Not Boring by Packy McCormick - Wander: Owning Happy Places

Welcome to the 868 newly Not Boring people who have joined us since last Tuesday! If you haven’t subscribed, join 184,121 smart, curious folks by subscribing here: Hi friends 👋, Happy Tuesday! It’s a great week over here at Not Boring HQ. The Eagles are back in the Super Bowl and I get to write about one of my favorite companies: Wander. Wander has a chance to build one of those iconic brands that becomes both noun and verb. As they grow their portfolio of incredible vacation rental properties throughout the US and beyond, I suspect that “Let’s Wander” will become synonymous with “Let’s get away for the week.” Building that kind of brand, especially when Airbnb and established hotel chains exist, is really hard. It takes a relentless attention to detail, a rare willingness to do everything in-house, and an uncommon ability to fit all of the pieces together just so. It also takes the capital to achieve ubiquity, which is why Wander recently launched Atlas, the first vacation rental REIT. So this is a piece about Wander, but it’s also a case study on how to build a Natively Integrated Company from the ground up. We’ve written that the most important companies of the next decade will be built at the intersection of Bits & Atoms — Wander provides a playbook for those willing and able to do the hard work. This essay is a Sponsored Deep Dive on a Not Boring Capital portfolio company. You can read more about how I choose which companies to do deep dives on, and how I write them here. Nothing in this essay is investment advice - check the footnote¹. Let’s get to it. Wander: Owning Happy PlacesNot all those who wander are lost. Look, I didn’t want to use that quote, but bear with me. Since J.R.R. Tolkien first wrote those words in The Riddle of Strider, they’ve been splashed across so many inspirational posters and Instagram bios that they’ve become meaningless. Worse than meaningless, in fact. Tolkien meant the exact opposite. The original is a reference to Aragorn, who wanders around his kingdom not because he is lost, but because he has a very specific goal: to learn to become a great ruler. Those who wander with a purpose, according to Tolkien, are not lost. Those who wander aimlessly are. Admittedly, I only looked into the history of that quote because this is a piece about a company called Wander. But as I read this explanation, it struck me that the dueling interpretations of that same quote are a perfect metaphor for Wander and Airbnb. Wander is vertically integrated and purposeful; Airbnb is a more meandering marketplace. You’ve heard of Airbnb, probably stayed in a few, and maybe even listed your home. I have, and I’ve had good, if varied, experiences. I’ve stayed in some Airbnbs that were more wonderful than the pictures and descriptions could have conveyed, and some that were more appalling than the Host would have wanted us to believe. Airbnb is a marketplace, and navigating a marketplace can feel like aimlessly wandering. For a long time, Airbnb had that special startup sheen on it that glossed over the inconsistencies. Sometimes, you’d show up to an Airbnb and the door was locked and the host didn’t answer the phone and you’d be stuck outside in a foreign country for hours. Sometimes the beds were barely made. Often, the pictures looked just a little bit better than the real thing. When people booked Airbnbs, all of the little hiccups became part of the adventure. “Remember when we were stranded outside our Airbnb in the rain in Porto for three hours and we found that amazing little bar next door?!” That was part of the fun! Not all those who wander are lost, and we were ~wAnDeRiNg~! Now, however, Airbnb is a public and well-known company, and the little inconsistencies aren’t as much fun as they used to be. The beds aren’t as comfortable as hotel beds. There’s no food in the fridge. The Host charged me a $300 cleaning fee and made me take out the trash? Tweets and videos like this one are more and more common:  Lol. Why would anyone stay in an AIRBNB over a hotel?

No wonder these places are empty.

