The Single Most Important Thing For Bitcoin Right Now

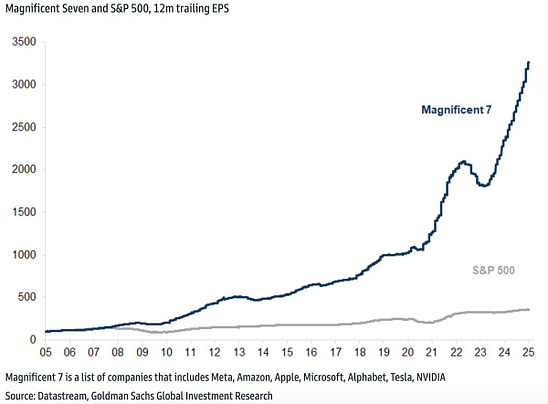

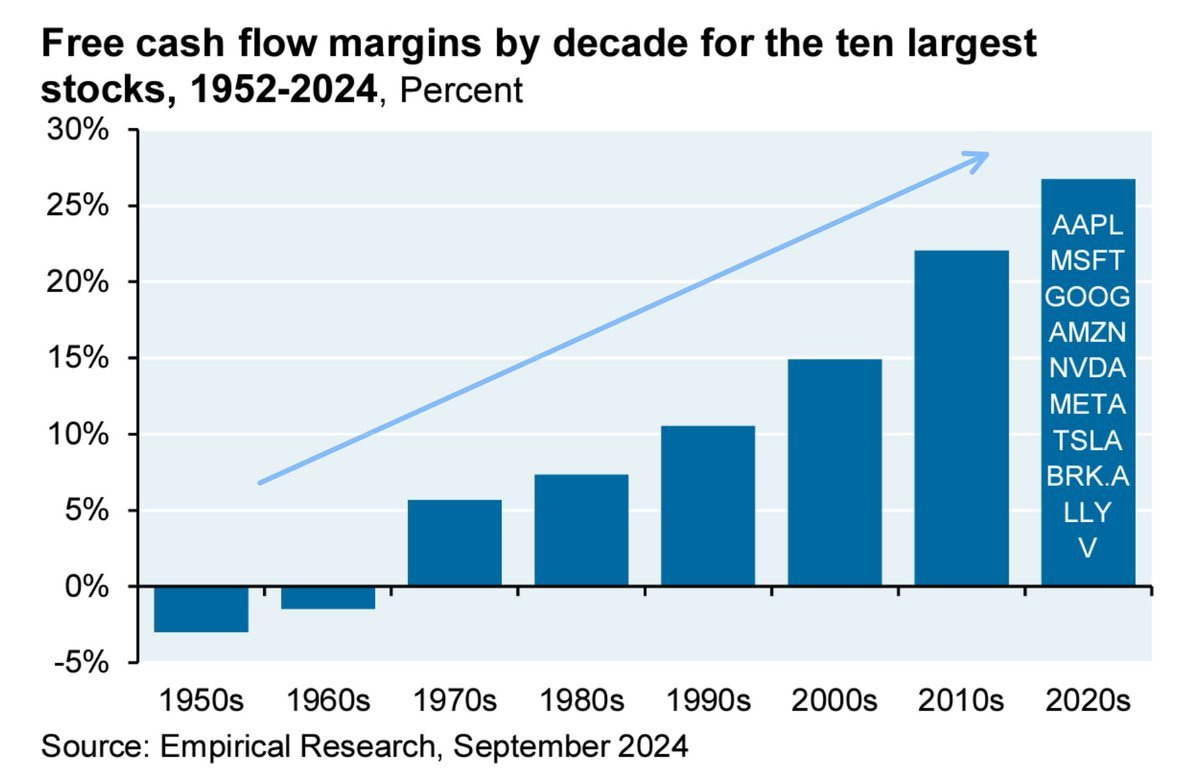

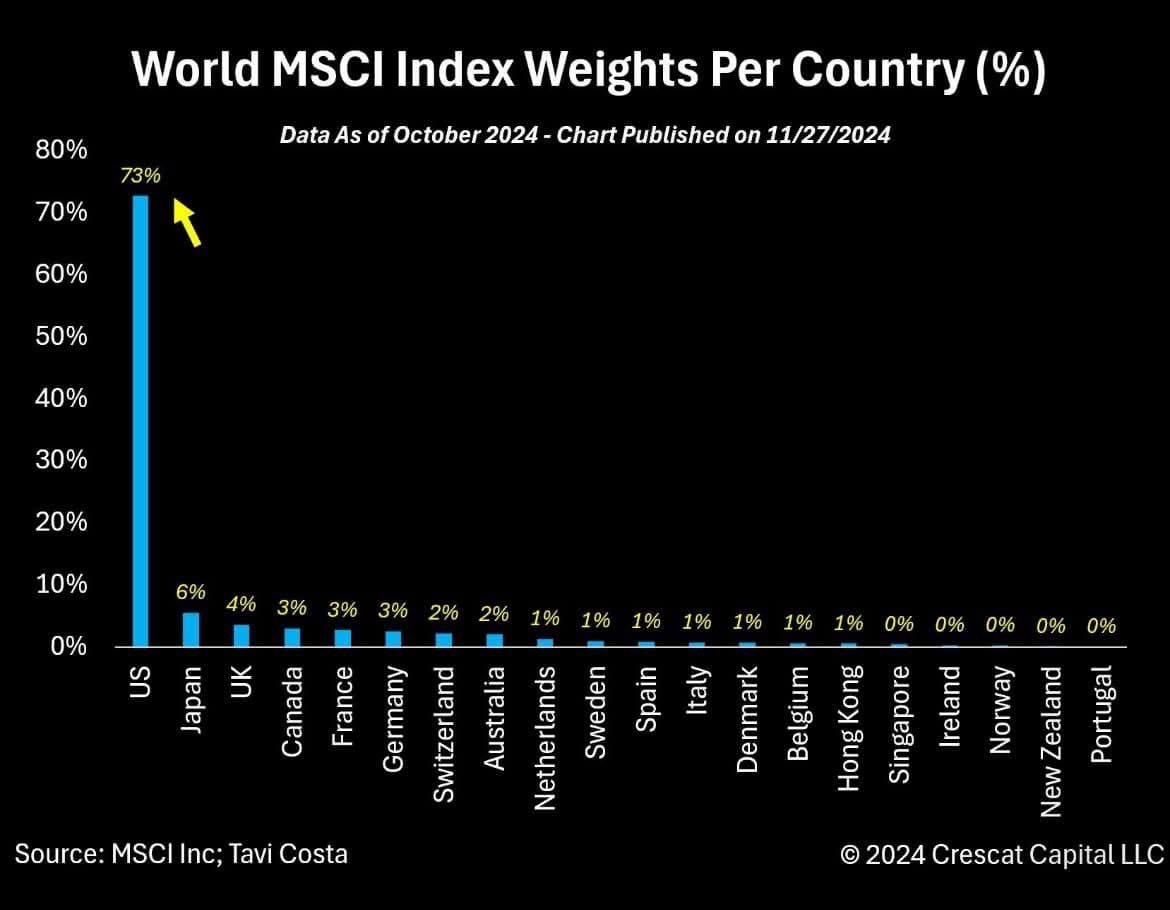

To investors, Yesterday I had the pleasure of speaking at FarmCon, one of the largest agriculture-focused conferences in the country. I was blown away by the ~ 1,500 people in attendance. There were farmers, commodity traders, technologists, financiers, and lots of people in-between. One of the themes we discussed on stage was the state of the US financial market. I did my best to explain bitcoin to the room, including the tailwind of continued monetary debasement and an inept fiscal policy situation that looks more like welfare than capitalism. The beauty of a room full of farmers is they are already deep down the rabbit hole of land, gold, and guns. Bitcoin is a stone’s throw away for their portfolio. But most people are not into bitcoin — they want to talk about the US stock market. It is important to put US stock market performance in context. The last 200 years of equity performance has been a 45 degree line up and to the right. Simply, investing in the US market has delivered exceptional returns throughout our lifetime, our parents lifetime, and their parents’ lifetime. Recent stock performance has been largely driven by the Magnificent 7. The degree of outperformance from these stocks is mind-blowing. You can see that the divergence started during the Global Financial Crisis and never stopped. Before everyone starts yelling that the Mag 7 is overvalued, it is important to realize that the free cash flow margin for these large companies has more than 5x’d since the 1970s. Better companies deserve better valuations. That part isn’t rocket science. But what becomes more complex is how dominant the US stock market is compared to the rest of the world. Tavi Costa recently posted this chart to visualize the domination: Cambria’s Meb Faber responded to this graphic saying “nearly all US investors look at this chart and think, ‘I need more US stocks’.” Speaking of Meb, he was on stage with me yesterday at FarmCon and he had some wise words for investors. His main point was that the dominance of US equities, particularly in tech, meant that history suggested value stocks and non-US equities should be good performers in the coming years. To be clear, Meb wasn’t calling a market top, nor was he saying that the bull run can’t drive tech stocks higher. He was explaining that the timeless investing strategy of buying things out of favor may be worth considering. That seems like a pragmatic suggestion. And the fact that so many people will critique Meb’s suggestion probably means there is more merit to it than you would think. But here is the thing — I am not a value investor. I am not an