Earnings+More - Same-game changer

Good morning. In this latest issue of Due Diligence, we take a look at the apparent ‘killer app’ in US sports betting, same-game parlays.

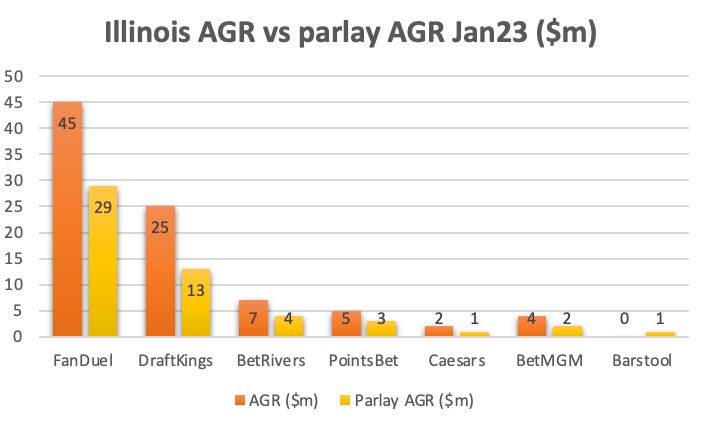

It's all about the game and how you play it. Same game, different rulesIn US sports betting, who wins with same-game parlays decides who wins the race. Clear as crystal: The latest data from Illinois gives a perfect illustration of the importance of parlays in general to the shape of the overall market. In January, FanDuel continued its market domination, grabbing just under 50% of the total AGR of $89m, while DraftKings accounted for 27%, with BetRivers (9%), PointsBet (5%), BetMGM (4%), Barstool (3%) and Caesars (1%) trailing behind. Further, and crucially for this edition of Due Diligence, Illinois also gives an insight into the mix of sports being bet on, including parlays. Here, we can see the importance of parlays within the market shares of the top two, in particular. 🧐 FanDuel and DraftKings are the parlay winners Total control: Between them, FanDuel and DraftKings control 70% of the total market by AGR and an even more impressive 79% of parlay AGR. By handle, DraftKings and FanDuel control 68% of the market but 75% of the parlay handle. 🪞 The handle breakdown mirrors the AGR picture Playing catch up: What is abundantly clear is that the rest of the market is failing to catch up with the leaders. The near 32% of handle share among the rest of the market only translates into AGR share of barely about 20%.

FanDuel’s advantage: During FanDuel’s investor day back in November, the company spoke about its record of innovation in parlays, introducing same-game parlays in 2019 before adding a new SGP user interface in 2020, SGP-plus in 2021 (with one-tap SGPs) and live SGP cash out bet tracking in 2022.

** SPONSOR’S MESSAGE** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand? Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for. The in-house partyStack, crackle and pop: The rationale for full in-house ownership of the tech stack is clear. During Penn’s Q4 call, CEO Jay Snowden said theScore Bet’s in-house migration in Ontario gave it enhanced control of the product roadmap, “especially with the retail masses that are betting mostly on parlays”.

Quick history: The rise of SGPs can be attributed (at least in part) to the Bet Builder/request-a-bet trend started by Sky Bet in the UK in the middle of the last decade. That initial wave saw the birth of SGP provider SportCast, which was acquired by OpenBet in May 2021 for an undisclosed sum.

Who’s on third?House rules: As is obvious from the data and what FanDuel said at its investor day, scale is vital for SGP development. “The sports-betting ecosystem is complex,” says Saunders. “Frankly, I don't think there is an operator in the world who doesn’t need a third party to some extent. That’s the starting point.”

Tangled web: Illustrating the intertwined relationships between operators and suppliers, in 2021 DraftKings announced an SGP agreement with Genius Sports and SportCast.

Coming unstuckCohesive experience: Donal Barron, ex-head of corporate development at Banach and now an independent consultant, says in-house SGPs benefit from being “more cohesive”.

