Canto Eco Checklist, Trending L1 with DeFi Components

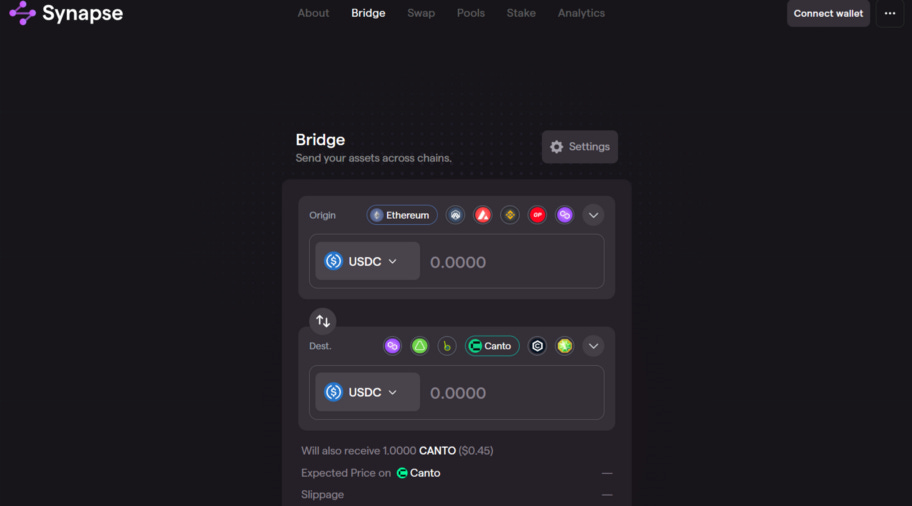

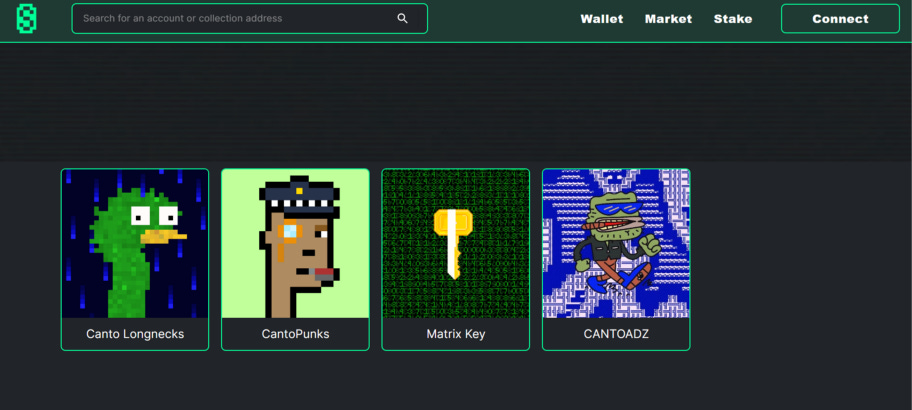

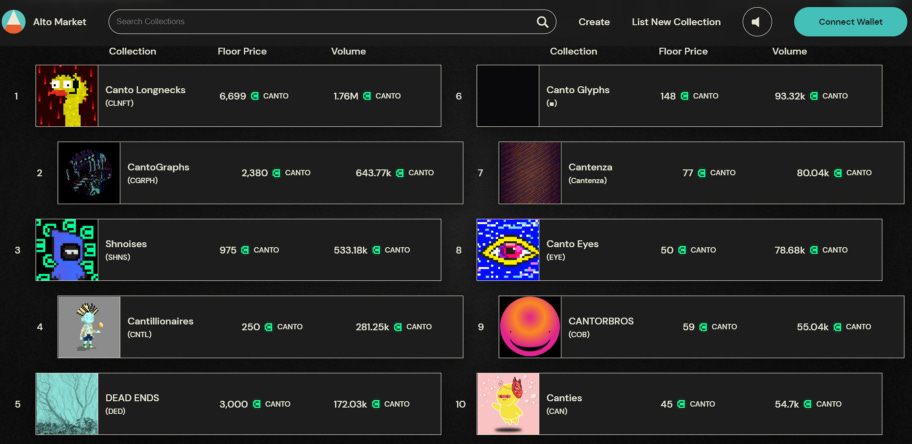

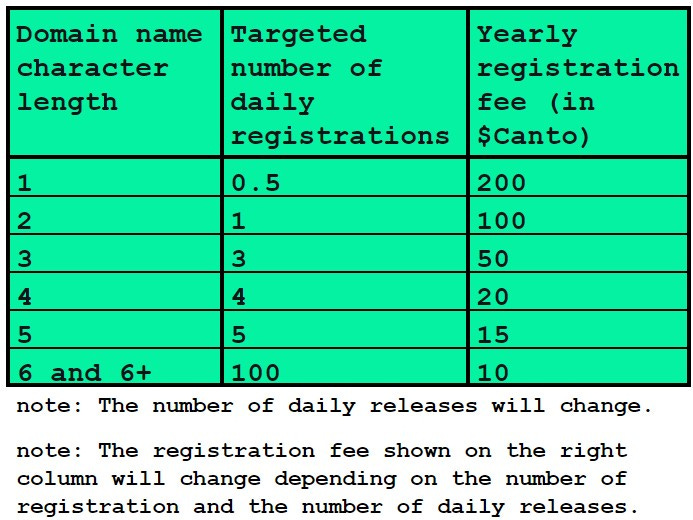

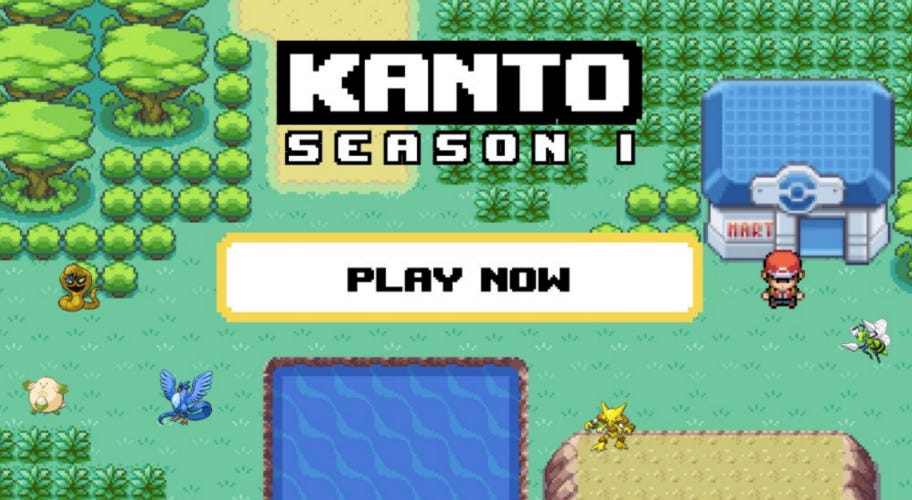

Author: @0xMavWisdom Following the recent launch of the Contract Security Revenue (CSR) cost allocation model, Canto has seen strong growth in the number of transactions, TVLs, and cross-chain data on the Canto. DeFiLlama data shows that TVL on the Canto doubled in January, and daily trading volume on the native decentralized exchange Canto DEX grew from less than $2 million at the beginning of January to around $50 million in February. According to the @minion0x data dashboard, the Canto chain hit a record number of active wallets and new wallets last week, and the chain’s main NFT marketplace, Alto Market, saw a significant increase in trading volume. Canto is a Layer1 network built on the Cosmos SDK, but is unique in that Canto comes with a number of DeFi-enabled components, such as a lending marketplace forked from Compound, a DEX forked from Solidly, and a NOTE stablecoin with an overcollateralization mechanism. Canto believes that the core of DeFi should exist as Free Public Infrastructure (FPI), which is built to fulfill DeFi’s promise to facilitate a new financial system that will be transparent, decentralized and free through the post-traditional financial era. In addition, to enable the investment of resources in the development and maintenance of public goods, and free use , Canto proposes a new model of contract secured revenue distribution as an incentive. CANTO is the native Token of the Canto network, with an initial supply of 1 billion, and is used primarily to pay for the gas cost of transactions, but also as a validator stake to secure the network. With the surge of on-chian activities, the price of CANTO has quintupled over time. In this article, we will take a look at the key dAPPs on the Canto. Bridge Gravity Bridge Canto’s native bridge solution, the issued Token GARV. Gravity Bridge enables many different Cosmos-based projects to connect to Gravity and use it to accept ERC20 assets and vice versa via IBC (Interblockchain communication). Due to the limitations of the Cosmos SDK, only a few types of Token transfers are currently supported for ETH, USDC, DAI, USDT, and WETH. Because Gravity Bridge is compatible with EVM chains, officials say that there is a chance that EVM cross-chain transfers such as Polygon will be available in the future. Synapse Protocol Multi-chain cross-chain protocol, currently supporting over 18 EVM and non-EVM blockchains, Canto is one of the key cross-chain projects. Canto is Synapse’s latest blockchain to support cross-chains, and is the protocol’s first entry into the Cosmos ecosystem. Officials say that over $1.5 million in assets were transferred to Canto via the Synapse Protocol in the three-day period from January 