Earnings+More - Weekend Edition #83

Weekend Edition #83Boyd sees Strip overflow benefits, analysts react to Penn, French World Cup betting examined, sector watch – tokens +MoreGood morning. Welcome to the latest weekender:

Boyd’s local actThe Nevada Downtown and Locals markets were every bit as effervescent as the Strip. Beats by Boyd: The booming Las Vegas market in the last three months of the year was “clearly benefiting” Boyd Gaming’s properties, particularly from the returning conventions business, according to CEO Kevin Smith.

Smith said the online partnership with FanDuel continued to deliver “impressive” results, generating $17m in EBITDAR during the quarter, while the recently completed Pala Interactive business also made a debut contribution.

Analyst takes: Macquarie said Boyd has developed several growth drivers, including online and the management contract at Sky River Casino in California that, the team suggested, would “help offset potential consumer pressure”.

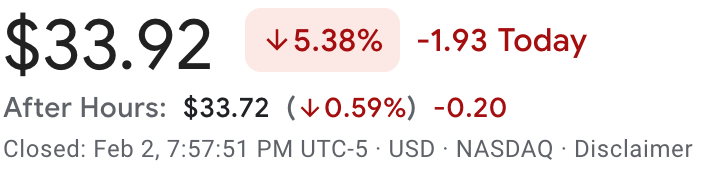

** SPONSOR’S MESSAGE ** The Fastest Sports Betting Data In The World: OddsJam offers real-time odds from over 150 sportsbooks in the United States, Canada, Europe, Australia, and more. See why tier 1 operators, affiliates, and DFS companies turn to the power of OddsJam sports betting data & screen to work smarter, not harder. Book a demo or drop us an email at enterprise@oddsjam.com. Penn analyst takesPenn’s share price decline of over 5% suggests some disappointment with its Q4 earnings. Don’t bring me down: The team at CBRE suggested regional gaming should hold up better than other consumer sectors in 2023 unless there is a severe recession, but they noted that investors’ expectations ahead of the earnings was for a “more upbeat outlook”.

While some analysts saw encouragement from Penn’s online performance in Ontario, Credit Suisse expressed skepticism of Penn’s online outlook, believing the Score brand in Canada “simply resonates more than Barstool does in the US”.

🛑 Penn suffers a 5%+ fall after earnings ‘disappointment’ World Cup betting – FranceFrench players staked record amounts during the Qatar World Cup, but post-Covid the activity levels were also a market corrective. Record stakes: Data from France’s gambling regulator ANJ has revealed that the World Cup generated record OSB stakes of €597m and GGR of €70m. The stakes were 56% higher than for the 2018 World Cup and 37% higher than for Euro 2020.

Player profiles: The main reason for the drop was fewer players opening accounts in 2022 (177k) than in 2018 (232k). Twice as many women aged 18-24 were recruited than during a regular season and the same age group accounted for 53% of new players. Ad break: Prior to the tournament ANJ set the objective of “de-intensifying advertising pressure” from sportsbooks and said a “change in tone was observed”.

Sector watch – fan tokensPremier in: Ethereum-based fantasy football league operator and French tech unicorn Sorare confirmed this week that it had signed a multi-year sponsorship agreement with the English Premier League.

Balls: Rival fan token provider Socios has also signed deals to list on secondary markets such as Binance and Mexc and in South Korea with the exchange Upbit. It recently unveiled a feature that enabled fans to win blockchain-authenticated ‘goal balls’ from the Italian Super Cup matchup between AC Milan and Inter Milan.

** SPONSOR’S MESSAGE ** Tried, tested and proven over a decade in the highly-regulated US market, and continuing to expand across Europe, Latin America, Asia and Africa. GeoComply harnesses the power of its market-leading geolocation technology to protect against fraud, including fake account creations, bonus abuse, account takeovers, stolen identities, money laundering, and more. Visit geocomply.com. Slot survey dataBroad positive: Macquarie welcomed Eilers-Fantini data showing ~20k slot replacement units were purchased in Q4 in North America. The analysts said the figures were 10% above pre-Covid levels and were “broadly positive” for a sector currently trading “well below historical averages”.

IGT debt ratingFitch has initiated on IGT’s debt with a stable outlook, reflecting IGT’s “conservative leverage”, which they say has “improved meaningfully” from pre-pandemic levels. “This has been funded by non-core asset sale proceeds and strong FCF generation,” Fitch added. ICYMIIn Earnings+More this week:

In Compliance+More this week:

On Sharpr this week:

NewlinesSlot manufacturer Aruze Gaming has filed for bankruptcy in Nevada. The group said it would continue operating under Chapter 11 rules; the filing was part of its efforts to restructure its finances following a recent garnishment judgment against it. EBET is hoping to raise $6.5m from investors through a sale of shares and warrants. GiG had finalized its agreement to provide its platform, sportsbook and omni-channel solution to Ontario-based operator Casino Time. Narrativa and Quarter 4 will provide their AI-generated sports-betting content and data to the Associated Press news agency. ODDSworks has partnered with Rush Street Interactive to launch its BETguard remote gaming server with the group’s BetRivers and PlaySugarHouse online portals in Pennsylvania, which will soon be followed by a New Jersey launch. Odds On Compliance and U.S. Integrity have established the joint venture ProhiBet to monitor and maintain prohibitions on athletes, coaches and league officials. What we’re readingTangy: The murky world of Worcestershire sauce. Chelsea shopping spree: Panic buys or strategic nous? (Who cares? An SW6 Ed. I do! An SW6 Sub-Ed). Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Penn’s hits and misses

Thursday, February 2, 2023

Penn Entertainment's Q4 comes in below expectations, earnings in brief from EveryMatrix +More

DraftKings hits the layoffs button

Thursday, February 2, 2023

DraftKings announces restructuring, Evolution earnings, Better Collective's Catena Media stake, optimism in Macau +More

Entain seeks UK ‘clarity’

Wednesday, February 1, 2023

Entain update, Las Vegas December, GiG completes AskGamblers deal +More

PointsBet’s NBC 'realignment’

Tuesday, January 31, 2023

PointsBet has changed the terms of its NBC deal, XLMedia issue trading update +More

888 VIP compliance scandal, CEO sacked

Monday, January 30, 2023

888 admits to VIP failures, Ontario's success, Grilla funding round, datalines – New York, the week ahead, the shares week, startup focus – humbl.ai +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