Popular Information - Who gets bailed out? Who gets left out?

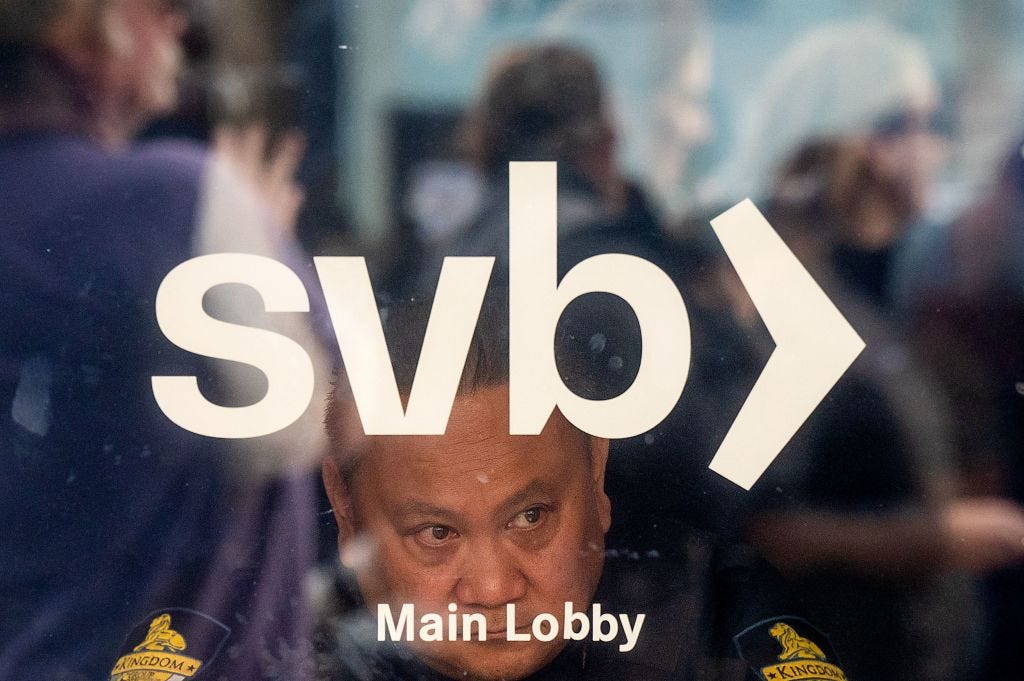

Too often, the media treats the news as a game. It's about who is up and who is down — who is winning and who is losing. Popular Information takes a different approach. We believe journalism should focus on people. That is the focus of today's edition. And it will continue to be the focus of Popular Information in the months and years to come. Our reporting has helped secure guaranteed sick leave for 170,000 restaurant workers, pressured large corporations to cut off donations to members of Congress who voted to overturn the election, and pushed Koch Industries to wind down its business in Russia. You can support this work — and help us do more of it — by upgrading to a paid subscription. If the cost of this newsletter ($6/month or $50/year) would create any kind of financial strain, please stay on this free list. That's why don’t have a paywall. But if you can afford it, consider becoming a paid subscriber. Last Friday, Silicon Valley Bank (SVB) — which held deposits for thousands of tech startups — collapsed. The failure was sparked by SVB executives mismanaging the bank's assets and fueled by venture capitalists like Peter Thiel, who encouraged the companies they invested in to pull out their funds en masse. Within hours, a bank with $200 billion in assets was insolvent. SVB was closed, and the Federal Deposit Insurance Corporation (FDIC) took over. Under the law, the first $250,000 deposited in a bank account is fully insured by the federal government. Larger account holders would have to wait for the FDIC to sell SVB's assets before they had access to more money. And many of the startups that banked at SVB had very large accounts. More than 90% of SVB's deposits were uninsured. Ultimately, companies and individuals that banked with SVB would have recovered most, if not all, of their money. But it would have taken time for the FDIC to sell SVB's assets and return more of the cash to larger depositors. But the startups that banked with SVB, and the venture capitalists that fund them, insisted waiting would be catastrophic. An open letter from Y Combinator, a "startup accelerator" that makes early investments in companies pleaded with the federal government to take action to "save innovation in the American economy." The letter asked Treasury Secretary Janet Yellen to "backstop" 100% of all deposits at SVB, giving companies immediate access to their money. The failure to do so would "set back US competitiveness by a decade or more" and "could lead to financial crisis and layoffs of more than 100,000 workers." The Y Combinator letter was signed by "over 5,000 CEOs and founders." And it was echoed by panicked pleas by venture capitalists and investors online.  YOU SHOULD BE ABSOLUTELY TERRIFIED RIGHT NOW — THAT IS THE PROPER REACTION TO A BANK RUN & CONTAGION

