Earnings+More - Fanatics makes BetPARX bid

Fanatics makes BetPARX bidFanatics poised to launch M&A move, Deal Talk reaction, Kambi investor day recap, startup focus – IO Stadium +MoreGood morning. On today’s agenda:

Fanatics’ BetPARX bidThe apparel-to-sports-betting giant is in talks about a takeover that analysts believe could be worth $100-$150m. Ball Parx: The news late on Friday that Fanatics has signed a letter of intent with the Greenwood Gaming-owned online operator came on the same day that the company took its first bet. No agreement has been reached, but analysts at JMP said it would likely be worth between $100m and $150m.

Breaking the seal: The company took its first bet in Maryland yesterday and going by a comment from CEO Matt King during a Massachusetts regulators meeting a fortnight back it appears that MA might be its debut online state. ** SPONSOR’S MESSAGE: BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 19-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand? Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for. Deal Talk instant reactionAccess points: Gideon Bierer, managing partner at Partis, suggested the key likely hinges on BetPARX’s market access in Michigan where the company has a partnership with the Gun Lake tribe. Bierer pointed out that Michigan is a ~$1.5bn GGR market and in terms of further market access is something of a closed shop.

What’s it worth? JMP indicated BetPARX generated LTM GGR of ~$80m, implying net revenue of $50m. Their price tag estimate is based on current trading levels for DraftKings of between 2x-3x sales.

More KambiThe backend supplier was keen to emphasize where it thought machine learning was taking sports betting. Where we’re going, we don’t need roads: COO Erik Lögdberg spoke about the challenge of the next generation of algorithms that will be able to take the “exploding bubble” of sports data and feed it into a “limitless sportsbook” for the end user.

Shape of things to come: CEO Kristen Nylen said the acquisition of Shape Games was about fulfilling the operator need for native apps – he noted that in the US consumers were overwhelmingly choosing apps over browsers. He added that “no-one is doing everything in-house”. “A lot of legacy tech is failing.”

The shares weekRivalry: The Toronto-listed esports-led betting operator enjoyed a good week after announcing an upbeat Q4 trading update. 🎮 Rivalry gets a bump off the back of this week’s upbeat trading update MGM/Entain reportHere we go again: Financial news site CTFN cited an industry source and an investment banker in suggesting MGM will ‘explore’ a bid for Entain only after the UK government’s White Paper on gambling is released.

Analyst takes – MacauDon’t dream it's over: “Unreasonable expectations” and the dangers of “dreaming the dream” about a return to pre-pandemic levels in Macau are the primary risks at present, suggested the team at Deutsche Bank.