27 to 30; the Synapse Canto bridge processed $5 million in transactions in a single day on February 2. A few assets such as SYN, NOTE, USDC and USDT are currently supported across chains. DEX Official: CantoSwap, Canto Lending, which together account for over 95% of the TVL market share on the Canto. Forteswap Forteswap is one of the oldest DEXs on the Canto, currently supporting the trading functions of BELIEVE, NOTE, ENC, RAB, CANTO, USDC, USDT, etc. Forteswap also provides liquidity functions while supporting trading functions, making it a more functional DEX on the Canto. CantoSwap DEX, which will be launched in 2022, has issued Token Matrix, which supports trading of assets such as Matrix, CSRG, COGE, OTTO, NOTE, etc. It also provides liquidity features for users, in addition to allowing them to perform liquidity mining on CantoSwap in four combinations: WCANTO/Matrix, cINU/Matrix, NOTE/Matrix, and CSRG/WCANTO. According to DeFiLlama, CantoSwap TVL is over $700,000, with strong growth since February. LeetSwap One of the DEXs of the Canto ecosystem, the issued Token LEET, is mainly used to reward liquidity mining, staking users or other positive community behavior. Leets has introduced a dynamic tax model for LEET Token, where holders are penalized for selling when the Token is oversold. LeetSwap has full DEX functionality (trading and liquidity provision) and users do not need any transaction fees to use its trading functionality. Slingshot Multi-chain aggregator DEX, offering over 40,000 cryptocurrency trades across 7 chains including Canto, Arbitrum Nova, Osmosis, and more, with real-time trading charts. Slingshot supports 62 Token trading on the Canto with an average gas cost of about $0.7 and a transaction fee of 0. Other DeFi Y2R Finance Y2R Finance is an Auto harvest protocol. Through smart contracts and an auto harvesting strategy, Y2R maximizes user revenue from LPs, AMM projects and other liquidity mining. It currently supports four groups of LPs — Canto/Atom, Canto/ETH, Canto/Note, NoteUSDC, and Note/USDT — for auto harvesting, and the staking feature is not yet live. NFT Marketplace Providence NFT Marketplace NFT marketplace, created by Cantoswap, claims to be Canto’s first and number one NFT marketplace. Currently there are four projects for sale on the platform, Canto Longnecks, CantoPunks, Matrix Key, and CANTOADZ, and the royalty has recently been reduced from 10% to 2.5%. Providence has launched the NFT stake feature, where users with CantoPunks will receive 10 MATRIX Token per day when staking; when users own CantoPunks and Matrix Key to pair with each other, the daily MATRIX Token reward will increase to 30. Alto Market Alto Market is a free public NFT marketplace on the Canto ecosystem. Currently there are over 60 NFT projects for sale on Alto Market. In addition to the usual buying and selling of NFTs, users can also mint their own NFTs on the marketplace. The marketplace currently supports