"Director of First Impressions": How corporations use phony titles to dodge billions in overtime

The future of this newsletter is in jeopardy. About half of our current readership found out about Popular Information through Twitter. And now Twitter is controlled by Elon Musk, a billionaire who has embraced right-wing politics. Since Musk took over, the Twitter account we use to promote Popular Information has lost tens of thousands of followers. And several left-leaning independent journalists have been suspended. That's why I need your help. Popular Information has 223,000 readers, but only a small percentage are paid subscribers. If a few more readers upgrade to paid, Popular Information can invest in alternative growth strategies, reach more people, and produce more groundbreaking accountability journalism. You can learn more about Popular Information’s impact over the last year HERE. The restaurant host is now the "Guest Experience Leader." The front desk clerk is now the "Director of First Impressions." The coffee cart attendant is now the "Coffee Cart Manager." Across the country, corporations are giving workers in low-wage jobs fancy-sounding titles. It's part of a scheme to evade the requirements of the Fair Labor Standards Act (FLSA) and deny these workers overtime pay. And it's working. According to a new study by the National Bureau of Economic Research (NBER), these tactics are allowing corporations to avoid $4 billion in overtime payments annually. The FLSA, enacted in 1938, is the bulwark of legal protections for American workers. Passed in response to the Great Depression, the FLSA established a national minimum wage and a 40-hour work week. Workers laboring for more than 40 hours are legally entitled to overtime pay, "a rate not less than time and one-half their regular rates of pay, except for exempt employees." What is an "exempt employee"? Under the law, an exempt employee must pass each of these three tests:

