Coin Metrics’ State of the Network: Issue 198

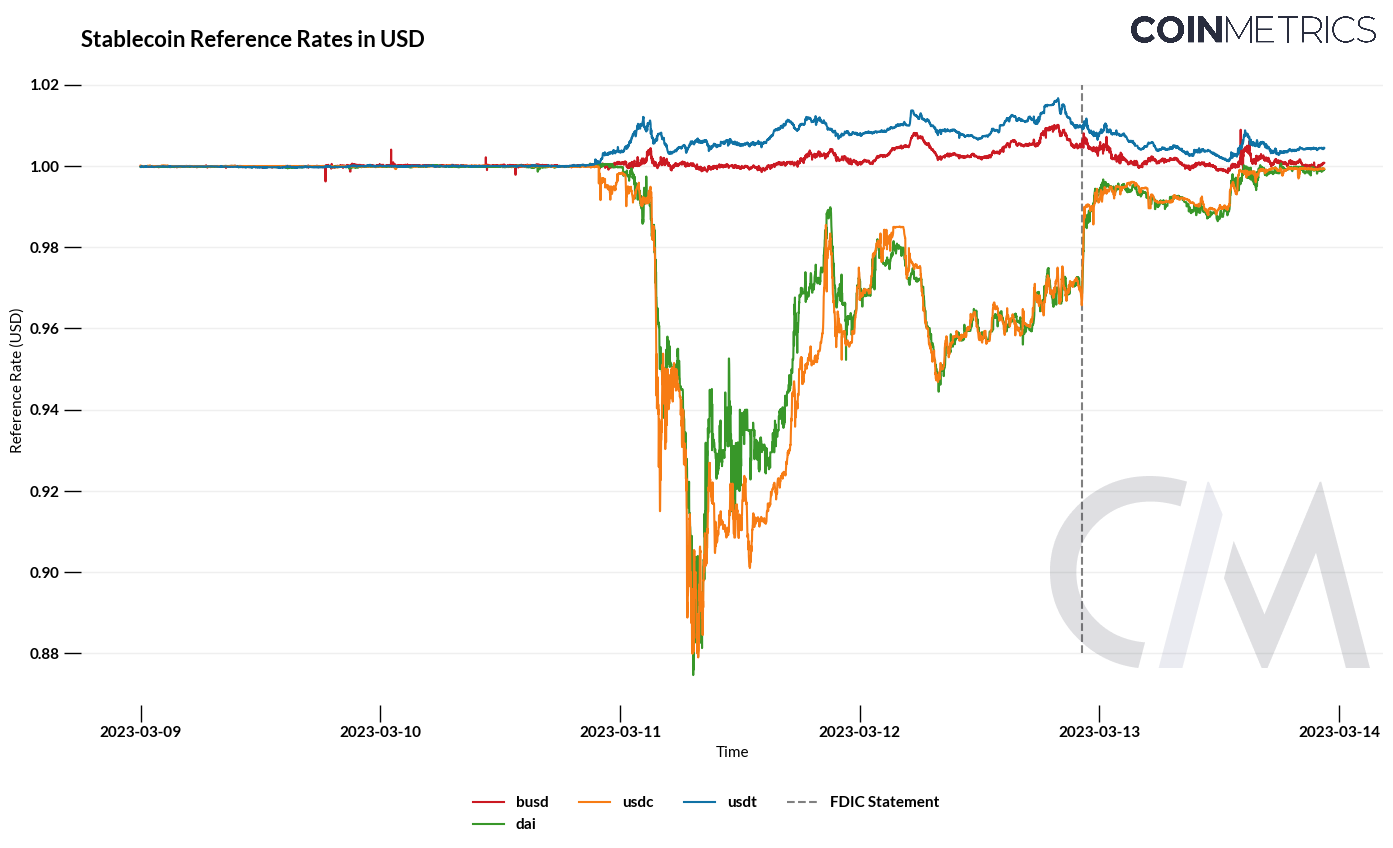

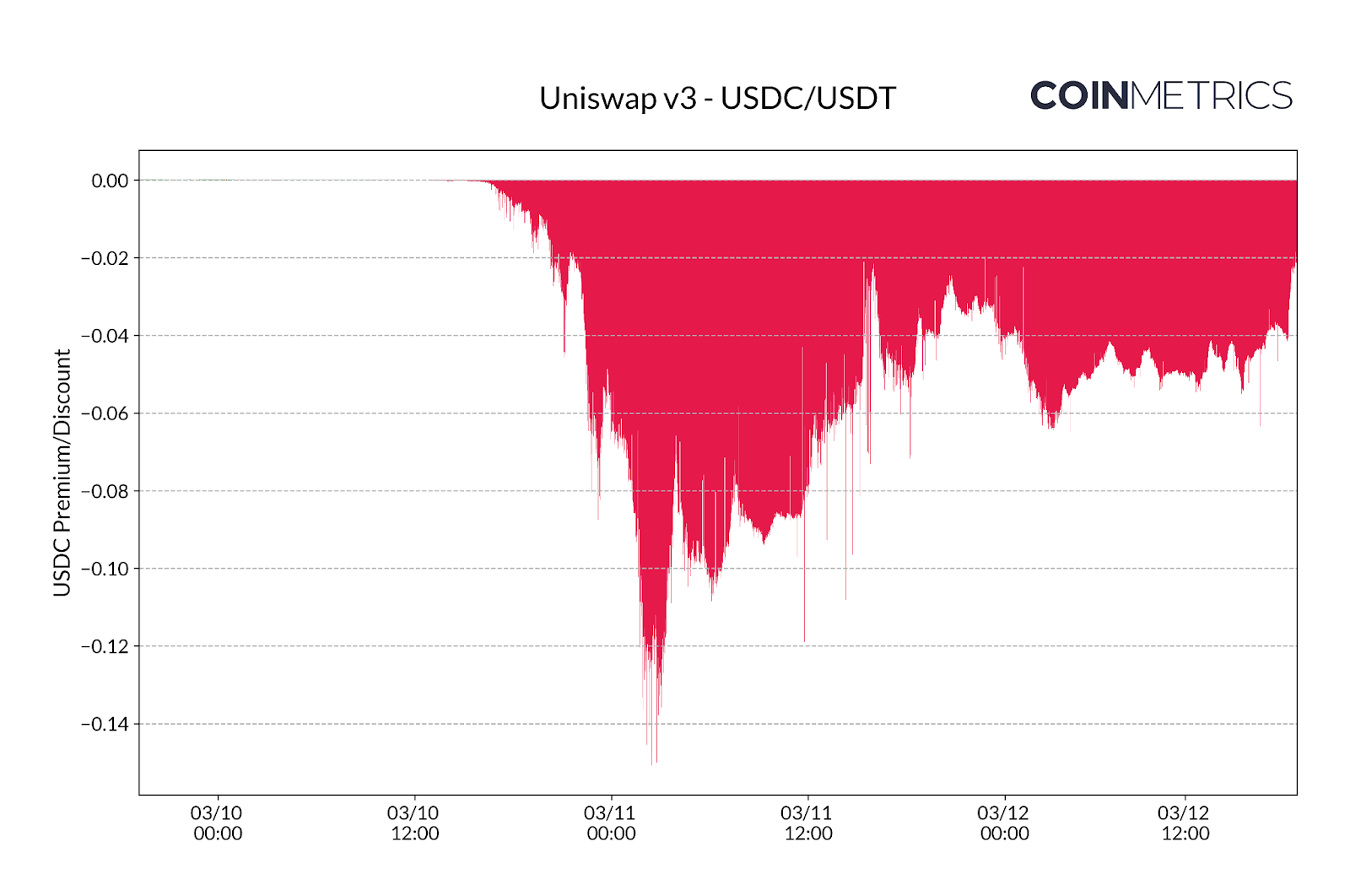

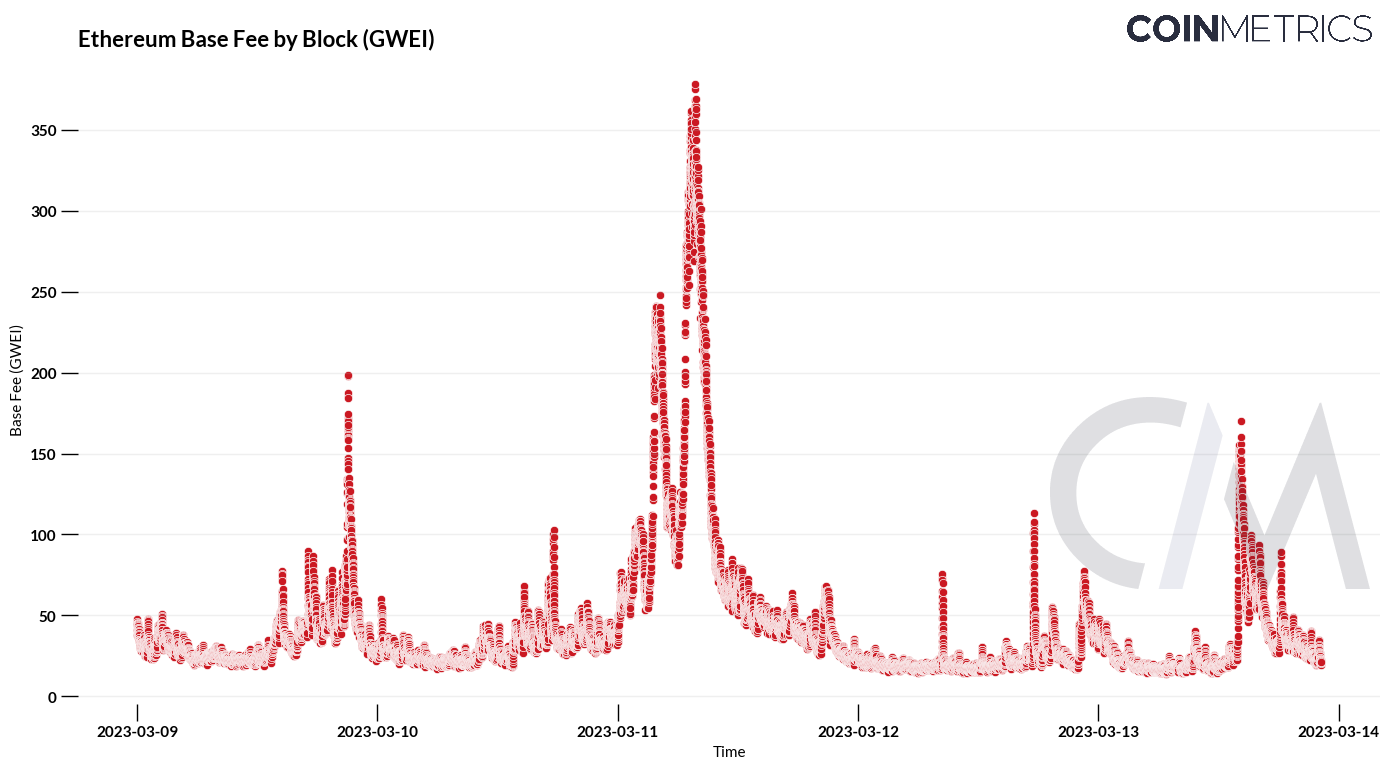

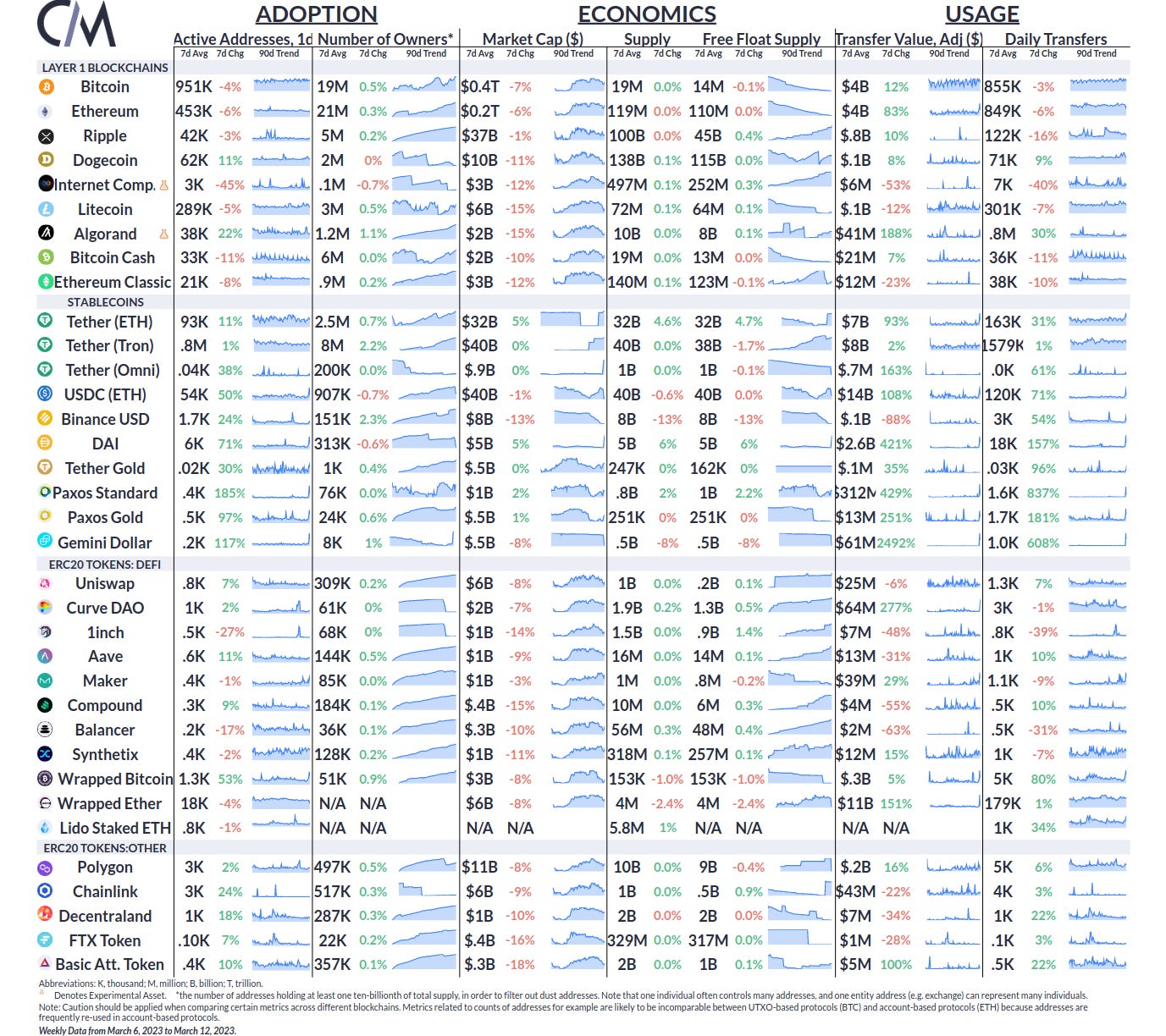

Get the best data-driven crypto insights and analysis every week: FDIC Takeover of Silicon Valley Bank: Assessing the Impact on StablecoinsBy The Coin Metrics Team Last week's events were a sudden shock to market participants on the whole—and a painful echo for crypto market participants that, by now, are all-too aware of the risks that centralized dependence poses to the market as a whole. Before we dive into last week’s events, we would like to draw our reader’s attention to a new report we have just released, detailing an update to our Trusted Exchange Framework in the form of a report documenting methods used to detect fake volume across exchanges. Centralized exchanges are a vital part of the crypto ecosystem, yet they can vary widely in quality across several use-cases. To improve the quality of information in our industry, Coin Metrics launched the Trusted Exchange Framework almost three years ago. Today, we are building on that effort with V2 of the framework, which aims to quantitatively and rigorously assess exchanges across various dimensions, including transparency and resilience, data quality, compliance, and tech infrastructure. The report summarizes extensive research conducted by Coin Metrics, which includes detecting wash trading, fake volume, and fraud. For example, organic market activity tends to follow specific properties from Benford’s Law—leading digits tend to be low and most frequent, and the frequencies decrease as the leading digit increases. The charts below show this in action applied to real-world data for a series of markets. Source: Coin Metrics (Note: blank