The most undervalued public chain? The introduction of TON ecosystem that based on Telegram

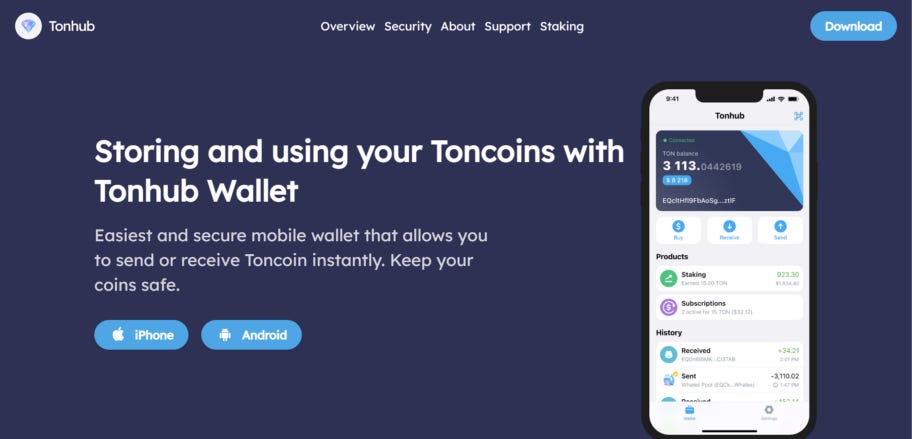

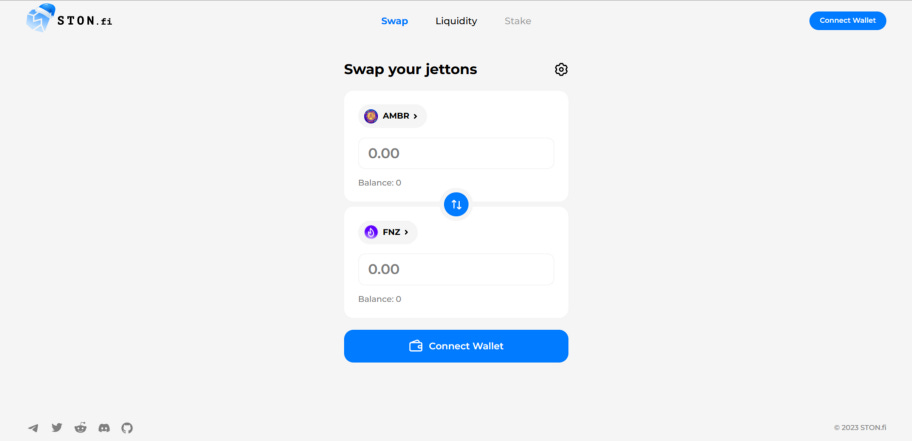

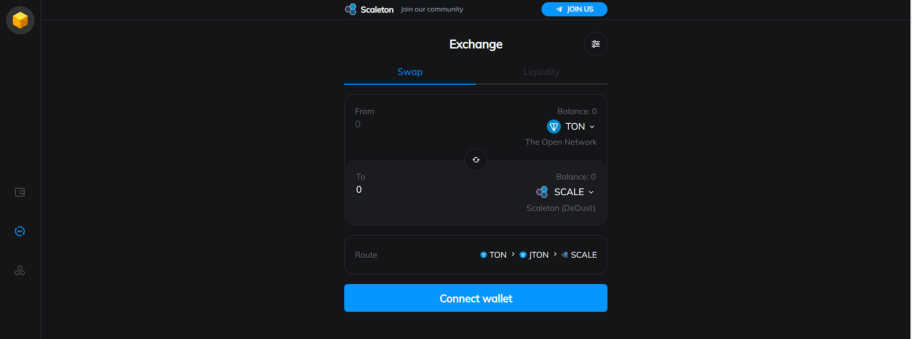

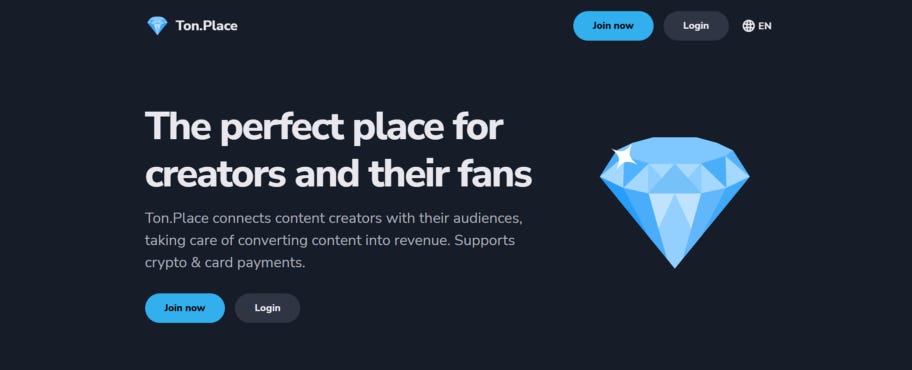

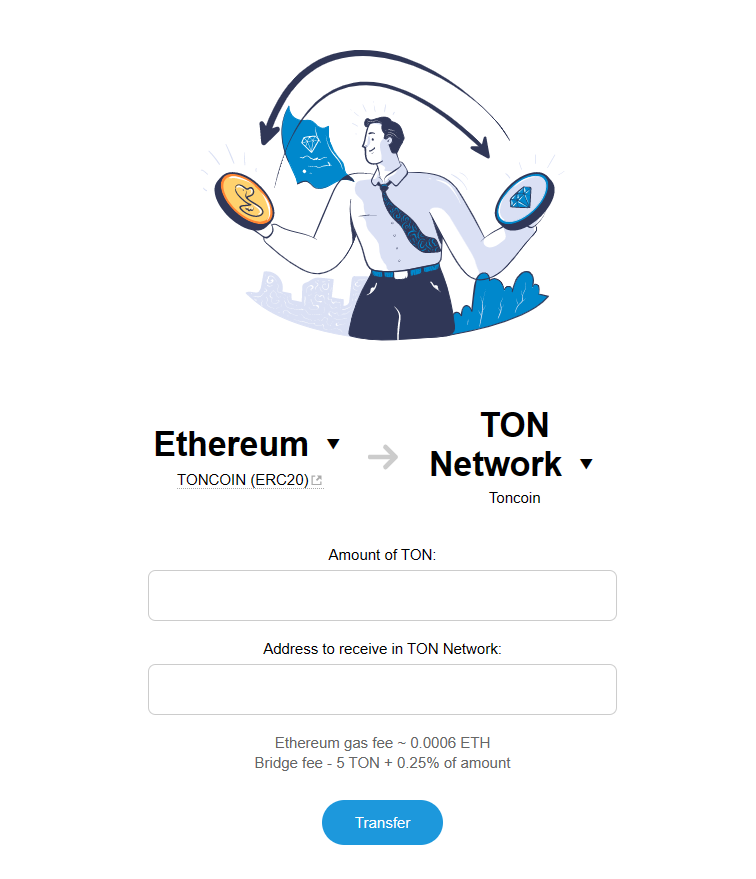

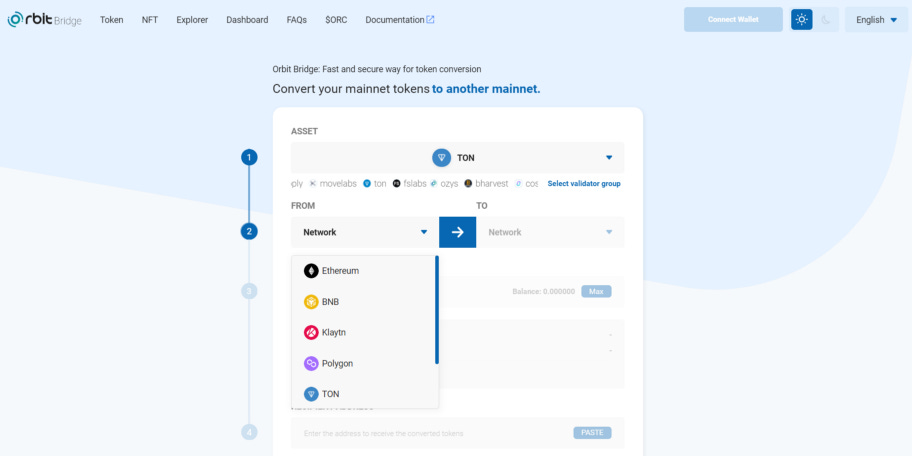

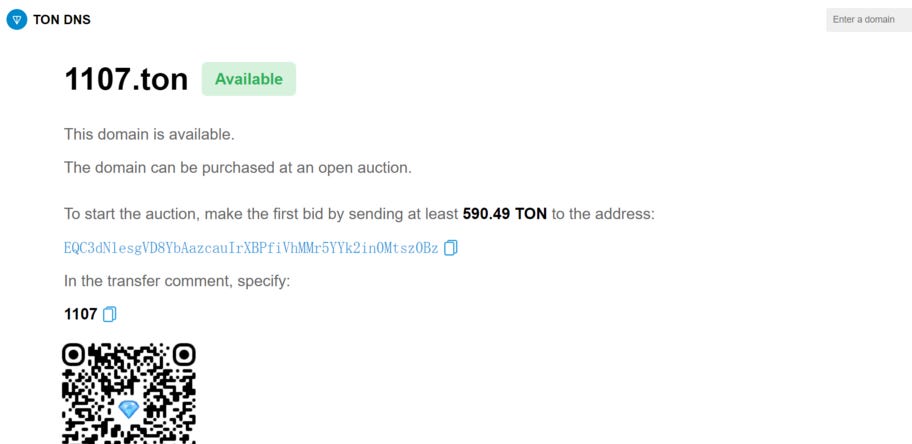

Author: @0xMavWisdom Editior: Colin Wu Note: This article is for information sharing only and is not associated with any interest in the items mentioned and is not endorsed in any way. The Open Network’s native Token, TON, has had a spectacular year in 2022. According to CoinMarketCap, after hitting a low of around $0.75 in June 2022, TON has risen to around $2 today, up over 200%, making it the 22nd largest cryptocurrency in terms of market cap. Arguably one of the most underrated public chains, TON was originally designed and built in 2018 as a fully decentralized Layer 1 blockchain with scalable and shardable performance, super-fast transactions, low fees, and easy-to-use applications by the team at Telegram, one of the three largest social media outlets in the crypto world. However, due to a legal dispute in 2020, the Telegram team eventually agreed to settle with the SEC, ending with a forced cessation of work. After the Telegram team abandoned the TON project, community developers took over and renamed it to its current name, The Open Network. The Open Network uses the POS mechanism and the main functions of TON Token are to pay transaction fees, settle payments and validate transactions. The current annual inflation rate based on the basic TON parameters is approximately 0.6%. It’s worth noting that in late December, TON’s official Twitter account @ton_blockchain was blocked for unknown reasons. This article will take stock of the main dAPPs native to the TON ecosystem. (Image source: Coin98Analytics) (1) Wallet Crypto Bot Users can use Crypto Bot for Token storage, transfer, payment and trading on Telegram, in addition to Crypto Bot’s P2P marketplace and subscription features. When using the P2P marketplace, buyers are not charged any fee and sellers are charged 1%; when using the trading feature, both