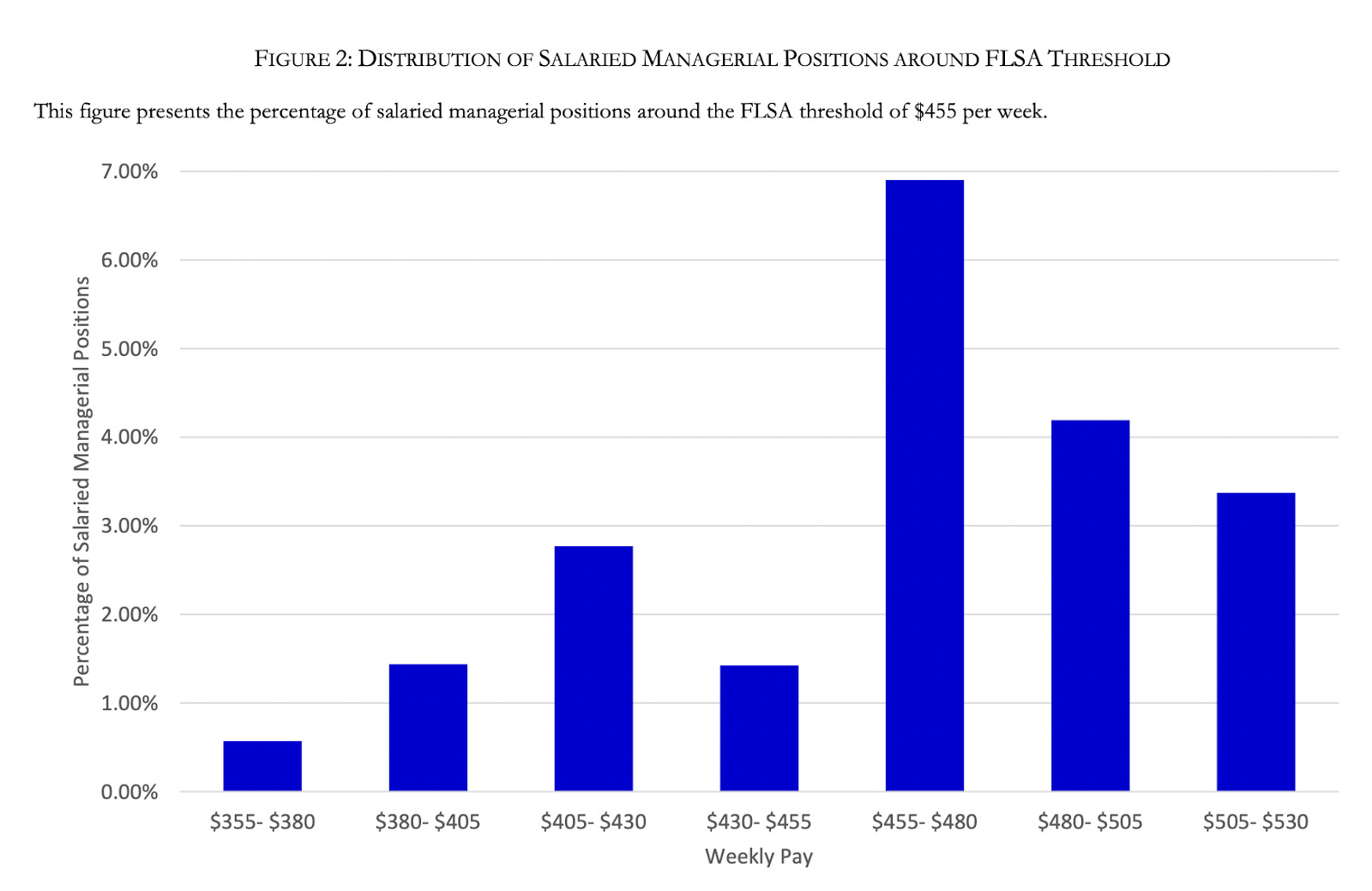

The first two tests are straightforward. Further, satisfying the "duties" by performing "professional duties" is well-defined. Jobs with "professional duties" are "learned professions such as teachers, professors, doctors, dentists, registered nurses, lawyers, and clergy, which require advanced knowledge acquired through a prolonged course of intellectual instruction." But satisfying the "duties test" by claiming an employee's work is "executive" or "administrative" is subject to abuse. An "executive" position's "primary duty must be to manage the business or a customarily defined department or subdivision," including supervising at least two employees. An "administrative" position "involves office/non-manual work directly related to management or business operations and requires judgment and discretion about significant business decisions." Whether a position meets either of these criteria "depends on the employer’s assessment of the position’s responsibilities and is difficult to verify externally." The only external signal of whether a position is "executive" or "administrative" is the job title itself. The Family Dollar Store, for example, gave a large number of employees the title of "Store Manager." But typically these positions "spent 60 to 90 hours a week performing manual labor tasks such as 'stocking shelves, running the cash registers, unloading trucks, and cleaning the parking lots, floors and bathrooms.'" A class action lawsuit was filed against the Family Dollar Store and the company ultimately was ordered to pay $35 million in unpaid overtime pay to 1,424 employees. Misclassifying workers to evade overtime pay laws is illegal but not uncommon. The NBER study analyzed hundreds of thousands of job listings that were posted between 2010 and 2018. The study found that "there is a systematic, robust, and sharp increase in firms’ use of managerial titles around the federal regulatory threshold that allows them to avoid paying for overtime." Specifically, there was a "485% increase in the usage of managerial titles for salaried employees just above the salary threshold set in the Federal Labor Standards Act." While you'd expect, in general, for the percentage of managerial positions to go up as salary ranges increase, there is only a pronounced jump right at the threshold established by the FLSA. Further, five states (Alaska, Connecticut, California, New York, and Maine) have established a different, higher threshold to exempt employees from overtime pay. In these states, there is no jump in managerial titles at the FLSA threshold. This suggests that the increase is driven by corporations seeking to game the system. Based on the data, the study estimates that "that firms avoid paying for over 151 million employee-hours by strategically using managerial titles." The stolen pay "equates to roughly $4 billion in overtime payments avoided per year." It costs the average affected employee $3,194, or 13.5% of their total salary. If misclassifying workers is illegal and can result in large penalties, why is it so pervasive? Because it's still very profitable. The study notes that "compliance actions for FLSA violations resulted in $226 million in back wages in 2019." So, overall, companies are paying $226 million to pilfer $4 billion in wages. That's an 18x return on investment. The major companies stealing workers' overtime payThe misclassification of workers to evade the FLSA is not something that only happens at obscure corporations. Major firms in nearly every industry engage in the practice. In 2017, JPMorgan "agreed to pay $16.7 million to resolve a lawsuit accusing it of violating federal law by misclassifying assistant branch managers at its banks across the country and failing to pay them overtime." In 2016, Avis Budget Car Rental agreed to pay $7.8 million to settle a lawsuit brought by "shift managers" who were not paid overtime. In 2012, Walmart was ordered "to pay $4.8 million in back wages and damages to thousands of employees who were denied overtime charges." The money went to "4,500 vision-center managers and asset-protection coordinators" who were improperly classified as exempt. The study was able to identify the companies with the highest percentage of "overtime avoiding positions." These are companies that are listing salaried positions within $50 of the weekly FLSA exemption threshold. The list includes Arby's, Sonic Drive-In, Pizza Hut, Domino's, Jiffy Lube, Burger King, GNC, H&R Block, Dairy Queen, Subway, Jimmy John's, Little Caesars, Office Max, and KFC. |

