Coin Metrics’ State of the Network: Issue 193

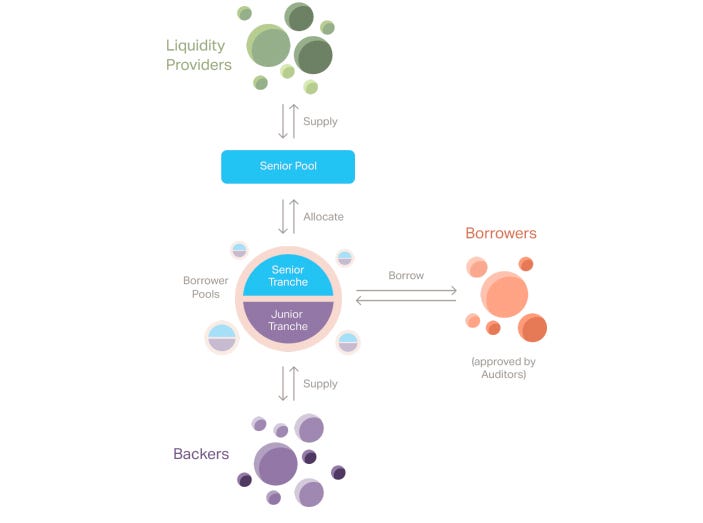

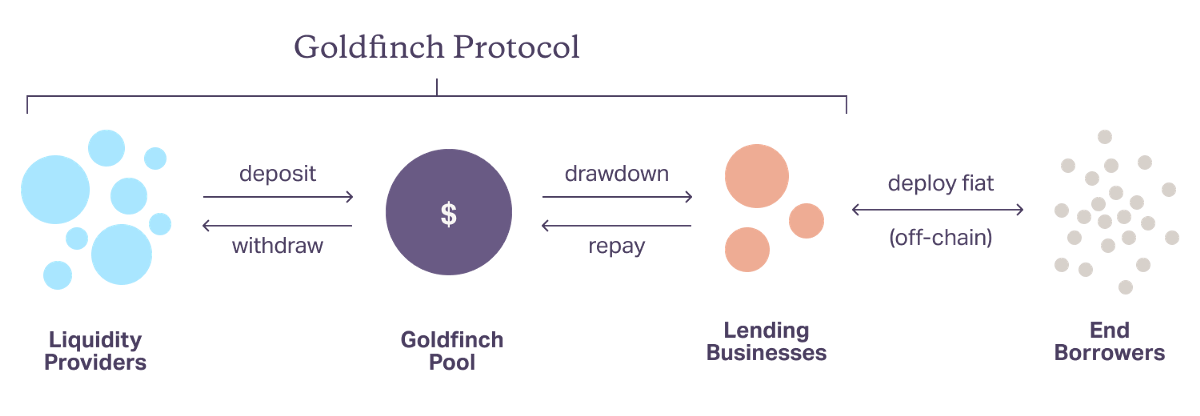

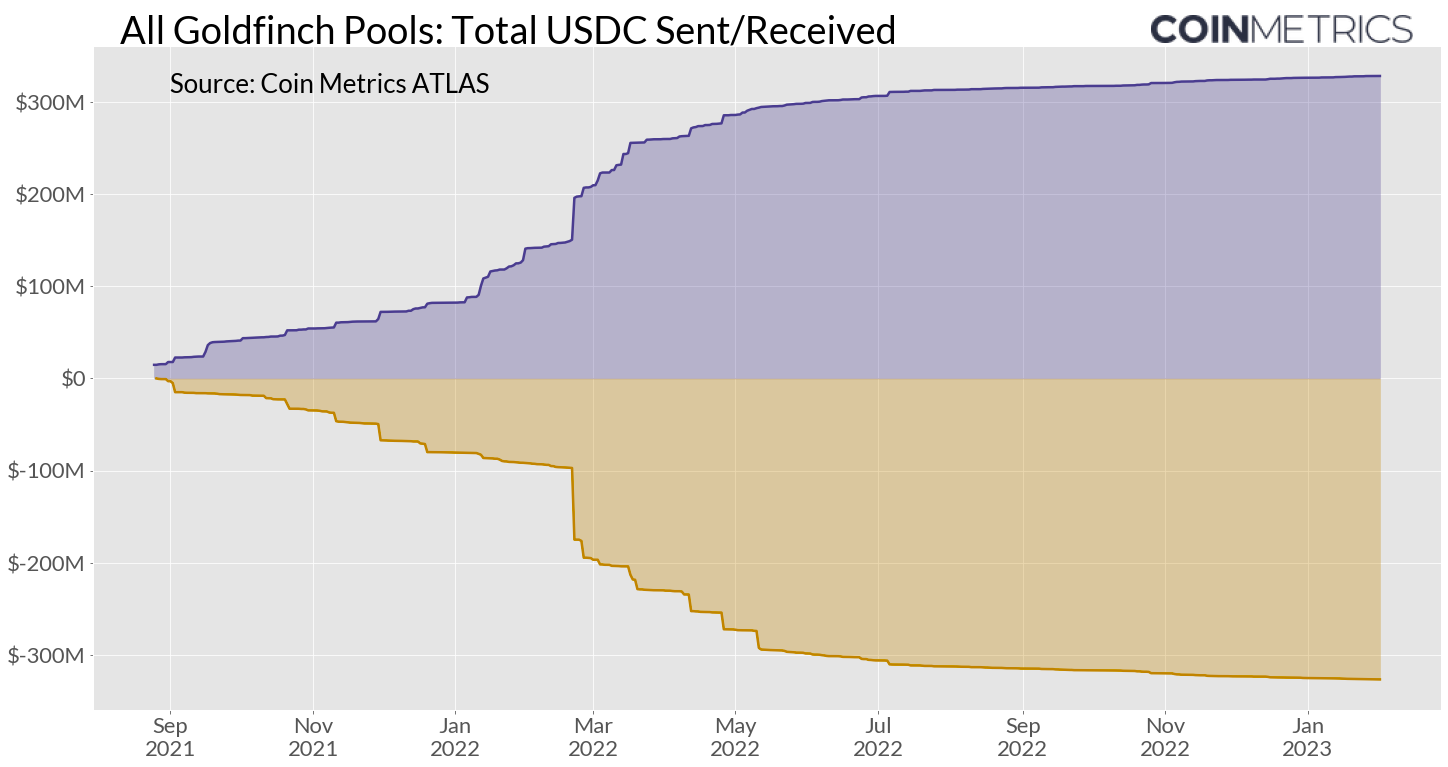

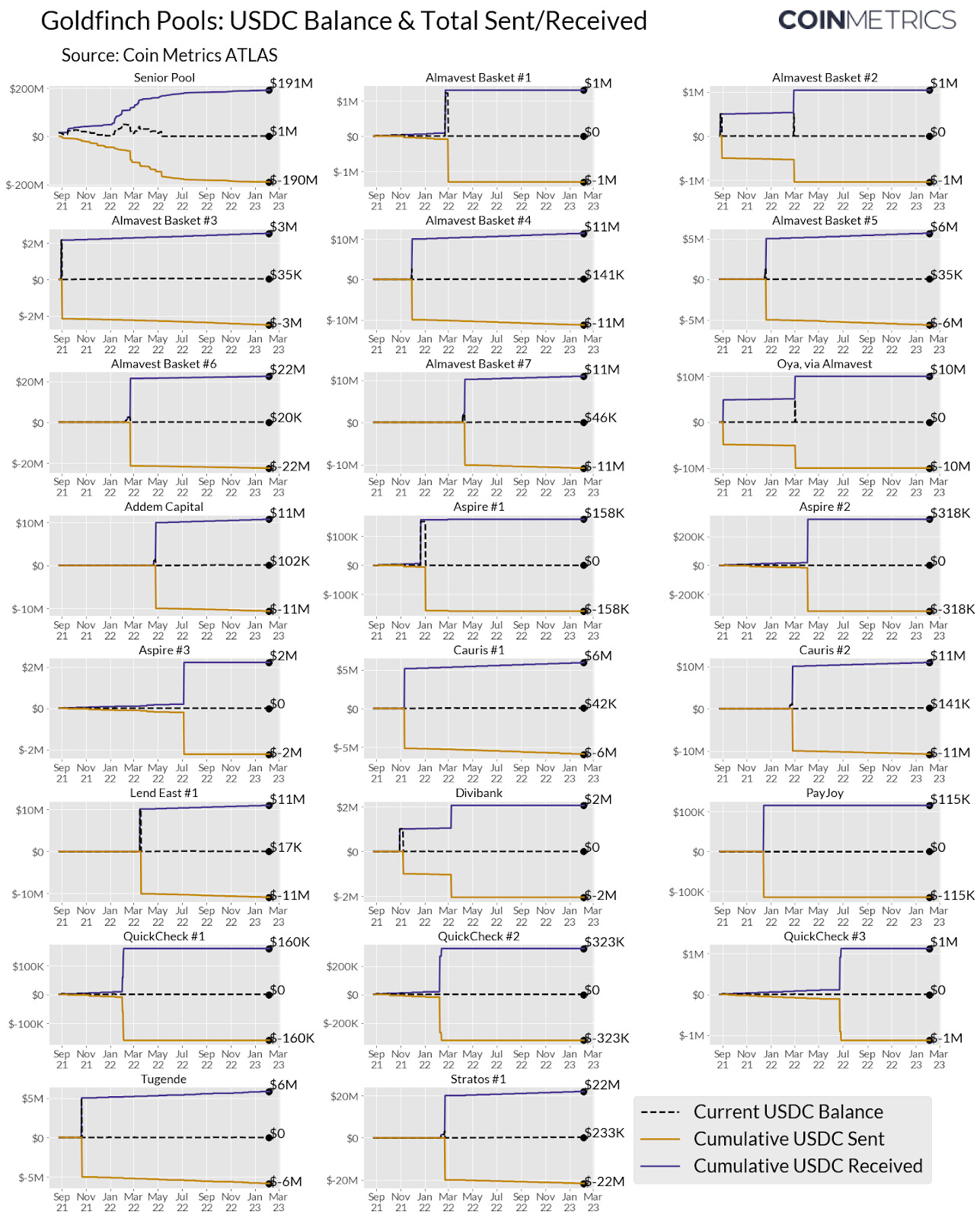

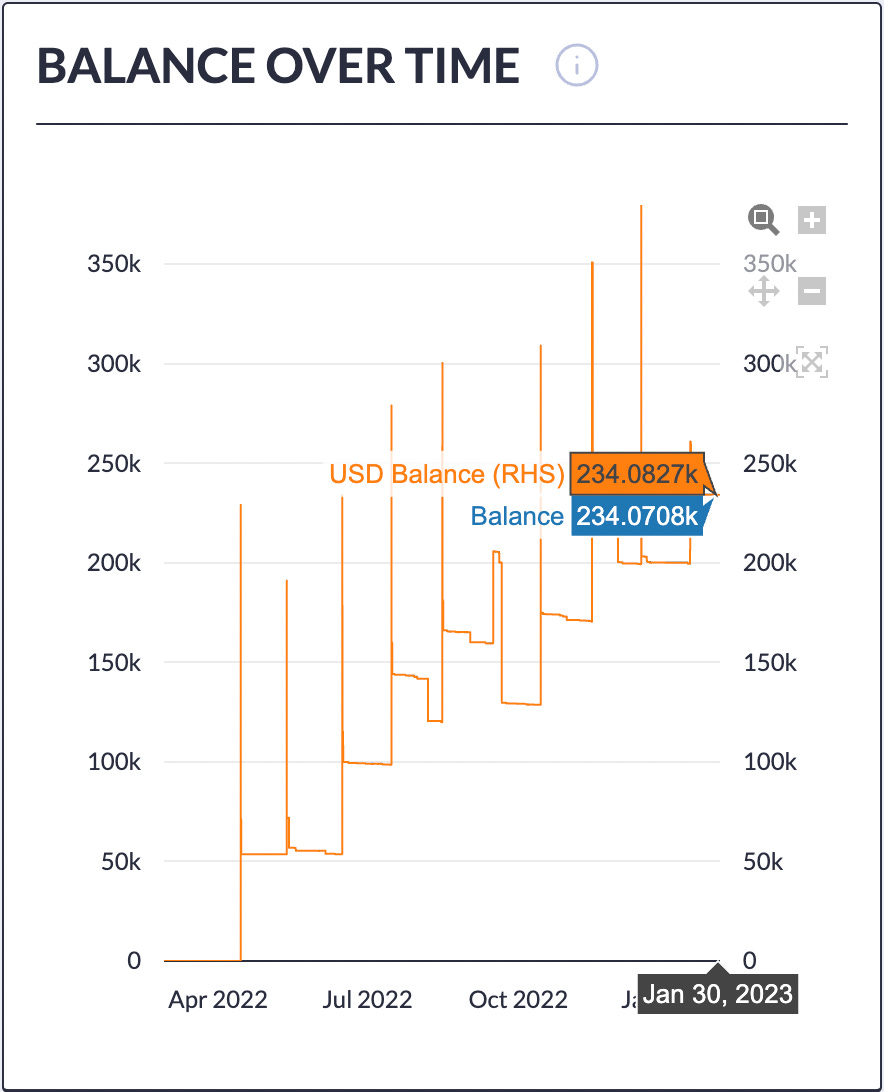

Get the best data-driven crypto insights and analysis every week: DeFi & Real World Assets: An Introduction to Goldfinch FinanceBy Tanay Ved The Decentralized Finance (DeFi) ecosystem has come a long way since its early beginnings. Today, it consists of a thriving set of applications harnessing the ability of blockchains to provide decentralized, transparent and composable access to financial services. However, a common criticism of these protocols has been their ability to provide value outside of the ‘crypto native’ economy. Therefore, a crucial step in the evolution of DeFi is its intersection with Real-World-Assets (RWA’s), which we expect to be a topic of significance going forward. By bridging these two together, real world problems can be solved in a more transparent, efficient, and accessible way. Through this issue of State of the Network, we’ll explore the theme of RWA lending through the lens of Goldfinch Finance—a decentralized credit protocol bringing real world credit activity on-chain. The Hurdles of BorrowingTaking the lending sector as an example, major problems can be identified in traditional and decentralized finance markets. Individuals and businesses in developing economies face several challenges in accessing capital due to several structural reasons. Lending, on the other hand, is primarily handled by banks and accredited investors. This presents significant barriers for a large user base due to fragmented access to capital within emerging markets. Secondly, a core limitation of DeFi lending protocols such as Aave and Compound is that they require loans to be overcollateralized with crypto assets. This requires businesses to supply large sums of collateral, greater than the loan they receive (collateral > loan). Although overcollateralization is a crucial aspect to how these protocols manage risk, this limitation leaves a majority of individuals with real needs to be met underserved due to insufficient access to capital. Alternative mechanisms in the form of undercollateralized loans introduce other challenges in determining the creditworthiness of borrowers without introducing the risk of defaults, or mapping crypto addresses to off-chain identities. Credit scores are a useful tool in traditional finance, however the absence of a reliable and secure way to understand on-chain identity is a huge problem to be solved. How the Goldfinch Protocol WorksGoldfinch is a decentralized credit protocol on Ethereum that loans out digital assets in the form of USDC stablecoins without the need for crypto-assets as collateral. Loans are secured by off-chain assets and income through real world businesses. This creates a sustainable source of yield for lenders uncorrelated to the downturns of the crypto market. Goldfinch’s lending model relies on ‘trust through consensus’, creating a way for borrowers to show creditworthiness based on the collective assessment of participants, as opposed to overcollateralization. This enables the protocol to reach untapped markets and opens access to financing in more equitable ways. The primary stakeholders crucial to how the protocol functions include borrowers, investors in the form of backers, liquidity providers (LP’s) and auditors. Source: Goldfinch Docs Borrowers that seek financing propose pools (smart contracts) defining the terms of the loan, such as the repayment schedule and interest rate. These individual borrower pools are then assessed by backers who decide whether to invest. Backers assume greater risk and are incentivized to provide first-loss capital to the ‘Junior Tranche’ (individual borrower pools) based on their due diligence and thus receive higher USDC yields in return. Liquidity providers supply second-loss capital to the Senior Pool allowing them