The Pomp Letter - Is Negative Inflation Upon Us?

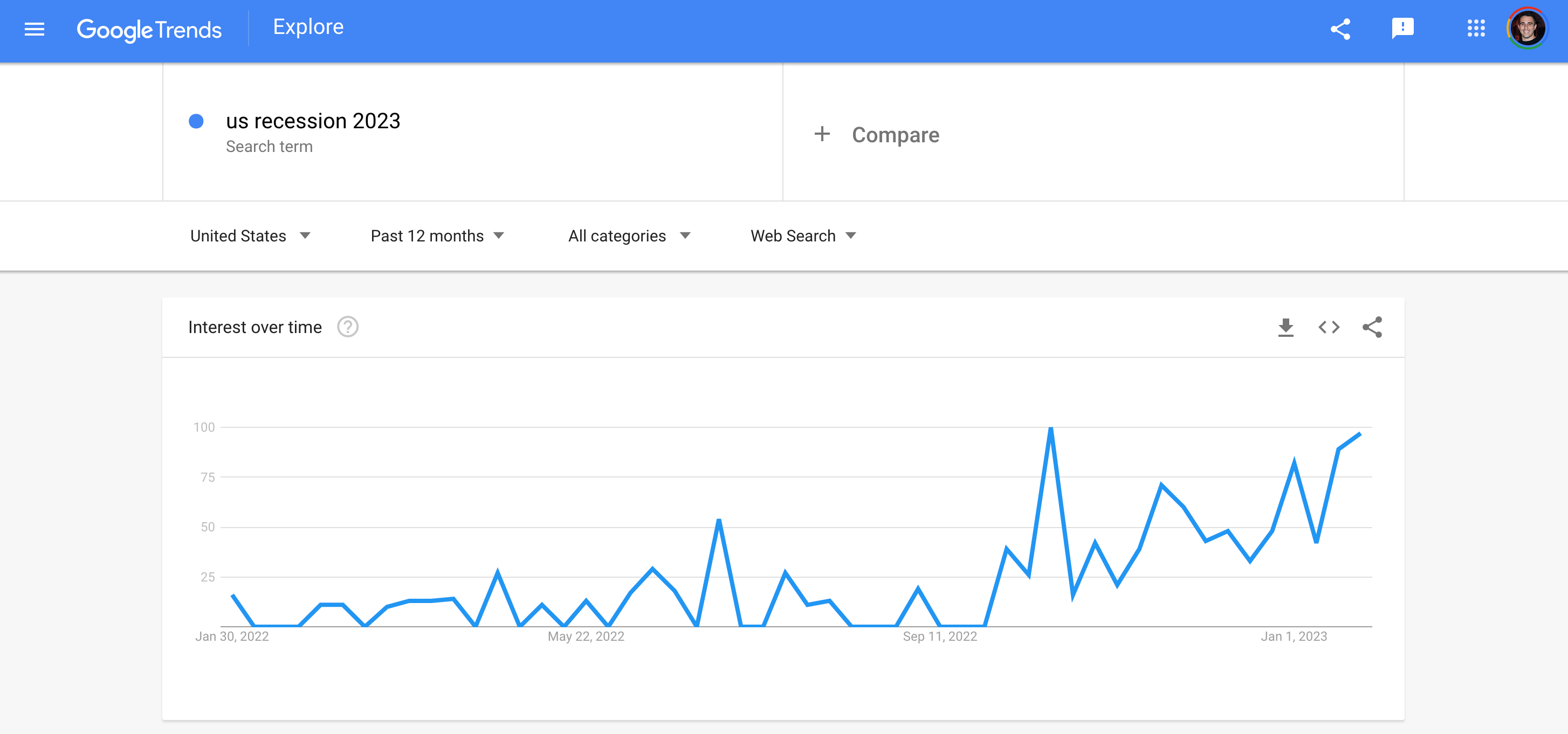

To investors, Inflation skyrocketed to multi-decade highs over the last three years and many people in the financial community have been warning of a persistently high inflation environment for many more years. That may happen, but what if it doesn’t? What is a likely alternative situation? I want to explore that answer today. Starwood Capital CEO Barry Sternlicht was on CNBC earlier this week talking about his views of financial markets through the end of 2023. He highlighted three specific ideas that are worth unpacking — some have been widely held by others, but some may be brand new to you. 2023 RecessionThe first idea that Barry shared was his expectation for a recession in the second half of 2023. This is not news to anyone who has been paying attention to various data points over the last year. As Barry pointed out, the savings rate is near historic lows, consumers are running out of money, and prices are unlikely to come back down. I would add in the fact that wage growth has not kept pace with inflation, so many workers are being paid less today than they were 2-3 years ago in purchasing power terms, and we are starting to see an uptick in layoffs across various industries. Also, there is a weird dynamic where an expectation of a recession may actually help to usher the recession in quicker. We can see a steady increase in search traffic for “US recession 2023” in recent weeks, which is a proxy for the general awareness of a recession occurring. The counter-argument is if everyone is expecting a recession, then maybe it won’t happen. I’ll leave it to each of you to decide which camp you are in. Negative CPIThe second point that Barry made in his conversation was an expectation that inflation would be negative by May or June of this year. My guess is there are few people who have been using this assumption as their base case, so let me unpack what his argument is. Inflation is the measurement of year-over-year change in the basket of goods measured by the Bureau of Labor Statistics (BLS). Housing (or shelter) makes up about 1/3 of the basket, so it is one of the main drivers of the CPI reading. If house and rent prices go up in a material manner, you can expect CPI to go up materially. The reverse is true as well. It is important to note that Barry Sternlicht runs Starwood Capital, which has over $100 billion in AUM focused on real estate, so there are few people who are better suited to discuss housing and rent price changes. According to Barry, rents are coming down nationally and he anticipates that metric to look similar to energy prices as they have fallen. Under that assumption, the falling house and rent prices will pull down the overall CPI number at a rapid pace. His argument that we will see negative CPI by the end of Q2 2023 is dependent on this falling CPI number combined with the high CPI numbers we saw in the summer of 2022. Remember, year-over-year change is much easier to produce volatility in CPI measurements on the upside and the downside. Base effects are a real thing! 🚨 The rest of this letter is only available for paying subscribers to The Pomp Letter. Their support makes this work possible. If you’re not a subscriber, consider subscribing to read the rest of this letter and help us continue to create independent work on financial markets 🚨... Subscribe to The Pomp Letter to read the rest.Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content. A subscription gets you:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Older messages