markets indicate that pair is not traded on that exchange) Several other techniques are included in our framework. We also made use of Coin Metrics’ unique experience of maintaining a market data collection system for over 40 exchanges over the past five years, which involves constant interaction with exchanges’ APIs and regular evaluation of data quality issues and interruptions in service. The new framework intends to promote transparency, innovation, and trust for the industry and its users, and feeds into Coin Metrics’ selection of high-quality constituent exchanges in our prices, indexes, and metrics. You can read more about our new Trusted Exchange Framework below. The Silicon Valley Bank StorySilicon Valley Bank (SIVB) was taken over by the FDIC on Friday morning following a bank run that drained their reserves and threatened the integrity of their depositors’ accounts. Despite the shutdown itself, the uncertainty leading to the FDIC’s action sparked market speculation on the stability and ongoing endurance of the USDC stablecoin, since Circle (USDC’s parent company) was custodying around $3.3B in SIVB, 8.25% of USDC’s $40B market cap. Given the rising importance of stablecoins to the digital asset ecosystem, the events of the last few days left industry participants closely following the stablecoin markets in the wake of these new banking tremors. This sudden event led to doubt in the ability of Circle to process withdrawals and maintain the 1:1 peg. Fiat-collateralized stablecoins are tokens issued on public blockchains that aim to track an underlying fiat currency (overwhelmingly the US dollar). For every 1 USDC issued, there is a promise of $1 kept in reserve off-chain (e.g. not on the blockchain) to back these tokens and handle redemptions accordingly. But when the integrity of reserves