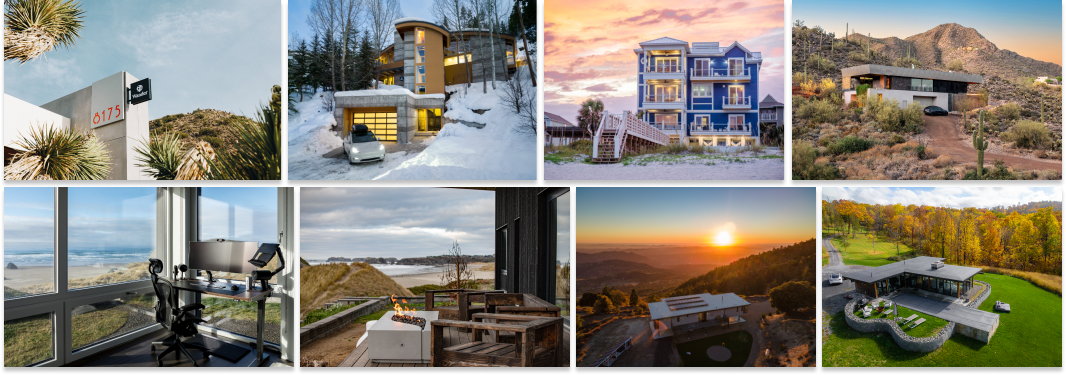

This won’t end well Wander, on the other hand, feels purposeful in every detail. If you haven’t heard of Wander, the best way to think of it is as a vertically-integrated Airbnb. If you haven’t seen Wander, the properties are ridiculous. Here’s a little eye candy: You should go check out the properties and the video tours for each on its site. After I mentioned to Puja that I was writing this piece, she watched all of them back-to-back. Wander properties are architectural gems in stunning locations – some have warnings not to bring kids because they’re perched on the edges of cliffs. They’re the kind of properties that can cost over $1,000 per night – don’t worry, you can split with friends or teammates in the app – and still reach occupancy rates in the 80-90% range and higher. In order to craft a perfect experience, the company handles everything itself:

The benefit of that approach is that it translates into a consistently high-quality experience. Wander’s Customer Satisfaction Score is consistently in the 90s. The drawback is that, unlike Airbnb which is able to acquire its supply for free and scale at near-internet speed, Wander is more expensive and slower to scale. Acquiring, renovating, and furnishing properties is neither cheap nor easy. Or rather, it was capital intensive until very recently, when it launched Atlas. In my Fund III announcement, I highlighted Wander specifically:

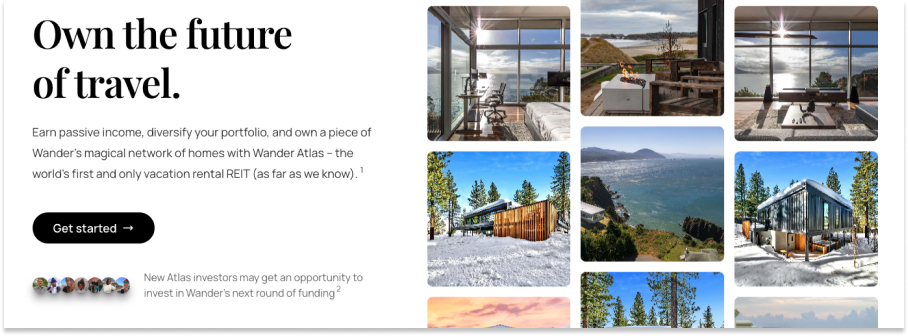

With Atlas, Wander is able to move the costs of acquiring, renovating, and furnishing its real estate portfolio off of its balance sheet by selling shares in its portfolio of homes to institutional and accredited investors. And investors get access to a new asset class – “the first and only vacation rental REIT (as far as we know)” – with a targeted 8% annual dividend². Importantly, Wander retains full control of the experience as it manages all properties in the Atlas portfolio. What Wander is doing with Atlas is catnip to me. It’s a marriage of my professional experience (better executed) with ideas I’ve been thinking through for a long time: While I believe that the natively-integrated approach is the only way to attack a category dominated by large marketplaces, which we’ll discuss, the company’s strategy really comes into focus with Atlas. During my first meeting with Wander CEO John Andrew Entwistle, a Thiel Fellow and second-time founder, it all clicked. It was the pitch I was born to swing at, and I immediately invested one of Not Boring Capital’s larger Fund II checks. My only regret one year later is that I didn’t invest more. Over the past year, I’ve seen Wander execute at every level, from the obvious product-related things to all the little details. Its investor updates are among my favorites to receive because each team leader writes his or her team’s section. I’m writing this wearing my Wander sweatshirt, the most comfortable I own. When I asked JAE where he got them, he told me they designed them in-house, down to the fabric selection, because the quality of the others they looked at didn’t meet their standards. Now, they’re bringing that same attention to detail to bear on Atlas. With Atlas, Wander is creating a new asset class – short-term rental REITs (Real Estate Investment Trust). The company spent roughly $1 million to bring the product to market, working with firms like Latham & Watkins, Ernst & Young, and Citrin Cooperman. They structured the product as a Reg D REIT instead of a Reg A offering. They poured months of effort internally – led by JAE, VP Finance & Head of Acquisitions David Molotsky (ex-Goldman Real Estate), and Head of Capital Markets Jake Kelley (ex-Morgan Stanley Real Estate Structured Finance) – into getting it right. The Private Placement Memorandum – which you’ll have the pleasure of reading during the subscription process – is 160 pages long and chock full of detail. It doesn’t feel like a two-year-old startup led by a 25-year-old founder did this. It’s all part of the master plan – a purposeful wander – that JAE laid out the first time we spoke.