Special Message From Pomp 🙏🏼

Wednesday, January 25, 2023

To investors, Every morning I wake up and write this letter. It forces me to learn about various topics and provides an opportunity to organize my thoughts. My goal is to provide independent analysis

Where Does The Government Spend Trillions Of Dollars?

Tuesday, January 24, 2023

Listen now (7 min) | An easy-to-understand breakdown of annual government spending

Never Finished (This Will Improve Your Life)

Monday, January 23, 2023

Listen now (13 min) | Pomp's notes on Never Finished by David Goggins

Fake Debt Ceiling Crisis Sends Investors Searching For Safety

Friday, January 20, 2023

Listen now (10 min) | There is madness in the market, but here is what you need to stay focused on.

The War of Art (Stop procrastinating!)

Friday, January 20, 2023

Listen now (11 min) | Pomp's notes on The War of Art by Steven Pressfield

You Might Also Like

14-day trial versus the 30-day trial

Monday, January 13, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack 14-day trial versus the 30-day trial When testing a 14-day free trial versus the original 30-

🦄 Spotify unwrapped

Sunday, January 12, 2025

The year-in-review strategy and how others are adopting it. 🎼

✊🏽 Old marketer shakes fist at cloud

Sunday, January 12, 2025

Why Hootsuite's CEO embraces Gen Z View in browser hey-Jul-17-2024-03-58-50-7396-PM I don't have to look any further than my own group chats to find stereotypical complaints about Gen Z in the

Marketing Weekly #214

Sunday, January 12, 2025

How to Accurately Track and Measure Lower Funnel Metrics • A Peek Inside My Content Plan • How to Build an Offer Your Audience Can't Refuse • How a Cup of Tea Turned Me into a Loyal Customer • The

Q4 2024 Roared Back for Venture Capital

Sunday, January 12, 2025

And the top SaaStr news of the week To view this email as a web page, click here This edition of the SaaStr Weekly is sponsored by Stripe Crunchbase: 50% of VC Capital Went to SF Bay Last Year, Q4

The Profile: The man behind OpenAI & the founder revolutionizing warfare

Sunday, January 12, 2025

This edition of The Profile features Sam Altman, Palmer Luckey, Adrien Brody, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Sunday Thinking ― 1.12.25

Sunday, January 12, 2025

"The amazing thing about life is that the beauty you see in anything is actually a reflection of the beauty in you."

China's VC future hangs in the balance

Sunday, January 12, 2025

Plus: Our top news hits of 2024, Indian VC fundraising & more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch January 12, 2025 Presented by

Brain Food: A Series of Plateaus

Sunday, January 12, 2025

Intensity is common, consistency is rare. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Recruiting Brainfood - Iss 431

Sunday, January 12, 2025

WEF Future of Jobs 2025, Meta ends DEI programmes, Impact of AI on Upwork project demand and a blacklisting site for 'toxic hires'... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