@POTUS & @SecYellen MUST GET ON TV TOMORROW AND GUARANTEE ALL DEPOSITS UP TO $10M OR THIS WILL SPIRAL INTO CHAOS This strategy worked, and on Sunday, the Department of the Treasury, the Federal Reserve, and the FDIC released a joint statement announcing SVP "[d]epositors will have access to all of their money starting Monday, March 13." This was possible by invoking the "systemic risk" exception, which gives the federal government access to a separate pool of insurance funds, called the Deposit Insurance Fund. If the Deposit Insurance Fund runs out of money, it "will be recovered by a special assessment on banks." Let's be clear: this is a bailout, which is a government intervention to prevent private loss. While the bank itself and stockholders were not bailed out, depositors were. The price of the bailout will be borne by the banking industry in general. And these costs will be passed down to anyone who does business with a bank. The depositors were not responsible for the mismanagement by SVB executives, but they took on that risk. There are cash management strategies and insurance products that can provide additional certainty for businesses with large amounts of cash. But doing business that way is a bit more expensive and inconvenient. So most depositors at SVB chose to leave their deposits over $250,000 uninsured. Nevertheless, the federal government's announcement was cheered not just by the tech industry but corporate America in general. The U.S. Chamber of Commerce, which represents nearly every major corporation in the United States, issued a press release applauding "the swift action by banking regulators to resolve the liquidity crisis at Silicon Valley Bank." It was necessary, the Chamber said, to "allow businesses to make payroll, pay their rent, and still keep an eye towards growth." It's good news that, as a result of the SVB's collapse, people who work in tech startups will not miss a paycheck or lose their job. But it also raises the question of which groups are deemed so important that protecting their interest requires quick and decisive collective action and which groups can be permitted to suffer. What is considered a crisis that must be avoided, and what is simply an unfortunate turn of events? No bailout for poor kidsIn March 2021, as part of the American Rescue Act, the federal government expanded the Child Tax Credit. The expanded credit was both larger in size per child and fully refundable, so it was available to all families, regardless of income. Beginning in July 2021, it was paid to eligible families as a monthly benefit so they did not have to wait to file their annual taxes. The expanded Child Tax Credit was wildly successful, lifting millions of children out of poverty. The monthly payments were spent "on basic household needs and children's essentials: the most common item is food." The payments were effective in meaningfully reducing "family food insufficiency, particularly among children in families with low and moderate incomes." After the July payment alone, "food insufficiency rates among families with children dropped by 24 percent." After two months of payments, "2 million fewer adults report[ed] that their children, specifically, did not have enough to eat." But the expanded credit was slated to expire at the end of 2021. The Biden administration offered a variety of proposals to extend the Child Tax Credit expansion. Traditionally, the Child Tax Credit enjoyed bipartisan support. It is, after all, about promoting the well-being of families. But all of the proposals were opposed by the business community. There was no letter from Y Combinator urging the government to take action to avoid a "crisis" in child poverty. Venture capitalists did not tweet in all caps about child poverty being a systemic risk to the health of the economy. And the U.S. Chamber of Commerce spent millions lobbying against an extension. In an open letter, the Chamber said it was concerned about "large amounts of transfer payments that are not connected to work." In other words, it was concerned with the size of the expanded Child Tax Credit and the fact that it was available to all families, regardless of income. In the end, the U.S. Chamber of Commerce's argument won the day. It convinced all Senate Republicans and a handful of Democrats to oppose extending the expanded Child Tax Credit. According to a study by the Center on Poverty and Social Policy, as a result of the decision to let the expanded child tax credit expire in December, 3.7 million children fell into poverty. The child poverty rate increased from "12.1 percent in December 2021 to 17 percent in January 2022" — a 41% increase. No one bailed out those kids. No bailout for homeownersIn the wake of the financial crisis of 2008, the federal government allocated hundreds of billions of dollars to bail out large financial institutions like AIG, Citigroup, and Bank of America. These institutions had invested heavily in toxic assets, including financial instruments made up of subprime mortgages. The bailout was promoted as an essential step to save the economy. Today, many of the beneficiaries are richer than ever. But not everyone was bailed out. In 2008, 861,664 families lost their homes to foreclosure, and there were more than 3 million total foreclosure filings. Overall, there were "7.8 million foreclosures...during the 10 years between 2007 and 2016." Although there were some modest efforts to finance mortgage restructuring and other relief, the government did not swoop in to save families. People are still grappling with the consequences. |

