Net Interest - Goldman and More

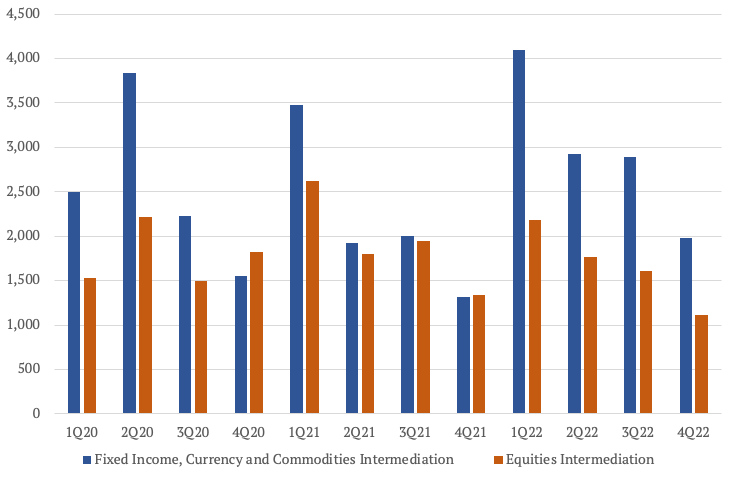

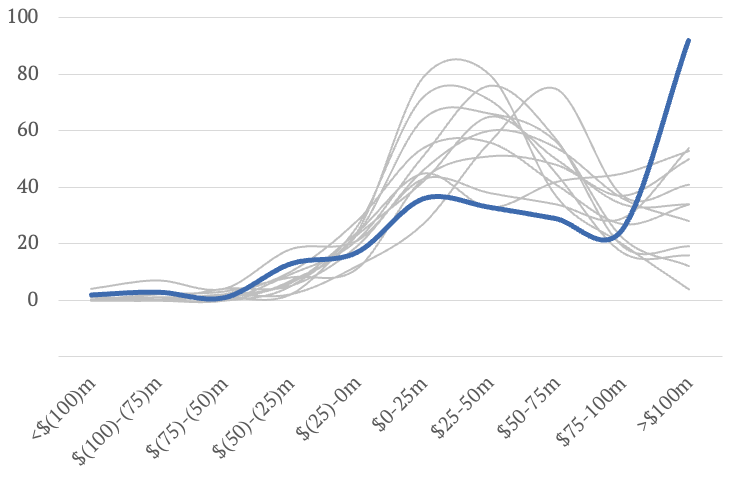

With so much going on in the finance sector this week, rather than a Big Read, today’s issue of Net Interest consists of four smaller reads. They span a range of companies: Goldman Sachs, Silvergate Capital, Revolut and Klarna. Each made waves this week from its corner of the industry and I’m here to provide some analysis. I’ve left the Goldman piece free to view, but put the other three pieces behind the paywall. If you’re not already a paid subscriber, please do sign up. As well as fresh content, paid subscribers also get access to a fully searchable archive of over 100 issues and counting. Goldman Sachs: Valuing the CoreGoldman Sachs is at its core a trading business. Last year, it earned 41% of its revenue from market making and other principal transactions. Throw in the net interest income associated with its global markets business and the contribution rises to 46%. In the previous two years, those revenue lines accounted for 50% of Goldman’s total revenues. Such business lines are tricky to value since their earnings don’t move in a straight line, making them difficult to forecast. David Solomon, Chairman and CEO of Goldman Sachs, acknowledged this at an investor day he hosted in New York this week. “I can’t shy away from the fact we’re in certain volatile businesses. And there will always be some volatility to that.” The volatile nature of these revenue streams is evident in their quarterly progression. Goldman’s fixed income intermediation revenues have ranged between $1.3 billion a quarter and $4.1 billion a quarter over the past three years. Compared with peers, that’s not even that bad. In the fourth quarter last year, Credit Suisse reported revenue of just $15 million in its equity sales and trading business – a mere rounding error as far as others are concerned. Over the past three years, Credit Suisse equity sales and trading revenues have ranged from a low of negative $33 million in the second quarter of 2021 to a high of $1.0 billion one quarter earlier. How many other industries generate negative revenues? Goldman Sachs has always appreciated the challenge this creates. In his book The Partnership, Charles Ellis recounts the valuation discussion that Goldman executives held ahead of their IPO in 1999: “Eric Dobkin, the firm’s expert on pricing large global equity underwritings, said he believed that because so much of the firm’s profits came from trading, an IPO would be priced at well under two times book value—a big discount from Morgan Stanley’s market valuation at nearly three times book value.” Recognising that other earnings streams could enhance its multiple, the firm began to invest more in asset management prior to its IPO. “The firm had always treated a dollar earned in asset management as no better and no worse than a dollar earned in trading, underwriting, arbitrage, or stock-brokerage,” writes Ellis. “Yet even investment management firms that earned only moderate profits had market valuations twenty to twenty-five times their earnings, while trading businesses were worth only five or six times current earnings. In other words, the market value of a dollar of earnings in asset management was four or five times the market value of the same dollar earned in a trading business.” In its most recent financial year, investment management fees contributed 19% to Goldman’s revenue, with private banking and lending adding another 5%. At its investor day this week, the firm outlined plans to do more, growing asset and wealth management fees from $8.8 billion to $10.0 billion over the next two years. But trading remains core and to convince investors that those earnings streams deserve a higher multiple, the firm also delivered a presentation showcasing their durability. In it, Dan Dees, Co-Head of Global Banking & Markets argued that although the component pieces of the business may be volatile, that doesn’t necessarily translate into volatility overall. “The reality has changed,” he says. He highlights three reasons. First, financing revenues act as a dampener. In recent years, financing revenues have grown to account for 22% of revenues in the Global Banking and Markets segment, up from 12% in 2013 as the firm has pushed further into prime brokerage and asset secured lending. Second, Goldman has a proven track record of outperformance across different market conditions, its people demonstrating an ability to capture the “opportunity born of [market] volatility year in and year out.” Third, the firm benefits from diversification that comes from operating multiple businesses across banking and markets. Dees concludes that, “In some ways, we’ve built a business model that’s designed to capture the upside volatility in the world without being as volatile ourselves.” Except for the increase in financing revenues, these points are not new. But Dees may have a point. A look at how the distribution of daily net revenues has evolved over time shows a clear shift to the right. Last year, Goldman earned in excess of $100 million a day on 92 occasions and lost money on only 36. While the number of loss-making days is roughly in line with prior years, the number of super-normal days has been increasing steadily over the years. Of course, the highest valuation multiples may be reserved for earnings streams with no variance at all, but as distributions go, this isn’t bad – if only it can be sustained. Subscribe to Net Interest to read the rest.Become a paying subscriber of Net Interest to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

Striped Down

Friday, February 24, 2023

Let's talk about Stripe

Worldpay Reborn

Friday, February 17, 2023

Plus: Commerzbank, Hargreaves Lansdown, Podcast

Boutique Wars

Friday, February 10, 2023

Plus: Short-Selling, Tether, Credit Suisse

The Art of Short Selling

Friday, February 3, 2023

Plus: Deutsche Bank, Custodia Bank, Late Fees

Growing Visa

Friday, January 27, 2023

Plus: Charles Schwab, Equity Research, Railsr

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