WuBlockchain - Summary: US regulatory crackdown BUSD

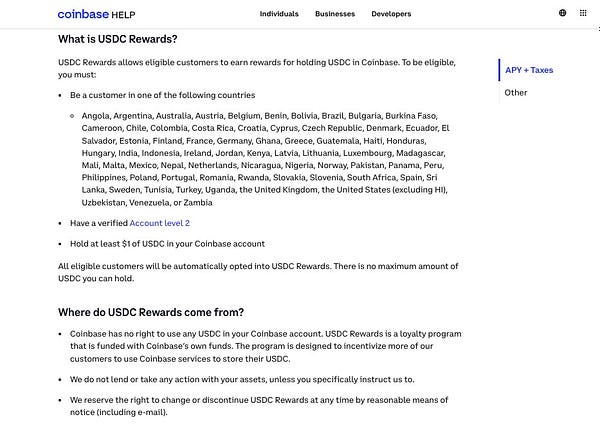

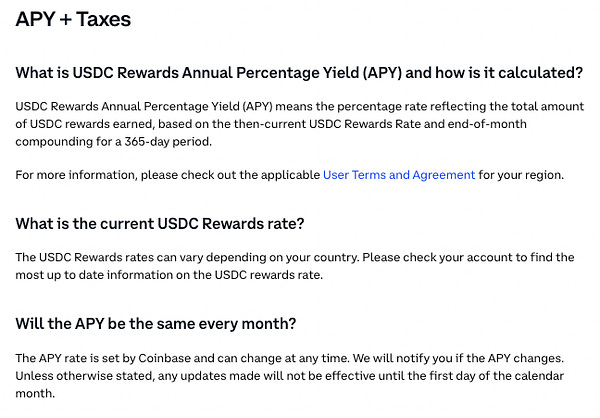

Author: Colin Wu On the morning of February 13th, Beijing time, the Wall Street Journal reported that the US Securities and Exchange Commission (SEC) has informed crypto company Paxos that it plans to sue the company for violating investor protection laws. The notice stated that Paxos’ digital asset, Binance USD, which was issued and listed, is an unregistered security. Companies receiving a Wells notice can respond in writing and tell the SEC why the lawsuit should not proceed. The Wells notice is not a final indication that the SEC will take enforcement action. The agency’s five commissioners must vote to authorize any enforcement settlement or lawsuit. The SEC has not previously taken enforcement action against a major stablecoin issuer. In the afternoon of February 13th, Beijing time, Bloomberg published news featuring a statement from Binance that the New York State Department of Financial Services has instructed Paxos to stop minting new BUSD. BUSD is a stablecoin fully owned and managed by Paxos, and its market value will only decrease over time. Paxos will continue to provide services for the product, manage redemptions, and follow up on other information as needed. Paxos also guarantees that the funds are secure and fully covered by reserve funds in its banks. Paxos stated that starting on February 21, it will stop issuing new BUSD tokens in accordance with the instructions of the New York State Department of Financial Services (NYDFS) and will work closely with it. BUSD will continue to receive Paxos’ full support and can be redeemed for at least until February 2024, either for USD or for Pax Dollar (USDP). https://www.prnewswire.com/news-releases/paxos-will-halt-minting-new-busd-tokens-301744964.html On the afternoon of the 13th, CZ explained in detail that the market value of BUSD will only decrease over time. Paxos will continue to provide services for the product and manage redemptions. Paxos also assures us that these funds are secure and fully covered by reserve funds in its banks, which have been audited multiple times by auditing firms. Regarding the SEC’s lawsuit against Paxos, apart from public news articles, I have no relevant information. The lawsuit is between the SEC and Paxos. CZ said, “I’m not a US legal expert. But personally, I agree with Mile’s logic (although it doesn’t matter much): I know that technically it can be considered a security without passing the Howey test. If they want to, the SEC can basically define any investable asset as a security. But this undoubtedly sets a terrible precedent. The SEC has labeled BUSD as an ‘unregistered security’ and sued its issuer, Paxos. But how can a stablecoin be considered a security when it clearly does not meet the Howey test criteria? No one ever had an ‘expectation of profit’ when buying BUSD.” CZ’s old rival Xu Mingxing also stated that he believes the SEC may not win the lawsuit because BUSD clearly has no profit expectations and should not be considered a security, but the NYDFS can request that BUSD be suspended or Paxos’ license be revoked. CZ stated that if BUSD is deemed a security by the court, it will have a profound impact on how the crypto industry develops (or not) in jurisdictions where it is classified as such. Binance will continue to support BUSD in the foreseeable future. We do anticipate users migrating to other stablecoins over time. We will adjust our products accordingly, for example, no longer using BUSD as the primary currency pair for trading. Given ongoing regulatory uncertainty in certain markets, we will review other projects in these jurisdictions to ensure that our users are not harmed improperly. There are many speculations about the reasons, with one view being that, in conjunction with Kraken’s staking product being fined by the SEC, Paxos’ own stablecoin USDP is not within the SEC’s warning range, and it is speculated that the SEC’s crackdown on BUSD may be related to its own yield-generating product. Circle also has a similar product, so it may also face similar scrutiny. Another view is that “securities” is a broader category defined by the Securities Act of 1933, including notes, bonds, debentures, evidence of indebtedness, certificates of interest, trust certificates, and depositary receipts, and does not necessarily have to strictly meet the Howey test. The fact that stablecoin issuers hold underlying Treasury securities makes them very similar to money market funds, exposing holders to securities, even if they do not profit from them. More specific reasons may require a detailed explanation from the SEC. USDT, which has a larger market share, has been in constant conflict with US regulators, but eventually settled through fines. It is surprising and puzzling that BUSD, which has a smaller market share and a better attitude towards regulation, has been “suddenly killed.” In addition, the future development of the event currently has strong uncertainty. Frank, editor-in-chief of TheBlock, said that he would not be surprised if the SEC is reviewing USDC. A few days ago, a senior exchange executive told him that the SEC is working on a “Night of Nazi Knives” for cryptocurrencies. Whether there will be additional companies or projects investigated/prosecuted in the future will provide more information to assess the direction of the event. Gabor Gurbacs, VanEck’s strategic advisor, stated that Coinbase offers a “reward” scheme for USDC users, using terms such as “APY” and “yield,” paid in USDC. Given Paxos’ latest developments and Gensler’s stance on staking and yields, it is speculated that the SEC is investigating such issues. Paying future returns can be regulated like some kind of fund. Tether CTO also liked the tweet.  