is in question, prices can go awry and break from the peg. With news of SIVB being taken into FDIC receivership on Friday, Coin Metrics’ Reference Rates showed a drop in the price of USDC, along with several stablecoins including Maker’s Dai ($6.3B market cap). Source: Coin Metrics’ Reference Rates Due to Circle’s presumed inability to access the funds they kept at SIVB and potential contagion, USDC’s reference price fell to just over ¢88 before recovering over the following days. DAI was seen tracking USDC’s price movement, likely due to DAI’s collateral pool composition, which includes approximately 42% of USDC. Conversely, stablecoin market giant Tether (USDT) and the recently beleaguered BUSD—two other stablecoins—were seen appreciating in price above their par value as market participants swapped their funds into stablecoins perceived as more safe due to a lack of existing relationship with SIVB. A great amount of stablecoin trading volume was also witnessed on decentralized exchanges (DEXs), where a discount of USDC vs. USDT emerged—reaching as high as 14 cents on Uniswap v3. Source: Coin Metrics’ DEX Data Feed But on Sunday March 12th, at 6:15 pm ET, the FDIC issued a joint statement along with the US Treasury and the Federal Reserve, which announced that the FDIC had secured support to fully protect all depositors and resume regular processing of transactions by Monday, March 13th. We can notice how prices jumped back to around ¢99 as market sentiment recovered in news the FDIC would guarantee all deposits (dashed line on the first price chart above). Activity across all networks rose in response to these events. However, the spotlight was on stablecoins principally housed in the Ethereum network. On-chain activity, including DEX trades, collateral lending, and token transfers caused a surge