ETH 2.0 Hot Concept: SSV.Network Eco Inventory Decentralized Staking Infrastructure

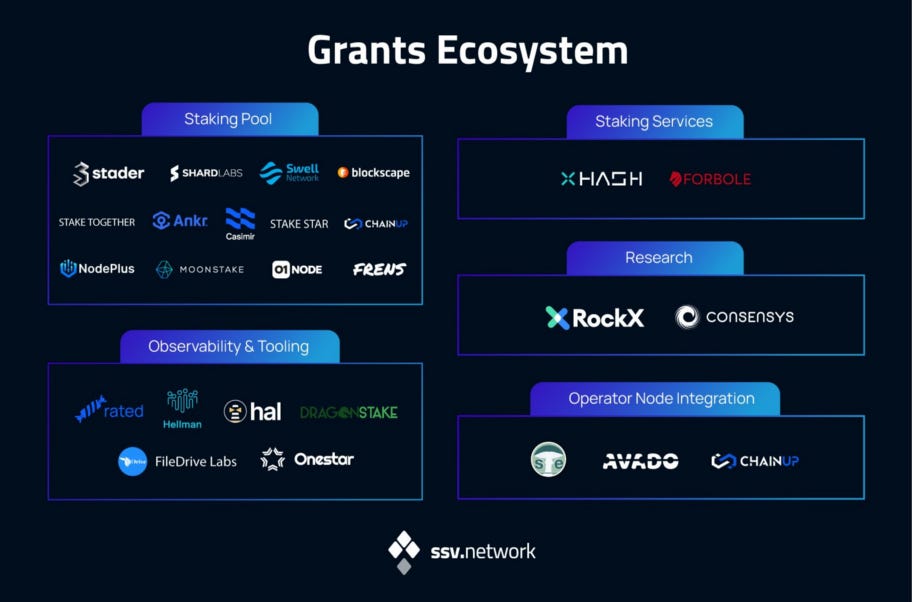

Author: @0xMavWisdom SSV.Network DAO recently launched a $50 million ecosystem fund to support the development of applications based on Distributed Validator Technology(DVT). The technology is a key component of Ethereum co-founder Vitalik Buterin’s roadmap for decentralising Ethereum, and SSV.Network hopes to use the funding to further consolidate the DVT as the key Ethereum infrastructure. SSV.Network is a fully decentralised open source Ethereum stake protocol developed with the participation of Obol, a secret shared verifier network for Ethereum, and Blox, an unmanaged Ethereum 2.0 stake protocol. SSV enables a secure and robust method of splitting verifier keys between untrusted nodes or operators in a secure manner while maintaining distributed control and activity of Ethernet verifiers for ETH staking. SSV.Network is currently in beta phase. The recently released Shifu V2 version of SSV.Network will allow upgraded nodes to formally participate in all responsibilities used in the Ethereum consensus. SSV is a native Token of SSV.Network, with a total of 1100w and essentially full circulation. The main uses of the Token are (1) Payments: Operators operate on behalf of stakes to verify that the validator receives SSV rewards (2) Governance: Submitting votes and voting on DAO decisions (3) Donations: Helping to fund developers and contributors who develop the network. Operators, partners and funding recipients form the basic ecosystem of SSV, with over 20 projects currently being built on top of the DVT. Staking Pool: The Staking Pool model of SSV.Network is mostly an integrated protocol, and there are no native Staking pool projects among the officially certified projects. Staking pools that are already under construction on SSV.Networks, such as Swell Network, ANKR, Spectrum, Steader, etc., have already introduced the ability to stake on SSV.Networks. Chainup, Shard Labs, Moonstake, Infinite Lux, 01Node, Onestar, Blockscape, tardust and others have not yet launched or will soon launch staking on SSV.Network. Staking Services Blox staking: Blox is an unmanaged ETH staking platform that claims to be the first unmanaged staking solution for Ethereum, with the native Token being CDT, launched in two phases. The team previously built and operated Blox Finance, and with funding from the Ethereum Foundation, Blox is developing an SSV node for Ethereum stakes. Users need to have 32 ETH and a cloud account created by the user to make a Blox stake, and the staker pays a monthly fee to the cloud service. XHash: An uncustodied enterprise stake provider on SSV that allows users to stake assets in an uncustodied form. XHash eventually charges nearly 9% of the stake proceeds as a fee and currently has over 1,100 verifiers and over 35,000 ETH staked on XHash. Forbole: Multi-chain stake provider, official SSV funded project, not yet live on SSV.Network stake. CryptoManufaktur: Founded in 2020, the company provided various price feeds in the Chainlink ecosystem, before joining the Ethereum ecosystem building, working with the Ethereum Foundation to provide testing solutions for beacon chains and partnering with Blox on their DV (Distributed Validator) project, and is currently active in the Prater test network. Suspected RUG: 0neinfra Observability & tooling DragonStake: one of the SSV funded projects, the team is focused on building blockchain security and operating validators for different proof-of-interest networks, while the SSV.Network stake feature is still in testing and is not yet live. Hal: Hal is Web3’s messaging application that currently has over 20,000 users. Users can use the app to query and monitor data from multiple blockchain networks, including SSV.Network, and be notified in the first instance by their email, Telegram, Discord, Twitter, Slack or Webhook. FileDrive Labs: SSV funded decentralised storage project that aims to enable everyone to benefit from distributed storage and build high-performance, user-friendly and scalable storage infrastructures and applications. Operator Node Consolidation Stereum: SSV funded tool for managing the setup and maintenance of Ethereum nodes that users can install and setup via the Ethereum Goerli test network or the main Ethereum network while maintaining user privacy. SSV.Network dominates the network with integrated protocols, which may be related to the fact that SSV itself is not aimed directly at C-users and serves more stake providers, node operators and centralised exchanges. However, another major strength of SSV. Network is its expertise in working with decentralised autonomous organisations. The DAO Partner Program, launched at the end of 2021, has already attracted Digital Currency Grup, Coinbase, OKEX Ventures, NGC Ventures, Allnodes, RockX, AMBER, Skillz and many others. SSV.Network provides a service equivalent to outsourcing, helping them to reduce the cost of using their infrastructure when staking. As a decentralised stake infrastructure enjoying the dividends of the ETH 2.0 stake track, SSV.Network is rightly built with stakes in mind, but it does not sell itself on taking deposits from users, instead moving to serve as an infrastructure for verifiers, a model that could be extended to other POS chains in the future. Reference: https://cointelegraph.com/news/ssv-launches-50m-ecosystem-fund-to-support-eth-staking-tech https://abmedia.io/20220111-ssv-network-non-custody-staking-protocol Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