Canto, wCANTO, NOTE, and CINU Tokens for payment. According to the @minion0x data dashboard, the Alto Market has recently grown significantly to become Canto’s primary NFT trading marketplace, with over 2 million CANTO per day, accounting for almost 30% of on-chain contract interactions and driving NFT Players to the Canto for “gold”. The current #1 NFT in the Alto Market is Canto Longnecks (CLNFT) with a floor price of 6,699 CANTO and over 1.7 million CANTO in volume. Canto Moon Canto Moon is one of the NFT marketplaces on the Canto, with 10 NFT projects currently for sale on its platform, including CantoPunks and Matrix Key. Canto Moon has launched the Token CMOON, which allows holders to use the Token for liquidity mining, staking or directly minting NFTs for profit. Other CANTO NAME SERVICE CANTO NAME SERVICE (CNS), the CANTO Domain Name Service, went live on February 1. Users can indicate that they belong to the “Canto Internet Society” by owning a “.Canto” domain name. Officials also learned from the “ENS” and “.com” domain name hype to use an anti-squatting pricing mechanism, using a Variable Rate Gradual Dutch Auction (VRGDA) to price the CNS. Canto Public Messaging Service CPMS (Canto Public Messaging Service) was developed by the CanToadzNFT team. It is an on-chain protocol similar to the real-life delivery of letters/postcards and is intended to be the hub for all messaging and delivery on the Canto. Users can “write letters” through CPMS to communicate messages to another user on the chain, with stamps (a set of stamps costs 10 CANTO). In addition, it offers a Gas Station service, where users can keep their gas stations full by purchasing an official Uncapped Supply NFT (priced at 50 CANTO). Users can get up to two Gas Fee refills at CPMS Gas stations (3.3 CANTO once). Canto Tools An important tool for exploring the CANTO ecosystem, Canto Tools not only showcases key CANTO projects, but also provides users with a calendar of major ecological events, data analysis tools, quick access to cross-link bridges, and some educational content on what needs to be learned within the ecosystem to help users fully understand and use the Canto network. Kanto Game Kanto Game is the first game built on the Canto ecosystem with an interface/gameplay similar to Pokémon. Players need to find and fight with sprites, use Kantó balls to capture and collect them. There are 151 sprite species for players to capture and explore, and each sprite is a tradable NFT, which players can trade back to CANTO for a profit at the right time. Canto’s decentralized concept and contract security revenue cost allocation model have raised expectations for the program, and its ecology is still in its early stages and worth keeping a long-term eye on, but speculation on CANTO prices should be kept cautious. Reference: https://mp.weixin.qq.com/s/lSpkeWVYUifY64Vam6mu0w Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Global Crypto Mining News (Jan 30 to Feb 5)

