Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #329

Datadog is one of the best executing software infrastructure companies having grown 63% YoY to $1.68B of Revenue in 2022. Q4 was also strong clocking in at $469.4M of Revenue but a YoY growth rate of 44%. While these numbers are fantastic, the decelerating growth in Q4 is certainly an area of concern. Such that management guided down its 2023 growth forecast to 23% - yes 23% YoY to $2.07B. Folks that’s a steep drop from 63% growth and reflective of the IT spending environment we live in today. Let’s dig deeper. Here’s Olivier Pomel, Co-Founder and CEO

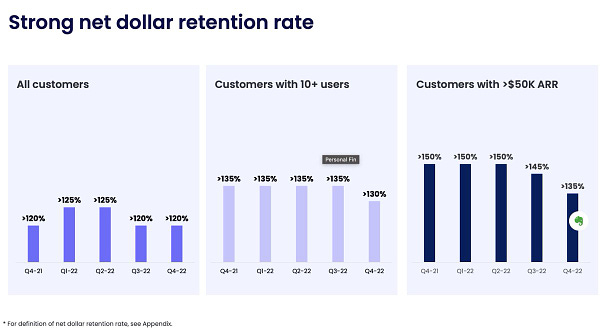

look forward to digging into this later today esp. what net $ retention looks like - I suspect next 3-6 mos we will see that best in class NDR of 130% will be more like 115-120%