international equity investor either. There are two types of investors in the world. Those who are betting on the world staying the same and those betting on the world changing. Nothing wrong with the former, but I am the latter type of investor. I want to bet on chaos and uncertainty. I want to predict where the world is going. The inherent difficulty in doing this is where the potential return lies. This is why I am interested in bitcoin, artificial intelligence, nuclear power, space technology, drones, robotics, gene editing, and a plethora of other innovations at the tip of the spear. I want to play a small part in helping to create the future we will live in. And there is nothing more obvious to me than bitcoin. This is why I pitched bitcoin as my best idea onstage at FarmCon. Yes, the digital asset has appreciated hundreds of percent in recent years. Yes, the digital asset is well known by investors around the world. Yes, bitcoin has produced many millionaires and billionaires already. But I believe we are all underestimating how important the technology will be, which means we are all underestimating how big the market cap of the asset will get too. How high will bitcoin’s price go? I am not sure. What timeframe are we looking at? I don’t know. But here is one thing I know — the single most important thing at the moment is whether the Trump administration implements the strategic bitcoin reserve. Nothing else matters more than that. The administration promised the strategic reserve on the campaign trail. There are many people across the administration that personally own bitcoin. It is hard to see a world where we don’t get the strategic reserve, but it isn’t a done deal until the coins are secured on the United States’ books. If the strategic reserve happens, all bets are off on what could happen to bitcoin’s price. We may see the craziest bull market we have seen so far. But for now, we wait and see what Trump does once he is in office. Hope you all have a great end to your week. I’ll talk to you on Monday. - Anthony Pompliano Founder & CEO, Professional Capital Management 🚨 READER NOTE: I am hosting Bitcoin Investor Week in NYC from February 24-28th. This will be the largest finance conference of the year focused on bitcoin. Speakers include Mike Novogratz, Cathie Wood, Jan van Eck, Anthony Scaramucci, Jack Mallers, and many others. You can purchase tickets here: Get ticket for Bitcoin Investor Week Meet The Man Trying To Get Amazon & Microsoft To Buy Bitcoin Ethan Peck is the Deputy Director for the National Center for Public Policy Research’s Free Enterprise Project. He also wrote a proposal to Microsoft and Amazon for them to put bitcoin on their balance sheet. In this conversation we discuss what he did, why he did it, how these shareholder proposals work, Saylor’s 3 minute pitch, how it gets approved, and what the impact will be. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intedneded to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Bubbles, Crashes & Fiscal Dominance - Should You Be Worried?

