Not Boring by Packy McCormick - Announcing Not Boring Capital Fund III

Announcing Not Boring Capital Fund IIIA $30 million Fund to invest in Hard Startups and tell their storiesWelcome to the 4,534 newly Not Boring people who have joined us since December! If you haven’t subscribed, join 181,387 smart, curious folks by subscribing here: Hi friends 👋, Happy Tuesday and Happy New Year! After a nice winter break and hours spent staring down my Blank Page, we’re back! Let’s kick the Not Boring new year off right: by announcing Not Boring Capital Fund III and inviting you to join in. I’ve been waiting to do this for a while and I can’t wait any longer, so let’s get to it. Introducing Not Boring Capital Fund IIIFirst things first, Not Boring Capital is back for Fund III: a $30 million fund. I’ve said it before and I’ll say it each time: there wouldn’t be a Not Boring Capital without all of you reading and sharing and giving feedback on Not Boring, so as with Funds I & II, I flipped the switch to 506(c) in order to invite Not Boring readers to get involved.

The interest in Funds I & II blew me away. The first time we did this, for Fund I, 903 of you expressed $47.5 million of interest. The second time, for Fund II, 1,543 people expressed $135.6 million of interest. This is a very different market, but I’m nervously optimistic. If you’d like to join us on our mission, you can submit your interest here: We want our LP group to be one of the big levers we bring to bear for our portfolio companies, so we’re being selective in how we put together the fund. We’ll be prioritizing people traditionally underrepresented in LP bases, long-time Not Boring readers, investors who have participated in syndicate deals, bigger checks who want to back NBC over multiple funds, and LPs who can add insights into the categories in which we’re investing and superpowers to our companies. I’ll reach out to as many people as we can accept ASAP. A note: In case the last year hasn’t proven this point, let me repeat it: venture capital funds are risky and illiquid. Simply put: don’t invest money you’re not willing to lose, or to keep locked up for a decade. If things go well, we’ll be returning capital in 7-10 years. So what’s new with Fund III? Over the past year, I’ve realized that we have the opportunity to make Not Boring Capital a top tier venture fund that’s around for decades, and to do that, we need to evolve. The core of Not Boring Capital remains the same: help companies tell their stories. It’s just getting some upgrades. Fund III is the harder, better, slower, stronger evolution of Not Boring Capital:

What got us here was good for a Solo GP, but it’s not enough if we want to build an enduring, top decile fund. I’ve spent a lot of time thinking about what will. There are strands of my thought process in last year’s essays like The Good Thing About Hard Things, Decentralization, Working Harder and Smarter, The Not Boring Liquid Super Team, and Optimism. If those pieces have resonated with you, I think you’ll like what we’re up to in Fund III. It’s the distillation. Not Boring’s mission is to make the world more optimistic, and the best way I know how to do that is to invest in, write about, and support the companies that give us reason to be excited about the future. Not Boring’s competitive advantage is our ability to help companies shape their narratives, and that resonates most clearly with founders of complex businesses with bold ambitions. Not Boring Capital’s main responsibility is to generate exceptional returns for our LPs, and I believe that we’re fortunate to be living in a time when complex businesses that solve hard problems and make the biggest positive impact will drive the biggest financial outcomes. Things are changing quickly. That’s been a theme in Not Boring since the beginning, and it proves more true each day. Just last year, humans achieved fusion ignition, cured a 13-year-old girl’s Leukemia with CRISPR, and started chatting with ChatGPT. Scratch that – that was just the last month of last year. I see no reason the pace of progress will slacken in 2023 or thereafter. Companies founded in this decade will shape humanity’s trajectory for the next century. Some people are pessimistic about that trajectory – AI will kill us all, the planet will burn. We are unabashedly optimistic about that trajectory, not in the sense that everything will be perfect, but in the sense that humans have agency, acquire new knowledge, and shape the future we want. Technology companies will have an important role to play in shaping it, and tremendous value to capture from the trillions of dollars shaken loose when they do. So what role can Not Boring play in shaping the future we want while generating top decile returns? Here, I think our original hypothesis is more valuable than ever. Paradoxically, many of the founders building the most important businesses are the worst at crafting a narrative. They’re scientists, technologists, and nerds who put all of their brain power into solving the specific hard problems they were born to solve. Their solutions are often complex and difficult to explain to non-technical folks. They don’t like to brag. That’s where we come in. Over the past couple of years running Not Boring Capital, I’ve invested in and written about companies like Ramp, Replit, Hadrian, Primer, Capital, Composer, Braintrust, NexHealth, Fount, ScienceIO, Unit, Scale. Our thesis has worked better than I could have hoped, but we need to keep evolving. There’s a temptation in a letter like this to project strength. You’ve likely read VCs’ blog posts over the last year, and if so, you’ve seen a consistent theme: “Everyone else behaved irresponsibly in the bull market, but not us. They’re all in trouble now; we’ve never been stronger.” It’s pretty incredible that every VC did the right thing, except for all of the other VCs. Me? I’ve done some things really well and I’ve learned some lessons. Besides inviting you to invest in the Fund, the other reason I send these emails is to pull back the curtain on raising and running a fund. It’s something I would have wanted to read before I started doing this. It should be particularly interesting this time around. Sharing was easy when the market was exuberant; it’s harder in a bear. But that’s when the lessons are most valuable. So today, we’ll cover it all, the good, the bad, and of course, the optimistic:

Investing in a venture capital fund in the current environment is not an obvious move. In fact, it’s deeply out of favor. There are plenty of reasons you shouldn’t invest in Not Boring Capital; let’s start with those. Why You Shouldn’t Invest in Not Boring CapitalThere’s this iconic scene in 8 Mile, when Eminem steps to the mic in the final rap battle and rattles off all the negative things his opponent might say about him before going on the offensive. (Parental Discretion Advised)  I like that. Let’s do it.

If I’m being honest with you, if I had a time machine, I’d play some things differently. I’d go back and make Fund II a little bigger, deploy a little more slowly, and be sitting on a pile of dry powder right now. But alas, I do not have a time machine. That said, I’m extremely proud of the portfolio we’ve built in Funds I & II. The thesis worked: we’ve been lucky enough to back exceptional founders building generational companies, and I’m confident we’ll outperform other funds of our vintage. The strategy – maximize winners, don’t minimize losers – seems to be working, too. In the update I sent to LPs over the weekend, I listed 114 companies I’m bullish on before cutting myself off, and I don’t want to pick favorites in public, so I’ll just go with a few I’ve written deep dives on to give you a sense of the companies and my thinking behind them: Ramp, Replit, Hadrian, Primer, Capital, Composer, Braintrust, NexHealth, Fount, ScienceIO, Unit, Scale. Today, Fund I is sitting at a 1.31x Gross MOIC (1.21x Net) and a 17.5% Gross IRR (12.2% Net). Fund II is at a 1.08x Gross MOIC (1.04x Net) and a 7.1% Gross IRR (3.7% Net). (Note: these are unaudited, don’t use them as a basis for any investment decision.) These numbers are nothing to write home about and too early to be meaningful – the average life of Fund I investments is 1.4 years and the average life of Fund II investments is 0.86 years. So how bad was 2022 for the portfolio? Better than you might expect.

Of note, we participated in the recap of one of those markdowns, and we’ve gained more on a subsequent markup in that investment than we lost in the original markdown. Crypto is out of favor, but I’m particularly proud of how well our web3 companies have held up:

I’m refraining from making any predictions on our performance throughout this piece, because no one knows how long this market will last or how anyone’s venture portfolio will perform, but I’ll say this: I think our web3 investments are going to surprise a lot of people with their impact and outcomes. Many are Hard Startups taking big swings at important challenges that I would and will back again. They’re tackling climate, decentralizing storytelling, curing rare diseases, giving people ownership of their AI models, building infrastructure, and yes, bringing real estate on-chain. Overall, our goal was not to minimize losers, but so far, damage has been minimal. There will likely be more pain to come in 2023, but our portfolio is full of Hard Startups that I expect to thrive through and coming out of this bear market. But to have invested from 2020 - 2022 and not come away with hard-earned lessons and adjustments would be delusional. I’ve learned some important ones through Funds I & II that will inform how Not Boring Capital invests and works with portfolio companies going forward. While I still believe that funds can generate strong returns by not maximizing winners, there are a few lessons I’m taking away to update my mental model:

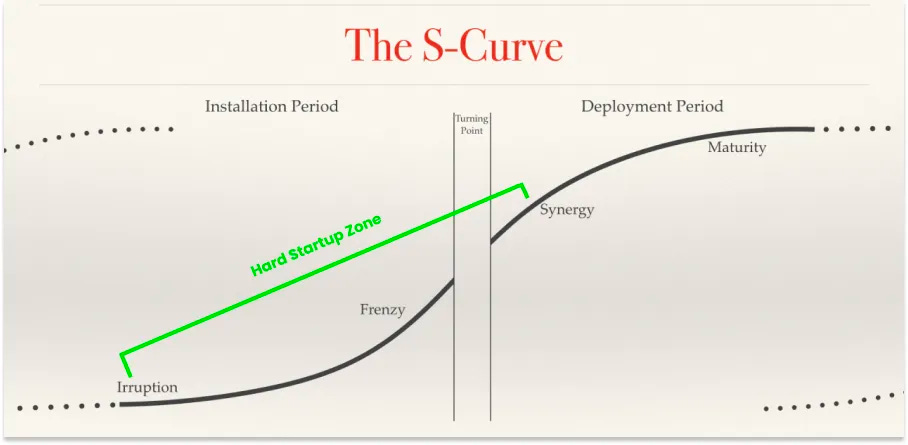

Some of these lessons are so painfully obvious in hindsight that I’m embarrassed to even write them down. Some are lessons that many GPs are learning (or re-learning), and others are more specific to Not Boring Capital. In any case, I think that it’s important to internalize and share those lessons, even if it makes me look dumb. The only way to get better is to learn and improve, and we’re putting the lessons we’ve learned to work in Fund III. Adapting is the only option. What works in venture capital is going to look a lot different in the coming decade than in the last one. Over the past few years, a couple of blog posts really influenced my thinking on this topic: Alex Danco’s Debt is Coming and John Luttig’s When Tailwinds Vanish. I added my own thoughts to the mix with last July’s The Good Thing About Hard Things: The argument in all three cases is that when a technology enters the Carlota Perez “Deployment Period,” venture capital probably isn’t the best fit.

Rates aside, many of the categories that drove crazy returns in the last decade are in the Deployment Period. That doesn’t mean that venture capital is dead. It does mean that in order to generate venture-style returns, VCs need to move back to the Installation Period and back riskier, non-consensus companies. Last Thursday, a Substacker named Bullfight Cap wrote Peter Pan and Neverland VC Returns, which summarizes the situation well:

To continue to produce venture returns, venture capitalists need to tackle new frontiers. And to build a top decile fund in the new environment, Not Boring Capital needs to evolve. Fund III Thesis, Advantage, and ApproachTo believe that Not Boring Capital Fund III is going to be a top decile fund, you need to believe a few things:

If you don’t believe that now is a good time to be investing in startups, then nothing else I’m going to say matters, so that’s a good place to start. Opportunity: Not Boring Capital’s Thesis Hard Startups tackling important challenges in big markets will build the most valuable companies over the next decade. Why? Hard Startups can often tap into large pools of waiting demand, build more defensible businesses, recruit better talent, and tap into that pluripotent wonder: differentiation. That hasn’t always meant they’ve been good venture investments. Why now? Hard Startups are riding some major tailwinds that make capital efficient growth possible just as trillions of dollars are up for grabs in the very big, traditionally tech-resistant categories. Over the past decade, small teams have been able to build amazing digital products efficiently thanks to the rise of AWS, APIs, and knowledge sharing. That trend will accelerate with AI and web3, as I laid out in Power to the Person. Crucially, we believe that this trend is entering into the physical world, making previously challenged startup business cases viable. Elliot laid out the case for this trend in biotech in Techbio Taxonomy. Similar dynamics are shaking up other hard categories, as I wrote covered in Decentralization. This will lead to new opportunities for early stage funds. On the Bits side, we believe that infrastructure companies will capture most of the value – whether traditional, AI, or web3 – as it becomes ever easier, and therefore more competitive, to build applications. Like everyone (which is probably a red flag), we’re excited about AI’s potential to change everything, but we’re approaching the space very cautiously for now – there’s going to be an investor bloodbath at the application layer. In web3, we think it’s a great time to be investing, as other investors disappear at the same time as infrastructure improves and entrepreneurs are imbued with a renewed appreciation that they need to create real value for users and connect with real world assets responsibly. Both AI and web3 will impact both Bits and Atoms – new infrastructure is needed for a Decentralized world – and that the intersection of AI and web3, while buzzword bingo, will be an interesting space to watch. On the Atoms side, we believe that startups will be able to harness new tech and commercialize cutting edge science to both partner and compete with incumbents for large slices of trillion-plus dollar industries like pharma, energy, defense, and education while giving humanity new superpowers. At the same time, a number of key experience curves are reaching points at which Atoms business models are economically feasible. We’ve covered these before:

Cheaper energy, intelligence, and infrastructure will make previously impossible things possible, and previously uneconomical things economical. Of course, Hard Startups are hard. One of the most frequent pieces of pushback I’ve gotten from LPs I’ve spoken to about Fund III has been around the investment dynamics of Hard Startups. It’s true that they’ve historically been challenging, especially for smaller funds, but we see the facts on the ground changing, and therefore see this reticence as an opportunity. We’ve backed a number of companies in traditionally capital-intensive categories with the ability to scale in a capital efficient manner. As one example from our Fund II portfolio, Wander, which is a vertically integrated vacation rental home company, just launched Atlas, the “world’s first vacation rental REIT,” to scale its portfolio without dilutive venture funding. Fund III biotech companies are doing work with AI that would have taken dozens of scientists years to complete, if they could complete it at all. Thanks to declining cost structures and new business models, we believe that this is the right moment in time for a fund like ours to invest in these categories. To outperform, you need to believe something that others don’t and act on that belief. That’s easy to say and harder to do, because those beliefs often seem dumb in the moment. Here’s my dumb belief: the value of top startups will be higher within the life of this fund than they were at the peak in 2021, but the makeup of the list will look very different. Less B2B SaaS, more Moonshots. Of course, there’s a lot of nuance here: each company is different, not all are pursuing capital efficient models, and sometimes, hard startups really are just hard. I’m happy to discuss in more depth with interested LPs. If you agree now is a good time to invest in Hard Startups, read on. The question is: can we invest in those top startups? Advantage: Deal Flow, Picking, Allocation, and Value Add In that 8 Mile section, I listed “Creator GP” as one of the potential knocks against me. In the bull market, seemingly everyone with an audience and a passing interest in startups launched a fund. LPs have predictably soured on this subset of GPs and rightly wonder whether they’ll stick around. Most won’t. I don’t particularly like the term Creator GP, but I’ll say two things:

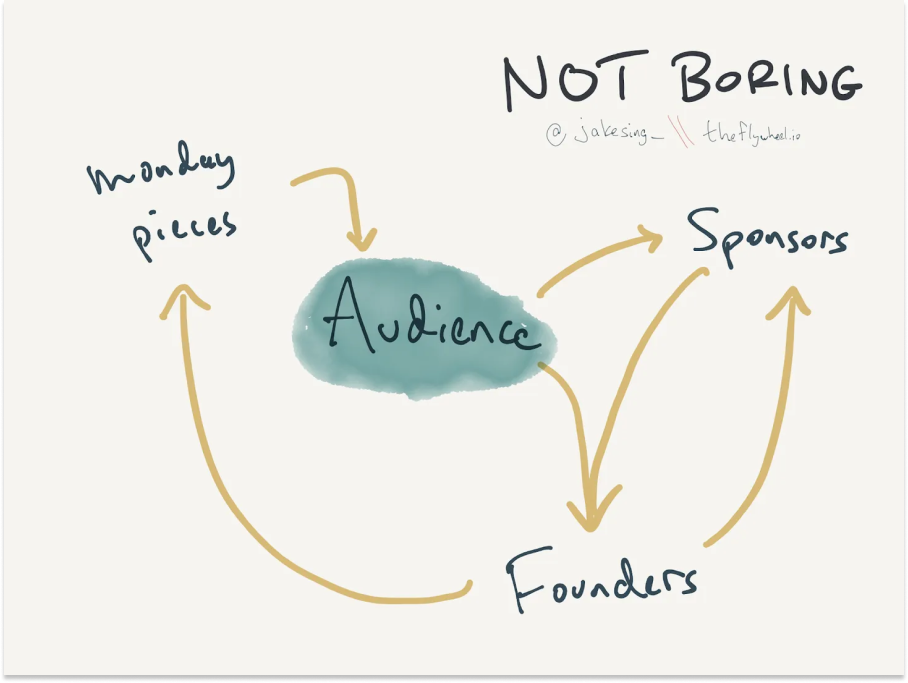

All of it comes together in the Not Boring Flywheel, which Jake Singer first wrote about in Million Dollar Newsletter, when there were only 35,000 of us reading this. Today, there are over 181,000 of us here, the Flywheel has only gotten stronger, and it can only be enhanced by more tightly coupling the types of companies we invest in and write about with our mission. All of it is in service of helping portfolio companies succeed, pre-credit for which shows up in our deal flow, picking, allocation, and value add. All four are intertwined, but I’ll try to break them apart. Deal Flow. By writing about the categories and ideas we’re most excited about, we put out a Bat Signal to founders building in those categories that we’re interested in their space, have thought a lot about it, and have a unique perspective to add. We first met Melonfrost (Fund III), for example, when Sam reached out after reading Elliot’s piece on Ginkgo Bioworks. A large percentage of the founders in our portfolio were Not Boring readers before we invested. Picking. Spending hours every week thinking deeply about the companies and industries we write about, talking to smart people, and getting feedback sharpens our thinking and helps us connect threads. Asking ourselves about whether we’d want to write about a company is also a good filter for what matters and what people will find useful, and I think that’s informed our picking ability. As we concentrate and write Deep Dives on all of our Core Fund III investments, this filter will get even tighter: do we want to spend a week or more of our lives heads down writing about this company? If we do, will our readers care about them? Particularly with a more concentrated fund, choosing what not to invest in is as important as choosing what to invest in. Allocation. The clarity of the newsletter value proposition helps us win bigger allocations. In Fund I, our average check size was $101,019. One of the questions we had going into Fund II was whether we’d be able to scale that, and we did: the average check size in Fund II was $207,424. For Fund III, we want to scale that again by writing $500k to $1 million checks in our Core investments and following on in the winners. There’s proof that we can do this. In Fund II, we wrote $500k-$1M checks in 17 companies like Vana, Ramp, ScienceIO, Varda, Primer, Series, Nucleus, and Composer. There’s a theme here: we’ve written about four of the companies I listed, and plan to write about all of the rest when the timing is right for them. One of the reasons that we’re going more concentrated in Fund III – beyond fund math – is that we can get bigger allocations in better companies when we write about them. Value Add. Our advantage in seeing great deals and winning allocations typically comes from the expectation that we will ultimately be able to add value. The most straightforward way that we do that is by writing deep dives on companies. My favorite example of the impact of a deep dive is this tweet from Will Manidis a couple of months after we wrote about ScienceIO in The Model of Everything:  two months after our Not Boring piece was published:

~75% of our commercial inbound mentions it by name

~50% of our customers came as a result of inbound from it

~90% of the candidates that find us, found us through Packy.