Today, we’ll analyze that strategy, tour Wander’s portfolio, dive into the details on Atlas, and discuss where the company might go from here:

To understand Wander’s potential, you need to understand the theory behind building a portfolio of STR properties. To do that, we’ll start by imagining that Airbnb and Zillow had a baby. Zillbnb and the Short-Term ArbitrageIn June 2020, I wrote a Fantasy M&A piece proposing that Zillow and Airbnb should merge. I gave five reasons I thought a combined “Zillbnb” could make sense, the most relevant of which for this piece is that combining Zillow’s Offers iBuyer product and Airbnb’s short-term rental expertise would create a more robust business. I wrote:

That’s a longer block quote than Dan normally lets me get away with, but it’s important context for thinking about Wander’s portfolio. Essentially, acquiring properties that the company expects to appreciate, financing them, and offering them as short-term rentals increases optionality, potentially lowering risk and improving yields compared to a standard iBuyer model and compared to a portfolio of single-family rentals (SFRs). In the iBuyer model, like Zillow’s now-defunct Offers or Opendoor, companies acquire properties, do improvements, and attempt to sell them quickly, taking a small spread on very large numbers. If the market turns, or a home takes longer than expected to sell, however, the company is stuck holding the bag. By introducing short-term rentals into the mix, they could generate revenue and buy themselves time to wait for the right sale price. The first time John Andrew told me the plan for Wander, I immediately saw the Zillbnb dream, but on a longer timescale. Instead of buying to flip, Wander would acquire properties that it expects to appreciate over a decade or so. It mainly buys residential homes, not those that are already operating as short-term rentals, which means that it can often acquire homes for less than they’re worth to the company. By building a diversified portfolio of high-quality STRs in different locations, it can reduce risk and improve yields across the portfolio. In real estate terms, Wander is buying residential homes and converting them into their “highest and best use”: short-term rentals. By converting them to STRs and improving them cost-effectively, they can then be valued based on a “cap rate” applied to the cash flow they generate, rather than appraised as a residential home. The cap rate is the Net Operating Income (NOI) the property generates each year divided by the Purchase Price of the home, and a lower cap rate is generally a sign that the property is a lower risk investment. So for illustrative purposes, if Wander buys ten $1 million homes that the market believes it could rent annually for $100k above its costs, it would be buying at a 10% cap rate – $100k/$1 million – for a total of $10 million. If it’s able to increase its NOI to $150k on each of the properties and sell the portfolio at the same cap rate – 10% – it could sell the portfolio for $15 million, or a 50% profit. If, by lowering risk through diversification and professionalization, it can lower the cap rate the purchaser is willing to pay to 8%, it can sell the portfolio for $18.75 million, or an 87.5% profit. If Wander is able to accelerate the institutionalization of the STR market, time may bring lower cap rates as the market matures. The larger and more sophisticated an industry becomes, the more likely it is to attract large pools of investors that generally seek low-risk, lower-yielding investments. As a very relevant comp, institutionalization of the SFR market over the past decade or so, and the billions of dollars invested in the space, have driven cap rates down from 10% to ~6%. Wander’s returns may be further enhanced if you factor in annual revenue growth and the fact that Wander finances its properties, meaning that it might take out a mortgage for 60-75% of the purchase price and only put down 25-40% in cash. If it can cover its mortgage payments and operating costs, it can produce higher levered returns than it could by paying the whole purchase price in cash. Up to this point, there’s not a huge difference between the STR model and the SFR model aside from the fact that SFR has been institutionalized, lowering cap rates. The STR market today is where the SFR market was roughly a decade ago. A professional SFR operator like Invitation Homes can purchase a diverse portfolio of residential properties, standardize them, rent them on an annual basis to cover its costs and generate NOI, and sell the lower-risk portfolio at a lower cap rate. Like Wander, an SFR operator can choose to rent out properties when the numbers favor renting, and sell them when the numbers favor selling. Here, though, Wander’s ability to rent properties short-term, for as little as three nights, gives them more optionality, and the opportunity to further increase NOI versus SFRs. As short-term rentals are the highest and best use, optionality provides downside protection. STRs typically generate more income than SFRs, but STRs can also be rented long-term (like SFR’s) if a particular home doesn’t perform well as an STR. The opposite is not true. Further, as a backup to the backup, a Wander STR could be converted back into a regular residential home if it isn’t performing as an STR or didn’t convert well into an STR. That backup backup market – the US single-family home market – is the largest, and one of the most liquid, marketplaces in the world. For now, though, Wander is able to generate a higher NOI by renting its properties to guests for a few nights at a time. Its focus is on increasing RevPAR – a hospitality industry metric based on Average Daily Rate (ADR) and occupancy – by continuing to improve the quality of the guest experience and making sure its properties are booked as many nights as possible. It’s able to do both of those things better than a pure marketplace could because it’s a Natively Integrated Company. To read how Wander is building a Natively Integrated Vacation Rental Company, learn more about Atlas, and glimpse into Wander’s future…Thanks to Dan for editing, and to JAE, Jake, Kyle, David, and Dom for your input! That’s all for today! We’ll be back in your podcast feed on Thursday and back in your inbox on Friday for the Weekly Dose. Thanks for reading, Packy 1 For the avoidance of any doubt, the Private Placement Memorandum (“PPM”) is the sole controlling document for all information concerning investment in Atlas. Neither Wander nor Atlas can guarantee future performance or any return on investment. Like any investment, an investment in Atlas entails the risk of loss of some or all of one’s invested capital. The PPM explains in detail the risks associated with an investment in Atlas and the related terms and conditions of the investment and it should be read carefully and in detail before investing. The PPM is the sole and exclusive source of information concerning investment in Atlas. 2 Neither Wander nor Atlas, nor certainly not Not Boring, can guarantee future performance or any return on investment. Like any investment, an investment in Atlas entails the risk of loss of some or all of one’s invested capital. Not Boring by Packy McCormick is free today. But if you enjoyed this post, you can tell Not Boring by Packy McCormick that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Weekly Dose of Optimism #27