Thursday, January 9, 2025

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Tuesday, January 7, 2025

Open this on your phone and click the button below: Add to podcast app

Bitcoin Will Infiltrate Every Corner of Finance and We Are Starting To See It Now

Tuesday, January 7, 2025

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin Is The New S&P 500

Friday, January 3, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin Metric Overview To Start 2025

Thursday, January 2, 2025

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Python Weekly - Issue 688

Thursday, February 27, 2025

February 27, 2025 | Read Online Python Weekly (Issue 688 February 27 2025) Welcome to issue 688 of Python Weekly. We have a packed issue this week. Enjoy it! The #1 AI Meeting Assistant Summarize 1-

Free download: 5 ways to improve your proposals

Thursday, February 27, 2025

A free resource for you ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

From living in a car to $1.4M in 5 months

Thursday, February 27, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack From living in a car to $1.4M in 5 months Taro Fukuyama and 2 of his friends from Tokyo

I'm launching a meme coin live RIGHT NOW

Thursday, February 27, 2025

(All for charity dw) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Vibe shift

Thursday, February 27, 2025

Billions added to values as investors warm to sector earnings ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Midnight Society Bows Out While ChronoForge Aims for a Bigger Stage 😮

Thursday, February 27, 2025

PlayToEarn Newsletter #260 - Your weekly web3 gaming news

WTF is open-source marketing mix modeling?

Thursday, February 27, 2025

Marketers should be wary of open-source programs promoted by purveyors with a walled garden history. February 17, 2025 PRESENTED BY WTF is open-source marketing mix modeling? Marketers should be wary

👀 What Content Is AI Citing?

Thursday, February 27, 2025

Another parasite SEO gift for you 🧙✨🎩 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The 2021 GTM Playbook Is Mostly Dead

Thursday, February 27, 2025

But What's The AI Era Replacement? To view this email as a web page, click here saastr daily newsletter The 2021 GTM Playbook Is Mostly Dead. But What's The AI Era Replacement? By Jason Lemkin

'Do Your Job: The Art of Winning' with Bill Belichick

Thursday, February 27, 2025

In his upcoming book “The Art of Winning,” set to be released in May, Coach Bill Belichick shares several key secrets to his extraordinary success on the field.