Earnings+More - Weekend Edition #82

Weekend Edition #82BetMGM update, LVS analyst reaction, Houlihan Lokey’s digital outlook, Caesars analyst takes, sector watch +MoreGood morning. In this issue:

BetMGM 'coming of age’BetMGM said it hopes revenues will hit up to $2bn this year as it targets EBITDA profits in the second half. Guiding lines: BetMGM is “coming of age”, according to CEO Adam Greenblatt after it said revenues for 2022 would come in at $1.44bn, 11% ahead of expectations, while EBITDA losses came in at ~$440m.

That's why I fell for the leader of the pack: In iCasino, BetMGM is in a clear leadership position with 30% market share. On the subject of iCasino competition, Greenblatt said the group could only focus on its own strategy.

Greenblatt said the focus on parlays, bonus optimization and finding profitable players versus less productive ones was “paying off” and resulting in a greater NGR percentage, reduced tax rates and increased flow through to EBITDA.

Sowing the seeds of love: As to further iCasino legislation, Greenblatt said a “tremendous amount of education work was going on behind the scenes”. The industry is “sowing the seeds for future legislation”.

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports. To find out more, or book a meeting at ICE, please visit www.metricgaming.com BetMGM analyst takesJam tomorrow: BetMGM’s exposure to the “higher-spending, stickier” iCasino market impresses the team at JMP, who suggested it will lead to a “sharp inflection: to profitability in 2024”.

Anger management: Deutsche Bank suggested it was “refreshing” that no TAM guidance was issued, as it “leads the industry away from benchmarking against largely misleading forecasts… and over aggressive forecasting”. Let’s get it on: There continues to be much chatter about the potential for MGM to buy Entain and resolve the JV issue once and for all, an outcome that Truist said would be a “positive, but not at any price”. The team at Peel Hunt said yesterday that “surely MGM is on the prowl”.

LVS analyst reactionThe prospects of Macau finally following the recovery path set out by other markets has the analysts purring. We’re all waving flags now: The upbeat tone from Las Vegas Sands AMC on Wednesday was noted by the analysts, with the team at CBRE suggesting “there is no one better to wave the green flag” than LVS in Macau.

Calling it: While still early, Wells Fargo noted LVS’s “real-time commentary on Macau’s rapidly recovering GGR” and noted the company has seen high-quality patronage across all segments and evidence of pent-up demand.

Of MICE and men: The team at Macquarie noted that Marina Bay Sands was back on track for a run-rate $1.6bn of EBITDA. In New York, they suggested LVS is a “serious contender” for a license given its track record in “MICE and non-gaming at scale”. 🎯 Las Vegas Sands enjoys a result bump Analyst takesCaesars: The team at CBRE suggested the “real story” this week for Caesars is its new capital structure. Following this week’s bond raise and new credit facility, the team noted the company’s variable rate debt exposure falls to 23% from 43%, thus removing a “significant overhang”.

OSB hold: Deutsche Bank analysts suggested the recreational sportsbook model is “largely, if not entirely, predicated on the mix of single event vs. parlay/multi-outcome wagers”. An operator’s hold level would “essentially mirror” its ability to push players towards parlays.

Digital outlookThe gaming team at corporate advisory firm Houlihan Lokey suggest the sector names are on a comedown from a once-in-a-generation boom. Froth and nonsense: The corporate advisor involved in many of the biggest sector M&A suggested key names in the sector have been oversold since the middle of 2022 – leaving their valuations looking attractive once again.

But they suggested that, with valuations now more attractive, it should give way to new rounds of investment for venture-backed companies in 2023/24. In particular, they thought venture capital and growth capital investors still have a “healthy interest” in digital transformation of the gaming space.

Where the money will go: Companies that target underserved markets; tech that helps lower CAC values; tech that disrupts incumbents; businesses with a shorter ramp to profitability; and essential services that benefit from broader industry growth. Where it won’t go: They noted, though, that with gambling still seen as a sin industry, it will limit the investor universe. Therefore, businesses working in the areas of sports integrity and responsible gambling “may be able to avoid being tagged by ESG concerns”. **Sponsor’s message** Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. The Gaming Fund, regulated by the Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy. Yolo Investments has just opened its fund to new investors as it looks to scale new cutting-edge concepts, including its exclusive high-roller land and live casino brand, Bombay Club, global banking network & OTC desk Aims Group. Sector watch – financial tradingThe UK’s largest spread-betting and CFD providers have all announced trading figures in the last few weeks. Retaining wall: Market leader IG Group said on Thursday it had seen strong trading in its financial H1 with revenue increased 10% to £519.1m, while pre-tax profit decreased by 2% to £240.5m. The company said it had seen growth in revenue per client and “consistency” in client retention rates.

Alphabet soup: Similarly upbeat noises came from rival CMC Markets, which said in an update that, while net operating income was weaker towards the end of the last calendar year, it “recovered strongly” this month meaning the company was trading in line with expectations for its year-end in March.

Plus points: Lastly, Plus500 reported earlier this month an “excellent operational and financial performance” in FY22, despite lower levels of activity across financial markets towards the end of the year caused by the 2022 FIFA World Cup.