Older messages

Silicon Valley Bank donated zero dollars to Black Lives Matter

Thursday, March 16, 2023

Tuesday night on Fox News, host Jesse Watters asserted that Silicon Valley Bank (SVB) "donated $74 million to Black Lives Matter." That was why, Watters claimed, federal regulators did not

Deregulating child labor

Tuesday, March 14, 2023

In February, a federal investigation found that Packers Sanitation Services illegally employed at least 102 children “in hazardous occupations” across 13 meat processing facilities in eight states. The

Florida book bans are not a hoax

Monday, March 13, 2023

For months, Popular Information has documented how thousands of books have been removed from the shelves of Florida school libraries or have otherwise been made unavailable to Florida students. These

Why Musk attacked me

Friday, March 10, 2023

Popular Information has documented how, under Elon Musk's leadership, Twitter's Community Notes feature has been weaponized against our reporting. Purportedly, Community Notes are used to

Tucker v. Tucker

Thursday, March 9, 2023

Tucker Carlson is the most watched political pundit on television. Carlson demeans immigrants, promotes white nationalist conspiracies, and defends Donald Trump. The pro-Trump commentary is especially

You Might Also Like

Seattle’s newest unicorn | Microsoft’s new AI division

Monday, January 13, 2025

Another delay for Blue Origin's orbital launch ADVERTISEMENT GeekWire SPONSOR MESSAGE: Revisit defining moments, explore new challenges, and get a glimpse into what lies ahead for one of the

☕ Stick to sports

Monday, January 13, 2025

Why elf is doubling down on sports marketing. January 13, 2025 View Online | Sign Up Marketing Brew It's Monday. Meta isn't just done with fact-checking. It's also throwing in the towel on

☕ Stage whisper

Monday, January 13, 2025

Diversity at NRF's Big Show. January 13, 2025 View Online | Sign Up Retail Brew Presented By Bloomreach It's Monday, and if instead of embarking on all of the challenges and indignities of a

The Los Angeles wildfires.

Monday, January 13, 2025

A special "my take" and a question about "Pakistani rape gangs" in England. The Los Angeles wildfires. A special "my take" and a question about "Pakistani rape gangs

Storm Fall

Monday, January 13, 2025

A Storm Trapped A Luxury Passenger Train // The Rise And Fall Of "Fact-Checking" Storm Fall By Caroline Crampton • 13 Jan 2025 View in browser View in browser A Storm Trapped A Luxury

⚡️ The ‘DOOM’ Technological Arms Race

Monday, January 13, 2025

Plus: 'Ahsoka' Season 2 just recast a crucial character. Inverse Daily Hackers will not rest until a classic shooter is playable on absolutely everything, including satellites and pregnancy

☕ The ways of Waymo

Monday, January 13, 2025

Waymo's co-CEO at CES 2025. January 13, 2025 View Online | Sign Up Tech Brew presented by Hyilo It's Monday. Today we've got the final real-time dispatch from CES 2025, a keynote from Waymo

The Architects Of L.A.’s Wildfire Devastation

Monday, January 13, 2025

Developers and real estate interests crushed efforts to limit development in high-wildfire-risk areas — including in LA neighborhoods now in ashes. Again and again, developers and real estate interests

Is a popular new solution to methane gas just a lot of hot air?

Monday, January 13, 2025

Plus: Donald Trump's feud with a fish, a new hottest year on record, and more. January 13, 2025 View in browser Kenny Torrella is a senior reporter for Vox's Future Perfect section, with a

The corporate lobbyist who will run the Trump White House

Monday, January 13, 2025

During the 2024 campaign, Trump condemned the power of lobbyists in Washington, DC, and pledged that, if he returned to the White House, they would have no influence. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