VitaDAO: Pfizer-Invested Longevity Research, A New Paradigm for Decentralized Science?

Wednesday, February 1, 2023

Author: @0xMavWisdom On 30 January, DeSci track longevity startup VitaDAO announced the completion of a $4.1 million funding round from Balaji Srinivasan, former CTO of Coinbase, and Pfizer Ventures,

Analysis of Degen Zoo: $20,000 for 30 days of development, DAOMaker's founder "go into business" himself

Tuesday, January 31, 2023

Author: @0xMavWisdom Note: This article is for information sharing only and does not endorse the project and is not intended as any investment advice. The development of an animal NFT game called Degen

Global Crypto Mining News (Jan 23 to Jan 29)

Monday, January 30, 2023

1. Bankrupt crypto lender BlockFi plans to sell loans backed by 68000 bitcoin miners for about $160 million. Sources familiar with the matter said that given the current price of bitcoin miners, some

Asia's weekly TOP10 crypto news (Jan 23 to Jan 29)

Sunday, January 29, 2023

Author:Lily Editor:Colin Wu 1. A large number of Chinese crypto entrepreneurs have relocated to Singapore link A large number of crypto entrepreneurs from China have relocated to Singapore in the past

Former PBOC Monetary Policy Member Huang Yiping: China Bans Cryptocurrencies, May Miss Development Opportunities

Sunday, January 29, 2023

Source: https://www.wu-talk.com/index.php?m=content&c=index&a=show&catid=10&id=11126 Huang Yiping, professor of finance and economics at the National School of Development of Peking

You Might Also Like

Interview with MicroStrategy Founder Michael Saylor: The Company Holding the Most Bitcoin in the World

Thursday, February 27, 2025

In this interview, Colin from WuBlockchain had an in-depth discussion with MicroStrategy founder Michael Saylor about the company's ongoing Bitcoin acquisition strategy, the growing adoption of

Abu Dhabi Invests $436.9M In Bitcoin ETF

Thursday, February 27, 2025

February 17th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Abu Dhabi Invests $436.9M In Bitcoin ETF Changpeng Zhao Sparks Meme Coin Rumours Coinbase Finally Lists POPCAT & PENGU

📈 BTC’s realised price (average acquisition price) reached an all-time high of $43,000; State of Wisconsin Invest…

Thursday, February 27, 2025

BTC's realised price reached an all-time high of $43000; Abu Dhabi's Mubadala Investment disclosed its BTC ETF holdings; South Korea to allow universities and charities to sell crypto donations

HashKey Exchange's Interpretation of the Hong Kong SFC Virtual Asset Roadmap

Thursday, February 27, 2025

We are pleased to see the Hong Kong government release the forward-looking and pragmatic “ASPI-Re” roadmap for advancing the virtual asset industry. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Argentina’s stock market plummets amid President Javier Milei’s LIBRA memecoin scandal

Thursday, February 27, 2025

Argentina's economic landscape shaken as Milei's LIBRA endorsement turns into multi-billion dollar fiasco. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Heated AMA Debate: 0G Team Responds to Allegations of CFX Soft Rug, Overvaluation, and Token Commitment Concerns

Thursday, February 27, 2025

This AMA primarily focused on the relationship between Conflux and 0G Labs, discussing 0G Labs' high valuation, fundraising structure, technical direction, and community concerns over transparency.

Pectra: Ethereum’s Next Major Upgrade

Thursday, February 27, 2025

Breaking down key changes included in Ethereum's Pectra hard-fork ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Solana falls to lowest price since November 2024 losing 43% since January

Thursday, February 27, 2025

Volatility reigns as Solana's price retreat tests its resilience against past support levels. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Five Projects with Real-World Revenue Scenarios Utiling Token Empowerment

Thursday, February 27, 2025

Memecoin once captured significant attention and investment with its unique culture, humorous image, and community-driven characteristics. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📉 Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation alloc…

Thursday, February 27, 2025

Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation allocated 45000 ETH to DeFi protocols. Standard Chartered established a JV to issue a HKD-backed stablecoin ͏ ͏ ͏ ͏