Older messages

How Walgreens manufactured a media frenzy about shoplifting

Friday, January 20, 2023

For several years, Walgreens and other major retailers have been sounding the alarm about an alleged spike in shoplifting, describing it as an existential threat to their business. These dramatic

The GOP's bogus war with corporate America

Friday, January 20, 2023

We've been told that the Republican Party has changed. Historically, the GOP has worked hand in glove with big business — slashing corporate taxes, repealing regulations, and weakening workers'

The true priorities of the global elite

Friday, January 20, 2023

This week, thousands of the global elite — billionaires, CEOs, celebrities, and government officials — are meeting in Davos, Switzerland for the World Economic Forum (WEF). The purpose of the event,

The untimely death of Larry Price Jr.

Friday, January 20, 2023

An Arkansas man died in jail after spending a year in pretrial solitary confinement. The official cause of death was malnutrition and dehydration. But the man, Larry Eugene Price Jr., was also the

The right to compete

Tuesday, January 10, 2023

In the United States, about 30 million people are subject to noncompete clauses, which "block people from working for a competing employer, or starting a competing business, after their employment

You Might Also Like

☕ Great chains

Wednesday, January 15, 2025

Prologis looks to improve supply chain operations. January 15, 2025 View Online | Sign Up Retail Brew Presented By Bloomreach It's Wednesday, and we've been walking for miles inside the Javits

Pete Hegseth's confirmation hearing.

Wednesday, January 15, 2025

Hegseth's hearing had some fireworks, but he looks headed toward confirmation. Pete Hegseth's confirmation hearing. Hegseth's hearing had some fireworks, but he looks headed toward

Honourable Roulette

Wednesday, January 15, 2025

The Honourable Parts // The Story Of Russian Roulette Honourable Roulette By Kaamya Sharma • 15 Jan 2025 View in browser View in browser The Honourable Parts Spencer Wright | Scope Of Work | 6th

📬 No. 62 | What I learned about newsletters in 2024

Wednesday, January 15, 2025

“I love that I get the chance to ask questions and keep learning. Here are a few big takeaways.” ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡️ ‘Skeleton Crew’ Answers Its Biggest Mystery

Wednesday, January 15, 2025

Plus: There's no good way to adapt any more Neil Gaiman stories. Inverse Daily The twist in this Star Wars show was, that there was no twist. Lucasfilm TV Shows 'Skeleton Crew' Finally

I Tried All The New Eye-Shadow Sticks

Wednesday, January 15, 2025

And a couple classics. The Strategist Beauty Brief January 15, 2025 Every product is independently selected by editors. If you buy something through our links, New York may earn an affiliate commission

How To Stop Worrying And Learn To Love Lynn's National IQ Estimates

Wednesday, January 15, 2025

... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

☕ Olympic recycling

Wednesday, January 15, 2025

Reusing wi-fi equipment from the Paris games. January 15, 2025 View Online | Sign Up Tech Brew It's Wednesday. After the medals are awarded and the athletes go home, what happens to all the stuff

Ozempic has entered the chat

Wednesday, January 15, 2025

Plus: Hegseth's hearing, a huge religious rite, and confidence. January 15, 2025 View in browser Jolie Myers is the managing editor of the Vox Media Podcast Network. Her work often focuses on

How a major bank cheated its customers out of $2 billion, according to a new federal lawsuit

Wednesday, January 15, 2025

An explosive new lawsuit filed by the Consumer Financial Protection Bureau (CFPB) alleges that Capital One bank cheated its customers out of $2 billion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