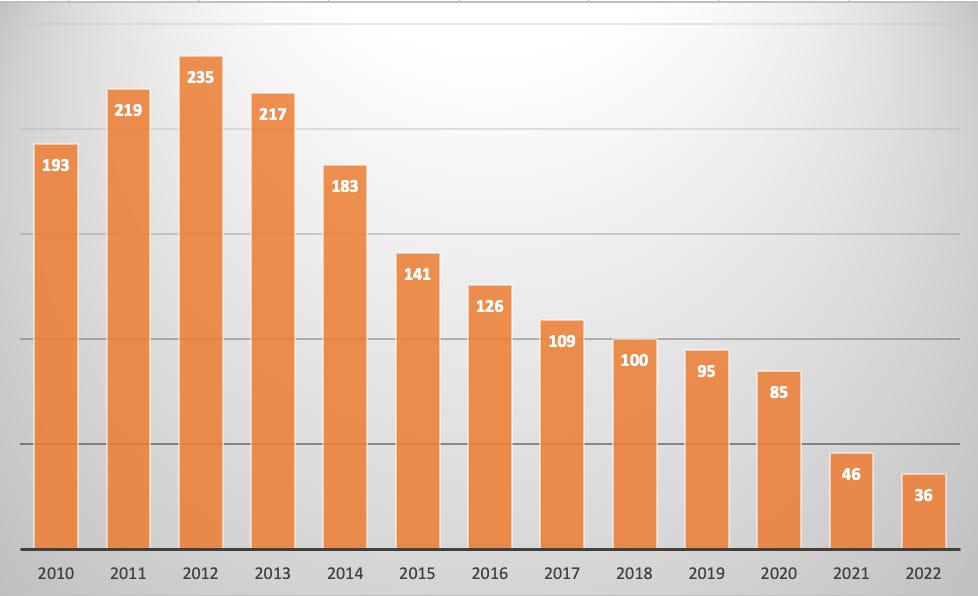

Behind the velvet rope: On VIPs, DB pointed out that under the new rules for junkets they can no longer extend credit, participate in revenue shares or work with multiple concessionaires. As such, the number of junkets has declined dramatically since its peak in 2012.

🌇 End of the road for junkets? (Deutsche Bank/Macau DICJ) More analyst takesLas Vegas: The boom looks set to continue at least into March, according to analysis of the latest room survey data from the team at Truist, who say the rates are robust but with convention-based weekdays showing stronger than leisure weekends. Regionals: The harsh weather impacted player visitation at the end of 2022 but should be viewed as a one-time impact, suggested the team at JMP after conducting a property road trip.

The week aheadLas Vegas Sands: On Wednesday, LVS will give an update against the backdrop of guarded optimism over Macau and the more robust Singapore. Jefferies analysts will be hoping for comment on the Macau concession renewal commitments and the expectations around the VIP business. Casino-to-bingo operator Rank will report its half-year numbers on Thursday. In mid-December, the company warned once again on profits, suggesting FY23 operating profits would fall to between £10m and £20m. On Tuesday, the debut issue of Compliance+More will be sent, including the latest from Massachusetts and Kentucky, an update on the sale of the Park Lane Club in London and a look at what UK Gambling Commission’s deputy CEO said in a speech in Copenhagen. Startup focus – IO StadiumWho, what, where and when: Las Vegas-based IO Stadium was founded in August 2021 by CEO Catherine Lee, who saw the potential for a fan-first full-service NFT development agency and marketplace.

Funding backgrounder: IO Stadium is a founder-funded start-up. The pitch: The company says there is an opportunity to create more immersive, gamified, utility-backed loyalty experiences in the world of sports and entertainment through web3 technologies, while brands can create new revenue streams and lay the groundwork for brand-centric economies.

What will success look like? “Success looks like an all-in-one rewards experience for gamers of all kinds that properly incentivizes loyalty to the brands they love,” says Lee. NewslinesThe Delaware State Lottery has issued an RFP for its iGaming contract, which is currently held by 888. Pollard Banknote has extended its relationship with the North Carolina Education Lottery to provide an iLottery platform until 2025 with renewal options through to 2028. What we’re readingMarge vs. the Monorail: a classic Simpsons episode remembered. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Weekend Edition #81

Friday, January 20, 2023

Bally's 'roadmap rescope', Smarkets redundancies, Kambi's rose-tinted hopes, DraftKings' Euro markets exit, BetMGM's PA promos +More

Weekend Edition #80

Friday, January 20, 2023

Kindred issues a profit warning, 888 update, MeridianBet reverses into Golden Matrix, DoubleDown buys SuprNation, Lottomatica IPO +More

Fanatics cites Sky Bet as ‘second-mover model

Friday, January 20, 2023

Fanatics' plans, OSB's inflection point, DraftKings' unruffled investors, GeoComply 'mimicry' evidence +More

Due Diligence #3

Friday, January 20, 2023

New entrants enter the OSB fray, Kindred serial warnings, recent analyst takes +More

Entain exits unregulated markets

Friday, January 20, 2023

Entain says NGR/EBITDA impact will be small, Macau junket operator ordered to pay $831m fine, Macquarie's 2023 outlook, New Jersey December, analyst takes +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