Free Markets, Regulation, Charlie Munger, and Bitcoin

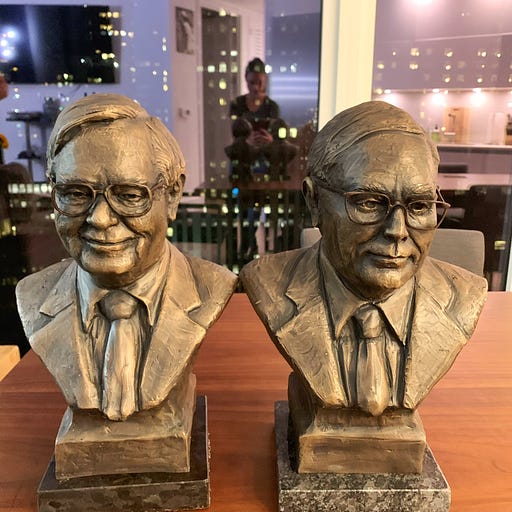

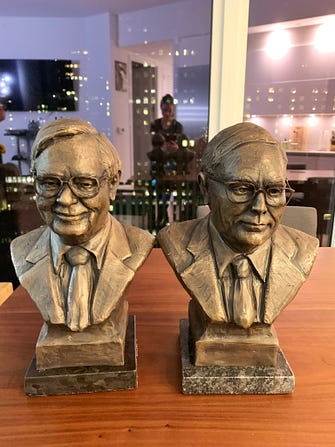

To investors, Charlie Munger has one of the best investing track records in history. He, along with his partner Warren Buffett, have been able to compound capital at an astounding rate for decades. On top of their incredible track record, Charlie and Warren have helped educate an entire generation of investors on the merits of value investing, long-term thinking, and the discipline of patience in an impatient world. It may surprise many of you to learn that I actually have a bronze bust of each of these investors on a desk in my office. They were a gift years ago from a friend and each serves as a reminder that long-term thinking, along with compound growth, can drive extraordinary results. It is no secret that both of these investing legends are not big fans of bitcoin or cryptocurrencies. They have previously called the assets rat poison, referred to trading crypto as equivalent to harvesting dead baby brains, and a multitude of other eloquent digs at the technology and community. This shouldn’t be surprising to anyone who follows their work — neither investor likes gold or other non-cash flow producing assets. Charlie Munger and Warren Buffett have built their wealth by investing in operating businesses that throw off cash, so bitcoin doesn’t fit that framework. With this context, it makes sense that Charlie Munger would write an op-ed on February 1 in The Wall Street Journal that takes a negative perspective on the industry (Why America Should Ban Crypto). But the points that Charlie made were quite surprising. First, he claims that these assets are not currencies or securities, but rather gambling contracts:

Next, he claims that the United States should ban cryptocurrencies in the same way that communist China and 1700s England banned certain assets.

The idea of banning new technologies or markets that threaten the incumbents is not new. Those in positions of power and influence have been trying to use regulation and law as a tool for centuries. If we look at Berkshire’s portfolio today, there are numerous financial organizations in their top 20 holdings who are threatened by the rise of bitcoin and cryptocurrencies (ex: Bank of America, American Express, US Bancorp, Bank of New York Mellon, and Citigroup). That is 25% of their top holdings that are in direct competition with the new technology. There is more to this story though…... Subscribe to The Pomp Letter to read the rest.Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content. A subscription gets you:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Older messages

Podcast app setup

Wednesday, February 8, 2023

Open this on your phone and click the button below: Add to podcast app

Bitcoin Fundamentals Keep Getting Stronger

Tuesday, February 7, 2023

Listen now (5 min) | A breakdown of bitcoin's fundamentals.

Meditations by Marcus Aurelius

Monday, February 6, 2023

Listen now (16 min) | Pomp's notes on Meditations by Marcus Aurelius

The Puppeteer of Markets

Friday, February 3, 2023

Listen now (5 min) | Central banks have a lot in common with Geppetto & Pinocchio.

How to Resist the Zero Interest Rate Mind Virus

Tuesday, January 31, 2023

Listen now (4 min) | The mind virus has infected a generation. It will take hard work to get them back.

You Might Also Like

Athletes Are Making Their Own Chip Deals 🥔💰

Monday, March 10, 2025

Athletes turning snacks into serious cash 🚀🥔

🔔Opening Bell Daily: Investor jitters grow

Monday, March 10, 2025

Traders keep selling stocks and US indexes are lagging the rest of the world.

A shellacking

Monday, March 10, 2025

Gaming share prices crater on US consumer fears ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10x more leads (powerful)

Monday, March 10, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

🥒 Now you’re in a pickle

Monday, March 10, 2025

This upstart grew sales by 29% YoY in a stalling industry View in browser mim-email-logo-2025-2 As liquor sales stagnated last year for nearly the first time in two decades, one segment of the market

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s Bitcoin Reserve, Tokyo Beast’s $1M Championship & King of Destiny’s 2M $GOD Showdown – Your Ultimate Crypto & Gaming Update!

Sunday, March 9, 2025

PlayToEarn Newsletter #263 - Your weekly web3 gaming news

The Profile: The man who wants to know everything & the med spas offering balding treatments

Sunday, March 9, 2025

This edition of The Profile features Tyler Cowen, Lalisa Manobal, Zhang Shengwei, and others. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But