to earn a passive yield. The senior pool automatically allocates funds to the borrower pools based on the number of backers, employing a leverage model approach. Being a backer or Senior Pool liquidity provider is represented via Backer NFT’s and FIDU that track the amount being supplied and redeemed. Since the approach relies on identifying whether participants are separate entities, Goldfinch requires participants to pass a ‘Unique Identity Check’ (UID). This is achieved through an NFT for identity (ERC–1155), representing KYC/KYB and allows for investor accreditation on-chain. UID is a critical component as it enables the on-chain representation of personhood and offers protection to sybil attacks, further opening up access to DeFi for individuals and institutions. To date, over 6500 UID’s have been issued in the form of Soulbound NFT’s that are interoperable with the rest of DeFi. Source: Goldfinch Docs Borrowers on the platform are financial institutions primarily composed of Fintech lenders in emerging markets. These businesses withdraw stablecoins from the pool to access a full life-cycle of funds and extend loans to small businesses and end-borrowers in need of capital. These funds are then repaid to the pool through regular interest payments. Although loans on Goldfinch are highly concentrated amongst fintech credit funds, access to financing has impacted an array of sectors including healthcare, energy, Edtech, and real-estate across a diverse range of geographies. Fintech shop ‘Tugende’ received a $5 million loan to expand its motorcycle taxi business in Kenya—an example illustrative of the impact created. The protocol generates revenue by allocating 10% of interest payments to its treasury and charges a 0.5% fee to LP’s on withdrawals from the Senior Pool. Additionally, it’s also worth noting that the protocol has a native governance token—GFI, which acts as an incentive mechanism for participants. On-Chain DataTo understand how borrower pools are structured and explore their