Coinbase offers "rewards" to USDC users. This rewards program doesn't look like loyalty points. It's paid in USDC and they use terms like "APY", "yield", etc... So where does the yield come from? Does Circle pass along yield via the Centre consortium? The SEC will likely ask. In late 2022, Reuters reported that the US Department of Justice’s investigation into Binance began in 2018, focusing on whether Binance violated US anti-money laundering and sanctions laws. At least six federal prosecutors were involved, with some believing that there was sufficient evidence to take aggressive action against Binance, while others believed that more time was needed to review additional evidence. In the past few months, Binance has met with Justice Department officials in Washington to discuss possible out-of-court settlement options, including pleading guilty or paying fines. It is worth noting that CZ emphasized that this incident is a lawsuit between the SEC and Paxos, not a lawsuit against Binance. As a result, the redemption process has already begun, and the multi-billion dollar BUSD market value has been completely abandoned, making it unlikely for a future settlement. When asked about the suggestion that Binance should create their own decentralized stablecoin similar to DAI, CZ responded that at this juncture, they would prefer others to do it to make it more decentralized. They cannot do everything. This statement seems to have some hidden meaning. Back in September 2022, Binance fully delisted the USDC trading pair, and the market share of BUSD quickly expanded to its highest level ever. And just half a year later, the tragedy happened suddenly. The oppressive force of U.S. regulation on the crypto industry, and the development of the crypto industry’s own resistance to censorship, have taken on new propositions in the present. Subsequent reports by NYDFS and Bloomberg explain more. According to the NYDFS statement, the department has ordered Paxos to stop minting BUSD issued by Paxos because of several outstanding issues with Paxos’ supervision of its relationship with Binance. The NYDFS emphasized that it authorized Paxos to issue BUSD on the Ethereum blockchain and has not authorized Binance-Peg BUSD on any blockchain. https://www.dfs.ny.gov/consumers/alerts/Paxos_and_Binance Bloomberg reported that Circle complained to NYDFS last fall about Binance’s poor management of its own token reserves, indicating that Binance did not store enough cryptocurrency reserves to support its tokens. The NYDFS determined that Paxos cannot safely and securely operate BUSD based on broad regulatory participation, recent examinations, and Paxos’ failure to timely remedy significant issues related to Paxos-issued BUSD. “Paxos failed to address key deficiencies that require the Department to take further action, ordering Paxos to stop minting Paxos-issued BUSD. The department is closely monitoring Paxos to verify if the company can facilitate redemptions in an orderly manner and comply with enhanced, risk-based compliance protocols.” CZ expressed in the AMA that he did not believe that Circle would do so, because doing so would also hurt themselves, Binance hopes to continue to cooperate with any industry partners. CZ also said in the AMA that need more stablecoins other than the U.S. dollar, such as Singapore dollar stablecoins, Japanese yen stablecoins, etc.; now Japanese yen stablecoin is already communicating with Binance. After BUSD leaves, more USD stablecoins will appear, and Binance will cooperate with more USD stablecoins. He said that after Luna and FTX, the regulation has become more stringent, and many traditional banks no longer cooperate with cryptocurrencies or are very careful. Binance has lost some traditional banking partners, which will hit the industry in the short term. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Global Crypto Mining News (Feb 6 to Feb 12)

Monday, February 13, 2023

1. The total capacity of crypto mining facilities in Russia has been increasing in the past year, despite the market downturn and sanctions. Depressed prices of mining equipment and stronger interest

CEX data report in Jan: trading volume recovery, web traffic maintained

Monday, February 13, 2023

WuBlockchain's statistics showed that: Spot trading on major exchanges rose 57.8 per cent month-on-month in January. The three biggest increases were Upbit +166%, BitMart +110% and KuCoin +90%. The

Asia's weekly TOP10 crypto news (Feb 6 to Feb 12)

Sunday, February 12, 2023

Author:Lily Editor:Colin Wu 1. Turkey's weekly summary 1.1 Turkey and Syria earthquake, exchanges launch donations link Earthquake in Turkey kills thousands. Exchanges have launched donations.

Weekly project updates: Bitcoin Punks have been fully minted, MakerDAO community proposes launch of Spark Protocol…

Saturday, February 11, 2023

1. ETH's weekly summary a. ENS DAO to sell 10000 ETH to cover operating expenses link ENS DAO's proposal to “sell 10000 ETH to cover operating expenses for the next two years” has been approved

WuBlockchain Weekly:Kraken faces SEC Investigation、Uniswap V3 Proposal Fiasco and Top10 News

Friday, February 10, 2023

Top10 News 1. Uniswap V3's weekly summary a. a16z voted 15 million UNI against the final proposal to deploy Uniswap V3 on BNB Chain link a16z voted 15 million UNI against the final proposal to

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