Maker and Taker will charge 1%. @Wallet @Wallet is TON’s hosting wallet. Like the Crypto Bot, using Telegram as a carrier allows users to buy tokens through bank cards, receive and trade tokens and send them to other wallets. Tonkeeper Tonkeeper is an unmanaged TON-based wallet that gives users more control, with key features including trading, transferring, sending and receiving funds in seconds, and the ability to buy, sell and trade TON through various Dapps such as Uniswap, plus price charts for users to monitor Token price changes. Tonhub Tonhub is an unhosted wallet with advanced security and user privacy at its core, allowing users to easily and securely access the wallet and send or receive TON via PIN or biometric login. (2) DEX STON.fi STON.fi is the AMM DEX on the TON blockchain, offering virtually zero fees, low slippage, an extremely simple interface, and direct integration with the TON wallet. Ston.fi currently offers the basic trading and liquidity provisioning features of the DEX, but only supports a small number of Tokens such as AMBR, FNZ, BOLT, TGR, TON, WTON, etc. DeFi Llama data shows that the current TVL of STON.fi is about $540,000, but it is already one of the most mature dAPPs on the TON chain. TonSwap TonSwap claims to be the first open source DEX on the TON blockchain, currently supporting only a small number of on-chain native Token such as AMBR, FNZ, BOLT, TGR and cross-chain assets such as USDC, ETH, BTC, etc. TonSwap is still in beta. DeDust DeDust, the DeFi platform developed by Scaleton for TON, is the first dAPP in Tonkeeper to fully switch to TON Connect 2.0 and now supports almost all wallets available in the TON blockchain. It currently offers fully functional DEX (swap and liquidity providing) and portfolio estimation capabilities. (3) stake TonStake TonStake claims to be the first and largest stake pool for TON. TonStake offers TON stakers an annualized yield of approximately 8.51% and charges users a 10% service fee. In addition, TonStake provides APIs for third-party service providers to integrate staking functionality. As of January 3, TonStake had over $4.2 million in total staked assets and had distributed over $340,000 worth of stake incentives to