Net Interest - The Demise of Credit Suisse

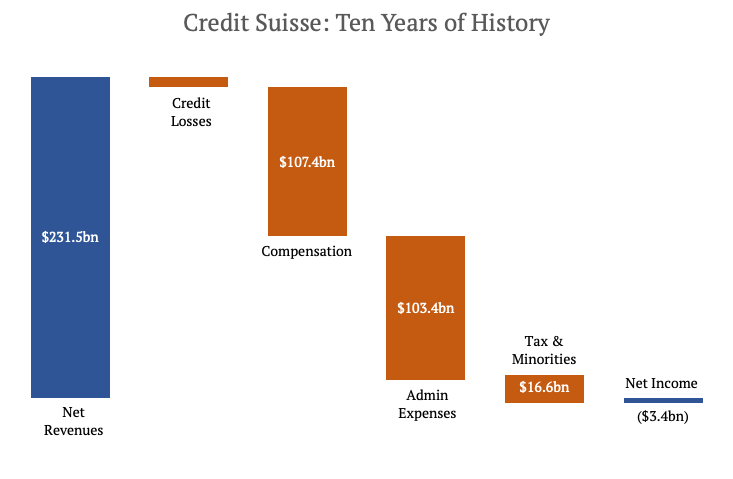

Welcome to another issue of Net Interest, my newsletter on the finance industry. Regular readers will know I’ve written quite a lot about Credit Suisse in the past. I used to work there as an analyst so I know the firm quite well and still retain fond memories from it. With its demise, I thought it would be useful to collate some of my thoughts on what went wrong. The situation is quite different from Silicon Valley Bank – Credit Suisse had ample liquidity to amble along but at some point last week, authorities ran out of patience. This piece examines what happened and why. Paid subscribers can read on to see what it all means for UBS: Is theirs the deal of the decade? I will also be hosting a webinar for paid subscribers to discuss the latest developments in the current banking crisis. If you’re not already signed up, you can do so here. Fifteen years ago, shortly after I’d left the place, Credit Suisse was flying high. It had just generated record earnings of $9 billion and sat atop various league tables. In investment banking, it was the number one ranked firm for IPOs, number one in algorithmic trading and a leader in emerging market bond issuance. In private banking, it managed close to three quarters of a trillion dollars of high net-worth wealth, growing at a rate of around 6% a year. The firm had been embroiled in its fair share of controversy over the years, but it never seemed to cause lasting damage. A few months before I joined, a team of five traders known as the “Flaming Ferraris” made headlines over rogue share deals they’d executed on the Stockholm Stock Exchange. Elsewhere around the world, the firm ran afoul of authorities as far apart as the United States, the UK, India, Japan, New Zealand and Ukraine. When John Mack was brought in as CEO of the investment banking unit in July 2001, he pitched a potential hire: “Brian, I’ve got the biggest, most fucked-up company in the world right here. Come back…and help me fix it.” It took some time but, on the surface at least, it looked like things got fixed. The firm suffered a loss in 2002 – its largest (to date) – as it booked litigation charges on a raft of cases linked to research analyst independence, certain IPO practices and Enron. Fortunately, none of these issues infected its private banking franchise which had experienced its own trauma long before my time. They still spoke in hushed tones of the Chiasso Affair in the wood-panelled corridors of Paradeplatz; management seemed committed to preventing anything like that from happening again. After its bumper year in 2006, Credit Suisse entered the global financial crisis on a relatively strong footing. It suffered write-downs in 2008 on leveraged finance and structured products exposures, swinging the group into a loss. But its private banking business was seen by clients as a place of shelter and net new assets drove 5% asset growth over a period when rival UBS – much more severely hit by the crisis – suffered outflows. Unlike UBS, Credit Suisse avoided having to seek assistance from the Swiss government and shored up its capital base via a 10 billion Swiss Franc raise from private investors (notably the Qatar Investment Authority and long-standing Saudi investor Olayan). The following year, 2009, Credit Suisse bounced right back and it didn’t do too badly in 2010 either. Over those two years, it made back the losses it incurred in 2008 nearly 1.5 times over. It was then that the rot began to set in. A near-death experience can have a profound impact on a person’s behaviour, and an institution is no different. Banks that had been closer to the abyss than Credit Suisse completely reformulated their strategy in response to the global financial crisis. NatWest Group is one we’ve discussed here before and, closer to home in Switzerland, UBS similarly overhauled its business practices. But Credit Suisse didn’t suffer that near-death experience; it chalked the crisis up as another temporary setback on its long list. As far as Credit Suisse was concerned, you take risk in the course of business and if it doesn’t work, you clean up and move on. In the past, the market had always been forgiving. The global financial crisis fit into that pattern. The company stuck with existing management and ploughed on. As late as 2015, group CEO Brady Dougan reiterated his commitment to the old model of investment banking. “Some argue for a change of tactics,” he told shareholders at that year’s annual general meeting. “But instead, we have persevered and worked to reshape this business into a streamlined division that is focused on core clients.” Yet the world had changed. Credit Suisse adapted to higher capital and liquidity requirements imposed on the industry by regulators as adroitly as its peers. But it didn’t adapt to other shifts. First, it failed to recognise that authorities had grown less tolerant of breaches of conduct. To settle its “Flaming Ferraris” case years earlier, the group had paid a penalty of around $250,000. Anticipating some inflation in conduct charges coming out of the crisis, Credit Suisse set aside 870 million Swiss Francs of litigation reserves to cover future legal liabilities by the end of 2011. Cases around research analyst independence, IPO practices and Enron were still pending and, in addition, a host of new cases had been brought, covering mortgage securitisation, breach of US sanctions, LIBOR rigging and more. To be extra cautious, the bank warned that “reasonably possible” losses could amount to a further 2.3 billion Swiss Francs. It wasn’t enough. In the ten years since, Credit Suisse has disbursed 15 billion Swiss Francs in legal settlements and, as at the end of 2022, it still anticipates another 1.2 billion Swiss Francs of charges. For every $100 of revenue it produced over that time, it disgorged $7 in penalties and fines. Certainly, the bank’s auditors may not have been able to predict the frequency of cases that would arise (at least publicly) but that’s a five times bigger cost than what was provisioned for at the beginning of the period. The market can be forgiving only up to a point. Second, when