The Pomp Letter - The Puppeteer of Markets

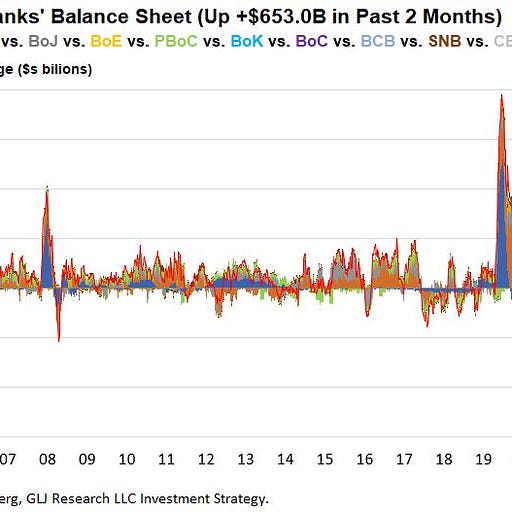

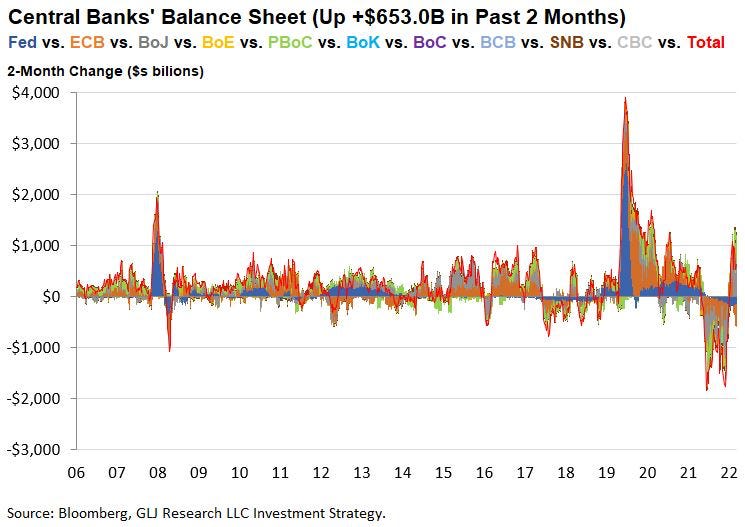

To investors, Carlo Collodi wrote the famous novel The Adventures of Pinocchio in 1883. Geppetto, the impoverished woodcarver, aspires to switch careers and become a puppeteer. He gathers wood blocks, sets aside dedicated time, and creates a marionette named Pinocchio. This timeless story has a number of similarities to the current financial market. First, central banks are the Geppetto equivalent. These organizations trace their history back to 1668 when the Swedish Riksbank was created to lend the government money and clear commerce transactions. The role and responsibility of the central bank was unchanged for centuries, but around the turn of the 20th century these organizations embodied Geppetto’s desire to change jobs. Central banks began to manipulate interest rates in an effort to stabilize economies, which was followed by the abandonment of the gold standard and the creation of fiat currencies. Second, central banks have perfected the occupation of puppeteer. They sit behind the scenes and pull strings to watch asset prices dance. This is painfully obvious when you evaluate a chart of the top 10 central bank balance sheets since 2006. It is easy to see where they have injected immense amounts of liquidity, which leads to subsequent asset price increases, along with demand destroying liquidity removal in the market creating the opposite effect. A micro example of how this mechanism plays out is the last 60 days or so. There has been a $653 billion increase in global liquidity from the top 10 central banks. Naturally, stocks and other assets have been rallying. This follows the significant drop in asset prices during 2021 that coincided with the draining of almost $2 trillion from the same balance sheets. Gordon Johnson recently pointed out that this net increase in liquidity has been largely due to China’s $500+ billion injection during the same 60 day period. At the same time, the Fed and ECB have been sucking liquidity out of the system to the tune of $150 billion and $430 billion respectively. Central banks want asset prices to go up, they pump the system with liquidity. Central banks want asset prices to go down, they drain liquidity from the system. Modern day Geppetto. It gets even better though. 🚨 The rest of this letter is only available for paying subscribers to The Pomp Letter. Their support makes this work possible. If you’re not a subscriber, consider subscribing to read the rest of this letter and help us continue to create independent work on financial markets 🚨... Subscribe to The Pomp Letter to read the rest.Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content. A subscription gets you:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Older messages

How to Resist the Zero Interest Rate Mind Virus

Tuesday, January 31, 2023

Listen now (4 min) | The mind virus has infected a generation. It will take hard work to get them back.

Four Thousand Weeks: Time Management for Mortals

Monday, January 30, 2023

Listen now (14 min) | Pomp's notes on Four Thousand Weeks by Oliver Burkeman

Is Negative Inflation Upon Us?

Friday, January 27, 2023

Listen now (8 min) | Inflation has been a multi-decade high, but maybe it will go negative in 2023?

Special Message From Pomp 🙏🏼

Wednesday, January 25, 2023

To investors, Every morning I wake up and write this letter. It forces me to learn about various topics and provides an opportunity to organize my thoughts. My goal is to provide independent analysis

Where Does The Government Spend Trillions Of Dollars?

Tuesday, January 24, 2023

Listen now (7 min) | An easy-to-understand breakdown of annual government spending

You Might Also Like

Dry powder piles up for mature funds

Monday, March 10, 2025

Defense tech VC deals balloon; data dive on VC's emerging opportunities; France's positive quarter, but sluggish year Read online | Don't want to receive these emails? Manage your

Digiday wants to hear from you

Monday, March 10, 2025

As a loyal reader, your feedback is vital as we continue to evolve our products and coverage. We're reaching out to see if you'd answer a few questions to help make your experience with Digiday

Advertisers are calling for full URL-level campaign reporting, and DSPs are responding in different ways

Monday, March 10, 2025

The Trade Desk quells talk of full URL-level campaign reporting (similar to Amazon), but there are nuances. March 10, 2025 PRESENTED BY Advertisers are calling for full URL-level campaign reporting,

The 90-10 Rule: Why Great Leaders Don’t Need Universal Approval

Monday, March 10, 2025

Leaders who focus too much on making everyone happy may inadvertently stifle the very innovation and progress that constructive dissatisfaction can inspire.

Athletes Are Making Their Own Chip Deals 🥔💰

Monday, March 10, 2025

Athletes turning snacks into serious cash 🚀🥔

🔔Opening Bell Daily: Investor jitters grow

Monday, March 10, 2025

Traders keep selling stocks and US indexes are lagging the rest of the world.

A shellacking

Monday, March 10, 2025

Gaming share prices crater on US consumer fears ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10x more leads (powerful)

Monday, March 10, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

🥒 Now you’re in a pickle

Monday, March 10, 2025

This upstart grew sales by 29% YoY in a stalling industry View in browser mim-email-logo-2025-2 As liquor sales stagnated last year for nearly the first time in two decades, one segment of the market

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