in demand for block space, with base fees rising to more than 350 GWEI/gas. This led to over 9.4K ETH being burnt, the largest single-day burn of ETH since May 12, 2022 during the Terra/Luna meltdown. Source: Coin Metrics’ Network Data Pro, Block-by-Block Data To provide some context to the exceptional level of on-chain activity, we have compiled some statistics on USDC (on Ethereum) using CM network data and created the dashboard view below. On March 9th there were 23K large addresses holding at least 100K USDC, and on March 12th there were 17K. Meanwhile, the number of holders of at least 100K USDT rose from 22K to 25K. There were 303K total transfers of USDC on March 11th, which was a single day record. Large sums of USDC were moving around on-chain on March 11th and there were almost as many transfers above $1M (8,028) than there were under $100 (12,566). Corroborating this, the median transfer size on that day was $10K, almost 10x the level just two days prior. Finally, 119K Ethereum addresses sent or received USDC on March 11th, an all-time high. One Ethereum address shouldn’t necessarily be interpreted as one individual, but to put this in perspective, there were 412K active Ethereum addresses on March 11th, and 1.2M addresses holding at least $1 of USDC the day prior. Source: Coin Metrics’ Network Data The chart shows several notable trends in the usage and adoption of stablecoins, particularly USDC. Interestingly, there was a surge in the number of large addresses holding ETH, suggesting that investors may have rotated out of stablecoins and into ETH to find safety. ConclusionDespite the recent banking tremors and uncertainty in the stablecoin market, the joint FDIC, Treasury, and Federal Reserve announcement on March 12th brought much-needed relief to Silicon Valley depositors, as well as to