Friday, January 27, 2023

Atomic AI, Blueprint, GLP-1s, Hydrogen Aviation, Biden's America, and DIMO

Atomic AI: Unlocking RNA

Wednesday, January 25, 2023

Why we invested in Atomic AI

Weekly Dose of Optimism #26

Friday, January 20, 2023

RSV Vaccine, Obesity and Diet, Solar Plunge, Rise of Steel, Recession Startups, OFP on NBF

Weekly Dose of Optimism #25

Friday, January 20, 2023

Not Boring Capital Fund III, Alzheimer's Accelerated Approval, Cancer Mortality Rates, Beiruti Solar, Quicklime, Direct Air Capture, Shot of Optimism

Differentiation

Friday, January 20, 2023

Or, why you should be a mutant

You Might Also Like

📣 New Digiday Publishing Summit speakers announced

Thursday, February 27, 2025

New Speakers Announced New speakers have been added to the lineup for the upcoming Digiday Publishing Summit, taking place March 24-26 in Vail. Explore some of our newest additions below and discover

Changing your Domain? Here's How to Avoid an SEO Disaster 🫨

Thursday, February 27, 2025

SEO Tip #78

🦅 I’m speaking at the Creator Growth Summit

Thursday, February 27, 2025

Join me live! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Her Social Site Made $80K in Jan. (and the Tool That Helped Her Do It)

Thursday, February 27, 2025

Last week, we had Niche Site Lady join us on the podcast. She had a ton of great things to say, but one thing in particular that I loved was all of her feedback on how to take her Search Optimized site

How You Can Get Google Ads That Cost Nothing [Roundup]

Thursday, February 27, 2025

Hey Reader, As an e-commerce seller, you probably know that Amazon is the #1 product search engine in the world. The question is, what is Google doing about it? Google shopping is pay-per-click, right?

Asking for Help Isn’t Weakness—It’s Leadership

Thursday, February 27, 2025

Two of the most powerful phrases we can express as leaders are: "I don't know" and "I need help."

Answer the CTA

Thursday, February 27, 2025

Find the right appeal.

The meme coin I launched went to nearly $1m...

Thursday, February 27, 2025

(All for charity dw) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🌁#88: Can DeepSeek Inspire Global Collaboration?

Thursday, February 27, 2025

How an open-source mindset, relentless curiosity, and strategic calculation are rewriting the rules in AI and challenging Western companies, plus an excellent reading list and curated research

He paid an SEO firm $20k but only got 4 pageviews

Thursday, February 27, 2025

Jason Rainsforth from Dependant Electrical in Melbourne spent $20k on a 24-month contract with an SEO firm but got a depressing 4 pageviews on his website. Plus more stories from Marketing and SEO