management finally did grasp that the investment banking business was too unwieldy, it managed its wind down poorly. In 2015, new CEO Tidjane Thiam found that a fifth of the assets in the investment banking division didn’t earn their cost of capital. His solution was to shrink the business around its more profitable parts, promising that what’s left would deliver a return on capital well into the double digits. It was the first of many attempts to bolster returns. Over the next several years, “restructuring” would become a mainstay of life at Credit Suisse. In spite of – or perhaps because of – the continual tinkering, profitability never reached its promised heights, with return on equity averaging around 3% a year. Good assets got thrown out with the bad – an outcome that became apparent in 2021 when Credit Suisse lost around $5.5 billion from its involvement with Archegos Capital Management. An independent inquiry commissioned by the board concluded that the loss partly stemmed from “injudicious cost-cutting”: Headcount reductions led to a less experienced workforce, notably in risk management. Third, as management was dealing with these issues, the competitive advantage of the group’s core private banking business eroded with the elimination of banking secrecy. In 2017, Switzerland adopted the International Convention on the Automatic Exchange of Banking Information (AEOI), agreeing to automatically release financial information to certain countries for the purpose of tax auditing. As part of this agreement, Swiss banks are obliged to send foreign tax authorities their client’s name, address, domicile, tax number, date of birth, account number, annual account balance and gross investment income. For a certain category of customer, that’s not good! In 2012, Brady Dougan estimated that 35 to 45 billion Swiss Francs of assets could potentially be at risk from European clients leaving, out of a pool of a trillion. But the bigger impact was on margins. As well as opening themselves up to tax authorities and regulators, Swiss banks opened themselves up to clients. Opacity is a tried-and-tested way to extract fees in financial services, and its elimination hits profit. Gross margins in Credit Suisse’s wealth management business declined from around 1.10% of revenues to around 0.85%. “I often say in Switzerland that we sell safety not secrecy,” CEO Tidjane Thiam said in the run-up to AEOI implementation. “And that’s a very important point for me about the business model we run.” As became apparent this month, Credit Suisse was able to sell neither. All of these factors squeezed the group’s profitability. In the past ten years, Credit Suisse earned around $230 billion in revenue. Around $110 billion was paid out to employees as compensation and benefits, and around $100 billion was consumed by other expenses. After credit losses of $7 billion, that left $13 billion to be shared between investors and the tax person. The tax person took it all. Net of tax, Credit Suisse lost money in five of the last ten years and in aggregate it lost $3.4 billion over the period. Now, it’s not unusual for banks to lose money. European banks do it all the time (well, not quite, but they’re not very profitable) and it doesn’t lead to them being declared unviable by regulators. So why the urgency to shut Credit Suisse down over the weekend? “Credit Suisse meets the capital and liquidity requirements imposed on systemically important banks,” declared its regulator just four days earlier. (“We welcome this statement of support,” tweeted back Credit Suisse, rather sweetly.) In its dying throes, the group had a regulatory capital ratio of 14.1%, ahead of its 13% target, and a liquidity coverage ratio of 144%. Once central bank support was factored in, that liquidity coverage ratio jumped to 190%, signalling that the bank had sufficient liquidity to meet almost 60 days of stressed deposit outflows. The stock price and credit default swap spread highlighted a greater degree of stress but liquidity support was meant to break the reflexive feedback loop between the market’s perception of a bank and its ability to operate. Credit Suisse had already lost 37% of its deposits in the fourth quarter last year, in a preview of what would happen at Silicon Valley Bank, but had been able to hang on. When deposit outflows accelerated this month (10 billion Swiss Francs was leaving per day, according to one report) and it became clear that under the current group structure they were unlikely to flow back, authorities decided to act. Because in banking, authorities have absolute power. And even though the post-2008 rulebook was of no use in this case given the bank’s ratios, one thing policymakers learned from the last crisis is that it is better to resolve a situation than to lurch from weekend to weekend. When asked, “Who is responsible for this disaster?” Credit Suisse’s chairman cited Twitter. “Last autumn we had a social media storm and this had huge repercussions – more in the retail sector than in the wholesale sector. And too much becomes too much,” he said. It’s actually a risk the company has laid out in its annual filings since 2021:

In the end, Credit Suisse’s reputation became so damaged by years of neglect that depositors began to take notice. For anyone with memories of the place, it’s a shame but, through UBS, the institution lives on. Paid subscribers can read on for further analysis on UBS’s acquisition of Credit Suisse. Details of the webinar I am hosting for paid subscribers is also below. ...Subscribe to Net Interest to read the rest.Become a paying subscriber of Net Interest to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

Contagion

Friday, March 17, 2023

Plus: Credit Suisse, Charles Schwab, First Republic Bank

The Demise of Silicon Valley Bank

Friday, March 10, 2023

The Rapid Collapse of the 16th Largest Bank in America

Goldman and More

Friday, March 3, 2023

Goldman Sachs, Silvergate Capital, Revolut, Klarna

Striped Down

Friday, February 24, 2023

Let's talk about Stripe

Worldpay Reborn

Friday, February 17, 2023

Plus: Commerzbank, Hargreaves Lansdown, Podcast

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