This week on E+M

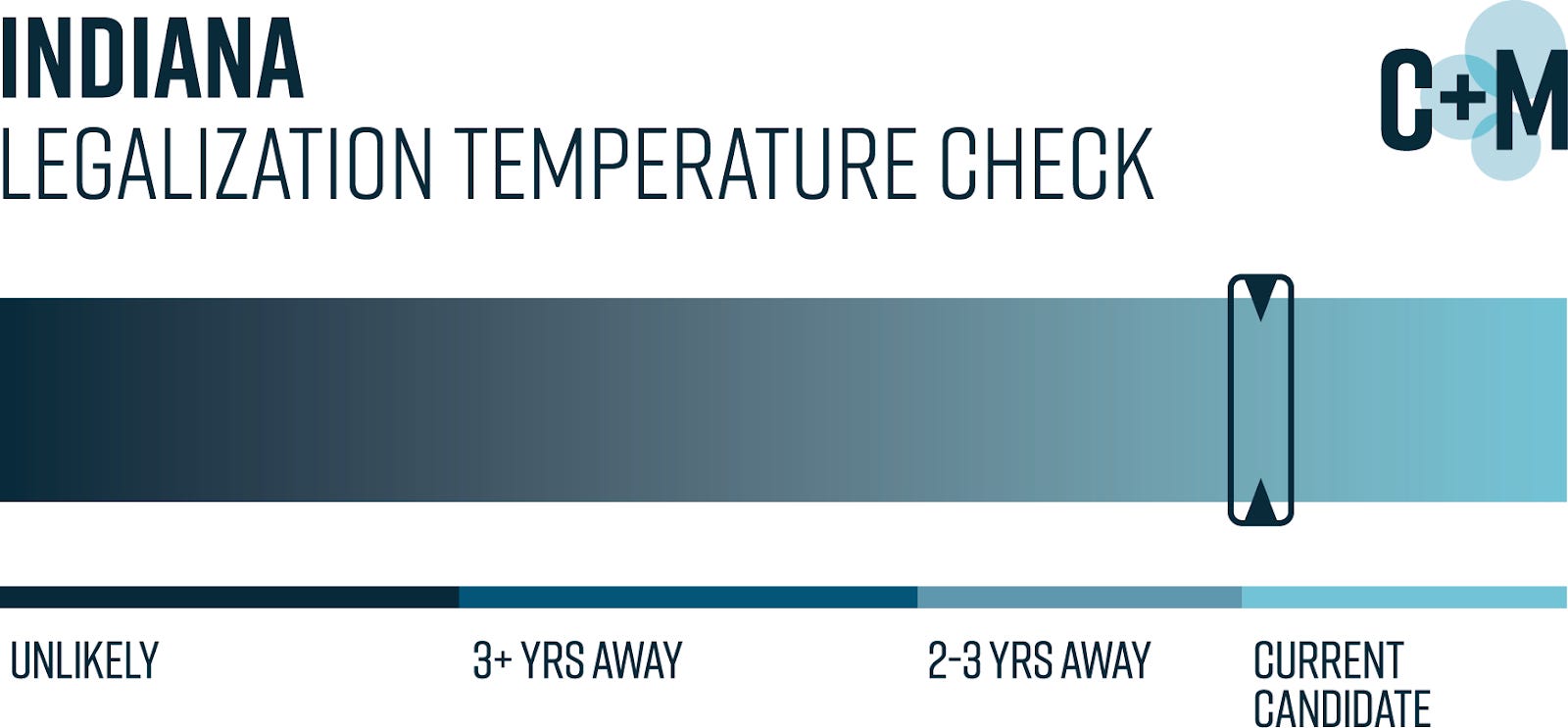

In Compliance+More this week, events in Massachusetts, Kentucky and Indiana were covered. Also, Skywind’s In Touch Games made it a hattrick of UK Gambling Commission regulatory settlements, the Park Lane Club’s travails were examined and Swedish gambling harm data offered insight into tackling problem gamblers. Earnings in briefBluebet: Handle was up 6.6% to AU$147.7m and actives increased 32.3% to 59.6k in Q2. The FIFA World Cup and US promotions drove a 58% increase in OSB handle. The group’s ClutchBet consumer brand soft-launched in Iowa and is set to go live in March in Colorado.

M&A lines

DatalinesDenmark: Gambling GGR rose 7.5% YoY to DK6.7bn in 2022, with iCasino up 2% YoY to DK2.9bn and reaching a record high of DK272.3m in December. Land-based casino GGR increased 59.3% to DK349.2m. Sports-betting GGR was down 3.6% to DK2.3bn and, despite the FIFA World Cup, December GGR was down 35% at DK135.5m, likely due to the national team’s failure to make it out of the group stages. NewslinesGiG has signed a five-year agreement to supply its player account management platform to the Latin American group JOY Enterprise, which will operate the Playr.bet brand in the region. Red Knot Communications has appointed Andy McNamara to head up its new Toronto office. Parimatch has rebranded its backend supply B2B business as GR8 Tech. 1XBET has denied a report that its license to operate in Curaçao has been suspended and that it has been declared bankrupt by a Dutch court. What we’re reading“For anyone who found solace or haven in Crosby’s singing, his death feels like the dimming of some golden light.” The New Yorker. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

LVS bullish on Macau

Thursday, January 26, 2023

Las Vegas Sands' eastern promise, Rank's season to be cheerful, Lottomatica pre-close statement +More

Earnings extra: Caesars Q4 pre-release

Monday, January 23, 2023

Caesars positive on Las vegas and digital, VICI's analyst thumbs up, Michigan data +More

Fanatics makes BetPARX bid

Monday, January 23, 2023

Fanatics poised to launch M&A move, Deal Talk reaction, Kambi investor day recap, startup focus – IO Stadium +More

Weekend Edition #81

Friday, January 20, 2023

Bally's 'roadmap rescope', Smarkets redundancies, Kambi's rose-tinted hopes, DraftKings' Euro markets exit, BetMGM's PA promos +More

Weekend Edition #80

Friday, January 20, 2023

Kindred issues a profit warning, 888 update, MeridianBet reverses into Golden Matrix, DoubleDown buys SuprNation, Lottomatica IPO +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