Earnings+More - Entain exits unregulated markets

Entain exits unregulated marketsEntain says NGR/EBITDA impact will be small, Macau junket operator ordered to pay $831m fine, Macquarie’s 2023 outlook, New Jersey December, analyst takes +MoreOn today’s agenda:

Gimme more of that Jailbird pie. Entain exitsEntain says it is exiting a number of unnamed unregulated markets where it “no longer sees a path to domestic regulation”. The company said the move is in line with its previously announced strategy that 100% of its revenues would come from markets that are nationally regulated. It said it would “accelerate the process of exiting the few remaining” unregulated markets with immediate effect.

**Sponsor’s message** Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. The Gaming Fund, regulated by the Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy. Yolo Investments has just opened its fund to new investors as it looks to scale new cutting-edge concepts, including its exclusive high-roller land and live casino brand, Bombay Club, global banking network & OTC desk Aims Group. Chau downThe former Suncity CEO has been sentenced to 18 years after being found guilty on multiple charges of defrauding the tax authorities. Under the counter: Alvin Chau, the ex-CEO of Macau junket operator Suncity, will be spending the next 18 years in prison and will be forced to pay a fine of $831m after the court found him guilty of multiple charges of fraud.

Sun setting: The junket operator subsequently ceased all business in Macau in December 2021 and Chau stepped down as chairman. The junket business has been one of the casualties of the Macau downturn as the Chinese authorities looked to crack down on cross-border money flows.

Macau recoveryBounce: The team at Wells Fargo suggested the first-week visitation data is tracking higher than Street estimates. GGR is still running well below 2019 levels (~39% in week one) but this is above EBITDA expectations for LVS and Wynn Macau, the team added.

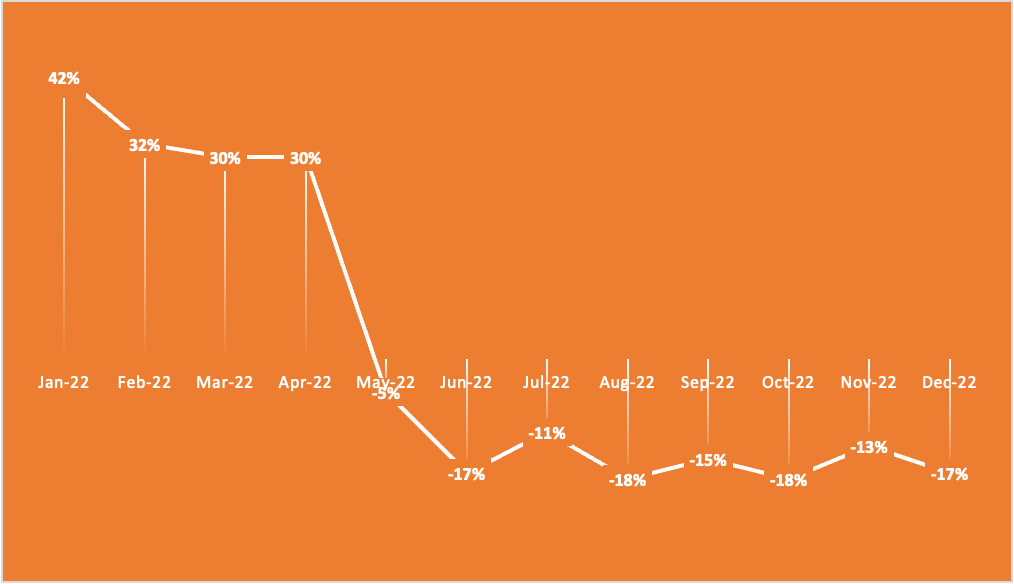

New Jersey DecemberLand-based, sports betting and iCasino all enjoyed an uplift in GGR in December. Dough boys: Casino gaming saw revenues rise 1.8% to $213.9m, while by the same metric sports betting was up 48% YoY to $87.7m and iCasino rose 14% to $152m. The sports-betting figure was despite handle falling 17% to $1.04bn, which was the eighth straight month of declines.