users. (4) Socialfi Ton.Place Ton.Place is a social media game that allows users to earn TON by posting exclusive content and sending messages to followers. Users can access all content creation tools by simply logging into their Ton.Place account via Telegram and activating their subscriptions. Players earn TON by posting (the more likes a post gets, the more TON it earns), sending messages (charging for private messages with up to 10 photo or video files attached) and referring friends (inviting friends and getting rewarded for their purchases and earnings). (5) NFT Marketplaces Disintar Disintar is one of the main NFT marketplaces on the TON chain. In addition to providing basic NFT trading functionality, creators can publish their works as NFTs on the Disintar marketplace without technical support. In addition, each user can create an NFT Room to transfer, sell and save. Disintar is currently in beta. TON Diamonds TON Diamonds is one of the main NFT marketplaces on the TON chain. Regular users are charged a 5% market fee to trade NFTs at TON Diamonds. However, users can get a reduction in transaction fees by purchasing official diamond NFTs of different grades (Small Diamond — 2% Fee, Medium Diamond — 1% Fee, Big Diamond — The user has the opportunity to get more airdrops, NFT priority sales, participation in IDO, etc. Currently, TON Diamonds has 6 kinds of NFT collectibles such as TON Diamonds and StickerFace Wearables to trade. In addition to the direct purchase route, users can also obtain NFTs through auctions. Getgems Getgems is one of the richest NFT markets for collection objects on the current TON chain. Users can purchase, sell, cast and transfer NFT on the platform. The user needs to pay Getgems 5% for each transaction, but does not charge for minting or transferring NFT. Fragment Fragment is one of TON’s unmanaged decentralized NFT trading platforms. Unlike the other NFT marketplaces mentioned above, Fragment is the most deeply tied to Telegram and is Telegram’s dedicated trading platform for usernames and virtual numbers, with transactions settled in TON. Initial shelf owners receive all proceeds after a 5% platform fee and conversion fee, and users can also bid for attractive