Earnings+More - 888 VIP compliance scandal, CEO sacked

888 VIP compliance scandal, CEO sacked888 admits to VIP failures, Ontario’s success, Grilla funding round, datalines – New York, the week ahead, the shares week, startup focus – humbl.ai +MoreGood morning. On today’s agenda:

One touch gives me chills and we ain't even close yet. 888’s compliance scandalCEO goes as company says Middle Eastern VIP suspensions will cost it 3% of group revenues. Scandal! 888 has immediately suspended VIP customers from the Middle East region after an internal compliance review uncovered AML and KYC failures. The company said “best practices have not been followed” but claimed the deficiencies were “isolated to this region only”.

Question time: The news leaves it open as to which jurisdiction the transactions with the VIPs would have fallen under. Whichever licensing authority it is will be unlikely to look kindly on events, suggested sources.

Possibly not unrelated: 888 has laid off dozens of staff at its 590-strong office in Tel Aviv, Israel, according to reports from a news site called CTech. Analysts at Regulus said this “may also be relevant”. Situations vacant: “888 now has the problem of finding a CEO who wants to take on an operational turnaround, intense regulatory scrutiny, high debt, UK retail exposure and gambling reputational risk,” said Regulus.

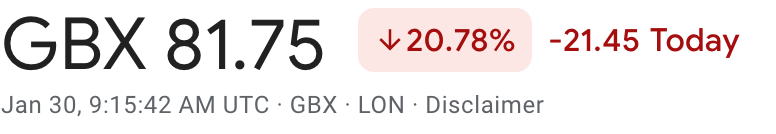

Compliance+More: Tomorrow’s newsletter will have more on the story. Sign up here. Catch a falling knife: Shares fell over 20% in early trading this morning. **Sponsor’s message** Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. The Gaming Fund, regulated by the Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy. Yolo Investments has just opened its fund to new investors as it looks to scale new cutting-edge concepts, including its exclusive high-roller land and live casino brand, Bombay Club, global banking network & OTC desk Aims Group. Ontario’s channeling successThe new regulated market is hitting the mark in terms of minimizing gray market activity. GGR in the three months to December rose 71% QoQ to C$457m from handle that soared 91% to C$11.5bn in what the analysts at Regulus said was an “extraordinary pace of growth”. iGaming Ontario noted the number of operators rose 50% over the period to 36; the number of sites rose to 68, a 62% increase.

Regulus pointed out that Ontario Lottery and Gaming’s online revenue has “not been distorted” by having to compete with commercial operators. OLG’s revenues have grown by a CAGR of ~65% to C$430m between 2019-20 and now, and ~20% market share.

One unhappy punter: Not everyone is quite so enthusiastic about Ontario’s success in converting gray market operators to regulated entities. On the BetMGM investor call last week, CEO Adam Greenblatt bemoaned the tough competitive environment in the province.

Datalines – New YorkWells Fargo says the second full week of YoY comparisons shows promotions are now more targeted. What dreams are made of: The second full week of year-on-year comparisons offer some insight into the evolving New York market, suggested the team at Wells Fargo. They pointed out that with GGR rising 33% in the week to January 22, but with handle off by over 21%, it indicated last year’s handle was “buoyed by promotions”.

All about the football: Handle is likely to continue to decline by the YoY metric, they added. This contrasts with other states that have seen handle growth. Michigan, for instance, was up 30% in its first YoY, Virginia 51% and Arizona 27%.

Analyst takesCaesars: The combined $4bn of news notes and credit facility raised by Caesars last week – both elements of which were upsized – could be a “catalyst” for the sector, suggested Jefferies. The team noted the raise looks to have been “catalyzed” by the expectation that the Fed is finished with raising rates.

Grilla raiseThe Miami-based esports and skill games platform has raised $3m and gone live with a beta offering. Just tell me that you want me: After receiving funding from well-known VC Tusk Venture Partners, the all-in-one platform provider has already attracted 20,000 registered users. The platform allows users to wager on any type of video game or skill-based competition.