the broader market to try and head off further contagion. It is worth noting that the fate of Silicon Valley Bank was important far beyond the digital assets ecosystem, with many early stage startups counting SVB as a banking partner across diverse industries like A.I., health tech, and energy. But with U.S. government support behind the deposits, USDC holders are breathing a sigh of relief, and stablecoins are poised to remain a vital part of the digital asset ecosystem. As evidenced by the exceptional level of on-chain activity, the crypto market responded positively to this news, with BTC and ETH rallying over $24,000 and $1,600 respectively. The events of the last few days highlight the risks posed by excessive reliance on centralized infrastructure, and will be certain to inform future decisions. But despite a quickly-evolving regulatory environment in the U.S., some of the basic primitives granted by digital bearer assets such as bitcoin—that they are trivially self-custodied, disintermediated, and provide on-chain transparency—are more acute than ever, echoing a sentiment which sparked a pseudo-anonymous Satoshi Nakamoto to release a new project to the world amid the Great Financial Crisis in October of 2008. Network Data InsightsSummary MetricsStablecoin activity marks a sharp rise in interest—50% and 71% rise daily active addresses for USDC and DAI, respectively— in no small part due to the fear that they could lose their peg as a result of Circle’s relationship with failed Silicon Valley Bank. Market caps across most major coins and tokens fell in fear of fallout as prominent stablecoins momentarily lost their peg to the dollar, with BTC falling by 7% and ETH falling by 6% over the last week. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Coin Metrics’ State of the Network: Issue 197