and secure Telegram usernames. (6) Cross-chain bridge Official Bridge Currently supports asset interoperability between two networks, i.e. BSC and ETH and TON, and transfers to and from assets are restricted to TON only. Orbit Bridge Orbit Bridge announced its support for the TON network on December 1. Besides the native asset TON, Orbit Bridge supports mutual cross-chains between the TON blockchains including Ethereum, BNB, Klayth, Polygon and other chains covering USDC, USDT, MATIC and other assets. In addition, Orbit Bridge has also strengthened its cooperation with TON blockchain and developed AMM-based DEX Megaton Finance based on TON blockchain developed by Ozys, which will be launched in January this year. (7) Launchpad Tonstarter Tonstarter is the first TON on-chain native launchpad to venture into early-stage promising projects. Tonstarter has already helped projects like Fanzee Labs to complete their fundraising, and is currently looking for projects related to stablecoin, DEX, lending, etc. for deeper collaboration and help with fundraising. TON Play TON Play is a GameFi launchpad with a Game Developer Acceleration Program award to help developers enter the Web3 space faster, with 25 games currently in development and 50 games in the pipeline. (8) Domain name TON DNS TON DNS is a TON on-chain domain name service provider, and users must register “.ton” with at least 4 characters and no more than 126 characters. The “.ton” domain name NFT is similar to the popular ENS that users can choose to store, give away or sell the domain name after acquiring it. For the initial unregistered domain names, they will be acquired by public auction; TON domain name NFT secondary trade can be sold in NFT trading market such as getgems. Overall, the TON ecosystem has dAPPs to fill different needs of users, but it is still in its early stages. Although Telegram’s early team is no longer involved in development, the core TON developers and community still have a relationship with Telegram, whose audience of over 700 million gives The Open Network a huge advantage in building its future ecosystem. Reference: Follow us |

Older messages

Why was an official in a small Chinese city arrested for "mining"?