underlying activity, we can turn to on-chain data. The chart below illustrates the cumulative amount of USDC received from backers and repaid by borrowers to all pools on Goldfinch (excluding the Senior Pool). A steady growth in loan originations can be seen throughout 2021 and first half of 2022 reaching $300M in USDC supplied and repaid. However, growth inflows have waned after May 2022 around the UST–Luna collapse. This can be attributed to a low supply of new deals, but highlights utilization of current loans and the appetite for yield uncorrelated to downturns in the crypto market. Source: Coin Metrics ATLAS The chart below offers a more granular view of the various credit lines (i.e. pools) on Goldfinch. In addition to the Senior pool, there are 22 individual pools representing various credit funds and the cumulative flows of USDC. Each pool has its unique terms such as the total capital that can be drawn-down, interest rate, repayment frequency, and loan duration based on the needs of each borrower. This is reflected through the varying timelines of originations and current USDC balances. Pools with $0 balances represent deals that have been fully repaid. Higher cumulative flows seen for Almavest baskets—focused on SMEs, carbon reduction projects and social impact businesses—are also noteworthy in comparison to other pools. Source: Coin Metrics ATLAS Another pool of significant size is Stratos #1, a US based credit fund providing structured financing to technology-enabled businesses. Once the $20M maximum capital has been drawn down after the opening date, funds can be withdrawn by the end borrower. A regular cadence of repayments can be seen as determined by the fixed interest rate and payment frequency. There’s a ~$19.8M principal outstanding over the term of the loan with a current balance of ~$234k. Source: Coin Metrics ATLAS & Goldfinch App ConclusionGoldfinch has created a unique protocol that addresses important obstacles in lending markets; however, it does have a fair