In it to win it: Evan Kaylin, CEO and founder, said Grilla was “founded on the principle that you don't have to be a pro to compete like one”. Who’s Tusk? Tusk Venture Partners was previously invested in FanDuel and Coinbase. It is run by Bradley Tusk out of New York. The week aheadPointsBet will be updating the market late on Tuesday, ET. Of interest will be any further news on the reported A$250m bid made by NTD, the company behind the Australian Betr business.

On Wednesday morning, Entain will provide a Q4 trading update. Last week’s update from BetMGM gave an insight into how the US joint venture was faring, news that was accompanied by the usual analyst chatter over whether MGM would come back with a bid for its partner. On Thursday, live gaming and iCasino supply giant Evolution will produce its Q4 earnings. Analysts will be hoping to hear more about whether the company has managed to turn things around with its RNG offering.

A busy week will also see an Earnings Extra released on Thursday afternoon as Penn Entertainment hits the wires. When the company last reported in Q3 it told the market that losses in its online business had widened. The next issue of Compliance+More will be released on Tuesday including reaction to UK gambling minister Paul Scully’s generally well-received speech at the Betting and Gaming Council AGM. The shares weekThe listed data providers enjoyed a good week with both Sportradar and Genius Sports seeing double-digit surges. It’s just the sun rising: Both the listed suppliers will be hoping the tide has turned for investor interest in their stocks after each suffered along with other key betting and gaming stocks in the latter half of 2022. 🔥 Sportradar and Genius Sports sitting in a tree Startup focus – humbl.aiWho, what, where and when: Humbl.ai was established by Alen Kojadinovic, who was previously head of casino at the affiliate firm Acroud.

Funding backgrounder: Humbl’s last funding round was in December when Leo Ventures invested €250k for 25% of the company with the option to increase its ownership. The pitch: Kojadinovic says his goal is to see the “real adoption of AI and automation tools within the iGaming industry” and across all geographies. The reaction from industry stakeholders has so far been “overwhelmingly positive”.

What will success look like? Kojadinovic says it is too early – “hopefully a decade away” – to think of exits or selling up.

Rokker’s Business Design services deliver global gaming clients with research and insight alongside actionable strategy, clarity and alignment. We research, analyse and ideate to address the challenges and opportunities that affect our client’s product, proposition, people and process. Our work aligns clients’ boards and teams in building businesses people love. To find out more visit: https://www.rokker.co.uk/ Affiliate M&AThe somewhat mysterious transaction that E+M wrote about late last year that saw Acroud snap up Catena Media’s paid media business also saw former SBAT founder Gary Gillies switch with the business. He has gone on social media to say that he is the third-biggest shareholder in the company with 11% – and had been foiled in his attempt to grab more. NewslinesDraftKings and beer giant Molson Coors Beverage Co. are reported to be teaming up for an ad to be run during the Super Bowl. Red Rock Resorts will open the Wildfire Casino in downtown Las Vegas on February 10, according to reports. MGM and the NFL Players Association will collaborate on creating new content and fan experiences with current and retired NFL players. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Weekend Edition #82

Friday, January 27, 2023

BetMGM update, LVS analyst reaction, Houlihan Lokey's digital outlook, Caesars analyst takes, sector watch +More

LVS bullish on Macau

Thursday, January 26, 2023

Las Vegas Sands' eastern promise, Rank's season to be cheerful, Lottomatica pre-close statement +More

Earnings extra: Caesars Q4 pre-release

Monday, January 23, 2023

Caesars positive on Las vegas and digital, VICI's analyst thumbs up, Michigan data +More

Fanatics makes BetPARX bid

Monday, January 23, 2023

Fanatics poised to launch M&A move, Deal Talk reaction, Kambi investor day recap, startup focus – IO Stadium +More

Weekend Edition #81

Friday, January 20, 2023

Bally's 'roadmap rescope', Smarkets redundancies, Kambi's rose-tinted hopes, DraftKings' Euro markets exit, BetMGM's PA promos +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