Friday, January 20, 2023

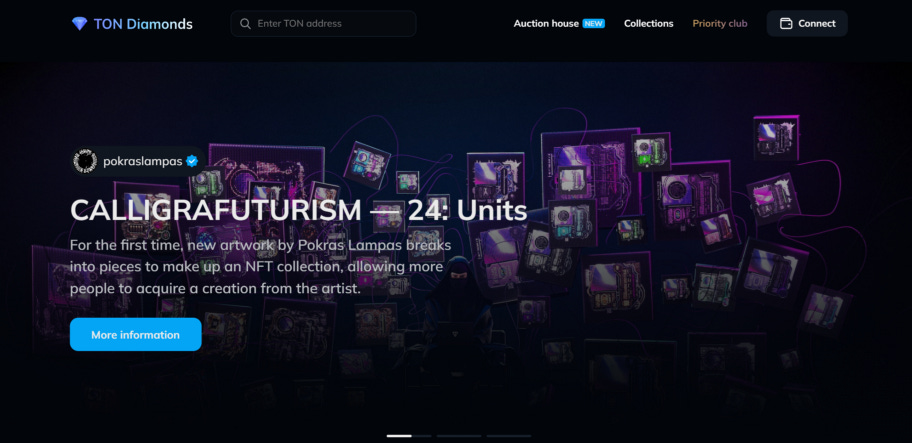

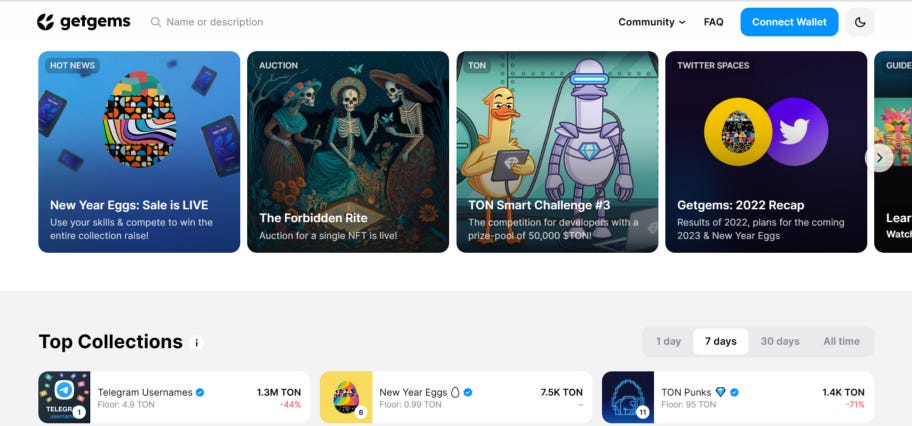

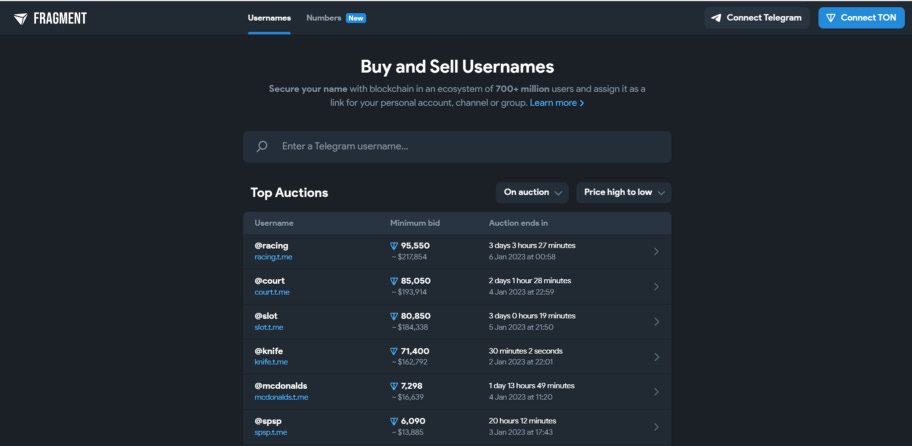

Original link: https://mp.weixin.qq.com/s/R6KGHyqsQmYZFTnoZmWqog Foreword: How a company located in Fuzhou, a small city in China, colluded with Chinese government officials and businessmen, and was

Ape Metaverse's first game Dookey Dash : How to play WEB3 game ?