Tuesday, March 7, 2023

Tuesday, March 7th, 2023

[Report] Coin Metrics' State of the Network: Issue 196

Tuesday, February 28, 2023

Tuesday, February 28th, 2023

Coin Metrics’ State of the Network: Issue 195

Wednesday, February 22, 2023

Wednesday, February 22nd, 2023

Coin Metrics’ State of the Network: Issue 194

Tuesday, February 14, 2023

Tuesday, February 14th, 2023

Coin Metrics’ State of the Network: Issue 193

Tuesday, February 7, 2023

Tuesday, February 7th, 2023

You Might Also Like

Weekly Project Updates: Berachain Deposits Surpass $1.1 Billion, Movement Secures $100 Million in Series B Funding…

Saturday, January 11, 2025

On Friday, the proportion of the USD0/USD0++ Pool on Curve, with a Total Value Locked (TVL) of $245 million, tilted severely. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Ethereum and Solana staking no longer classified as collective investment schemes in the UK

Friday, January 10, 2025

The UK Treasury's amendments are part of the government's recent plans to foster crypto innovation. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: U.S. Government Authorized to Sell $6.5 Billion Worth of Bitcoin, Pro-Crypto Pierre Poilievre…

Friday, January 10, 2025

The US government has received approval to liquidate 69000 Bitcoins (valued at $6.5 billion) seized from the “Silk Road” darknet market, a government official confirmed to DB News on Thursday. ͏ ͏ ͏ ͏

US Government can now sell $6.5 billion Silk Road Bitcoin before Trump enters office

Thursday, January 9, 2025

Federal court ruling accelerates sale of Silk Road Bitcoin as market watches closely. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: TGEs Look To Heat Up Crypto In 2025

Thursday, January 9, 2025

Monday Jan 6, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR TGEs To Heat Up Crypto In 2025 Solana Remains Skeptical About AI Agents BTC Looks To Regain Momentum, DOGE & SUI Surge UK

Mining News in December: Ethiopia's Rise, Huaqiang North Mining Machine Prices Rise, Oilfield Giant Invests in Bit…

Thursday, January 9, 2025

Title sponsored by Bitdeer, a NASDAQ-listed mining company. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Let's Make Money from Farming

Thursday, January 9, 2025

CRYPTODAY 140 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Ripple CEO Brad Garlinghouse hails Donald Trump meeting as US crypto engagement grows

Wednesday, January 8, 2025

Trump's pro-crypto stance sees Ripple and other crypto leaders engaging in transformative talks at Mar-a-Lago. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUS…

Wednesday, January 8, 2025

Weekly active addresses on L2s were 5x higher than on Ethereum. Ethena plans to launch iUSDe for financial institutions in February. Solayer launched the Solayer Foundation and LAYER governance token ͏

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUS…

Wednesday, January 8, 2025

Weekly active addresses on L2s were 5x higher than on Ethereum. Ethena plans to launch iUSDe for financial institutions in February. Solayer launched the Solayer Foundation and LAYER governance token ͏