com.au is jointly owned by BetMakers Technology, Tekkorp, News Corp and former BetEasy chief executive Matthew Tripp.

Chance your arm: As sources suggested, this is an opportunistic bid. In the past year, PointsBet’s shares are down over 72% and following the temporary boost of the June bid they have fallen 63% since the mid-year point. 🎢 PointsBet’s share price slide in 2022 As PointsBet noted in its ASX statement, “any potential transaction will be assessed in the context of PointsBet’s global strategy and opportunities”. Rokker’s Business Design services deliver global gaming clients with research and insight alongside actionable strategy, clarity and alignment. We research, analyse and ideate to address the challenges and opportunities that affect our client’s product, proposition, people and process. Our work aligns clients’ boards and teams in building businesses people love. To find out more visit: https://www.rokker.co.uk/ What’s it worth?The figures: The Australian business generated gross win of A$338.4m (US$232.9m at current FX rates) from total gross win of A$497.8m or 68% of the total. Net win was A$215.4m or 70% of the total of A$309.4m.

Synergies: The rumored price of A$250m appears expensive and would equate to a EBITDA multiple of ~32x. But sources suggested the cost synergies would be significant, with Betr able to eliminate duplicate tech and trading teams and move to a single brand. Bleeding money: The problem with PointsBet is the cost of its US operations. Doing a similar exercise as E+M did with DraftKings in a recent Due Diligence edition, it can be seen that the North American losses of A$213.1m helped tip PointsBet into a loss from operations of A$250m.

Runway: As with others in the US market, the question turns to whether PointsBet has the liquidity to reach profitability. Set against its operating losses is a cash position minus player balances of A$427.2m. Most recently, in June PointsBet raised $94.2m after SIG Sports Investments Corp., an offshoot of financial group Susquehanna International, bought a 12.8% stake.

The tracks of my tiers: According to one advisor, PointsBet’s separate Australia and US operations are ripe for being part of consolidation plays in their respective markets. But not together.

PlayUp SPAC offThe IG Acquisition Corp. SPAC calls off its merger with PlayUp. Inevitable: As was predicted in the last edition of Deal Talk, the always improbable merger of the IGAC SPAC and largely Australian-facing PlayUp has been called off after the SPAC informed the SEC that it has served a termination notice. IGAC will now be dissolved, with outstanding shares being redeemed.

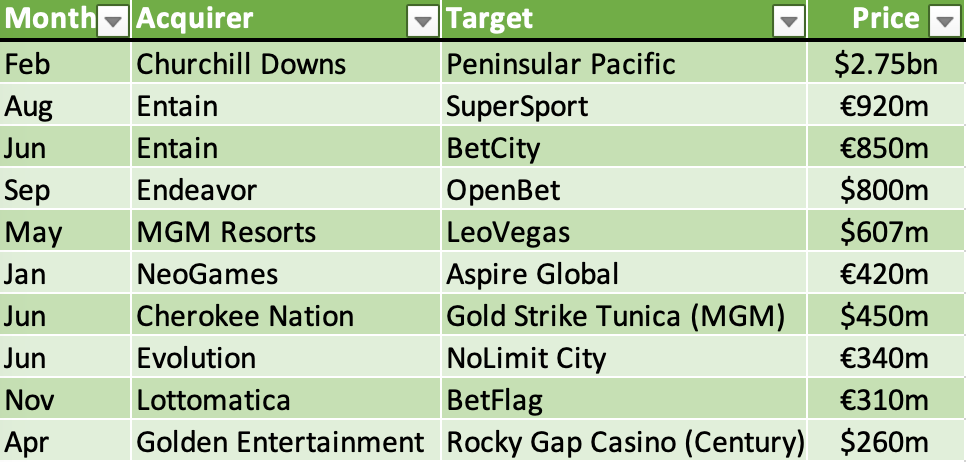

M&A in 2022Over $9.8bn of M&A transactions were tracked in the past 12 months. The big ten-0: According to the transactions tracked across the course of 2022, at least $9.8bn of sector-specific deals were completed in 2022. Taking account of the deals where the amounts were not disclosed, E+M estimates that ~$10bn of M&A was completed over the course of the year.

🎯 The top 10 M&A transactions in 2022

Signs of stress: It is possible to discern a drop off in activity in the latter half of 2022. Included in the top 10, for instance, is Endeavor’s completion of its deal for OpenBet, originally announced in September 2021.

Further reading: Global deal-making suffered a record fall during the second half of this year as rising interest rates and economic uncertainty saw M&A activity freeze. And there was no surge in Q4. The month in transactions

Affiliate M&A – slight returnGiG’s €45m deal for AskGamblers is the big news from the gaming affiliate space. Question time: Better Collective remains the daddy of gaming-related affiliate M&A, with its €105m deal for the esports-focused Futbin in April being the biggest deal for the sub-sector in 2022. But arguably of more significance for the sector is GiG’s deal to buy AskGamblers and other European-facing assets from rival Catena Media.

👀 BREAKING: Notably, just this morning Catena Media announced it had appointed Carnegie Bank to advise on a potential sale of the company’s remaining assets.

In other recent gaming affiliate M&A news, US-facing affiliate Betsperts acquired Bleacher Nation for an undisclosed sum in a cash-plus-equity deal in late December. This follows on from Playmaker’s $31m purchase of Wedge, Seven Star’s deal for Moneta and Acroud’s deal for further Catena assets, which all occurred in October. On socialBet365 in Pennsylvania…  There will surely be a lot of people reading into this but it's just a market access agreement. Been a while since these were press release-worthy announcements

ir.churchilldownsincorporated.com/news-releases/… Contact

|

Older messages

Exclusive – Simplebet scouting NCAA games

Monday, January 9, 2023

Micro-betting supplier goes in-stadia for data, November sees OSB declines across majority of states, startup focus – Outlier +More

Weekend Edition #79

Friday, January 6, 2023

Bet365's year, Caesars vote of confidence, Fanatics' Candy talk, Genius/BetConstruct settlement, sector watch – Italian cash access +More

The Startup Month #6

Tuesday, January 3, 2023

The growth company funding environment for the year ahead, a look back to the funding achieved in 2022 +More

Ohio opens – without Fanatics

Monday, January 2, 2023

BetFanatics fails to launch in Ohio, other Betr makes PointsBet bid, Genesis Global goes belly up, startup focus – Players Lounge +More

Weekend Edition #78

Friday, December 23, 2022

UK regulation review, Massachusetts licensing, Churchill Downs' Exacta deal, iCasino pivot, the esports betting year +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