Friday, January 20, 2023

Author: @0xMavWisdom Editor: Colin Wu Blue chip NFT project Bored Ape Yacht Club (BAYC) recently announced the launch of the minting game Dookey Dash on 18 January via BAYC Sewer, with gameplay similar

VC Yearly Report: Cryptocurrency funding totaled $37.7 billion with 1,769 projects

Tuesday, January 10, 2023

Author: WuBlockchain According to Messari, there were 1769 public crypto VC projects in 2022, up 30% from 2021 (1364 projects in 2021). The industry-level classification is as follows: In 2022, the

Global Crypto Mining News (Jan 2 to Jan 8)

Monday, January 9, 2023

1. In 2022, Core Scientific ($CORZ), Riot Blockchain ($RIOT), Bitfarms ($BITF), Iris Energy ($IREN), and CleanSpark ($CLSK) traded down 99%, 85%, 91%, 92% and 79%, respectively. Mining bitcoin became

Asia's weekly TOP10 crypto news (Jan 2 to Jan 8)

Sunday, January 8, 2023

Author:Lily Editor:Colin Wu 1. Gopax's weekly summary 1.1 Binance has completed due diligence on the Gopax exchange acquisition link According to Decenter, Binance has recently completed due

You Might Also Like

WuBlockchain Weekly: SEC Terminates Lawsuits Against Multiple Crypto Companies, Bitcoin Drops Below $80,000, OKX S…

Friday, February 28, 2025

On Friday, OKX market data revealed that BTC fell below $80000, reaching a low of $78258, with the current price at $80514, reflecting a 24-hour decline of 7.22%. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

FBI confirms North Korea-backed Lazarus hackers stole $1.5 billion from Bybit

Thursday, February 27, 2025

FBI tracks Ethereum laundering spree by North Korean hackers amid rising threat of cyber warfare in the crypto world. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with MicroStrategy Founder Michael Saylor: The Company Holding the Most Bitcoin in the World

Thursday, February 27, 2025

In this interview, Colin from WuBlockchain had an in-depth discussion with MicroStrategy founder Michael Saylor about the company's ongoing Bitcoin acquisition strategy, the growing adoption of

Abu Dhabi Invests $436.9M In Bitcoin ETF

Thursday, February 27, 2025

February 17th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Abu Dhabi Invests $436.9M In Bitcoin ETF Changpeng Zhao Sparks Meme Coin Rumours Coinbase Finally Lists POPCAT & PENGU

📈 BTC’s realised price (average acquisition price) reached an all-time high of $43,000; State of Wisconsin Invest…

Thursday, February 27, 2025

BTC's realised price reached an all-time high of $43000; Abu Dhabi's Mubadala Investment disclosed its BTC ETF holdings; South Korea to allow universities and charities to sell crypto donations

HashKey Exchange's Interpretation of the Hong Kong SFC Virtual Asset Roadmap

Thursday, February 27, 2025

We are pleased to see the Hong Kong government release the forward-looking and pragmatic “ASPI-Re” roadmap for advancing the virtual asset industry. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Argentina’s stock market plummets amid President Javier Milei’s LIBRA memecoin scandal

Thursday, February 27, 2025

Argentina's economic landscape shaken as Milei's LIBRA endorsement turns into multi-billion dollar fiasco. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Heated AMA Debate: 0G Team Responds to Allegations of CFX Soft Rug, Overvaluation, and Token Commitment Concerns

Thursday, February 27, 2025

This AMA primarily focused on the relationship between Conflux and 0G Labs, discussing 0G Labs' high valuation, fundraising structure, technical direction, and community concerns over transparency.

Pectra: Ethereum’s Next Major Upgrade

Thursday, February 27, 2025

Breaking down key changes included in Ethereum's Pectra hard-fork ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Solana falls to lowest price since November 2024 losing 43% since January

Thursday, February 27, 2025

Volatility reigns as Solana's price retreat tests its resilience against past support levels. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