Monday, February 6, 2023

1. Kazakhstan Parliament adopts law regulating crypto mining and exchange. The Law of the Republic of Kazakhstan on Digital Assets and its related accompanying documents were considered by the Senate

Asia's weekly TOP10 crypto news (Jan 30 to Feb 5)

Sunday, February 5, 2023

Author:Lily Editor:Colin Wu 1. Kazakhstan's weekly summary 1.1 Kazakhstan Parliament adopts law regulating crypto mining and exchange link Lawmakers in Nur-Sultan have approved the final version of

Innovation or attack? Sorting out the "NFT Big Block" on the Bitcoin Network

Sunday, February 5, 2023

Written By:Liu Changyong On February 1, 2023, Bitcoin Network mined the largest block in the history of nearly 4M, containing a nearly 4M largest transaction in the history, and the transaction fee is

Weekly project updates: Ethereum's Zhejiang testnet is live, Optimism Foundation proposes Bedrock, etc

Saturday, February 4, 2023

1. ETH's weekly summary a. Ethereum's first public withdraws testnet to launch 1st of Feb link Parithosh, DevOps at the Ethereum Foundation, tweeted that the first public withdrawals testnet

WuBlockchain Weekly:The Fed announced a rate hike of 25 bps、Nostr-based Damus social network goes live and Top10 N…

Friday, February 3, 2023

Top10 News 1. The Fed announced a rate hike of 25 bps as scheduled link The statement has repeatedly emphasized that it will adhere to the ultimate goal of 2% inflation. Markets expect to raise

You Might Also Like

HashKey Exchange's Interpretation of the Hong Kong SFC Virtual Asset Roadmap

Thursday, February 27, 2025

We are pleased to see the Hong Kong government release the forward-looking and pragmatic “ASPI-Re” roadmap for advancing the virtual asset industry. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Argentina’s stock market plummets amid President Javier Milei’s LIBRA memecoin scandal

Thursday, February 27, 2025

Argentina's economic landscape shaken as Milei's LIBRA endorsement turns into multi-billion dollar fiasco. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Heated AMA Debate: 0G Team Responds to Allegations of CFX Soft Rug, Overvaluation, and Token Commitment Concerns

Thursday, February 27, 2025

This AMA primarily focused on the relationship between Conflux and 0G Labs, discussing 0G Labs' high valuation, fundraising structure, technical direction, and community concerns over transparency.

Pectra: Ethereum’s Next Major Upgrade

Thursday, February 27, 2025

Breaking down key changes included in Ethereum's Pectra hard-fork ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Solana falls to lowest price since November 2024 losing 43% since January

Thursday, February 27, 2025

Volatility reigns as Solana's price retreat tests its resilience against past support levels. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Five Projects with Real-World Revenue Scenarios Utiling Token Empowerment

Thursday, February 27, 2025

Memecoin once captured significant attention and investment with its unique culture, humorous image, and community-driven characteristics. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📉 Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation alloc…

Thursday, February 27, 2025

Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation allocated 45000 ETH to DeFi protocols. Standard Chartered established a JV to issue a HKD-backed stablecoin ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📉 Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation alloc…

Thursday, February 27, 2025

Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation allocated 45000 ETH to DeFi protocols. Standard Chartered established a JV to issue a HKD-backed stablecoin. ͏ ͏ ͏ ͏

XRP investors buoyed by Donald Trump’s Ripple posts and SEC’s ETF acknowledgment

Thursday, February 27, 2025

As Trump's posts stir optimism, SEC's acknowledgment of XRP ETFs heightens anticipation. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

USDT/USDC Prepaid Card’s Popularity Is Soaring – FinTax Reminds You to Be Aware of Related Risks

Thursday, February 27, 2025

In recent years, with the rapid development of the cryptocurrency market and digital payment technologies, several exchanges and wallet service providers have launched their own USDT/USDC prepaid card