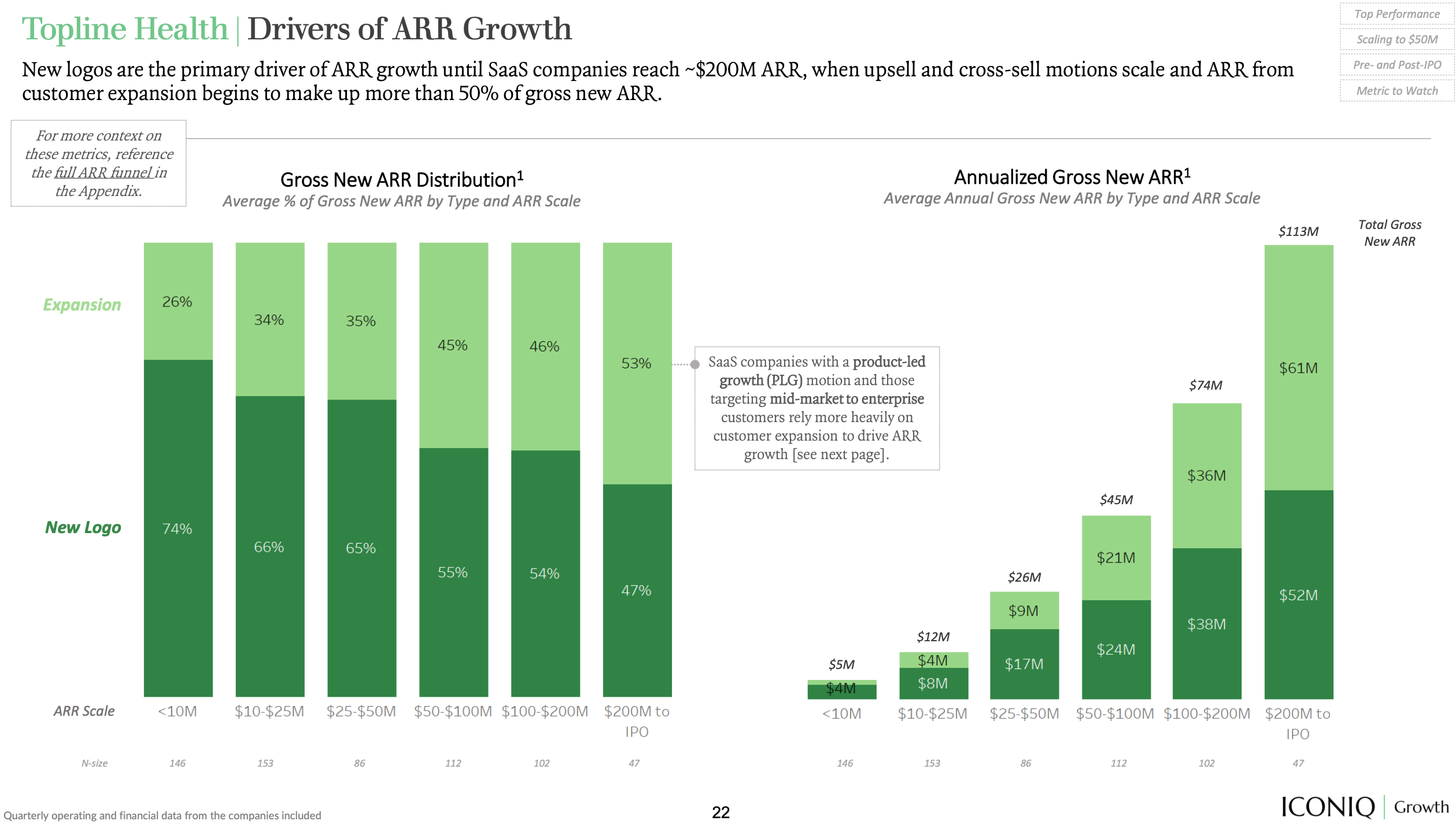

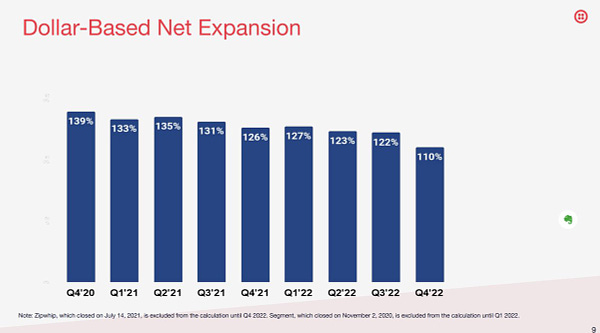

"Analysts at RBC Capital Markets said the guidance, implying 24% annual revenue growth, looked… https://t.co/XI07MexFk0  Barron's @barronsonline It’s clear that Datadog’s multi-product portfolio has been keeping the NDR >130% but there are signs of this not lasting as customer usage 📉. It’s been an absolute rule for the last couple of years that the BEST enterprise software companies have a Net $ Retention > 130%. It’s been the case for the last two years, and many still consider that to be a universal truth. In fact it is one of the most amazing and efficient growth engines as you can see from this chart from Iconiq - as companies scale, the breakdown of New ARR from expansion of existing customers is close to 50% for companies >$50M ARR. While Datadog does not explicitly discuss NDR numbers for its lower growth forecast, it’s pretty clear that’s a huge reason for the forecasted lower growth in 2023. When finally asked directly about NDR, here’s Dave Obstler‘s (CFO) answer: Implicit in that guide is below 130% NDR.

While Datadog is just one data point on infrastructure, it’s an important one given its market share, success, and breadth of products. While not an infra company, here’s Monday.com trending lower as well. Here’s Twilio As you plan your sales models and forecasts for 2023, I’d take a harder look at what NDR numbers you’re benchmarking against as it seems to me that while Datadog hit it’s 130% NDR number, it’s going to fall this year, and it’s just the beginning of a new normal for best in class which will likely land in the 115-120% range, save a few outliers. As a startup who is modeling against some of these public comps, don’t fret as these public cos are reporting a few months behind, and I can promise you that the >130%+ NDR days are over. You are probably still best in class when the dust settles in the next few months. Just keep building, fighting the good fight, and protect that customer base. As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups

Enterprise Tech

Markets

What's Hot in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

What's 🔥 in Enterprise IT/VC #328

Saturday, February 11, 2023

Avoid the death spiral of activity - also meet EdGPT 🤖

What's 🔥 in Enterprise IT/VC #327

Saturday, February 4, 2023

Hope springs eternal especially when it comes to AI

What's 🔥 in Enterprise IT/VC #326

Saturday, January 28, 2023

On planning...Be Macro Aware, Micro Obsessed

What's 🔥 in Enterprise IT/VC #325

Saturday, January 21, 2023

Startups as art: lessons from legendary music product Rick Rubin on creating music that feels like magic

What's 🔥 in Enterprise IT/VC #324

Friday, January 20, 2023

The world has fully reset on round sizes at early stages - what does it mean for founders?

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