share of risks and challenges. Most importantly, the possibility of a borrower defaulting cannot be overlooked—which presents credit risk. Incentives to align participants and guardrails have been created to mitigate this, however, there’s still a degree of trust required between parties involved. Without the requirement of overcollateralization, potential vectors in the form of dishonest behavior and collusion should be recognized. Furthermore, Goldfinch deals with companies in numerous jurisdictions, which could be met with regulatory risks. In conclusion, several platforms leveraging real-world assets through tokenization and as collateral are emerging in DeFi. Although these approaches bring unique challenges, it's clear that this area presents tremendous opportunity to extend the qualities of DeFi to a broader pool of assets and participants alike. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Bitcoin daily active addresses surged 7% week-over-week to a 7-day average of 955K. This comes as Bitcoin based NFT’s (known as Ordinals), continue to gain traction. Ethereum daily active addresses remain unchanged at a seven-day average of 507k, whereas on-chain activity for stablecoins USDC and Tether (ETH) grew 22% and 23% respectively. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. To learn more, acquire our data, or contact Coin Metrics, reach out here. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

[Report] Coin Metrics' State of the Network: Issue 192

Tuesday, January 31, 2023

Tuesday, January 31st, 2023

Coin Metrics’ State of the Network: Issue 191

Tuesday, January 24, 2023

Tuesday, January 24th, 2023

Coin Metrics’ State of the Network: Issue 190

Friday, January 20, 2023

Wednesday, January 18th, 2023

Coin Metrics’ State of the Network: Issue 189

Tuesday, January 10, 2023

Tuesday, January 10th, 2023

Coin Metrics’ State of the Network: Issue 188

Wednesday, January 4, 2023

Wednesday, January 4th, 2023

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