Thanks @packyM.

ScienceIO is a Hard Startup, and a complex one to explain, and I think the performance of the piece speaks to the fact that we’re at our best when we’re explaining those types of companies. In addition to Deep Dives, we’ve also added the Not Boring Talent Collective, which portfolio companies can use to hire Not Boring readers, and the Not Boring Founders podcast and The Founder’s Letter, which give our portfolio founders a chance to tell their stories directly. As more of our portfolio companies launch products worth being optimistic about, we can include them in the Weekly Dose of Optimism. Late last year, I launched Anton Teaches Packy AI with Chroma CEO Anton Troynikov, which helps me learn what’s going on in AI and gives Chroma some extra visibility.  As we continue to evolve, we’ll keep experimenting with new ways to help our portfolio companies tell their stories, and hopefully, to impact their stories in real-time. We’re successful if we give just a little more leverage to the founders who are trying to bend humanity’s trajectory upwards. Ultimately, we believe we are best-positioned to help those companies tackling the biggest challenges with the best teams and technology through storytelling and that they’re the ones that are most aligned with our mission. Approach: Portfolio Construction Our Fund III approach to portfolio construction is our biggest departure from Funds I & II. In Funds I & II, we invested in 207 companies. For Fund III, with more experience, smarter team members, and bigger ambitions, we’re ready to move to a more concentrated strategy. The Fund will make roughly thirty Core investments from $500k to $1 million (up to $2 million including follow-on rounds), aiming for 1-5% ownership. We are not looking to lead rounds; we want to be a valuable 2nd - 4th check in Core companies. We will likely write $500k checks in pre-seeds and seeds and $1+ million checks in larger Seeds and Series A’s. We’ll invest roughly 50% in Bits and 50% in Atoms. We will also write a handful of smaller Explore checks in incredibly talented founders and early stage moonshot ideas, often at the pre-seed and seed. The best of these will graduate to Core investments in Fund III or future funds. We’ll reserve 20% of capital to invest in follow-on rounds for our winning companies. Previously, we had a third category, Growth, but we’re going to be focusing earlier stage - Pre-Seed through Series A – out of Fund III. We will do later stage portfolio company follow-ons and the occasional high-conviction later stage deals via SPVs, to which LPs will have first access. Of course, this is a riskier strategy than a broader portfolio on paper, but if we want the chance to earn top decile venture returns, we need to take venture risks. Ultimately, we’re resetting and doubling down on Not Boring’s unique strengths, which we think are particularly well-suited for the market to come. Many VCs focus on a particular sector, which can work very well if that sector is doing well. We’re more hybrid, which I think makes sense in a market that’s changing as quickly as this one: we’re focused on Hard Startups broadly with a horizontal skill set – writing – and can add depth in the areas we’re most interested in by adding double-threats like Elliot and Rahul to the team. As I’ve written about before, I’m a big fan of differentiation, even for its own sake, and love a good coherent strategy. An added benefit of our strategy is that our unique advantage is strengthened because there’s no one like us focusing on investing in Hard Startups and helping them tell their stories. Big funds like Lux, Founders Fund, and a16z’s American Dynamism practice are certainly focused on Hard Startups and are excellent lead partners for founders. There are excellent smaller funds focused on many of the specific verticals we’re investing in, but few who cover the breadth we do. And as far as I know, there aren’t any small, non-lead funds investing in Hard Startups who have storytelling at their core. But it’s early, and everything above is just words. The proof is in the portfolio. Fund III Early PortfolioWe began fundraising among existing LPs last year and have started investing out of Fund III, and so far, I’m really excited about the portfolio we’re building. It gives a good flavor of the types of companies we’re going to be investing in going forward. To date, we have invested $2.6 million in nine companies (6 Core, 3 Explore) out of Fund III in companies in biotech, web3, energy, and education since we began deploying. Our investments in nxyz, Atomic AI, Melonfrost, Circa, Tlon, Jia, Odyssey, and Jaza (the ninth is still in stealth) offer a good flavor of the types of investments we’re making out of this fund:

We’re not building this portfolio specifically to perform in a bear market – bear markets are temporary, and this one hopefully won’t last the 10 year life of the fund – but an added benefit to investing in companies that are solving problems fundamentally important to people, where no alternatives exist, is that there will be demand in any market if they pull it off. Anyone who invests in Fund III will be investing in these companies that are already in the portfolio, and hopefully, similarly bold and ambitious ones over the next two years. We have been incredibly selective with our Fund III investments to date and will continue to apply the same high bar going forward. To Infinity and BeyondThis is the start of a new chapter for Not Boring, one that draws on everything we’ve learned so far and everything that gets us so excited about the future. My goal is for this portfolio to be legendary: I want other investors to talk about our returns in a decade, founders to talk about Not Boring’s contributions for years, and our grandkids to still be talking about the impact our companies had in a century. I feel incredibly lucky to get to write and invest in companies I respect as a living. Thank you for giving me the opportunity to do it. I hope you’ll join us. If you’d like to consider becoming an LP in Not Boring Capital, please submit your interest here: It’s not going to be easy, but it’s going to be fun. Thanks to Dan, Henry, Elliot, Rahul, and Puja for the comments and feedback! Thanks to Dan, Henry, Elliot, Rahul, and Puja for the comments and feedback! That’s all for today! We’ll be back in your inbox on Friday with the first Weekly Dose of Optimism in 2023. Thanks for reading, Packy |

Older messages

Blank Page

Monday, December 19, 2022

To 2023 and Beyond

Aleo: Can You Keep a Secret?

Tuesday, December 13, 2022

A Deep Dive Into Zero-Knowledge Proofs and the Future of the Internet

Weekly Dose of Optimism #23

Friday, December 9, 2022

TSMC Factories, Our AI in Data, Nano x AI, The Century of Biology, Malaria Antibodies

Four Seasons Total Tech

Monday, December 5, 2022

Winter is Ending in AI, Solar, Nuclear, Space, & Biotech. Summer is Coming

Weekly Dose of Optimism #22

Friday, December 2, 2022

Alzheimer's Treatment, Shape Rotators and Wordcels on Generative AI, ChatGPT, Diplomatic AI, Wormholes, and Good Quests

You Might Also Like

Free download: 5 ways to improve your proposals

Thursday, February 27, 2025

A free resource for you ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

From living in a car to $1.4M in 5 months

Thursday, February 27, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack From living in a car to $1.4M in 5 months Taro Fukuyama and 2 of his friends from Tokyo

I'm launching a meme coin live RIGHT NOW

Thursday, February 27, 2025

(All for charity dw) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Vibe shift

Thursday, February 27, 2025

Billions added to values as investors warm to sector earnings ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Midnight Society Bows Out While ChronoForge Aims for a Bigger Stage 😮

Thursday, February 27, 2025

PlayToEarn Newsletter #260 - Your weekly web3 gaming news

WTF is open-source marketing mix modeling?

Thursday, February 27, 2025

Marketers should be wary of open-source programs promoted by purveyors with a walled garden history. February 17, 2025 PRESENTED BY WTF is open-source marketing mix modeling? Marketers should be wary

👀 What Content Is AI Citing?

Thursday, February 27, 2025

Another parasite SEO gift for you 🧙✨🎩 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The 2021 GTM Playbook Is Mostly Dead

Thursday, February 27, 2025

But What's The AI Era Replacement? To view this email as a web page, click here saastr daily newsletter The 2021 GTM Playbook Is Mostly Dead. But What's The AI Era Replacement? By Jason Lemkin

'Do Your Job: The Art of Winning' with Bill Belichick

Thursday, February 27, 2025

In his upcoming book “The Art of Winning,” set to be released in May, Coach Bill Belichick shares several key secrets to his extraordinary success on the field.

Good Questions

Thursday, February 27, 2025

About Google's Performance Max.