🎢 New Jersey’s eight months of handle declines plotted Macquarie’s outlookThe team suggests there will be a step change for OSB, while the Las Vegas calendar looks packed. Step on: The sports-betting operators will benefit from a pincer movement in 2023 as high hold driven by same-game parlays and cash-out coincides with lower promotional spend, according to Macquarie. This is without any further new legislation, which would be a “major catalyst”.

Going to a party: The team also believed Las Vegas will see revenues come in ahead of consensus, driven by increased group business and by a packed sports and entertainment calendar. The team also thought international demand has been “underestimated”. Analyst takesWynn Resorts: Looking at their “contrarian” stance, the team at CBRE said their recommendation is to “double down” in 2023, saying Wynn “checks on the boxes” on their affinity for “levered equities with stable cash flow, efficient access to capital and an improving fundamental outlook”.

Boyd: Credit Suisse has suggested there are undervalued drivers of growth, including more to come from Downtown Las Vegas following Boyd’s investment in its Fremont Street property.

Churchill Downs: The hitherto “under-the-radar concept” of historical horse-racing machines has been underappreciated, suggested JMP, with growth hitting 68% CAGR since 2019. They noted that the group is one of the only large-scale operators in the space. Downloads: JMP said app downloads rose 9% YoY for the first week of NFL playoffs for the operators that control ~90% of the online market share, the team noted this was against a tough comp, with New York launching online sports betting this month last year. Regulatory finesTony, Toni, Toné: The UK Gambling Commission has issued another fine, this time to TonyBet after investigators found it guilty of failing to have fair and transparent terms and failing to follow social responsibility and anti-money laundering rules.

M&A briefs

Earnings in briefSTS: Revenue for 2022 rose 17% to PLN663m, while NGR in Q4 came in at PLN200m. The company said that in order to focus on the Polish market this year it would phase out its activities in the UK and Estonia. DatalinesMassachusetts casino GGR was up 8% to $103.2m, while Tennessee’s sports-betting GGR rose 186.4% to $47m, with handle rising 29% to $440.4m NewslinesGAN has gone live with OSB and iCasino in Mexico with its B2C brand Coolbet. As required by local regulations, the group partnered with a locally licensed operator but did not reveal their name. Inspired: Brooks Pierce is the new CEO of Inspired Entertainment, having previously held the position of COO , while Lorne Weil remains as chairman. Esports Entertainment: Ex-CEO Grant Johnson is suing the company for breach of contract and wrongful termination. He is claiming accusations from Esports of fraud, wilful misconduct and gross negligence are false. Horse/bolted: Genesis Global’s license has been suspended by the Malta Gaming Authority following its December announcement that it would file for bankruptcy protection. Betting content publisher Tallysight will supply its editorial, publishing and monetization services to The Athletic’s sports fantasy and betting teams. CalendarJan 19: Kambi Capital Markets Day Jan 26: Rank FY ContactThis is a +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Deal Talk #6

Tuesday, January 10, 2023

PointsBet's Oz sale, sector-related M&A deals in 2022 worth $10bn, IGAC SPAC downs PlayUp merger, gaming affiliate M&A is back (sort of) +More

Exclusive – Simplebet scouting NCAA games

Monday, January 9, 2023

Micro-betting supplier goes in-stadia for data, November sees OSB declines across majority of states, startup focus – Outlier +More

Weekend Edition #79

Friday, January 6, 2023

Bet365's year, Caesars vote of confidence, Fanatics' Candy talk, Genius/BetConstruct settlement, sector watch – Italian cash access +More

The Startup Month #6

Tuesday, January 3, 2023

The growth company funding environment for the year ahead, a look back to the funding achieved in 2022 +More

Ohio opens – without Fanatics

Monday, January 2, 2023

BetFanatics fails to launch in Ohio, other Betr makes PointsBet bid, Genesis Global goes belly up, startup focus – Players Lounge +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