SGP by the numbersAdding to the mix: Describing their impact on DraftKings’ revenues, the analysts at Macquarie noted that its parlay handle mix added 70 bps to the group’s annual hold rate of 7.7% and a 600 bps decrease in promotional reinvestment as a percentage of revenues in 2022.

Further reading: The rise of America’s new favorite way to bet. ** SPONSOR’S MESSAGE ** Tried, tested and proven over a decade in the highly-regulated US market, and continuing to expand across Europe, Latin America, Asia and Africa. GeoComply harnesses the power of its market-leading geolocation technology to protect against fraud, including fake account creations, bonus abuse, account takeovers, stolen identities, money laundering, and more. Visit geocomply.com. Analyst takesLight & Wonder’s move to explore the potential for a joint Australian listing got the thumbs up from the team at Truist. “We think a potential secondary listing there is largely about multiple arbitrage,” the team added. Deutsche Bank suggested that Sportradar’s post-earnings share price fall was an overreaction as the company is “already profitable”, has a strong balance sheet (having paid off $220m of outstanding debt) and part of its investments are in AI, which is currently an investor favorite. DraftKings continued to get the stink eye from the analysts at Roth MKM, who suggested there are more negatives than positives in terms of catalysts. “We don't believe industry revenues will reach the scale needed for DraftKings to generate meaningful operating leverage,” the team added. An eventual primary listing in the US for Flutter is a done deal, going by what analysts on both sides of the Atlantic said about the news that the company was consulting shareholders on a dual listing. Wells Fargo said the move would be a catalyst, while Peel Hunt said Flutter was “taking our ball away”. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

US sportsbooks’ banking choice MVB tumbles

Monday, March 20, 2023

Banking crisis drags MVB shares down, Spain's local heroes, PA data, startup focus – Grilla +More

Weekend Edition #89

Friday, March 17, 2023

Betr's expanded offering, Light & Wonder dual track, Sportradar analyst reaction, New Jersey February +More

Sportradar’s game, set and match

Thursday, March 16, 2023

Sportradar CEO talks revenues and ATP, Playtech's Hard Rock deal, Jason Robins' taxonomy, Super Group and Inspired earnings +More

London’s lost listings luster

Tuesday, March 14, 2023

Flutter's desertion for foreign fields deals a blow to London and poses questions for rival Entain +More

Gambling’s relief at SVB rescue act

Monday, March 13, 2023

Gambling's limited exposure to SVB collapse, Sportradar's ATP deal, six launch in Mass, startup focus – ALT Sports Data +More

You Might Also Like

'They're like Switzerland': Brands walk tightrope between authenticity and political backlash

Friday, March 28, 2025

These days, brand marketers are tasked with showing up authentically and culturally relevant with the specter of political backlash looming large in the background. March 28, 2025 PRESENTED BY '

🔔Opening Bell Daily: Tesla vs. Trade War

Friday, March 28, 2025

Elon Musk's EV maker and its domestic production are relatively insulated from Trump's tariffs.

Meet the consultant with an idea that could revolutionize athletic apparel contracts

Friday, March 28, 2025

A fresh take on how athletic brands could transform college sports partnerships

Friction factory

Friday, March 28, 2025

Is Angstrom providing enough to help BetMGM win share? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

This page has generated $18 million

Friday, March 28, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

Tesla’s Gain, America’s Loss

Friday, March 28, 2025

+ India has 13 more billionaires. Meanwhile, the US Embassy in India is cancelling visa appointments.

🔍 What You Should Pin to Your IG Account

Friday, March 28, 2025

March 27, 2025 | Read Online All Case Studies 🔍 At some point everyone wonders what they should pin to their IG profile. Is it your top videos? Is it info about you? I talked to other creators and

Copious coconuts and a canoe campaign

Friday, March 28, 2025

Weekender #54 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🔍 It’s Time To Get Your Emails On Brand

Thursday, March 27, 2025

Your emails should look as good as they convert. Let's fix that. OR Brand consistency builds trust—here's how to apply it to email.

Last Chance - FBA for Canadians Course + $400 Off

Thursday, March 27, 2025

Offer closes Friday at midnight